Global Oil Demand Reaches Unprecedented Heights

Economic Growth Drives Record-Breaking Oil Consumption and Emissions | That's TradingNEWS

Global Oil Consumption Surges to Record Highs Amid Economic Recovery

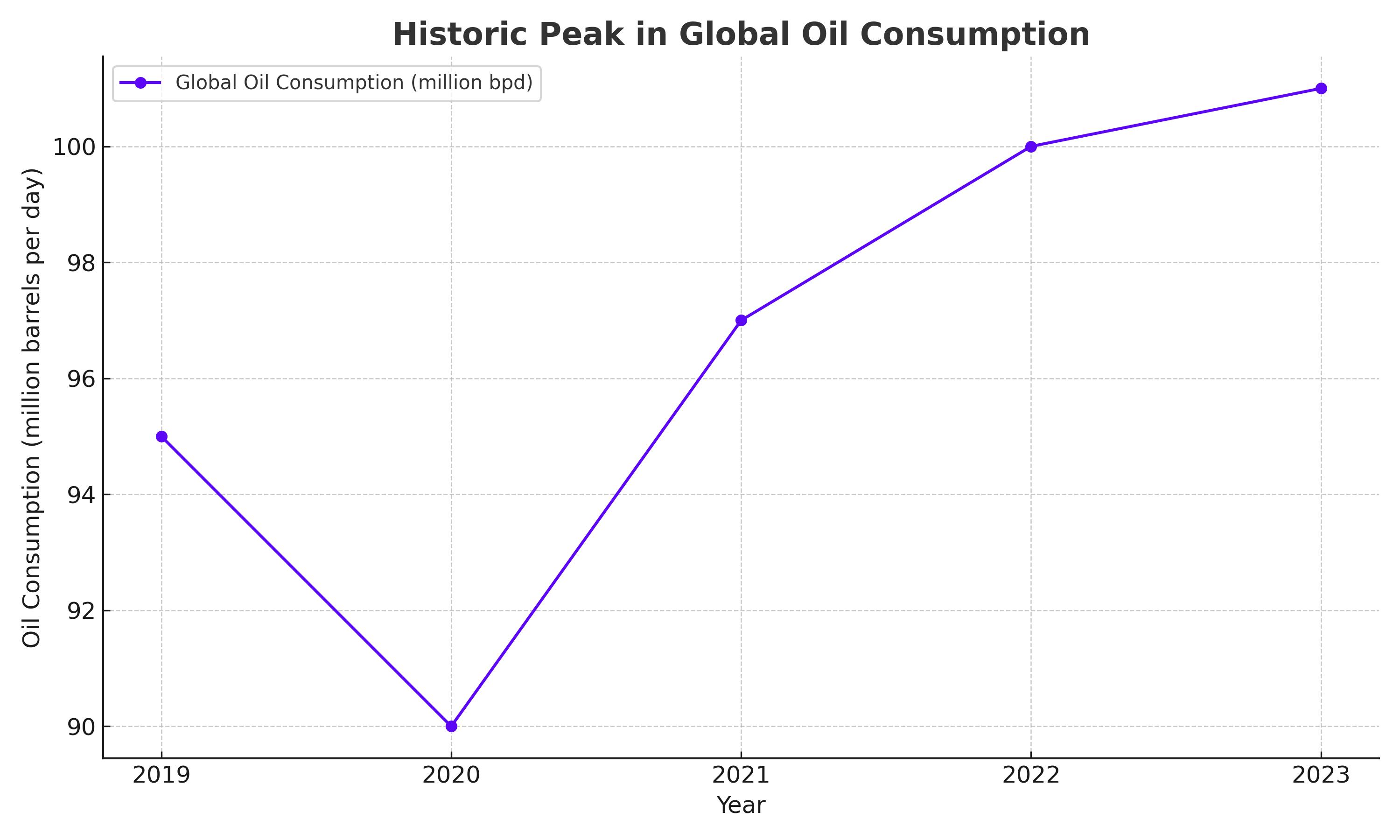

Historic Peak in Global Oil Consumption

Global oil consumption reached unprecedented levels in 2023, exceeding 100 million barrels per day (bpd) for the first time. This milestone, reported by the Energy Institute, marks a notable increase from the previous year when oil and biofuel consumption together hit 100 million bpd. This rise underscores the continued heavy reliance on oil despite global efforts towards renewable energy.

