Fidelity 2024 Outlook - Growth, Dividends and Market Leadership

Unveiling FNF's Financial Fortitude: From Market Share Dominance to Dividend Excellence | That's TradingNEWS

Fidelity National Financial, Inc. (FNF): A Deep Dive into Market Performance and Growth Prospects

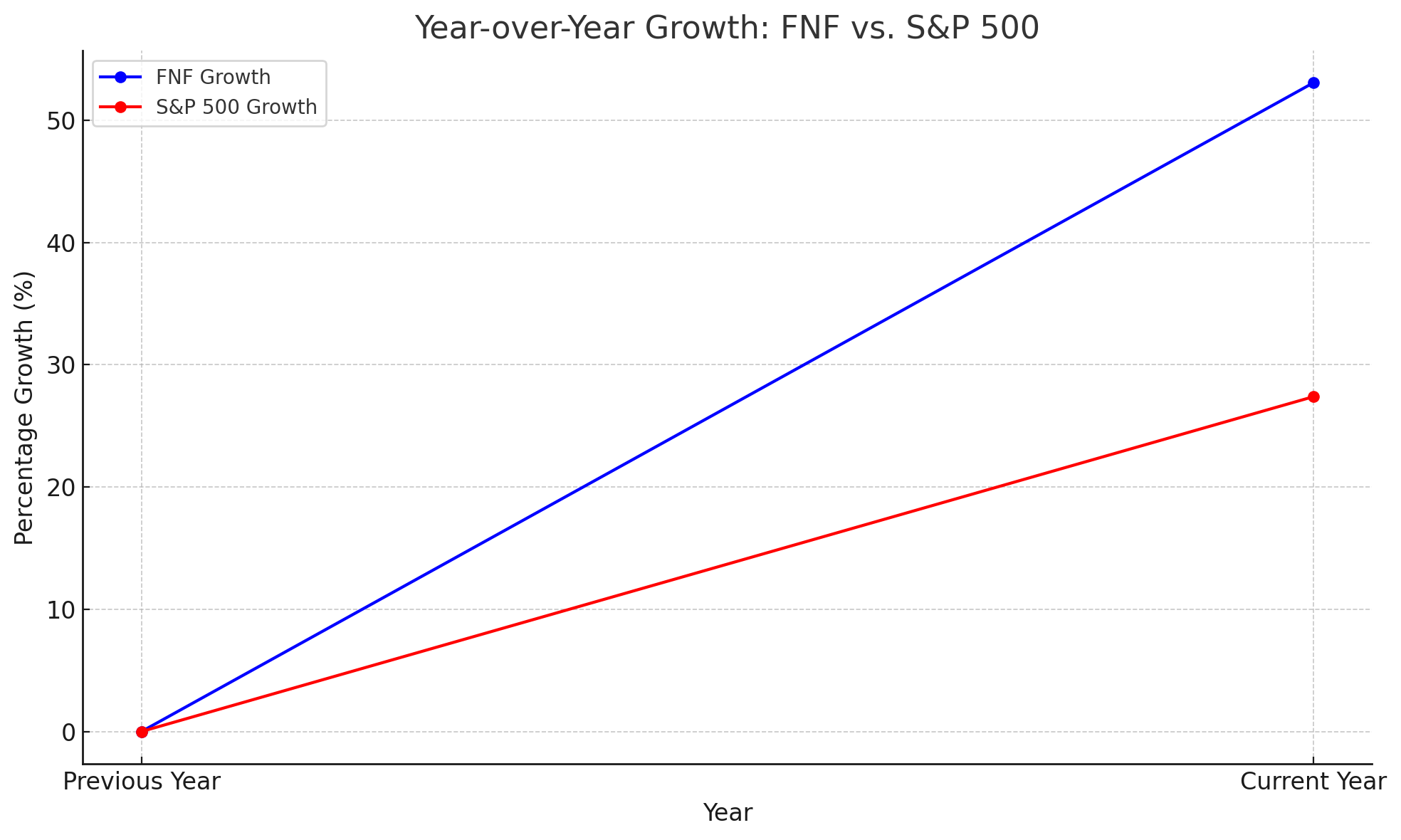

Market Position and Performance Metrics

Fidelity National Financial, Inc. (NYSE: FNF) stands as a beacon in the financial services landscape, distinguished by its commanding presence in the title insurance sector. With a Market Cap of approximately $14.454 billion and a share price fluctuation from $52.60 to $53.09 during the day, the stock has exhibited a remarkable journey. Year-over-year, FNF has seen a 53.07% appreciation, outpacing the S&P500's 27.39% increase, signaling robust investor confidence and a bullish market sentiment towards the company.

