EUR/USD Holds Key Levels Amid Diverging Central Bank Policies and Market Shifts

The EUR/USD pair continues to struggle as it trades near a two-year low of 1.0178. After months of consistent bearish momentum, the pair faces critical economic events and diverging policy paths between the Federal Reserve (Fed) and the European Central Bank (ECB). As market participants weigh inflation data, labor market strength, and geopolitical developments, the EUR/USD remains in a precarious position.

US Dollar Strength and Rising Treasury Yields Exert Pressure on EUR/USD

The sustained strength of the US dollar, underpinned by robust labor market data and resilient economic indicators, has been a primary driver of the downward pressure on EUR/USD. The Federal Reserve’s hawkish stance, supported by expectations of only one rate cut in 2025, contrasts sharply with the ECB's more aggressive easing trajectory. The US 10-year Treasury yield remains near multi-month highs at 4.77%, attracting capital flows into the US dollar and intensifying the euro’s struggle.

Higher yields provide investors with attractive returns on US government debt, making the dollar more appealing compared to the euro, especially as European bond yields lag. The divergence in bond yields has further amplified selling pressure on EUR/USD.

Eurozone Economic Weakness Compounds the Decline

The eurozone faces subdued economic data, with Germany’s wholesale price index barely meeting expectations at 0.1%, and French budget deficits widening to -€172.5 billion. Industrial production across key economies has also underperformed, reflecting a slowdown in economic activity. With inflation in the eurozone moderating, the ECB is under pressure to deliver further rate cuts to support growth.

ECB officials, including François Villeroy de Galhau, have signaled the likelihood of interest rates reaching 2% by summer, highlighting a battle against lingering inflation while managing downside risks to growth. This dovish stance contrasts with the Fed’s more cautious approach, further weighing on the euro.

