EUR/USD Struggles at 1.0285: Will Rate Policies Send the Euro Lower?

Persistent Resistance and Diverging Central Bank Policies Keep EUR/USD Bears in Control | That's TradingNEWS

EUR/USD Stalls at 1.0285 Amid Uncertainty Over Rate Divergence and Market Sentiment

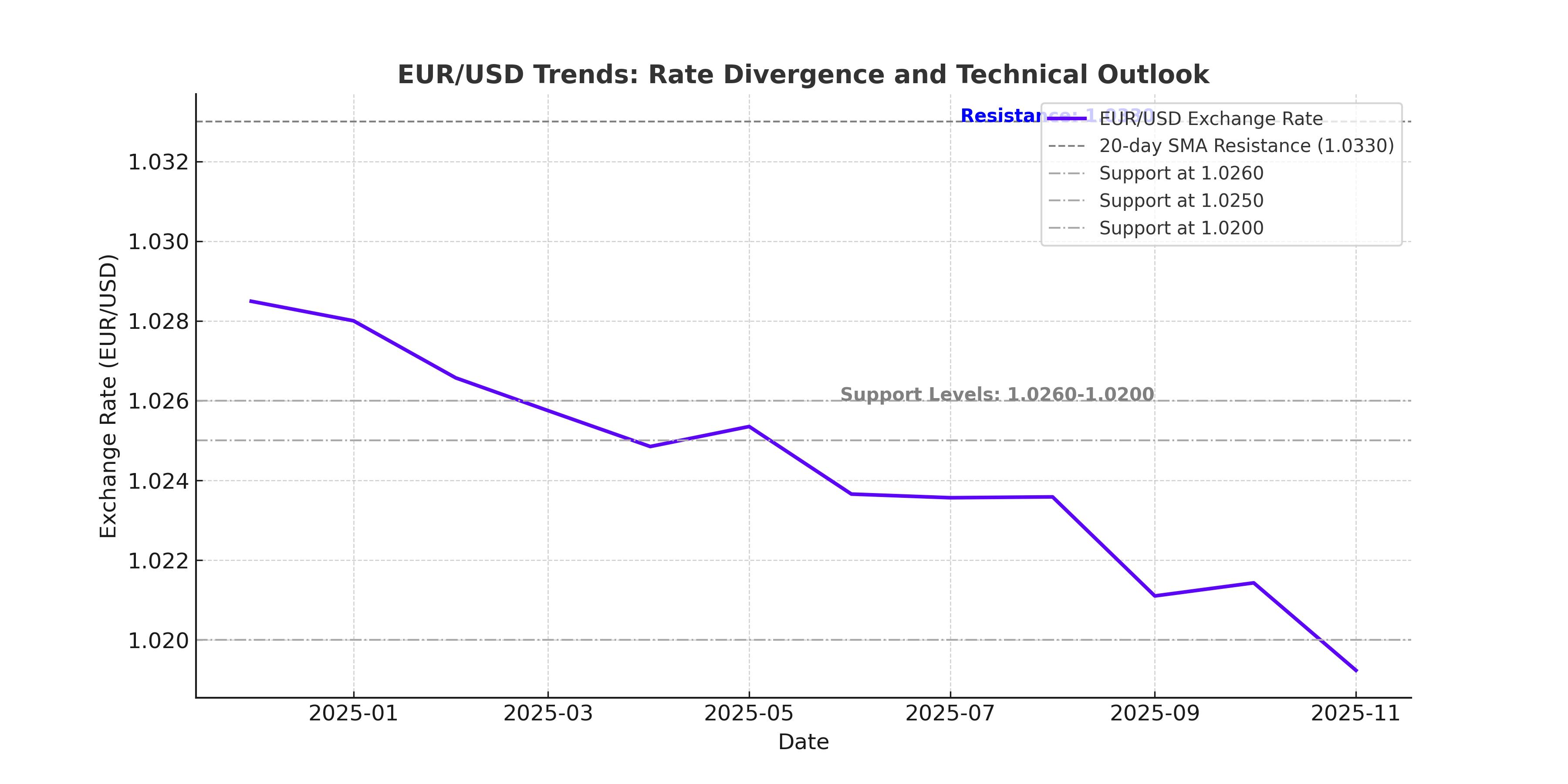

The EUR/USD pair, trading at 1.0285, finds itself constrained by a lack of decisive momentum as technical and macroeconomic forces keep the currency in a tight range. Despite slight gains earlier this week, the pair remains below its 20-day Simple Moving Average (SMA) at 1.0330, highlighting persistent resistance for bulls. The Relative Strength Index (RSI) nudges up to 44, signaling limited bullish momentum, while the Moving Average Convergence Divergence (MACD) histogram remains stagnant with minimal green bars, underscoring the lack of follow-through buying interest.

Rate Divergence and Economic Projections Favor USD Strength

Diverging monetary policies between the Federal Reserve and the European Central Bank (ECB) are pivotal in defining the EUR/USD trajectory. The Federal Reserve's steady rate cut expectations, with futures markets pricing in two reductions this year, contrast with the ECB’s aggressive approach, as analysts anticipate up to four cuts by mid-2025. This divergence bolsters the US dollar’s attractiveness, especially in light of robust US retail sales data, which, though slightly below expectations, supports a resilient economy. Meanwhile, the Eurozone faces stagnation as weaker industrial activity and muted growth prospects weigh on the euro. The impact of these policies continues to keep the EUR/USD pair under pressure, as traders anticipate further downside risks.

Technical Hurdles Keep EUR/USD Below Key Levels

On the technical side, the 20-day SMA remains a key resistance level at 1.0330, a threshold bulls need to breach to reverse the recent bearish narrative. Immediate support lies around 1.0260–1.0250, a critical zone that, if broken, could push the pair toward the psychological level of 1.0200. While the broader bias remains bearish, any rally toward 1.0350 is likely to encounter selling pressure, particularly as the 50-day SMA aligns closely with this resistance zone. The pair’s inability to sustain gains above 1.0300 reinforces the prevailing bearish sentiment.

Impact of Trump's Policies and Global Trade Dynamics

President-elect Donald Trump’s proposed import tariffs, which include a 10% levy on all imported goods, present another layer of complexity for the EUR/USD pair. The Eurozone, heavily reliant on exports, faces economic headwinds from these potential policies, which threaten to reduce trade volumes and further strain its growth trajectory. Conversely, these measures could buoy the US dollar as markets anticipate stronger inflation and economic resilience. Analysts point to the possibility of increased volatility in the EUR/USD pair as markets react to the unfolding policy landscape.

Consolidation Phase Points to Limited Volatility

With market participants anticipating little in the way of high-impact Eurozone or US data in the immediate term, EUR/USD is likely to consolidate further. Analysts forecast the pair to trade within a narrow range of 1.0270 to 1.0330 in the coming sessions. The broader range between 1.0220 and 1.0400 reflects the pair's constrained movements amidst limited catalysts. This lack of directional conviction keeps traders cautious as they await significant policy updates or economic data that could provide clearer direction.

Outlook: Sell on Rallies Amid Persistent Downside Risks

Given the technical and macroeconomic landscape, the outlook for EUR/USD remains bearish. The pair is likely to encounter selling pressure on any approach toward the 1.0330–1.0350 range, with downside targets at 1.0220 and potentially 1.0100 if bearish momentum accelerates. While oversold conditions may prompt short-term bounces, these are unlikely to shift the broader trend. For now, the combination of Eurozone economic fragility, US policy divergence, and technical resistance zones suggests the EUR/USD pair remains a sell-on-rallies prospect, with limited upside potential in the near term.