ExxonMobil Buy Potential (NYSE:XOM) Reports Robust Q2 24 Performance with Record Production

ExxonMobil Surpasses Earnings Expectations, Achieves Record Production, and Advances Sustainability Initiatives in Q2 2024 | That's TradingNEWS

ExxonMobil (NYSE:XOM) Reports Robust Q2 2024 Performance with Record Production and Strategic Growth

Record Production and Financial Performance

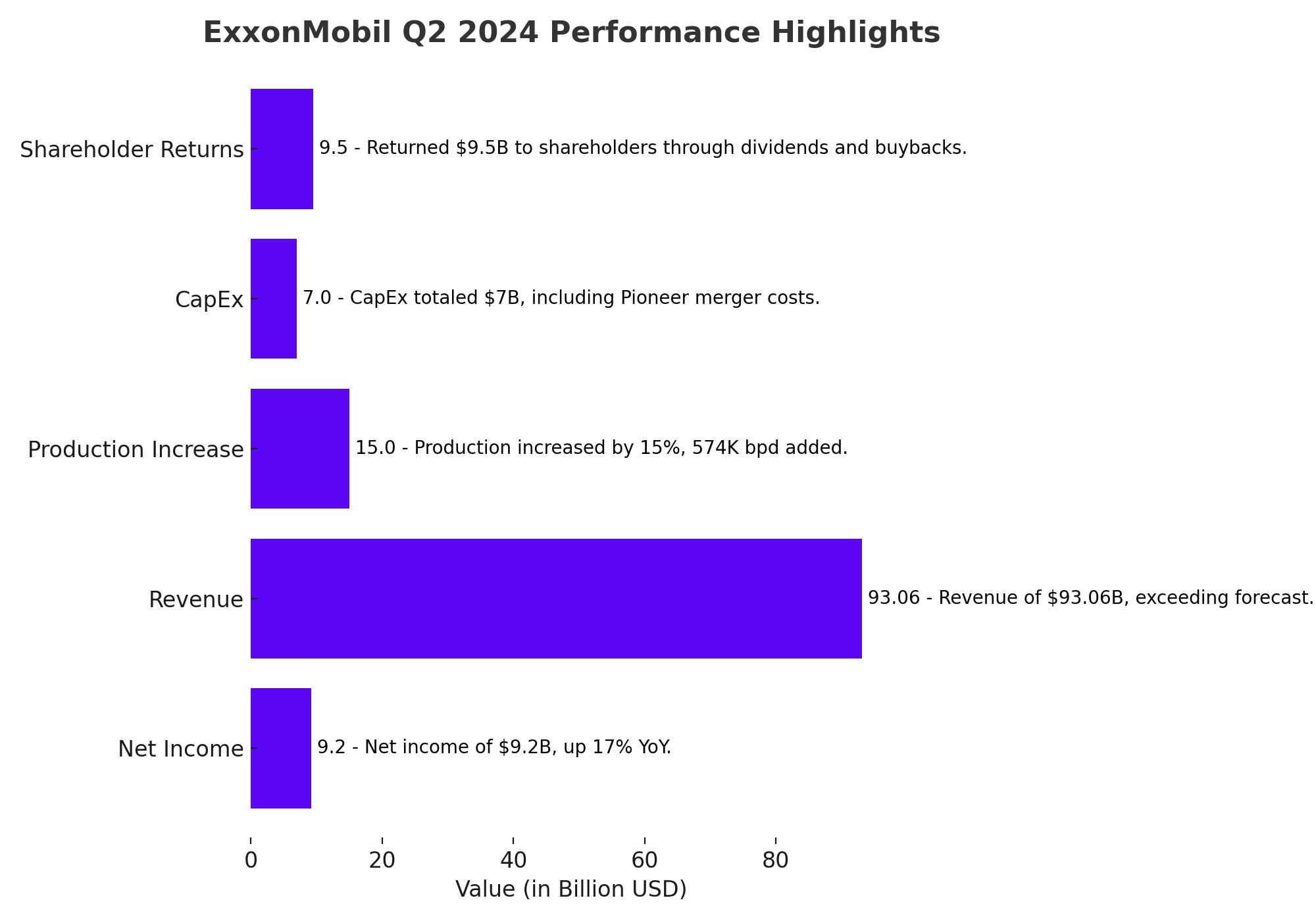

ExxonMobil (NYSE:XOM) delivered a strong financial performance in Q2 2024, achieving its second-highest quarterly earnings in a decade. The company reported net income of $9.2 billion, or $2.14 per share, surpassing Wall Street expectations of $2.01 per share. This marked a 17% increase over the previous year's profits of $7.9 billion, or $1.94 per share. Revenue rose to $93.06 billion, exceeding the forecasted $90.99 billion and reflecting a significant increase from the $82.91 billion reported a year ago.

Impact of the Pioneer Merger

The acquisition of Pioneer Natural Resources, finalized in May 2024, played a crucial role in boosting ExxonMobil's earnings. The merger added $500 million to the company's earnings within the first two months post-closing. This strategic move also supported a substantial 15% increase in production, translating to an additional 574,000 barrels per day, bringing total production to 4.4 million barrels per day. This included record outputs from key regions such as Guyana and the Permian Basin.