Record-Breaking Emissions

Emissions surged by 2.1% in 2023, surpassing 40 gigatons of carbon dioxide equivalent. Direct energy consumption alone contributed over 35 gigatons of these emissions. This increase highlights the ongoing environmental challenges associated with rising energy demands.

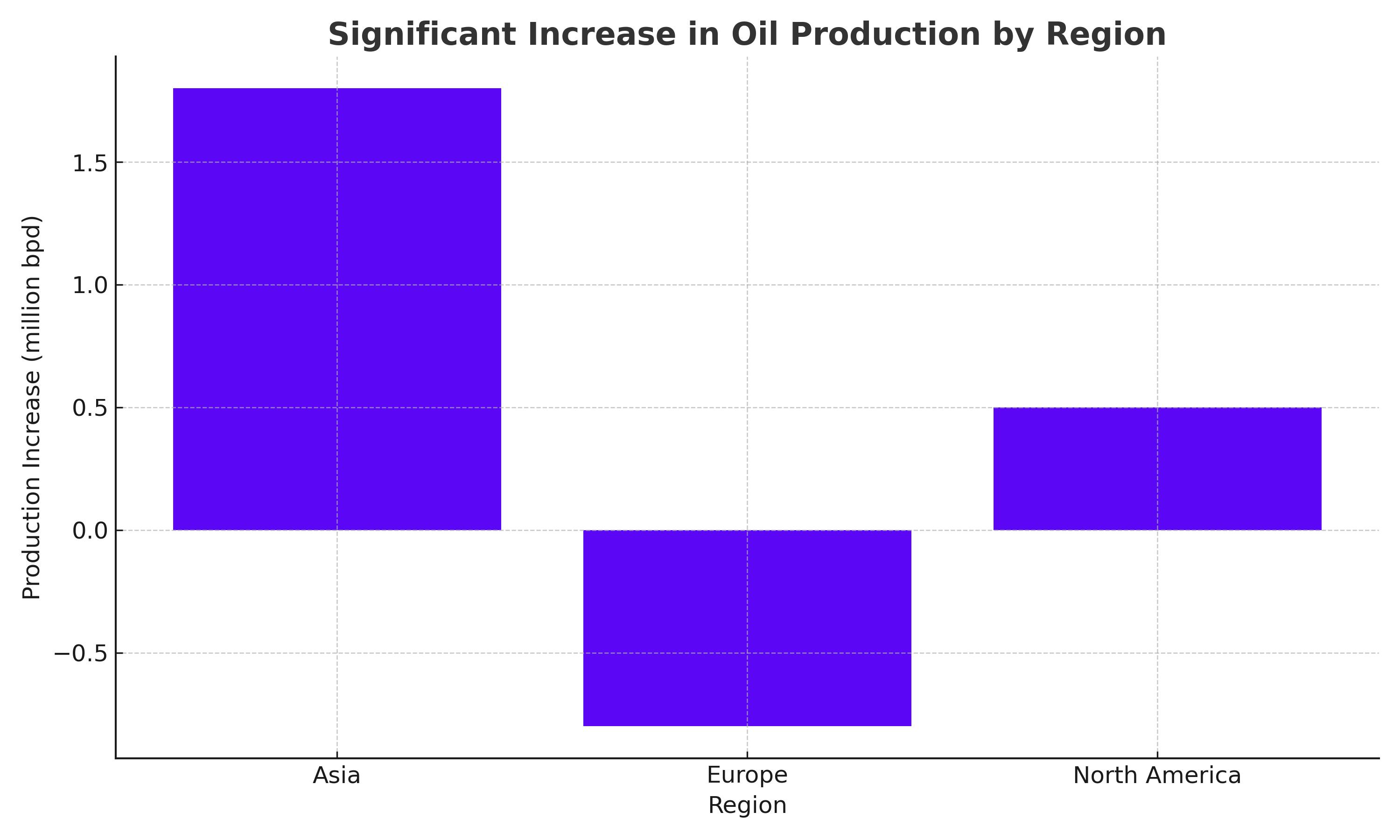

Significant Increase in Oil Production

In 2023, global oil production grew by 1.8 million bpd, reaching a record 96 million bpd. The demand increase was primarily driven by a 5% rise in Asia, which offset a 1% decline in Europe. North American demand saw a modest increase of 0.8%, reflecting varying regional consumption patterns and economic activities.

Stable Natural Gas Production

Natural gas production remained relatively unchanged from 2022, with declines in Russia and Europe. Overall demand for natural gas increased slightly by 0.02%, or 1 billion cubic meters. This stability contrasts with the dynamic changes seen in the oil sector.

