Expanding Apple Partnership: A Multi-Billion Dollar Boost for Globalstar’s Growth

Globalstar’s (NYSE:GSAT) shares have surged in response to an expanded services agreement with Apple (AAPL), marking a pivotal moment for the satellite services provider. The partnership, structured around a $1.5 billion investment, will see Apple funding the construction, launch, and operation of a new mobile satellite services (MSS) network. This agreement deepens Globalstar’s role in Apple’s ecosystem, especially in supporting Apple's Emergency SOS feature, which has gained traction across regions like the U.S., Canada, Europe, and now Asia-Pacific.

Under the revised terms, Apple is set to prepay $1.1 billion, covering new satellite and ground facilities and supporting Globalstar’s growth. Additionally, Apple will acquire a 20% stake in Globalstar’s subsidiary, Globalstar Licensee, through a $400 million investment. Notably, Apple’s equity arrangement will allow quarterly redemptions post full repayment, reinforcing Apple’s long-term commitment while offering Globalstar operational flexibility. In return, Apple will pay an annual service fee of $30 million, a figure set to grow as network capacity and usage increase.

This extended partnership with Apple provides Globalstar with a steady revenue stream, with potential incremental earnings tied to specific performance milestones and regulatory approvals. It also offers a lifeline to Globalstar’s financial stability, as the agreement modifies Globalstar’s debt repayment schedule and relaxes certain loan covenants, allowing the company to focus on strategic expansion without immediate cash constraints.

View Globalstar’s real-time chart here.

Financial Performance: Steady Growth and Improving Margins

Globalstar reported strong financial results for the second quarter of 2024, with revenue increasing 10% year-over-year to $60.4 million. This growth was primarily driven by an 18% rise in service revenue, although offset by a dip in equipment sales, attributed to fluctuating IoT sales timing. The company’s EBITDA margin also improved, reaching 54%, up from 49% in the prior year, indicating that Globalstar’s revenue scale is translating into profitability, even with the high fixed costs typical of the satellite services industry.

For the full year 2024, Globalstar projects revenue in the range of $235 million to $250 million, a conservative 8% increase at the midpoint. This projection aligns with consensus estimates and reflects the continued support from Apple as well as growth in government and commercial IoT sectors.

While Globalstar is not yet profitable on a GAAP basis due to ongoing satellite deployment and infrastructure costs, the company has emphasized its cash flow potential post-investment. With significant cash expenditures expected in the short term due to milestone payments for next-gen satellite deployments, investors are likely to see fluctuating cash flows. However, once these satellites are operational, Globalstar should generate substantial free cash flow, especially if demand for their enhanced connectivity services scales as expected.

