FBTC vs. BTCI – Which Bitcoin ETF Delivers Bigger Profits at $100K+ BTC?

Should You Bet on FBTC’s Growth or BTCI’s 28% Yield for Maximum Returns? | That's TradingNEWS

BATS:FBTC vs. BATS:BTCI – The Ultimate Bitcoin ETF Showdown for 2025

Which Bitcoin ETF Delivers Superior Returns and Stability in 2025?

Bitcoin ETFs have taken over the market, providing investors a regulated and accessible way to gain exposure to BTC without managing wallets or dealing with security risks. Two of the most competitive funds in this space are Fidelity Wise Origin Bitcoin Trust ETF (BATS:FBTC) and NEOS Bitcoin High Income ETF (BATS:BTCI). While both funds provide exposure to Bitcoin, their structures, objectives, and returns differ significantly.

FBTC is a pure-play Bitcoin ETF that simply holds BTC, tracking its price performance as closely as possible. This makes it one of the best options for investors looking to ride Bitcoin’s long-term appreciation, with minimal intervention and no added complexity. In contrast, BTCI employs an options-based strategy, aiming to generate high monthly income through covered call writing on Bitcoin-linked ETFs like IBIT and BITO. The result is a 28% annualized yield—far higher than what traditional ETFs provide—but at the cost of reduced upside.

With Bitcoin recently trading above $100,000 and eyeing new all-time highs, the question for investors becomes: Which ETF is the better choice? Should you prioritize price appreciation or monthly income?

Performance: FBTC vs. BTCI – Who Wins on Returns?