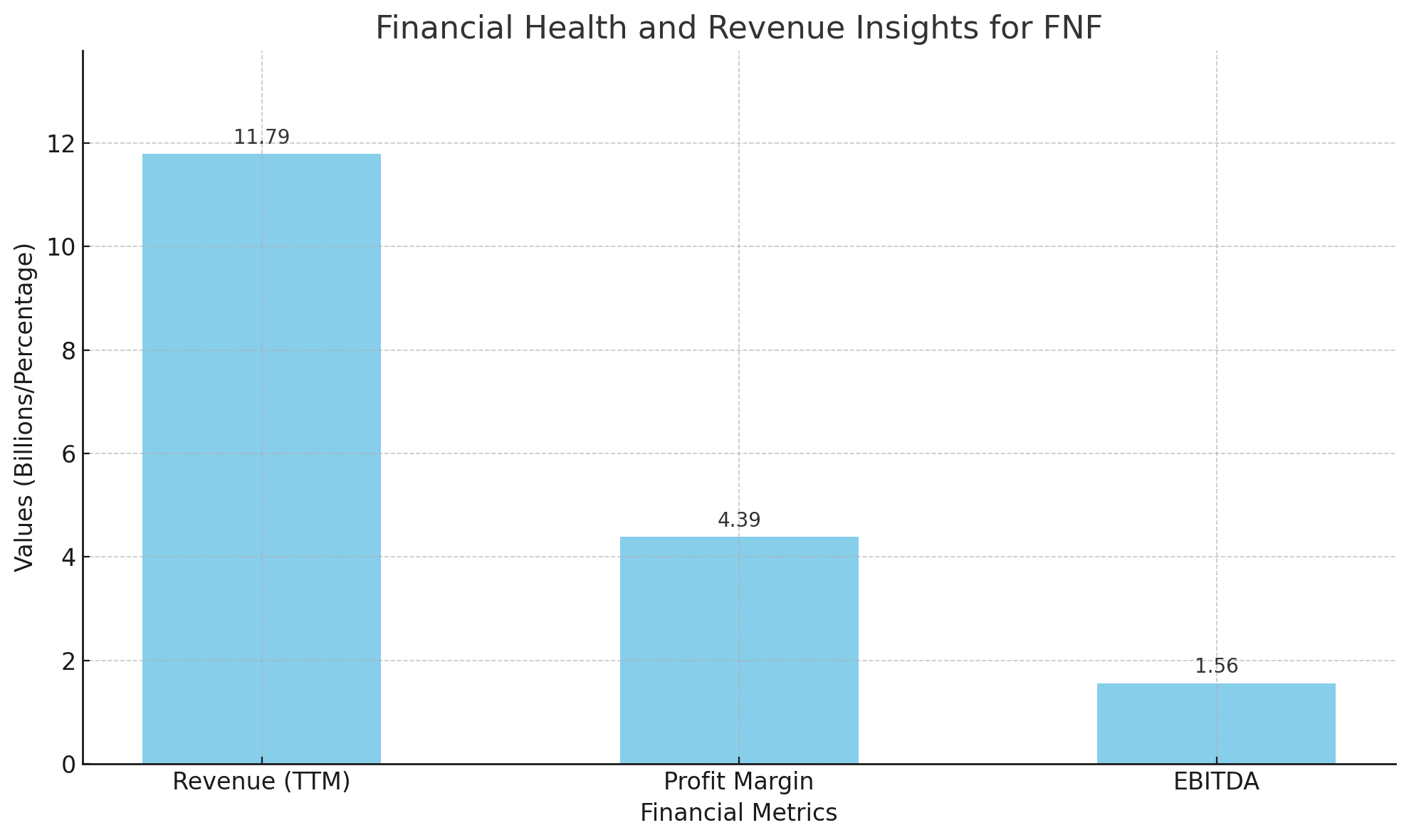

Financial Health and Revenue Insights

Delving into the fiscal health of FNF reveals a company on a solid growth trajectory. With Revenue (TTM) touching $11.79 billion and a Profit Margin of 4.39%, the company has navigated through the complexities of the financial sector with finesse. The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) stands at $1.56 billion, underpinning the operational efficiency and profitability of FNF. A critical examination of the Dividends & Splits section highlights a forward annual dividend rate of 1.92, yielding 3.62%, a testament to FNF's commitment to shareholder value.

