Exxon Mobil Investment Analysis - A Strong Buy

Unlocking the Potential: Why Exxon Mobil (NYSE:XOM) is a Lucrative Investment Choice for Bullish Investors | That's TradingNEWS

Current Valuation and Market Performance of Exxon Mobil

Exxon Mobil Corporation (NYSE:XOM) closed its latest trading session at $119.42, experiencing a minor decrease of 0.18%. The stock displayed stability within a daily trading range of $118.83 to $120.20. With a substantial market capitalization of $470.874 billion and a price-to-earnings (P/E) ratio of 14.63, Exxon Mobil showcases a solid financial foundation, indicative of its strong earnings performance.

Financial Stability and Performance Metrics of NYSE:XOM

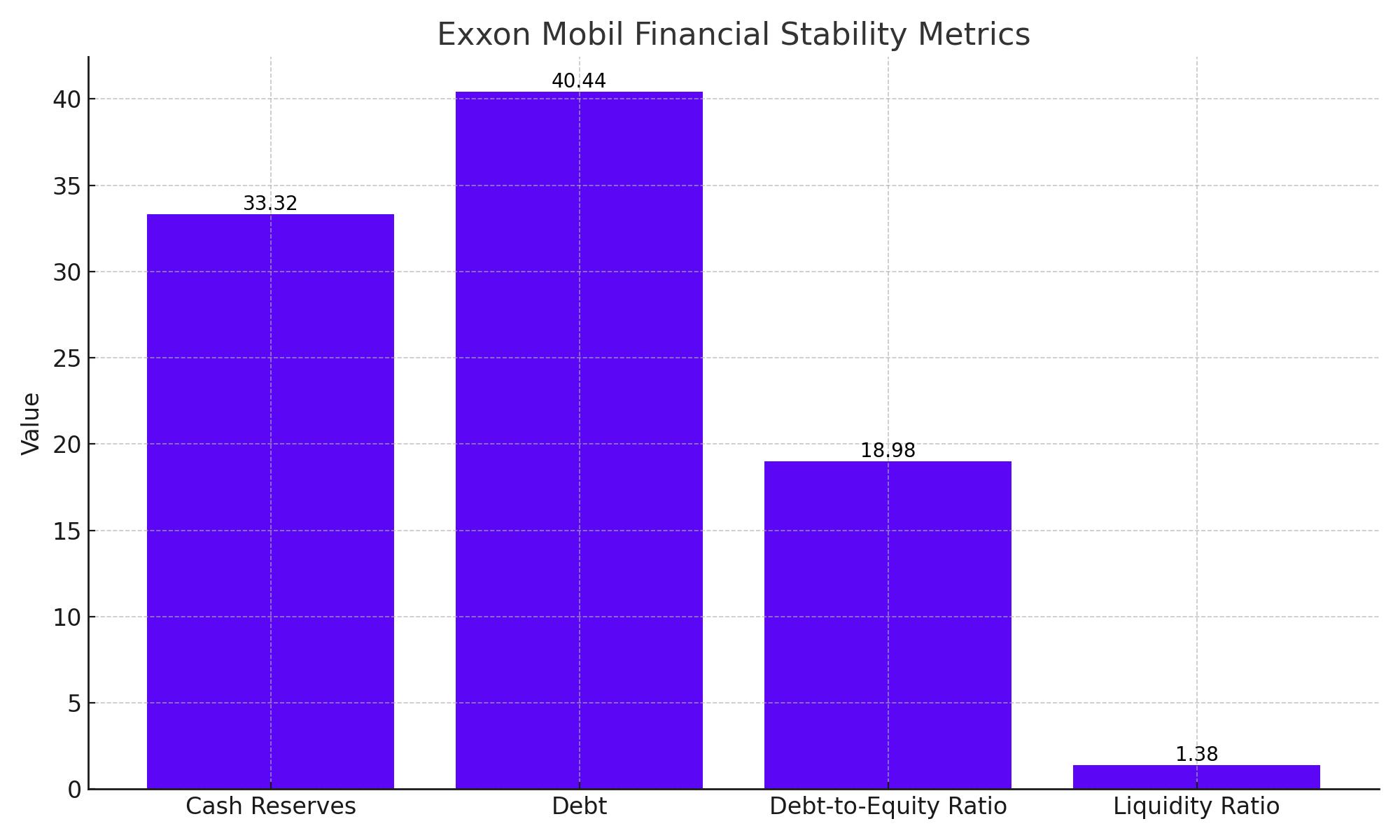

Exxon Mobil's balance sheet remains robust, with cash reserves totaling $33.32 billion versus a debt load of $40.44 billion, resulting in a debt-to-equity ratio of 18.98%. The company's liquidity ratio is currently at 1.38, affirming its ability to cover short-term liabilities efficiently. The stock has reached a year-to-date high of $123.75, and the slight pullback in its current price could represent a strategic buying opportunity for investors.