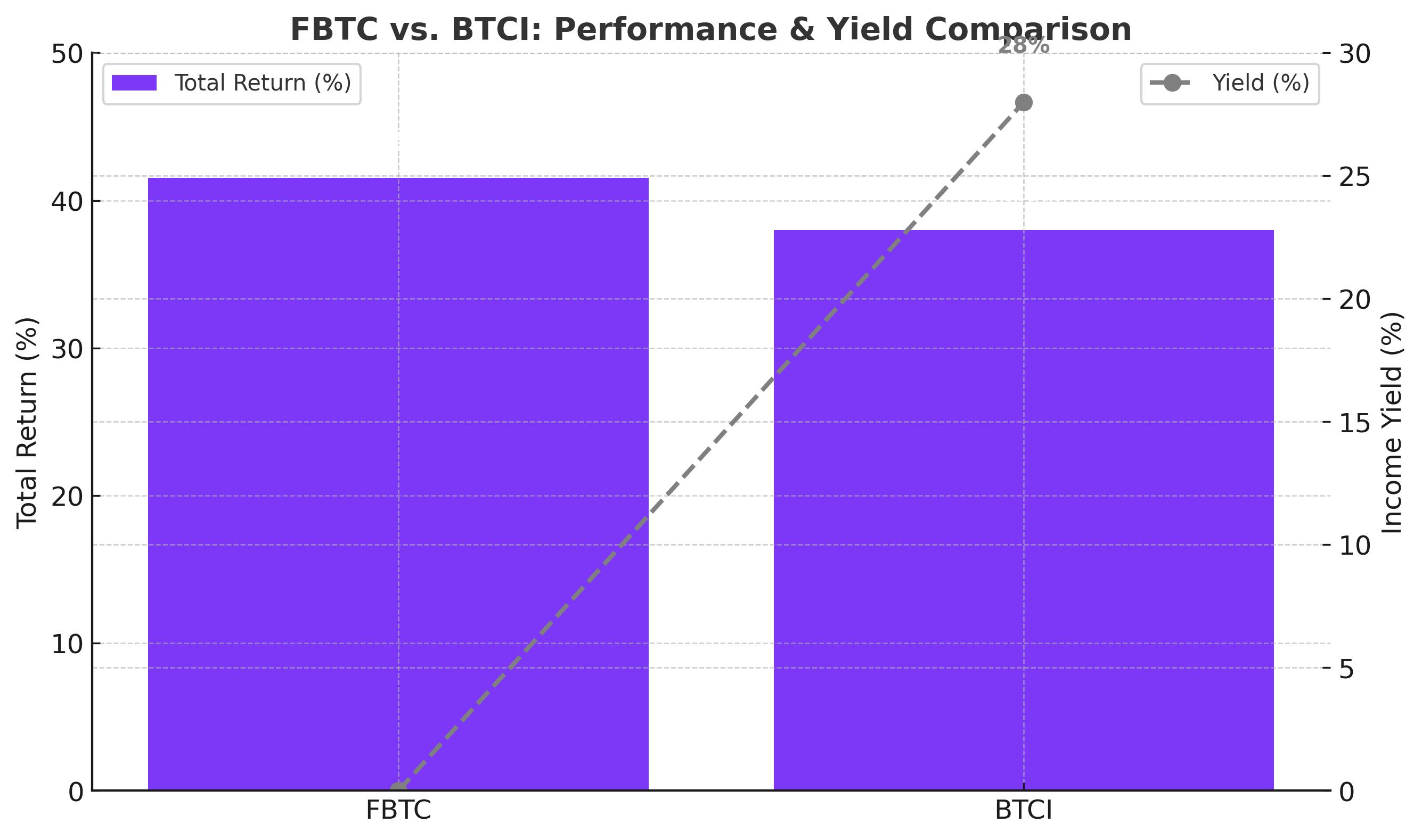

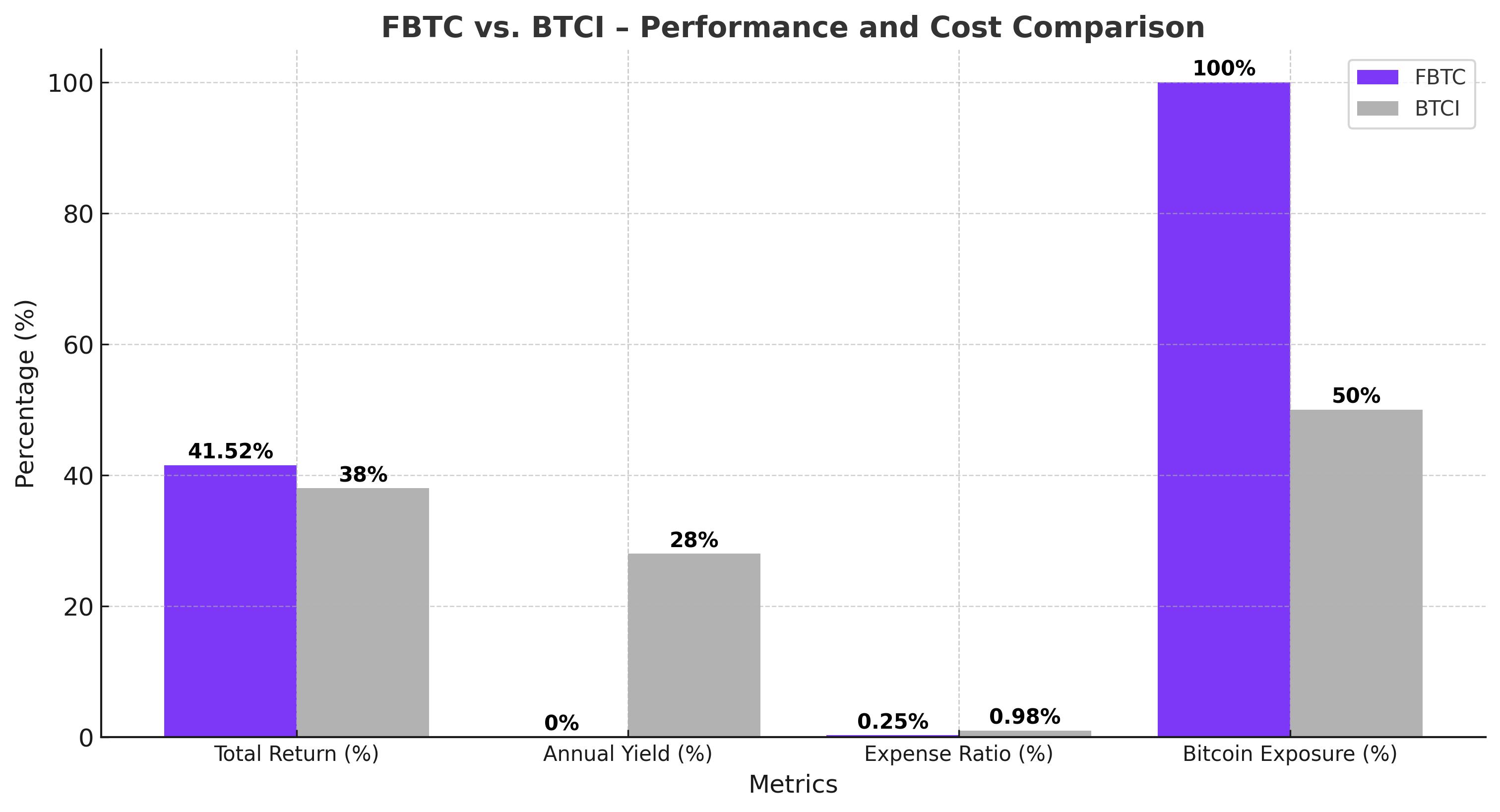

FBTC has seen a 41.52% total return since its inception, closely mirroring Bitcoin’s movement. The ETF is designed to reflect Bitcoin’s exact price performance, so when BTC surged from $60,000 to $100,000 in late 2024 and early 2025, FBTC holders saw nearly identical gains. No complex options strategies, no yield dilution—just direct exposure to Bitcoin.