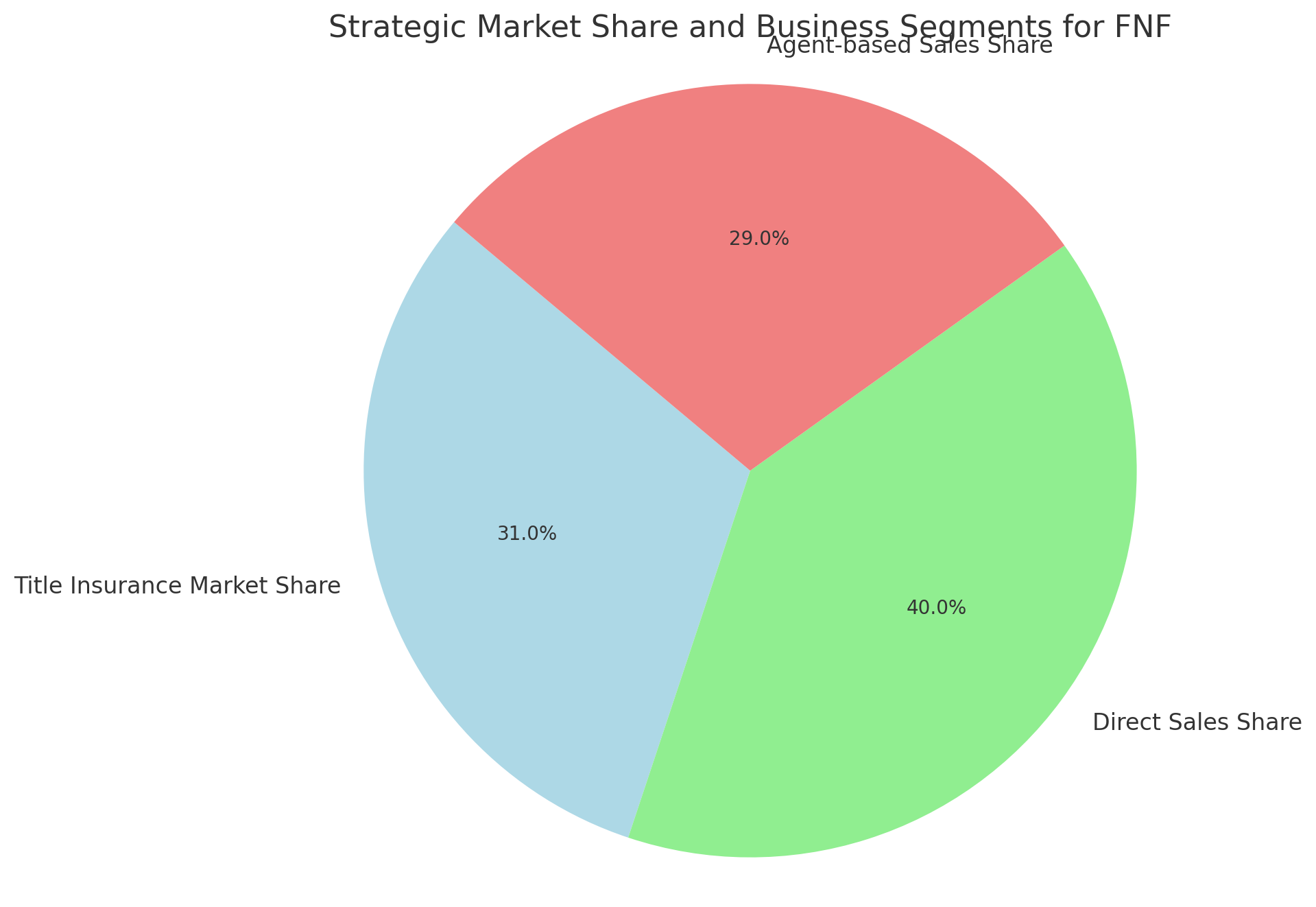

Strategic Market Share and Business Segments

FNF's strategic dominance is evident in its market share, boasting a 31% hold in the title insurance market. This leadership extends to a 40% share in direct sales and a slight edge in agent-based sales. Such market penetration is pivotal, offering FNF the leverage to upscale and cross-sell its diversified portfolio, including mortgage services and real estate technology solutions.

Technological Advancements and Efficiency Gains

The digitization of title verification processes marks a significant leap towards operational efficiency. The shift from manual, days-long verifications to digital, minute-long checks not only enhances customer satisfaction but also positions FNF as a frontrunner in adopting technological advancements to streamline operations and improve margins.

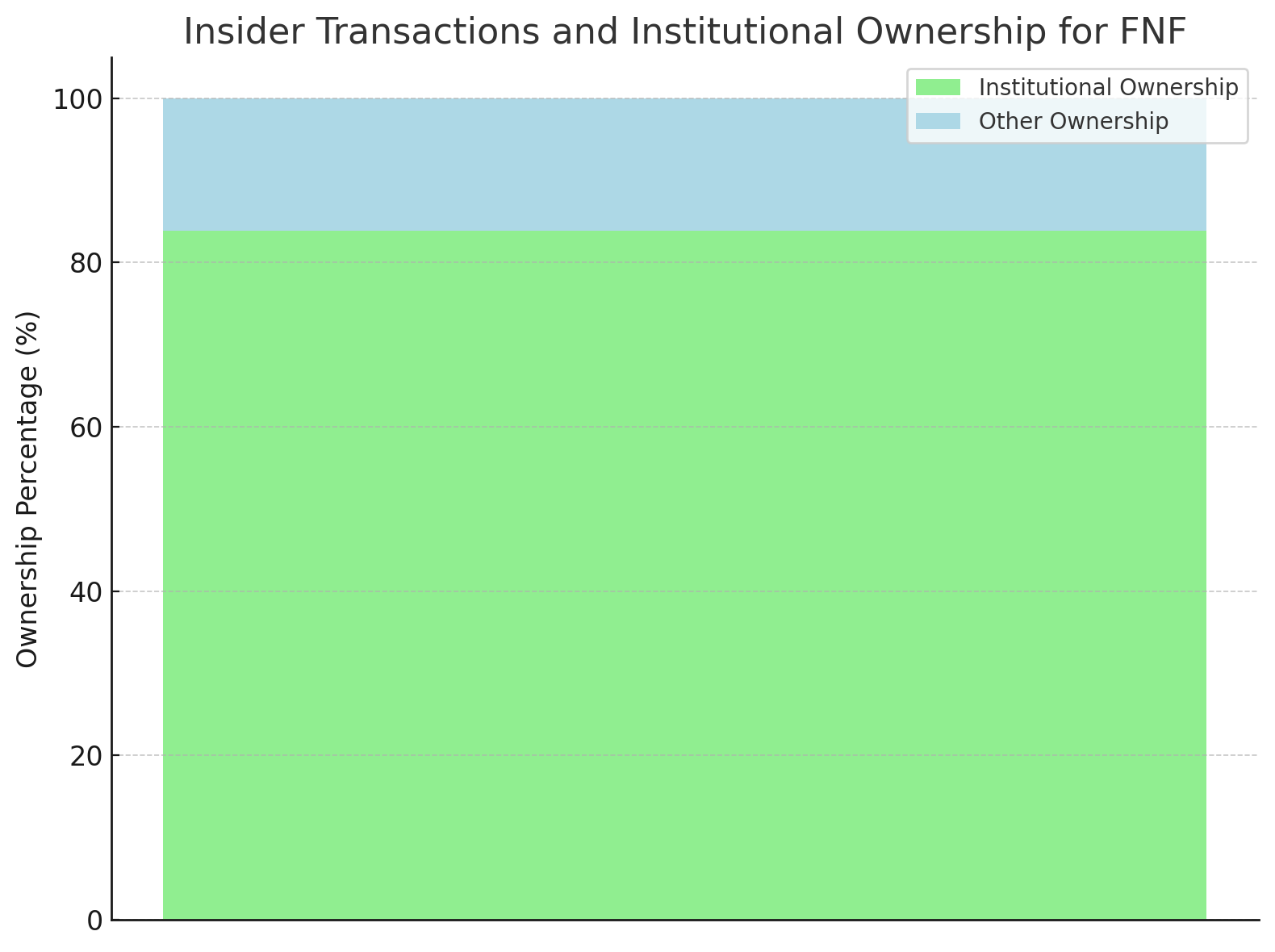

Insider Transactions and Institutional Ownership

A link to Insider Transactions reveals a strategic play by FNF's directors, indicating confidence in the company's growth trajectory. Moreover, the substantial 83.88% institutional ownership underscores a strong vote of confidence from the market, reflecting the perceived long-term value of FNF shares.

Dividend Reliability and Growth Prospects

FNF's dividend history is a narrative of consistency and growth, with a Dividend Payout Ratio of 95.81% and a history of annual increases. This trend is not just a reflection of the past but a forward-looking indicator of FNF's financial health and its management's confidence in future earnings.

Fiscal Year Analysis and Forward-Looking Statements

The fiscal year ending December 31, 2023, along with subsequent quarters, has painted a picture of resilience and growth. Analysts' average estimates suggest an upward trajectory in both earnings and revenue, indicating optimism about FNF's ability to scale and adapt in a fluctuating economic landscape.

Valuation and Investment Thesis

FNF's valuation, with a Trailing P/E of 27.80 and a Forward P/E of 12.82, suggests a company at a pivotal growth juncture. The juxtaposition of its current valuation against historical metrics and sector averages offers a nuanced view of FNF's investment potential. While the company's P/E ratios indicate a premium valuation, the underlying financials, market leadership, and growth prospects justify this positioning.

Conclusion

In summary, Fidelity National Financial, Inc. (NYSE: FNF) presents a compelling case for investors seeking a blend of stability, growth, and dividend yield. With a robust market position, a commitment to technological innovation, and a solid financial foundation, FNF is well-equipped to navigate the challenges and opportunities of the financial services landscape. Investors are encouraged to closely monitor FNF's performance, particularly in relation to market trends and interest rate movements, to make informed decisions. For real-time stock analysis and detailed financials, visit TradingNews.com and explore FNF's stock profile and insider transactions here.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback