Crude Oil Prices Drop Amid Global Tensions and Supply Shifts

WTI and Brent React to Gaza Ceasefire, Russian Sanctions, and Mixed Economic Signals | That's TradingNEWS

WTI and Brent Oil Prices Fluctuate Amid Ceasefire and Sanctions Impact

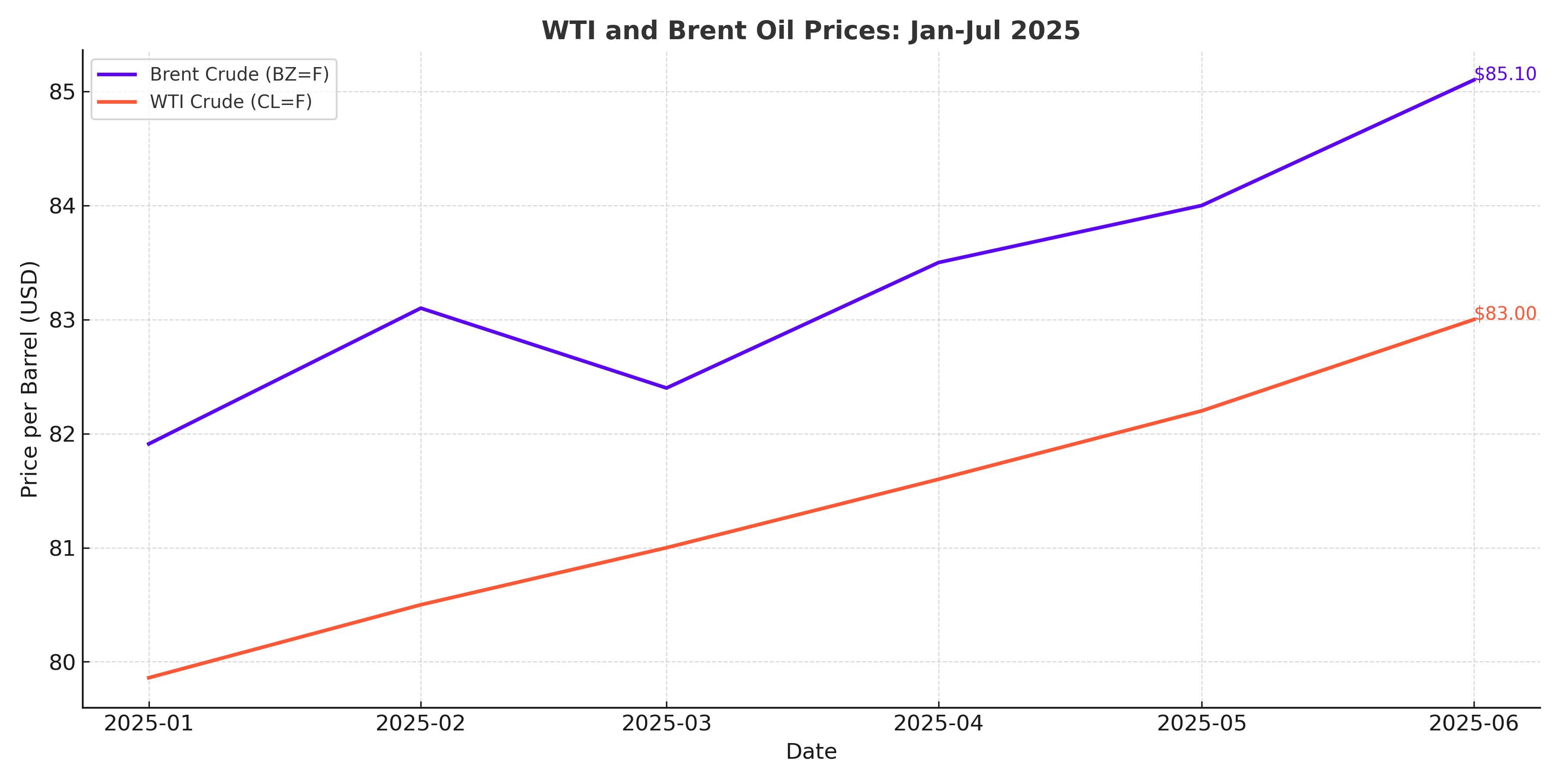

Oil prices have shown significant fluctuation recently, influenced by geopolitical developments, market fundamentals, and evolving supply-demand dynamics. As of the latest trading session, Brent crude (BZ=F) was priced at $81.91 per barrel, while West Texas Intermediate (WTI) (CL=F) traded at $79.86 per barrel. The volatility stems from factors such as a ceasefire agreement in Gaza, heightened concerns over Russian oil supplies due to U.S. sanctions, and changes in OPEC production.

