Five Below NYSE:FIVE Stock Growth and Value

A Comprehensive Analysis of Five Below's Market Position, Financial Health, Strategic Expansion, and Investor Potential in the Competitive Retail Sector | That's TradingNEWS

In-Depth Analysis of Five Below, Inc. (NYSE:FIVE): A Retailer Defining Value and Growth

Corporate Overview and Market Positioning

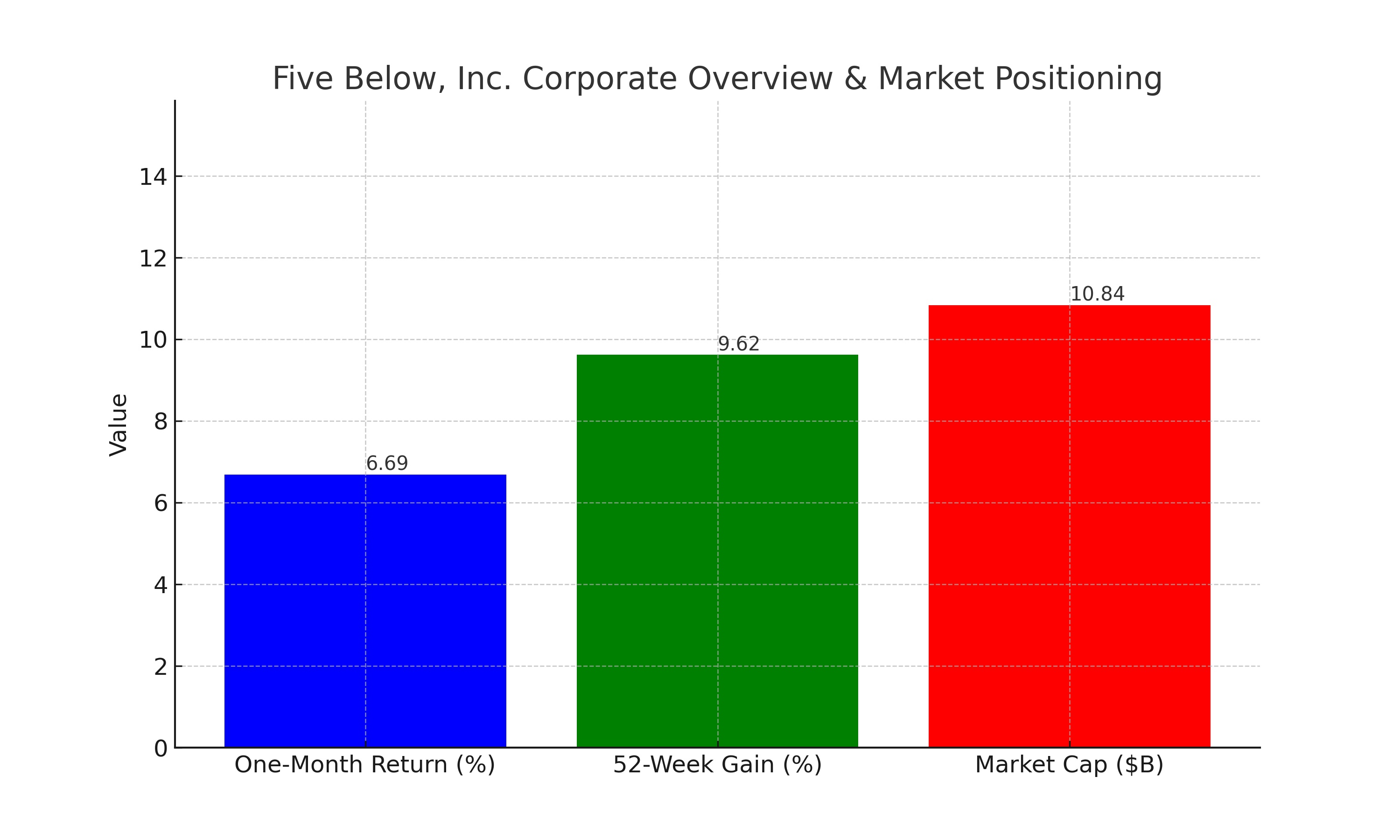

Five Below, Inc. (NYSE:FIVE), a distinguished player in the specialty value retail sector, headquartered in Philadelphia, Pennsylvania, has showcased remarkable resilience and growth in a dynamic market environment. As of December 12, 2023, the company's stock price stood at $196.39 per share, reflecting a one-month return of 6.69% and a 52-week gain of 9.62%. Currently, Five Below holds a substantial market capitalization of approximately $10.839 billion, positioning it as a significant contender in the retail sector.

Financial Performance and Stock Valuation

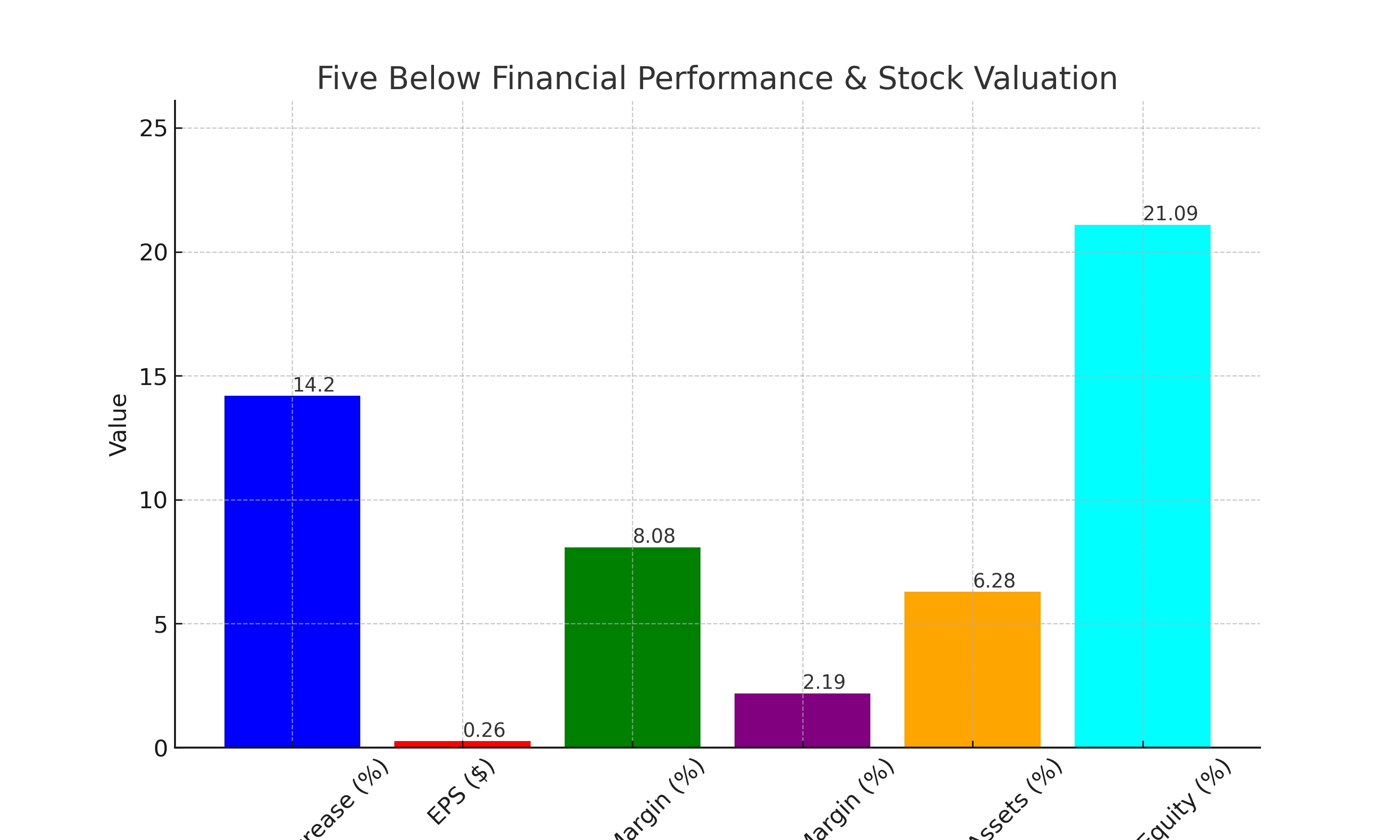

Five Below's financial journey is marked by impressive numbers and strategic growth. The company reported a year-over-year sales increase of 14.2%, totaling $736.4 million. This growth can be attributed to an accelerated pace of new store openings and a notable rise in comparable sales, particularly driven by increased customer traffic.

However, it is crucial to note a decrease in earnings per share (EPS), dropping from $0.29 to $0.26 year-over-year. This decline was primarily due to challenges such as shrinkage, which the company is actively addressing. Despite this, Five Below beat market expectations in terms of profitability, highlighting its robust operational efficiency.

As of the most recent quarter ending October 27, 2023, Five Below reported a profit margin of 8.08% and an operating margin of 2.19%. The company's return on assets stood at 6.28%, with a notable return on equity of 21.09%. These figures reflect Five Below's strong financial health and operational effectiveness.

Growth Drivers and Competitive Edge

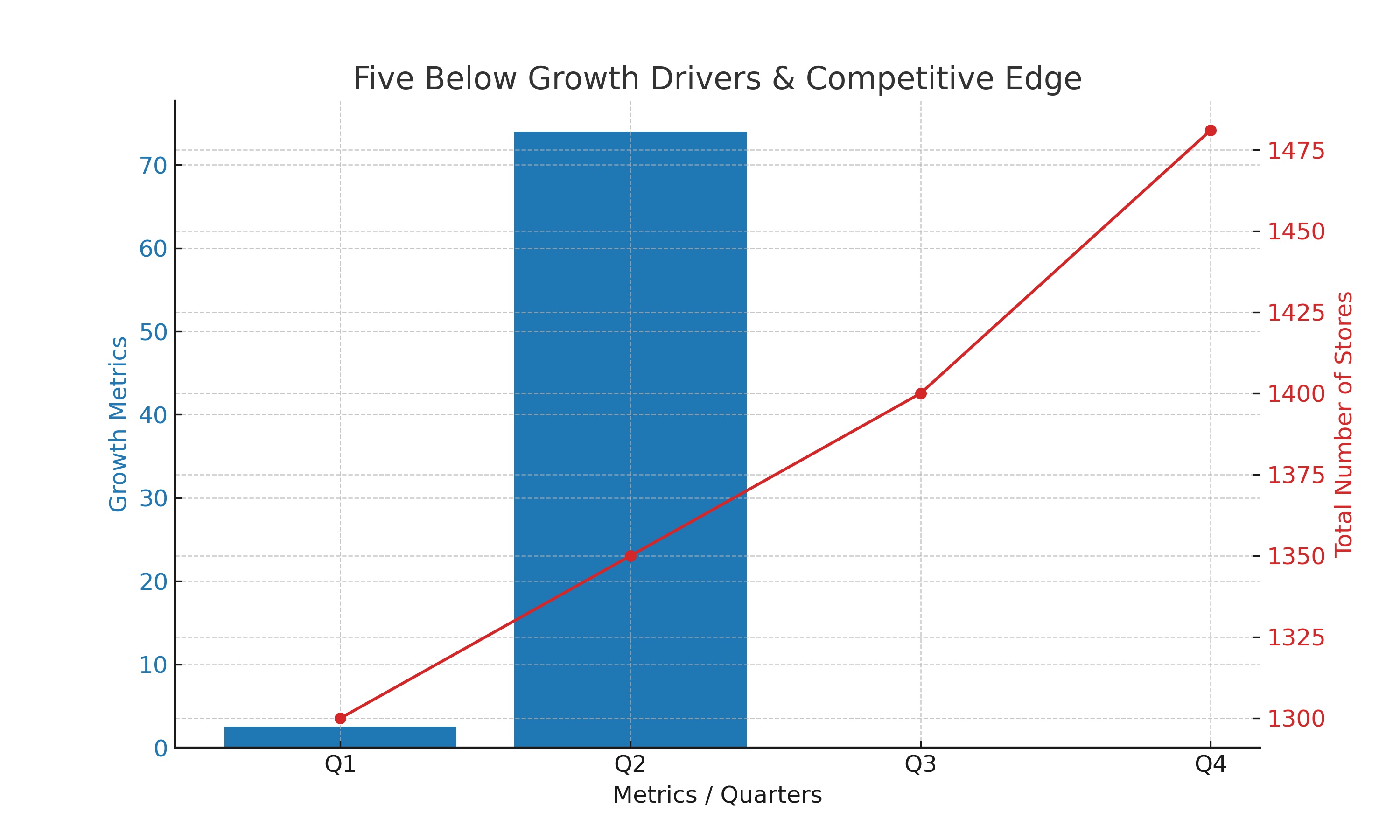

The growth trajectory of Five Below can be dissected into two primary drivers: comparable sales and new store openings. The company successfully grew its comparable sales by 2.5% year over year, with a significant contribution from an increase in customer transactions. This growth is a testament to Five Below's ability to maintain relevance and appeal in its stores.

Simultaneously, Five Below embarked on an aggressive expansion strategy, opening a record 74 new stores in a single quarter, bringing its total to 1,481 stores. Importantly, these new stores are performing in line with the company's expectations, suggesting a healthy growth path without significant cannibalization of existing stores.

Management Efficiency and Shareholder Alignment

An intriguing aspect of Five Below's corporate governance is the significant stake held by insiders, totaling around US$202 million. This level of investment by insiders, including a reasonable CEO compensation package of US$7.0 million, aligns management interests with those of shareholders, underpinning a culture of integrity and commitment to the company's future.

Future Outlook and Strategic Initiatives

Looking forward, Five Below is not resting on its laurels. The company is innovating in areas such as inventory management, leveraging technology, and analytics to optimize operations further. This proactive approach is evident in its reinvestment strategies, with the company spending $232 million on capital expenditures in the first nine months of the year, a 34% increase year over year.

Market Risks and Opportunities

Despite its robust performance, Five Below is not immune to market risks, including fluctuations in consumer spending and competitive pressures. The retail sector, known for its cyclical nature, poses challenges that Five Below must navigate. However, the company's diversified revenue streams and strategic growth initiatives provide a buffer against these uncertainties.

Investment Potential

Given the current financials and growth prospects, Five Below presents an intriguing investment opportunity. The company's forward P/E ratio stands at 28.99, with a trailing P/E of 40.07. While these figures may appear high, they need to be juxtaposed against the company's growth trajectory and market positioning.

Market Dynamics and Investor Sentiment

Five Below (NYSE:FIVE) operates in a highly dynamic retail environment, where market trends and consumer preferences can shift rapidly. The company's ability to adapt and stay relevant, especially in the face of rising competition from e-commerce platforms and other value retailers, is key to its sustained growth. Investor sentiment around Five Below has generally been positive, buoyed by its consistent financial performance and strategic expansion plans. This optimism is reflected in the stock's 52-week range, showcasing resilience amidst market volatility.

Revenue and Earnings Forecast

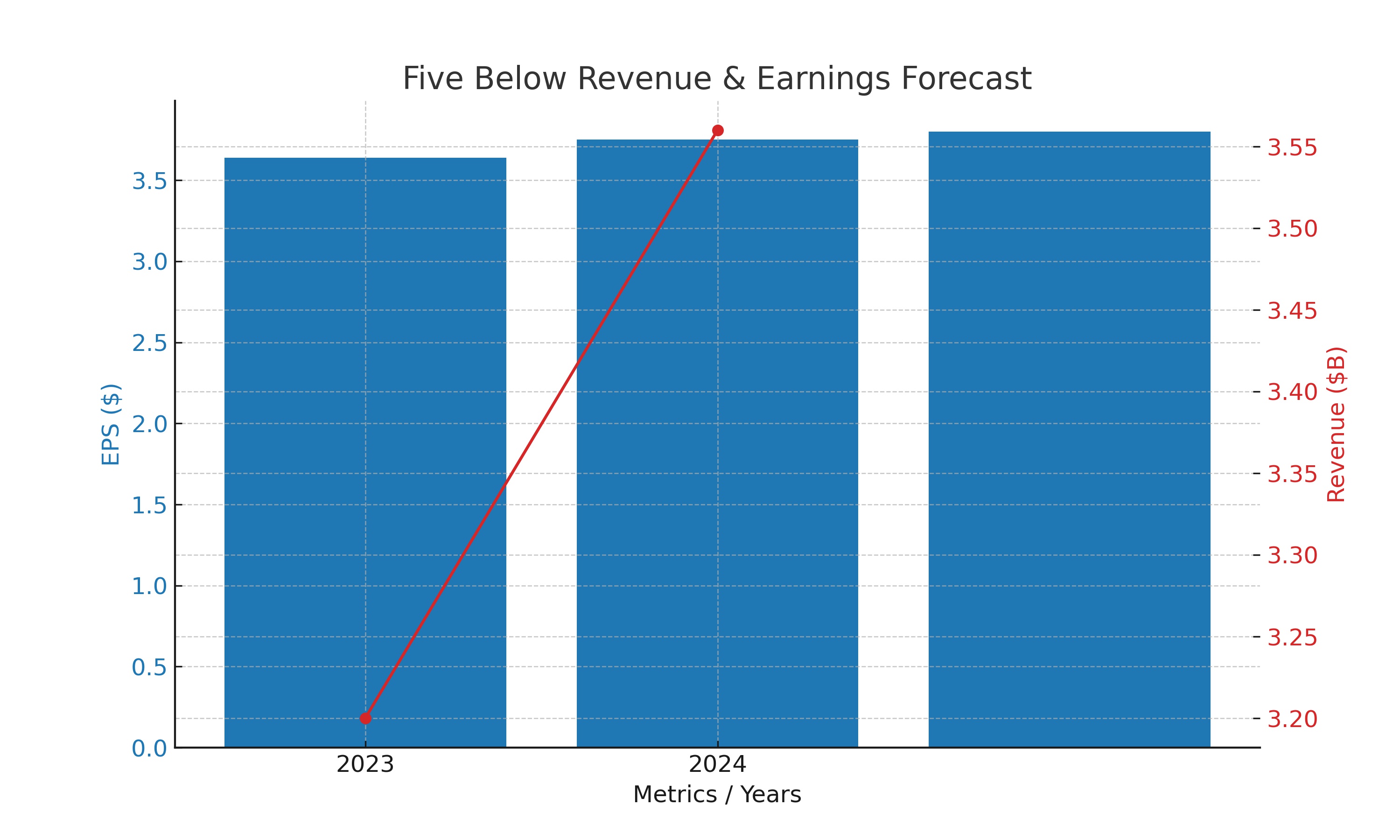

Projected revenue and earnings estimates are crucial in evaluating Five Below's future performance. For the current quarter ending January 2024, analysts expect an average EPS of $3.75, with a high estimate of $3.8 and a low of $3.64. The annual revenue forecast for 2024 stands at $3.56 billion, signaling a significant year-over-year growth. These figures illustrate confidence in Five Below's ability to maintain its growth trajectory and capitalize on market opportunities.

Strategic Analysis: Store Expansion and Operational Efficiency

A critical factor in Five Below's growth strategy is its aggressive store expansion. The company's focus on increasing its store footprint, especially in lucrative markets, is expected to drive revenue growth. The impressive performance of new stores, without significant cannibalization of existing ones, is a testament to the brand's strength and market demand.

Operational efficiency, seen in Five Below's effective inventory management and optimized supply chain, also contributes to its competitive edge. These factors, combined with the company's strategic store placements, have enabled it to maximize sales and profitability.

Management's Strategic Vision and Shareholder Value

Five Below's management has shown a strong commitment to shareholder value. This is evident in their strategic initiatives, including stock buybacks and consistent investment in store growth and operational enhancements. The management's focus on balancing growth with operational efficiency is crucial in navigating the competitive retail landscape.

Market Risks and Challenges

While Five Below's growth prospects are promising, potential risks cannot be overlooked. Market volatility, changing consumer preferences, and competition are ongoing challenges. The company's performance in the upcoming quarters, particularly during crucial holiday seasons, will be critical in assessing its resilience and adaptability to market changes.

Investor Considerations

Investors eyeing Five Below should consider its growth potential against market risks. The company's PEG ratio (Price/Earnings to Growth ratio) of 1.16 suggests that its stock might be reasonably valued given its growth expectations. However, investors should closely monitor its quarterly performance, especially in key metrics like same-store sales growth, EPS, and revenue forecasts.

Conclusion

In summary, Five Below (NYSE:FIVE) stands out as a robust player in the value retail sector, marked by its strategic expansion, operational efficiency, and strong management vision. While facing the usual risks associated with retail, the company's agility and proven track record position it well for continued growth and profitability.