USD Strength and Euro Weakness Keep EUR/USD Under Pressure

The EUR/USD pair has been under sustained selling pressure, currently trading near 1.0310, marking its third consecutive day of losses. This decline reflects the pair's struggle to regain momentum, as both macroeconomic and technical factors favor the bears. Despite intermittent attempts to reclaim higher levels, the broader bearish trend persists, with a failure to establish a foothold above the 20-day Simple Moving Average (SMA) adding to the negative sentiment.

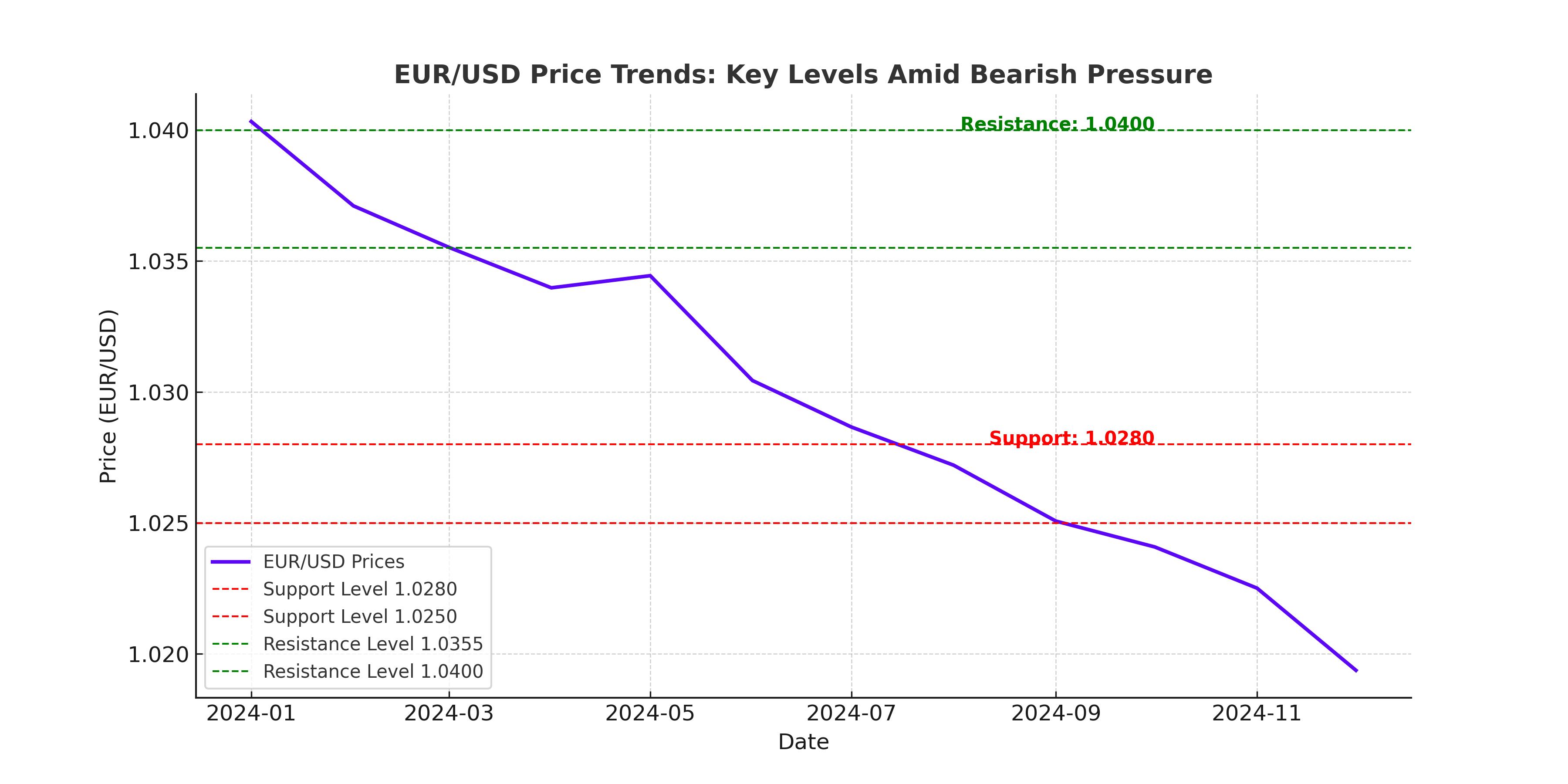

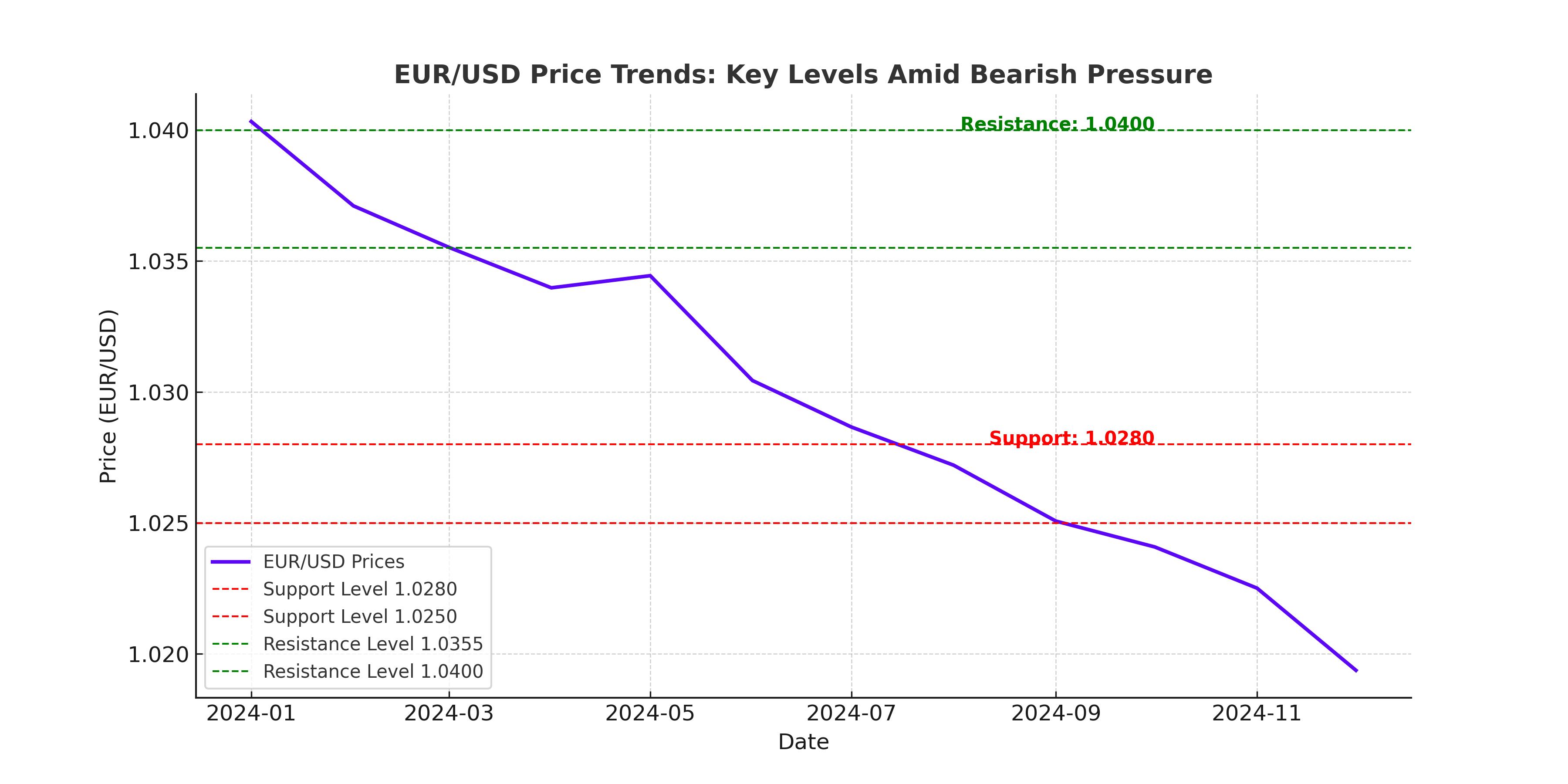

Technical indicators reinforce the bearish outlook. The Relative Strength Index (RSI) hovers at 40, signaling limited buying interest, while the Moving Average Convergence Divergence (MACD) histogram shows diminishing bullish momentum. Critical support lies at 1.0280, with deeper potential targets near 1.0250 and the psychologically significant 1.0200. On the upside, a meaningful recovery requires the pair to breach resistance levels at 1.0350 and beyond, with 1.0400 acting as a key threshold for a potential trend reversal.

Diverging Central Bank Policies Weigh on EUR/USD

One of the driving forces behind the Euro's recent weakness is the divergence in central bank policies. The Federal Reserve's focus on maintaining higher interest rates contrasts sharply with the European Central Bank's (ECB) more cautious approach, creating a monetary policy gap that has favored the U.S. dollar. The ECB has signaled concerns over stagnant economic growth and inflationary risks, leaving markets skeptical about its ability to maintain hawkish policies.

