EUR/USD Price Faces Bearish Pressure Amid Diverging Central Bank Policies

The EUR/USD pair has continued its struggle to gain significant upside traction, with current trading levels hovering around 1.0270, reflecting a 0.23% decline on the day. Despite brief attempts to push higher, resistance at the 20-day Simple Moving Average (SMA) has repeatedly capped any sustained rally. This highlights a market environment dominated by bearish sentiment as macroeconomic and geopolitical uncertainties weigh heavily on the euro.

The technical picture for the EUR/USD reveals rising green bars in the MACD histogram, which suggest modest buying interest. However, the Relative Strength Index (RSI) remains at 43, firmly in negative territory, signaling that bearish momentum persists. The immediate support at 1.0250 acts as a critical level for market participants, with a breach likely to push the pair toward 1.0220. Conversely, a recovery above 1.0300 would be necessary to inspire bullish momentum, potentially setting a course toward the next resistance level at 1.0350.

ECB’s Dovish Tone Weakens Euro Prospects

Comments from Luis de Guindos, Vice President of the European Central Bank (ECB), have further dampened enthusiasm for the euro. De Guindos highlighted the ongoing disinflation process across the eurozone, with inflation now standing at 2.4%—a level comfortably near the ECB’s 2% target. With interest rates stabilized at 3.15% following four consecutive cuts in 2024, the ECB appears inclined toward maintaining a dovish stance.

De Guindos also expressed concerns about geopolitical risks, including the war in Ukraine and looming trade tensions with the incoming Trump administration. These factors contribute to a broader narrative of slower economic growth in Europe, further pressuring the euro against the US dollar.

The persistent interest rate differential—4.5% in the United States versus 3.15% in the eurozone—continues to draw capital away from Europe, creating a challenging environment for the EUR/USD pair. Market expectations for additional ECB rate cuts in 2025 contrast sharply with the US Federal Reserve's more neutral stance, intensifying the euro's struggles.

US Economic Data and Fed Policy Provide USD Tailwind

The US economy remains a key driver in the EUR/USD dynamic. Recent data showed a mixed picture, with retail sales rising by 0.4% in December, missing the forecasted 0.6% increase. However, upward revisions to November’s figures (from 0.7% to 0.8%) underscore the resilience of American consumer activity.

On the labor market front, initial jobless claims rose to 217,000, slightly above expectations of 210,000. While this hints at some softening in the jobs market, the broader US economic outlook remains robust.

The Federal Reserve's policy outlook continues to support the US dollar. Recent comments from Fed Governor Christopher Waller hinted at potential rate cuts if disinflation progresses favorably. Market participants are now pricing in a 50% probability of at least two rate cuts by the end of 2025, with the first potentially arriving as early as June. This measured approach contrasts sharply with the ECB’s dovish pivot, providing a consistent tailwind for the USD.