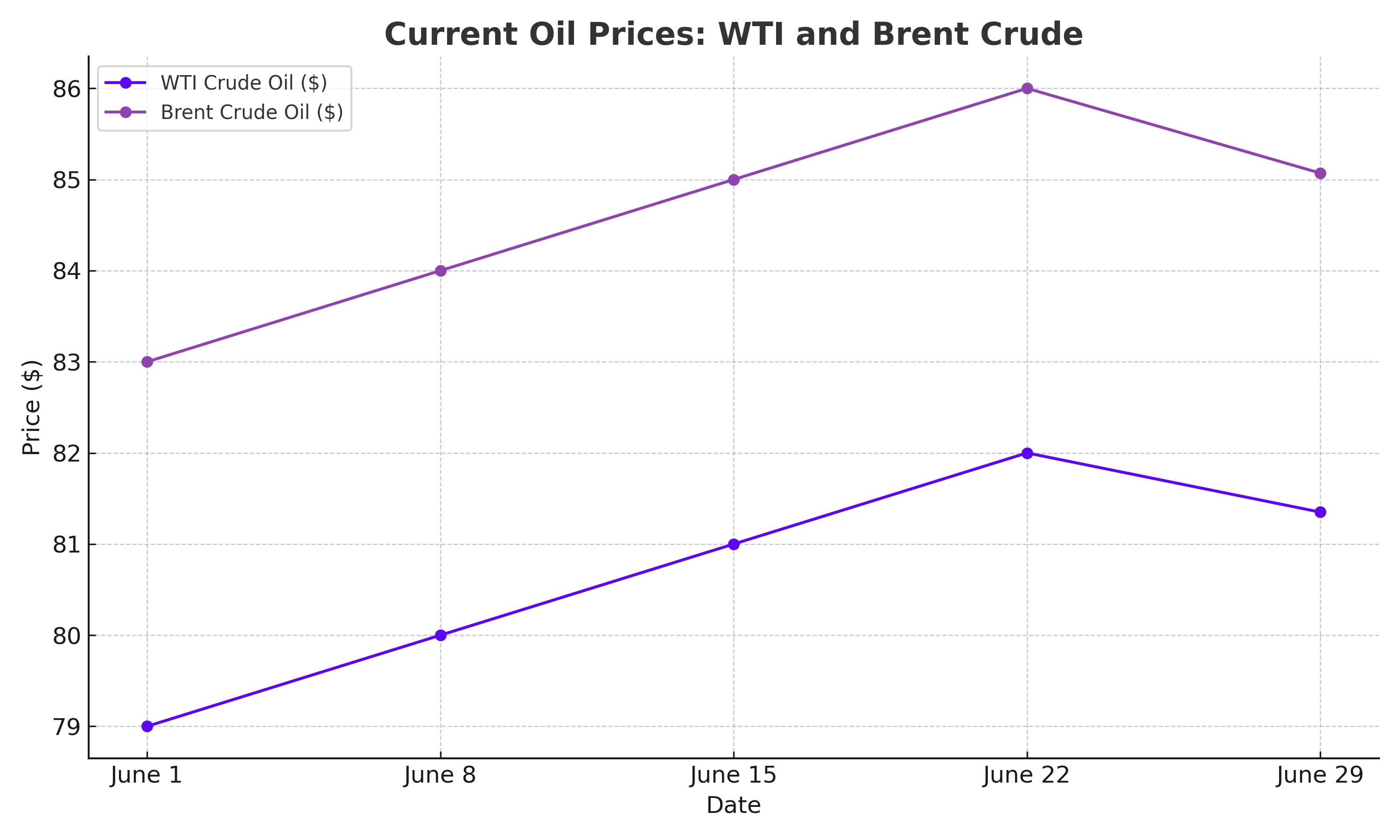

Current Oil Prices and Market Dynamics

As of June 19, 2024, WTI Crude Oil at the NYMEX Stock Exchange fell by 0.20% to $81.35 per barrel, while Brent Crude Oil at the ICE Stock Exchange in London decreased by 0.30% to $85.07 per barrel. These fluctuations are influenced by ongoing market conditions and geopolitical developments.

Analysts' Forecasts and Market Sentiments

Standard Chartered Bank analysts, led by Commodities Research Head Paul Horsnell, predict a rapid increase in oil prices towards $90 per barrel. This forecast is supported by speculative short-covering, consumer hedging, and stronger U.S. oil data. They project Brent crude oil prices to average $98 per barrel in Q3 2024 and $106 per barrel in Q4 2024.

Global Oil Demand Projections

April 2024 saw global oil demand estimated at 101.77 million bpd, 470,000 bpd higher than previous forecasts. Analysts expect demand to hit new records of 103.3 million bpd in May and 104.1 million bpd in June. This growth, the second-highest in six months, signifies a robust recovery in global oil consumption.

Geopolitical Risks and Regulatory Challenges

Geopolitical tensions, such as Ukrainian drone strikes on Russian energy infrastructure and potential conflicts involving Iran-backed Hezbollah, pose significant risks to oil supply. Additionally, regulatory challenges like the UK Supreme Court ruling on onshore oil drilling complicate future project approvals.

U.S. Oil Production Forecasts

J.P. Morgan's Commodities Research team predicts U.S. total liquids production will exceed 20 million bpd in 2024 and 2025. This growth highlights the significant role of U.S. production in the global oil market.