Conversely, the U.S. labor market remains robust, as evidenced by falling unemployment claims to 201K, and upcoming Non-Farm Payrolls (NFP) data is expected to show a moderate but steady increase in jobs. This resilience underpins the Federal Reserve’s gradual tightening stance, further bolstering the greenback. Meanwhile, the Eurozone faces disappointing economic data, such as Germany's recent 5.4% drop in factory orders, adding to the EUR/USD pair's bearish momentum.

Key Levels to Watch in EUR/USD

The pair's immediate trajectory hinges on how it interacts with pivotal technical levels. Resistance at 1.0355 represents a crucial barrier, reinforced by the 20-day SMA. A break above this level could signal a short-term recovery, but sustained bullish momentum would require a breach of 1.0418, where significant volume has previously stalled upward moves.

On the downside, support at 1.0280 aligns with historical value areas, while a deeper decline toward 1.0250 could expose the pair to parity levels near 1.0000 if broader market dynamics remain unchanged. The Fibonacci retracement levels also play a key role, with the 1.0200 mark emerging as a critical inflection point for both buyers and sellers.

Impact of U.S. Data and Fed Signals on EUR/USD

Upcoming U.S. economic data, including NFP and Consumer Price Index (CPI) figures, will be instrumental in determining the pair's next move. Softer-than-expected U.S. data could ease pressure on the Fed to maintain its current tightening path, providing a potential lifeline for the Euro. However, strong U.S. data could exacerbate the bearish trend in EUR/USD, driving it toward multi-year lows.

The Federal Reserve's minutes and commentary from policymakers suggest a cautious approach to rate hikes, but markets remain vigilant for any signals that could imply a shift in stance. A dovish tone from the Fed could help stabilize EUR/USD in the near term, while a hawkish tilt may accelerate the pair's descent.

Broader Market Sentiment and Geopolitical Factors

Geopolitical concerns and global economic trends are also influencing the EUR/USD pair. Uncertainty surrounding U.S. fiscal policies under President-elect Trump and trade tensions with major partners could inject volatility into the pair. Additionally, concerns over the Eurozone's economic stability, particularly in light of weaker German and French economic data, amplify downside risks.

Inflation remains a central theme for both economies. While the U.S. battles persistent inflationary pressures, the Eurozone grapples with mixed signals, with the ECB struggling to balance growth and inflation expectations. These dynamics will play a crucial role in shaping the EUR/USD pair's medium-term outlook.

Conclusion

The EUR/USD pair remains firmly entrenched in a bearish trend, with sellers maintaining control amid strong U.S. economic data and Eurozone weaknesses. Key technical levels and upcoming economic releases will be pivotal in determining the pair's direction. While a short-term recovery is possible if resistance at 1.0350 is breached, sustained upward momentum appears unlikely without significant shifts in macroeconomic fundamentals. For now, the path of least resistance favors the downside, with parity levels increasingly coming into focus.

That's TradingNEWS