BTCI, on the other hand, has posted a 38% total return since its launch in October 2024. However, the key difference is that only 26.5% of BTCI’s total return comes from Bitcoin price appreciation—the remaining 11.5% is from its covered call income strategy. Essentially, BTCI is capturing about 50% of Bitcoin’s price movement, meaning if Bitcoin surges past $120,000, BTCI holders won’t see the full gains.

So far, BTCI has underperformed FBTC in a rising Bitcoin market. While its 28% yield is highly attractive, investors sacrificing price upside must determine whether the monthly income is worth missing out on Bitcoin’s bull run.

Expense Ratios – Is FBTC or BTCI More Cost-Effective?

FBTC wins on fees. Its 0.25% expense ratio makes it one of the most affordable Bitcoin ETFs available. Over time, this can significantly impact returns, especially for long-term holders who plan to benefit from Bitcoin’s continued appreciation.

BTCI, in contrast, charges 0.98%, nearly four times higher. The elevated fee is due to its active options strategy, which requires frequent portfolio management. While its 28% yield may justify the cost for some income-focused investors, those looking for long-term growth may find the fee structure less appealing.

Income vs. Growth – What’s the Better Long-Term Strategy?

FBTC is purely a growth ETF—its value mirrors Bitcoin’s price movement with no dividends or income distributions. Investors who are betting on Bitcoin surpassing $150,000 in the next 12-18 months will benefit from FBTC’s structure, as there are no options strategies capping upside potential.

BTCI, however, prioritizes income. Through covered call writing on Bitcoin-related ETFs, BTCI generates a staggering 28% yield, providing investors with consistent monthly distributions. However, this income comes at the expense of potential capital appreciation—meaning if Bitcoin continues climbing, BTCI holders won’t fully participate in the upside.

For example, when Bitcoin surged from $60,000 to $100,000, BTCI captured only about 50% of that movement due to its options strategy. If BTC rises to $150,000 or $200,000, BTCI will leave a significant amount of gains on the table. Investors who prioritize passive income over capital appreciation might still prefer BTCI, but those looking to maximize Bitcoin’s explosive potential will likely favor FBTC.

Tax Implications – Which ETF is More Efficient?

Tax efficiency is critical for long-term investors. FBTC follows standard capital gains taxation—if you hold it for more than a year, your gains are taxed at long-term capital gains rates, making it simple and predictable.

BTCI employs a complex tax structure due to its options strategy. Covered call premiums are taxed as 60% long-term and 40% short-term capital gains under Section 1256 tax rules, which can be beneficial for high-income investors. Additionally, BTCI’s distributions are classified as return of capital (ROC), allowing for deferred taxation but potentially lowering cost basis over time.

For tax-sensitive investors, BTCI’s structure offers advantages, especially for those in high-income brackets. However, those looking for pure Bitcoin exposure without tax complexity may find FBTC to be the better choice.

Risk Analysis – Which ETF is More Stable?

Both FBTC and BTCI carry inherent risks, primarily tied to Bitcoin’s volatility. Bitcoin’s price movements can be extreme, with historical drawdowns of 50% or more in bear markets. FBTC is fully exposed to this risk—if Bitcoin drops back to $70,000, FBTC holders will experience the full decline.

BTCI’s covered call strategy provides some downside protection due to its monthly income generation. Even in a bearish environment, BTCI can continue generating income from options premiums, softening the impact of a Bitcoin downturn. However, if volatility declines or Bitcoin trades sideways for extended periods, BTCI’s income potential could shrink.

Another major risk for BTCI is early assignment on its options contracts. Because BTCI sells covered calls on Bitcoin ETFs, if BTC surges unexpectedly, options could be exercised early, leading to capped gains and NAV erosion.

Which ETF Should You Buy?

If you believe Bitcoin is heading for $150,000 or higher in 2025, FBTC is the clear winner. It provides unrestricted upside, a low 0.25% expense ratio, and direct exposure to Bitcoin’s price movement.

However, if you prefer passive income and want to generate monthly cash flow, BTCI’s 28% yield is unbeatable. While capped upside is a drawback, BTCI still captures a portion of Bitcoin’s growth while delivering steady, tax-efficient income.

For growth-focused investors, FBTC is the superior choice. For income-focused investors, BTCI offers a compelling alternative—if you can tolerate missing out on Bitcoin’s explosive bull runs.