Environmental and Legal Implications

The UK Supreme Court's ruling requiring the inclusion of end-use combustion emissions in Environmental Impact Assessments sets a new precedent, complicating future project approvals. This decision reflects growing environmental scrutiny and regulatory challenges in the energy sector.

Conclusion: Navigating Market Volatility

The oil market's recent performance reflects a complex interplay of factors, including record-high consumption and significant price movements. As of June 19, 2024, WTI Crude Oil prices fell slightly to $81.35 per barrel, while Brent Crude Oil dropped to $85.07 per barrel. Despite these fluctuations, analysts at Standard Chartered predict a potential rise to $90 per barrel, supported by improved U.S. oil data and speculative short-covering.

April's global oil demand surged to 101.77 million barrels per day, and projections for May and June anticipate new records of 103.3 million and 104.1 million barrels per day, respectively. This robust demand growth underlines the market's resilience and the ongoing economic recovery.

Geopolitical risks and regulatory challenges, such as the UK Supreme Court ruling on emission considerations for new projects, add layers of complexity to market dynamics. However, with the U.S. expected to exceed 20 million barrels per day in total liquids production by 2025, the market's supply side remains strong.

That's TradingNEWS

WTI Oil Prices Surge: Can WTI Break $65 or Will Market Risks Weigh it Down?

Gold Price Forecast: Is XAU/USD on Track to Hit $4,000?