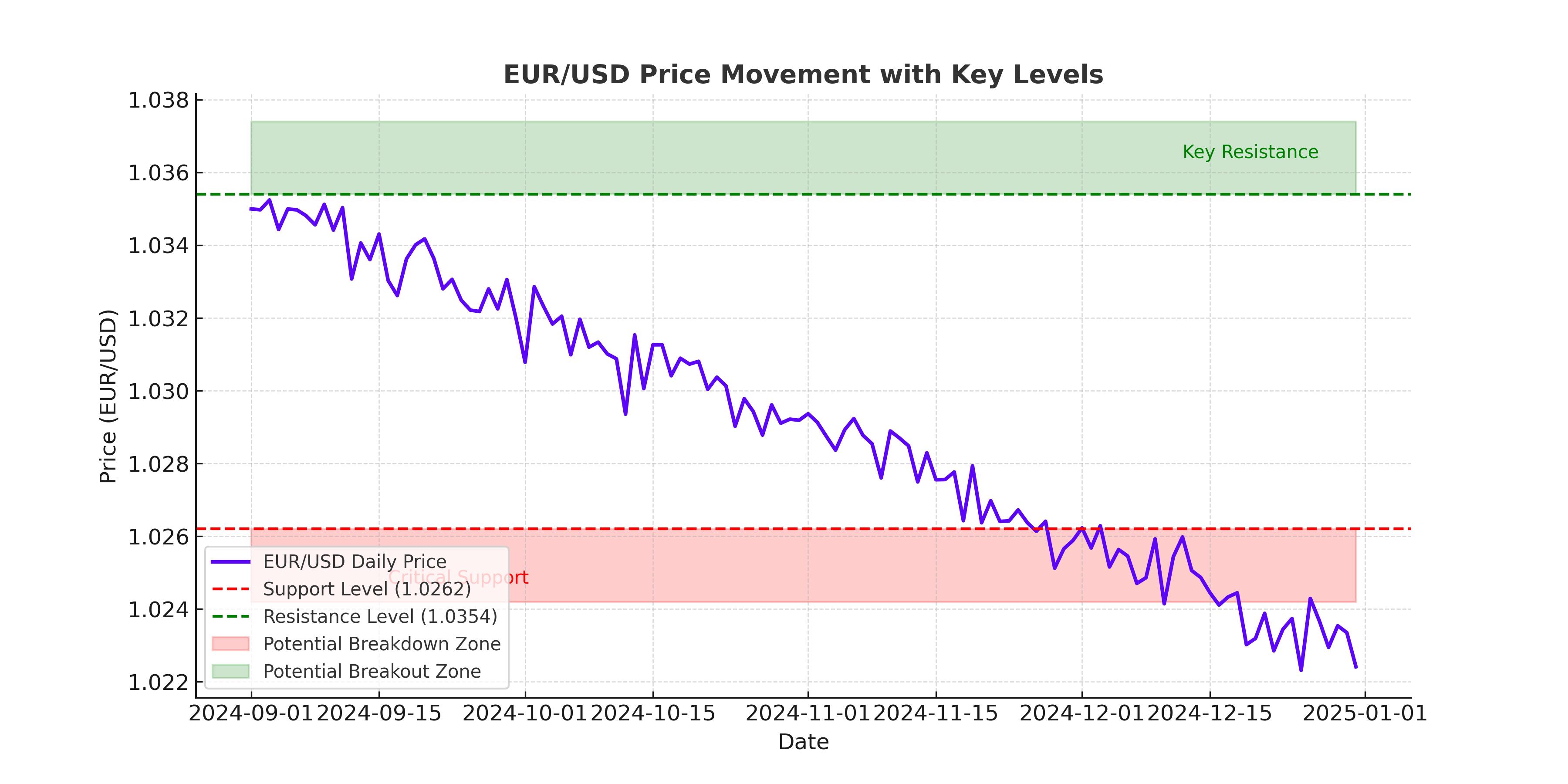

Technical Analysis: Bearish Channel Persists

From a technical perspective, the EUR/USD remains entrenched in a bearish channel that has defined price action since September 2024. The pair has lost over 8% from its peak levels, and the inability to sustain gains above key resistance zones underscores the dominance of sellers.

Key support is seen at 1.0262, a level that aligns with previous periods of indecision dating back to 2022. A sustained break below this level would likely confirm further bearish momentum, targeting the 1.0220 and 1.0170 levels. On the upside, resistance at 1.0354 represents a critical inflection point; a break above this level would signal the end of the current bearish trend and open the path toward 1.0550.

The RSI presents a mild bullish divergence, with higher lows in RSI values despite lower lows in price. This could indicate a short-term correction, but such moves are unlikely to alter the broader bearish trajectory unless accompanied by a decisive break above key resistance levels.

German Economic Weakness Adds Pressure on the Euro

Germany, the eurozone’s largest economy, reported a 0.2% contraction in GDP for 2024 following a 0.3% decline in 2023. Weakness in the manufacturing sector, with output falling by 3%, has been a significant drag on growth. The construction industry also suffered a 3.8% decline, reflecting the impact of rising interest rates.

While some areas of the services sector showed resilience, including a 2.5% increase in information and communication, overall economic activity remains subdued. Foreign trade figures paint a similarly bleak picture, with exports down 0.8% and imports up just 0.2%.

These developments highlight the structural challenges facing the eurozone, further reducing investor confidence in the euro.

Geopolitical Risks and Trade Policies Loom Large

The EUR/USD pair also faces headwinds from geopolitical uncertainties. The anticipated policy direction of the Trump administration, including potential tariffs and trade restrictions, poses a significant risk to eurozone exports. Additionally, ongoing conflicts in Ukraine and the Middle East add to market unease, driving investors toward the relative safety of the US dollar.

Outlook for EUR/USD

The EUR/USD remains under pressure from a combination of factors, including diverging monetary policies, weaker economic fundamentals in the eurozone, and geopolitical risks. The pair is unlikely to see sustained upside momentum unless there is a significant shift in market sentiment or policy direction. With key resistance at 1.0354 and support at 1.0262, traders should monitor these levels closely for potential breakouts or breakdowns. The outlook remains bearish, with the potential for parity in the coming months if current trends persist.