Operational Efficiency and Cost Savings

ExxonMobil has continued to enhance its operational efficiency, achieving cumulative structural cost savings of $10.7 billion since 2019. In Q2 alone, the company saved an additional $1 billion. These savings are part of ExxonMobil’s broader goal of achieving $5 billion in savings by the end of 2027 compared to 2023 levels. The company's focus on cost efficiency is a critical component of its strategy to maintain profitability and shareholder value amid fluctuating industry conditions.

Capital and Exploration Expenditures

The company’s capital and exploration expenditures totaled $7 billion in Q2 2024, including $700 million related to the Pioneer merger. Year-to-date, ExxonMobil has spent nearly $13 billion on capital projects, underscoring its commitment to growth and expansion. The company has set a capital spending target of $28 billion for the year, which includes the high end of its previously announced guidance for 2024 and additional investments from the Pioneer operations.

Shareholder Returns and Financial Health

ExxonMobil has maintained a strong focus on returning value to shareholders. In Q2 2024, the company returned $9.5 billion to shareholders, comprising $4.3 billion in dividends and $5.2 billion in share buybacks. ExxonMobil plans to repurchase over $19 billion of shares in 2024 and increase the annual pace of share repurchases to $20 billion through 2025, contingent on market conditions. Additionally, the company declared a third-quarter dividend of $0.95 per share, payable on September 10, 2024.

Advancements in Carbon Capture and Sustainability Initiatives

ExxonMobil continues to advance its carbon capture and storage (CCS) initiatives, a key component of its sustainability strategy. The company has signed agreements to increase its total contracted CO₂ offtake to 5.5 million metric tons per year, more than any other company has announced. Furthermore, ExxonMobil announced the world's largest planned virtually carbon-free hydrogen project, which aims to capture 98% of CO₂ emissions. The company also entered into a memorandum of understanding (MOU) with SK On for 100,000 metric tons of lithium, enhancing its portfolio in sustainable energy solutions.

Future Outlook and Strategic Focus

ExxonMobil's strong second-quarter performance highlights its strategic focus on high-value production and sustainable growth. The successful integration of the Pioneer merger and record production levels in key regions underscore the company's operational efficiency and market leadership. Despite challenges such as fluctuating industry margins and natural gas prices, ExxonMobil’s robust financial health and strategic initiatives position it well for continued growth. CEO Darren Woods emphasized the company's commitment to improving earnings power and delivering shareholder value, as evidenced by record production levels and high-value product sales growth.

Earnings by Segment

In Q2 2024, ExxonMobil's earnings by segment revealed significant growth:

- Upstream: Earnings rose 24% quarter-over-quarter to $7.07 billion, driven by the Pioneer acquisition, record production in Guyana and the Permian Basin, and structural cost savings.

- Energy Products: Earnings decreased by 31% quarter-over-quarter to $946 million, due to weaker industry refining margins.

- Chemical Products: Earnings increased by 2% quarter-over-quarter to $779 million, supported by stronger margins and high-value product sales growth from record performance product sales.

- Specialty Products: Earnings slightly decreased by 1% quarter-over-quarter to $751 million, with higher expenses offset by favorable tax impacts.

Balance Sheet and Cash Flow

ExxonMobil’s balance sheet remains robust, with a debt-to-capital ratio of 14% and a net-debt-to-capital ratio of 6%. The company generated strong cash flow from operations, totaling $25.2 billion in the first half of 2024. Free cash flow amounted to $15.0 billion, including working capital outflows of $2.6 billion. Shareholder distributions for the first half of the year totaled $16.3 billion, reflecting the company's commitment to returning value to shareholders.

For real-time stock data and detailed insights into ExxonMobil's performance and strategic initiatives, visit ExxonMobil stock profile.

Market Outlook and Strategic Focus

Looking ahead, ExxonMobil is well-positioned to capitalize on its strategic initiatives and market opportunities. The company's focus on high-value production, particularly in regions like Guyana and the Permian Basin, coupled with its advancements in CCS and low-carbon hydrogen, underscores its commitment to sustainable growth. Despite potential challenges from fluctuating industry margins and natural gas prices, ExxonMobil's diversified portfolio and operational efficiencies provide a solid foundation for continued success.

Summary

ExxonMobil's (NYSE:XOM) Q2 2024 performance reflects its strategic acumen and operational strength. With net income of $9.2 billion, record production levels, and significant advancements in sustainable energy solutions, the company continues to demonstrate its market leadership. The successful integration of Pioneer Natural Resources, robust financial health, and aggressive capital investments further solidify ExxonMobil's position in the evolving energy landscape. As the company advances its initiatives in carbon capture and storage, and virtually carbon-free hydrogen, it remains well-equipped to deliver long-term value to shareholders and support global decarbonization efforts.

For the latest updates on ExxonMobil's stock performance and strategic developments, visit ExxonMobil real-time stock chart. Additionally, detailed insights into insider transactions can be found on ExxonMobil's stock profile.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback