Fortinet Stock (NASDAQ:FTNT) Rockets 57% YTD: Should You Jump In?

Explosive Growth, AI Innovation, and Market Leadership Propel Fortinet's Stock to New Heights! | That's TradingNEWS

Comprehensive Analysis of Fortinet (NASDAQ:FTNT): Growth, Prospects, and Investment Outlook

Fortinet (NASDAQ:FTNT) has been on a stellar growth trajectory, buoyed by strong financial results, innovative product offerings, and strategic market positioning. The company’s performance in Q3 2024 reflects its ability to capitalize on the increasing demand for cybersecurity solutions while navigating industry challenges effectively. Here’s an in-depth analysis of Fortinet’s recent results, market dynamics, and potential as an investment opportunity.

Q3 2024 Financial Highlights: Robust Growth in Revenue and Margins

Fortinet posted revenue of $1.51 billion in Q3 2024, marking a 13% increase year-over-year, outpacing analyst estimates of $1.48 billion. The company's non-GAAP earnings per share (EPS) came in at $0.63, representing a remarkable 54% annual growth. This result significantly exceeded the company’s own guidance of $0.51 per share and reflected higher operational efficiencies.

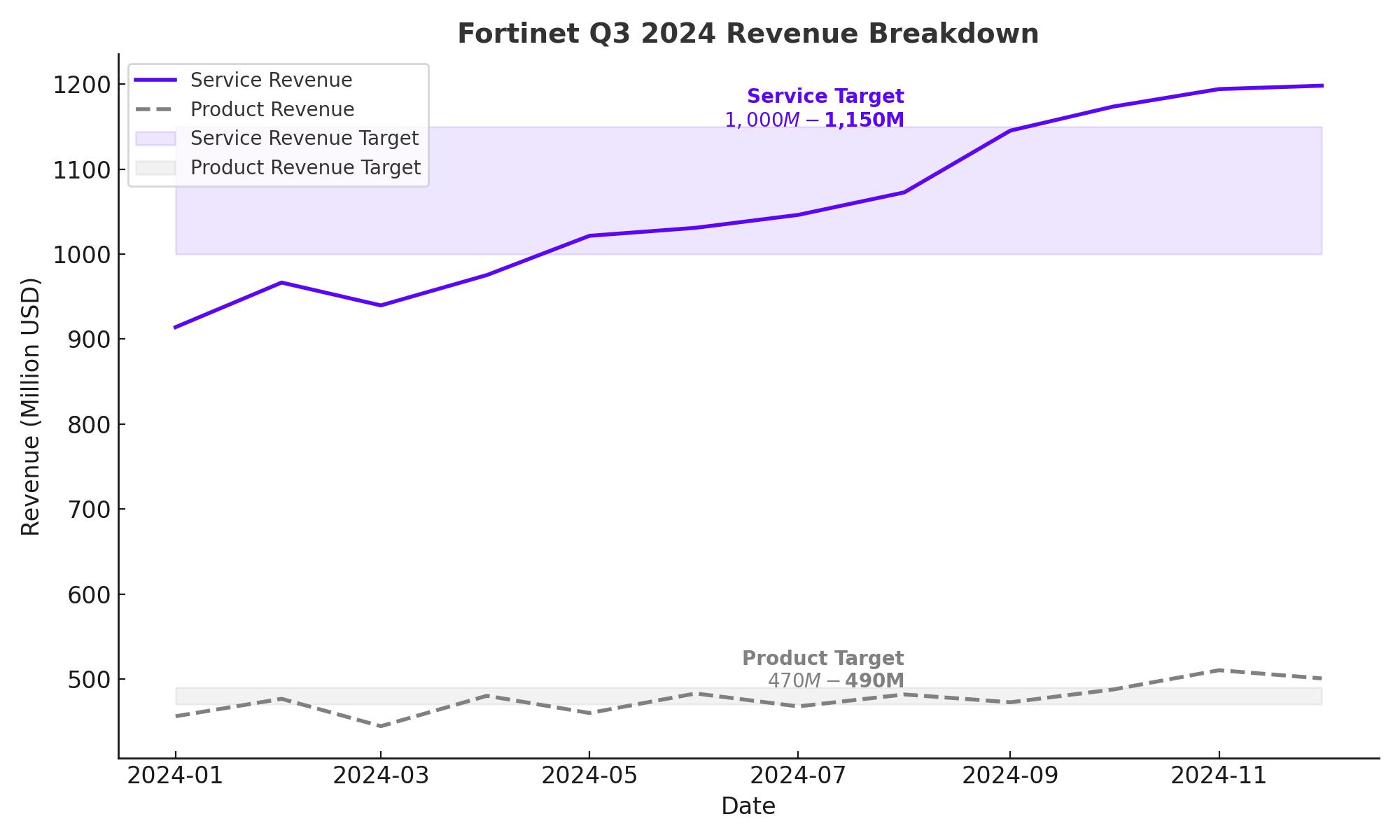

The revenue split between services and products highlights a critical shift. Services contributed $1.03 billion, a 19% increase, and accounted for 68% of total revenue. This compares favorably to the previous year's 65%, demonstrating the strategic pivot toward high-margin recurring revenue streams. Product revenue, after five consecutive quarters of decline, grew by 2% to $474 million. This signals a recovery in product sales, which are essential for driving long-term service revenue.

Fortinet's operating margin expanded to 36.1%, up from 27.8% in Q3 2023. This improvement is primarily due to increased service revenues, which boast gross margins of 88.5%, significantly higher than the 68.4% margin of product sales. Overall, the company’s profitability metrics underline its success in scaling operations while maintaining cost discipline.

AI-Driven SecOps and Unified SASE as Growth Catalysts

Fortinet’s strategic focus on artificial intelligence (AI) and Secure Access Service Edge (SASE) technologies has been instrumental in its recent performance. AI-driven SecOps achieved 32% billings growth in Q3, accounting for 10.5% of total billings compared to 9% in Q1. This upward trajectory underscores the growing demand for advanced cybersecurity solutions powered by machine learning.

The global market for AI-driven cybersecurity is projected to grow at a compound annual growth rate (CAGR) of 13%, reaching $163 billion by 2028. Fortinet is well-positioned to capture this opportunity, given its robust portfolio of AI-enhanced tools like FortiAI. The company’s proactive investment in research and development (R&D), which constitutes a significant portion of its operating expenses, ensures continued innovation.

Unified SASE also saw significant traction, with revenue increasing by 27% year-over-year. This product simplifies networking and security integration, offering companies a seamless way to secure both on-premise and remote operations. Unified SASE is expected to grow at a 16% CAGR, reaching $46 billion by 2028. Fortinet’s deep penetration into this market, supported by a strong distribution network, will likely drive sustained growth.

Product Revenue Recovery and Upcoming Firewall Refresh Cycle

Product revenue, which had been under pressure for several quarters, showed signs of recovery with a 2% year-over-year growth in Q3. Excluding backlog, product revenue grew at double-digit rates sequentially, signaling an improvement in demand dynamics.

Looking ahead, the company anticipates a significant refresh cycle for its firewall products in 2025, with a record number of units expected to reach the end of their support life in 2026. This offers a substantial revenue opportunity, as existing customers upgrade to Fortinet’s latest hardware offerings. The expected refresh cycle aligns with Fortinet’s broader strategy to maintain leadership in network security, particularly in the firewall segment, where it holds a dominant market share.

Market Leadership and Competitive Positioning

Fortinet’s leadership across multiple Gartner Magic Quadrants, including Network Firewall, SD-WAN, and SASE, demonstrates its comprehensive capabilities in cybersecurity. The company’s flagship platform, FortiOS, integrates these solutions, creating significant switching costs for customers. This integration not only enhances customer retention but also drives cross-sell opportunities, increasing lifetime value.

Recent partnerships, such as with CrowdStrike, further strengthen Fortinet’s competitive positioning. This collaboration combines Fortinet’s firewall technology with CrowdStrike’s endpoint protection, delivering an end-to-end cybersecurity solution that directly competes with offerings from Palo Alto Networks (NASDAQ:PANW). Such strategic moves underscore Fortinet’s ability to innovate and adapt in a rapidly evolving market.

Insider Transactions and Institutional Confidence

Insider activity reflects a positive outlook on Fortinet’s prospects. Chief Operating Officer John Whittle recently sold 38,495 shares for approximately $3.29 million, while simultaneously exercising stock options. This activity aligns with a broader trend of insiders strategically managing their holdings without indicating a lack of confidence in the company’s future.

Institutional investors continue to show strong support, with institutional ownership at 83.71%. Recent additions by CapitalOne and Eastern Bank highlight growing confidence in Fortinet’s ability to deliver sustainable growth.

View Insider Transactions for NASDAQ:FTNT

Valuation and Market Sentiment

Fortinet’s valuation metrics remain attractive despite its recent stock rally. The stock trades at a forward P/E ratio of 43, below the sector average of 66.8. Its enterprise value-to-sales ratio stands at 11.5, slightly higher than peers but justified by its superior growth prospects and profitability.

The company’s free cash flow (FCF) generation is particularly noteworthy. With a 150% FCF-to-net-income conversion rate, Fortinet’s valuation in terms of EV/FCF is closer to 25x, making it an attractive investment for long-term holders.

Future Prospects and Strategic Initiatives

Fortinet’s focus on innovation, customer retention, and operational efficiency positions it well for sustained growth. The company’s unified platform strategy, coupled with its investments in AI and SASE, ensures it remains ahead of the curve in addressing evolving cybersecurity needs.

Management’s commitment to prudent capital allocation, including opportunistic share buybacks and bolt-on acquisitions, further enhances shareholder value. Fortinet’s founders, who collectively own nearly 15% of the outstanding shares, bring decades of expertise, reinforcing confidence in the company’s long-term vision.

Risks to Monitor

While Fortinet’s outlook is positive, several risks warrant attention:

- Macroeconomic Uncertainty: Slower global IT spending or prolonged sales cycles could impact near-term performance.

- Competitive Pressure: Aggressive moves by competitors like Palo Alto Networks may challenge Fortinet’s market share and pricing power.

- Guidance Adjustments: Reduced billings guidance for FY2024 reflects potential headwinds, which could dampen investor sentiment if not mitigated.

Investment Decision: Why Fortinet (NASDAQ:FTNT) is a Buy

Fortinet’s robust fundamentals and market leadership make it a strong Buy for long-term investors, despite its recent 57% YTD surge. Trading at approximately $94.20, the stock remains well-positioned for further upside due to its accelerating growth in high-margin service revenue, which now constitutes 68% of its top line. With operating margins expanding to 36.1% and a projected EPS growth of 37% for FY2024, Fortinet demonstrates unmatched operational efficiency in the cybersecurity space.

The anticipated firewall refresh cycle in 2025, coupled with the rapid adoption of AI-driven SecOps and Unified SASE solutions, supports future growth. The stock trades at a forward P/E of 43 and a compelling EV/FCF multiple of 25, reflecting a favorable valuation compared to peers. Insider ownership of nearly 15% aligns management's interests with shareholders, reinforcing confidence in the company’s strategic vision.

While current levels may prompt caution for new investors, Fortinet’s superior execution, strong R&D investments, and industry tailwinds make it a compelling buy for those focused on long-term gains. Potential upside remains significant, especially as the cybersecurity market continues to expand, and Fortinet maintains its leadership in key growth verticals.