Analysis of Exxon Mobil’s Quarterly Financial Results

For the quarter ending March 2024, Exxon Mobil reported a net income of $8.22 billion from revenues totaling $83.083 billion, marking a year-over-year decrease. The company’s profit margin stands at 9.9%, reflecting a slight compression due to increased operational expenses. This financial snapshot resulted in a cautious response from the market, highlighted by a modest decline in stock value following the earnings release.

Strategic Operations and Project Developments at Exxon Mobil

Exxon Mobil has made significant strides in enhancing its operational efficiency and expanding its project portfolio. Key developments include the Payara project in Guyana, which is set to substantially increase the company’s production capacity. In the liquefied natural gas (LNG) sector, Exxon Mobil is actively expanding through initiatives like the Golden Pass LNG project alongside ventures in Papua New Guinea and Mozambique, aligning with its long-term strategy to meet evolving global energy needs.

Specific Economic Factors Affecting Exxon Mobil

Exxon Mobil's operations and financial outcomes are closely tied to the fluctuations in global oil and gas prices, which have been volatile due to geopolitical tensions, particularly in the Middle East and Eastern Europe. For instance, Brent crude oil prices, which significantly influence Exxon's revenue streams, have fluctuated between $95 and $123 per barrel over the past 52 weeks. Such volatility affects the company's upstream profitability and strategic planning. Additionally, natural gas prices have seen a dramatic decline, with Henry Hub prices dropping by over 50% from January 2023 to March 2024, impacting the company’s gas operations revenue.

Upcoming U.S. Economic Indicators and Their Potential Impact

Exxon Mobil's future performance is also likely to be influenced by key U.S. economic indicators. The U.S. GDP growth rate, which slowed to an annualized rate of 2.1% in the last quarter, suggests potential headwinds for industrial energy consumption. Consumer confidence indices, another crucial economic measure, are anticipated to sway fuel consumption patterns. For example, a significant rise or fall in consumer confidence can directly affect the demand for gasoline and diesel, impacting Exxon Mobil's downstream operations.

In-Depth Investment Analysis and Forward-Looking Perspectives on Exxon Mobil

Current Valuation and Dividend Yield

Exxon Mobil currently trades with a P/E ratio of 14.63, suggesting a moderate valuation compared to historical standards. The company maintains a strong dividend yield of 3.18%, with a consistent forward annual dividend rate of $3.80 per share, making it an attractive option for dividend-seeking investors. The firm's commitment to maintaining a healthy payout ratio, which currently stands at 45.59%, underscores its financial stability and investor-friendly policies.

Strategic Investments and Growth Projections

Exxon Mobil is actively investing in high-yield projects that promise substantial future returns. Notably, the company's involvement in the Payara project in Guyana and its expansions into LNG markets, such as the Golden Pass LNG terminal and projects in Papua New Guinea, are expected to significantly enhance its production capacity. These projects are projected to contribute to a production increase of up to 500,000 barrels per day in the next five years, bolstering Exxon Mobil’s output and revenue generation capabilities.

Exxon Mobil Is a Buy Investment Consideration for (NYSE:XOM)

Analyzing the current metrics and future prospects of Exxon Mobil reveals a compelling narrative for potential investors. With a market capitalization of $470.874 billion and a modest P/E ratio of 14.63, the company represents a robust investment grounded in substantial financial health and strategic growth initiatives. The stock's minor price decrease to $119.42 and its stability within a narrow daily trading range highlight its market resilience.

Exxon Mobil's financial solidity is further demonstrated by its considerable cash reserves of $33.32 billion against a debt of $40.44 billion, maintaining a healthy debt-to-equity ratio of 18.98%. This financial structure supports the company's ambitious expansion projects, such as the Payara project in Guyana and the Golden Pass LNG project, which are poised to significantly boost production capacity and meet global energy demands.

The company's strategic response to volatile oil and gas prices—exemplified by recent fluctuations in Brent crude and a sharp decline in natural gas prices—illustrates its adept management in a challenging geopolitical landscape. Moreover, upcoming economic indicators from the U.S. could impact market sentiment, potentially affecting Exxon Mobil's performance. However, the company's proactive management of resources and strategic investments provide a buffer against such uncertainties.

Given these considerations, coupled with a strong dividend yield of 3.18% and a forward annual dividend rate of $3.80 per share, Exxon Mobil presents as a potentially lucrative buy for long-term investors. The company's commitment to high-yield projects and its strategic positioning within the energy sector enhance its appeal, suggesting a bullish outlook for those looking to invest in a stable, dividend-paying stock with promising growth prospects.