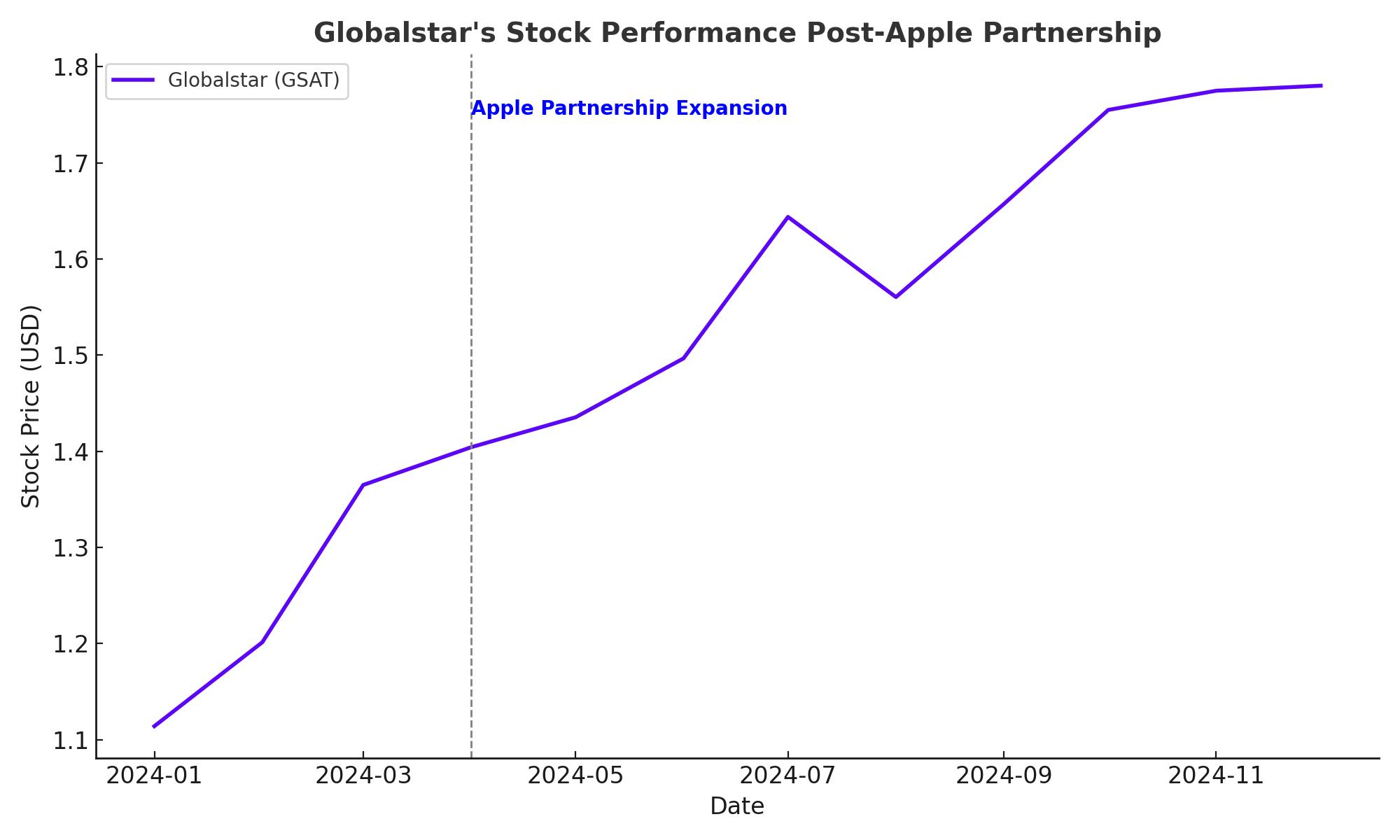

Market Sentiment and Stock Price Performance

Globalstar’s stock has demonstrated remarkable resilience and upward movement, fueled by investor optimism following the expanded Apple partnership. In recent trading, NYSE:GSAT opened at $1.50, up from the previous close of $1.38, with shares trading at $1.51. This 31.9% jump reflects a robust market response to the Apple agreement, showcasing renewed interest in Globalstar’s future prospects in mobile satellite services and beyond.

The company’s current ratio of 0.70 and quick ratio of 0.63 indicate a stable liquidity position, especially important as Globalstar embarks on large-scale infrastructure investments. With a market cap of $3.28 billion and a beta of 0.53, Globalstar offers a unique risk profile, balancing growth potential with lower volatility relative to broader market indices.

For detailed insider transactions on Globalstar, see here.

FCC License Extension and Long-Term Satellite Network Strategy

A critical element of Globalstar’s growth plan includes the recent extension of the FCC license for its HIBLEO-4 satellite constellation, which allows operation for an additional 15 years and permits the launch of up to 26 replacement satellites. This regulatory green light is a strategic win for Globalstar, ensuring continued service provision to millions globally, especially as demand for satellite connectivity surges across both commercial and consumer sectors.

The expanded satellite constellation will support voice and data communications services, targeting various applications from emergency preparedness to remote business continuity. With global licensing expanded under the new Apple agreement, Globalstar is set to further cement its market position in regions spanning North and South America, Europe, and Asia-Pacific.

Diversification and Growth in IoT, Terrestrial, and Private Networks

Globalstar’s strategic roadmap includes a broad array of connectivity services, spanning wholesale satellite capacity, IoT, and terrestrial wireless services. As of 2024, the company has organized its business into key verticals: consumer wholesale, consumer retail, government, commercial IoT, and XCOM RAN, with the latter two demonstrating the most promising growth potential.

The XCOM RAN (Radio Access Network) technology, introduced earlier this year, is expected to enable high-density wireless deployments, providing up to 4x the traffic capacity of traditional 5G networks in indoor venues. This technology is set to revolutionize private networks, especially for industries like manufacturing and logistics that require reliable, high-capacity connectivity. The market for private 5G, valued at around $2 billion, is projected to grow to $36 billion by 2030, offering a lucrative opportunity for Globalstar’s XCOM RAN and n53 licensing.

Globalstar’s n53 spectrum, which is compatible with CBRS (Citizens Broadband Radio Service), is another high-potential asset. In collaboration with partners like Global Telecom and Hawk Networks, Globalstar aims to leverage this spectrum to offer private wireless connectivity, particularly valuable in environments with restricted CBRS access. This integration could prove instrumental in developing mission-critical applications for sectors such as oil and gas, mining, and government facilities.

Financial Position and Share Repurchase Program

As of Q2 2024, Globalstar held $64 million in cash, a figure bolstered by the recent Apple deal, which has significantly strengthened the company’s balance sheet. While ongoing satellite investments are expected to weigh on cash flows, the infusion from Apple provides a financial buffer, enabling Globalstar to pursue long-term projects without compromising liquidity.

Additionally, Globalstar’s board has approved a $40 million share repurchase program, indicating confidence in the stock’s intrinsic value and a commitment to shareholder returns. The company has repurchased 534,246 shares to date, totaling $12.8 million at an average price of $23.97. This buyback initiative not only underscores Globalstar’s positive outlook but also serves to enhance stockholder value by reducing the shares outstanding.

Valuation and Long-Term Outlook

Trading at a price-to-earnings (P/E) ratio of -16.09 and a beta of 0.53, Globalstar’s valuation reflects both its high growth potential and inherent risks associated with large-scale infrastructure investments. However, the Apple partnership and the FCC license extension substantially improve Globalstar’s revenue visibility, positioning it well for future growth.

With expected revenue between $235 million and $250 million for 2024, Globalstar’s valuation metrics suggest room for upside, particularly if revenue from the Apple MSS agreement scales as anticipated. The company's ability to convert service revenue into free cash flow is poised to increase, especially once its next-generation satellite network is fully operational.

Analyst Outlook: Buy, Hold, or Sell?

Given the substantial Apple investment, expanded service offerings, and FCC licensing extension, Globalstar (NYSE:GSAT) represents a compelling growth story in the satellite services industry. While current profitability is impacted by heavy capital expenditures, the projected revenue growth and strategic partnerships signal long-term potential. With institutional backing, diversified revenue streams, and regulatory approvals in place, (NYSE:GSAT) could be a strong Buy for long-term growth investors. Short-term volatility may persist, but the stock’s fundamentals and strategic initiatives make it an attractive option for those seeking exposure to the fast-evolving satellite connectivity sector.