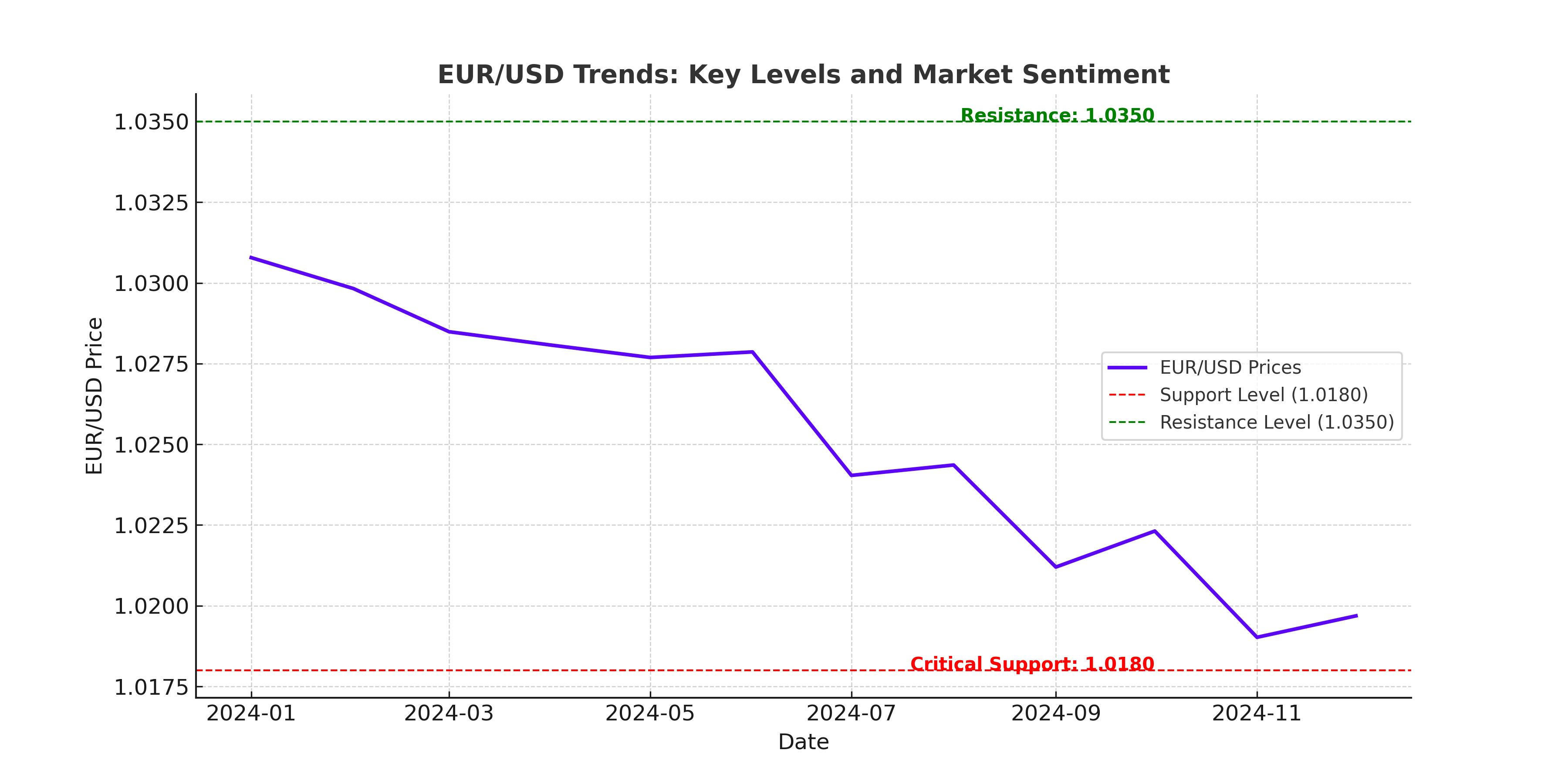

Key Support and Resistance Levels for EUR/USD

Technical analysis shows EUR/USD trading within a descending channel, with support at 1.0178 and immediate resistance near 1.0350. The pair's 50-day exponential moving average (EMA) at 1.0300 remains a key hurdle for bullish momentum. Failure to hold above 1.0300 could see EUR/USD retest the 1.0180 region or lower.

Momentum indicators such as the Relative Strength Index (RSI) have improved slightly to 47, suggesting a potential for consolidation. However, the Moving Average Convergence Divergence (MACD) indicator continues to show bearish tendencies, reinforcing the broader downtrend.

Impact of US Inflation Data on EUR/USD Outlook

The release of the US Consumer Price Index (CPI) data has added further volatility to the pair. The December CPI rose 0.4% month-over-month, in line with expectations, while core inflation excluding food and energy moderated to 3.2% year-over-year. These mixed signals have reinforced market expectations of a less aggressive Fed in the near term, supporting the dollar's dominance.

The gradual approach to tariffs and fiscal policies under the incoming Trump administration introduces an additional layer of uncertainty for EUR/USD. Tariff hikes are expected to hurt eurozone exports, adding to the euro’s challenges. Conversely, any dovish surprises in US economic data could provide short-term relief for the pair.

EUR/USD Path Forward: Buy, Sell, or Hold?

The EUR/USD faces critical resistance at 1.0350, with a break above this level potentially opening the path to the 1.0400-1.0458 range. However, sustained dollar strength, driven by higher yields and robust economic data, suggests the pair may struggle to hold gains. If the pair falls below 1.0180, it could extend losses toward parity.

Market participants should closely monitor upcoming US inflation data, ECB policy announcements, and geopolitical developments, as these factors will shape the medium-term trajectory for EUR/USD. The divergence between the Fed’s and ECB’s monetary paths remains the central theme, leaving the pair vulnerable to downside risks.

In the short term, EUR/USD may experience relief rallies driven by profit-taking or a pullback in the US dollar. However, the broader outlook remains bearish unless significant changes in economic data or policy expectations emerge. For now, EUR/USD appears to be a "sell on rallies" trade, with investors advised to remain cautious and vigilant.