The recent ceasefire between Israel and Hamas has temporarily eased concerns about supply disruptions in the Middle East, home to a substantial portion of the world's oil reserves. The agreement, brokered by Qatar, outlines conditions to halt attacks in the Gaza region, potentially stabilizing shipping routes like the Suez Canal and Red Sea, which are critical for global oil transport. For example, the Suez Canal handles over 6.8 million barrels per day in combined crude oil and refined product flows, emphasizing its significance in the global energy market.

Impact of OPEC's Production and Forecasts

OPEC's recent monthly report highlighted a modest increase in output by 26,000 barrels per day (bpd) to 26.74 million bpd in December 2024. Despite the increase, the organization has maintained its 2025 global oil demand growth forecast at 1.45 million bpd, reaching 105.2 million bpd, a projection that has limited bullish momentum for prices. These stable forecasts, combined with increased production, have applied downward pressure on crude prices.

The Role of U.S. Economic Data

The U.S. retail sales data for December, which showed unexpected strength, pointed to sustained economic resilience. However, higher sales figures also sparked concerns about prolonged Federal Reserve rate hikes. The Fed's cautious stance on cutting rates has kept economic growth in check, indirectly influencing energy consumption levels. Despite this, recent comments from Fed Governor Christopher Waller, suggesting potential rate cuts due to easing inflation, have bolstered hopes for improved oil demand in 2025.

Geopolitical Tensions and Sanctions

The Biden administration's decision to intensify sanctions on Russian energy producers, such as Gazprom Neft and Surgutneftegas, along with 183 oil-transporting vessels, has raised questions about global supply stability. With Russia's primary customers seeking alternative sources and freight rates increasing, the potential for tighter market conditions remains a concern. Analysts argue that Trump's upcoming inauguration may bring policy shifts, as his prior administration frequently clashed with OPEC to control price levels.

U.S. Inventory Drawdowns and Market Rebalancing

U.S. crude oil inventories dropped by 2 million barrels last week to 412.7 million barrels, marking an eighth consecutive week of declines and signaling tighter domestic supply conditions. The reduction is attributed to rising exports and lower imports, which supported WTI's recovery earlier in the week. However, a temporary build in gasoline and distillate stocks has slightly mitigated bullish sentiment.

WTI and Brent Price Drivers

Both benchmarks have demonstrated responsiveness to physical buying and shifts in futures spreads. The current front-month contracts show a premium over later-dated futures, reflecting near-term demand strength and market tightness. For example, the spread between the front and second-month Brent contracts is in the 90th percentile of historical data, emphasizing strong near-term demand signals.

Natural Gas and Broader Energy Market Trends

Natural gas prices have also risen, with February futures trading at $4.11 per million British thermal units, supported by forecasts of an Arctic blast expected to drive demand higher in February. A colder-than-expected winter could also push oil demand higher for heating purposes, adding another layer of support to energy prices.

Key Takeaways for the Oil Market Outlook

With geopolitical uncertainties, ongoing sanctions, and shifting monetary policies, the trajectory for Brent and WTI prices remains fluid. While the immediate impact of the Gaza ceasefire and Houthi militia developments has reduced the geopolitical risk premium, the longer-term outlook depends on OPEC's cautious stance and the strength of global economic recovery. Brent's resistance at $85 and WTI's potential support near $78 suggest a narrowly balanced market prone to sharp movements based on news flow and macroeconomic data. Whether these factors will sustain a bullish breakout in oil prices or keep them range-bound will depend largely on demand dynamics and further geopolitical developments.

That's TradingNEWS

Read More

-

Chipotle Stock Price Forecast - CMG at at $36: Can CMG Still Justify Its Premium Valuation?

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: $2.00 Support Keeps a Run Toward $2.58 Alive

13.12.2025 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI at $57 and Brent at $61 Struggle Under 2026 Supply Glut Fears

13.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market News - Nasdaq Drops to 23,195 as AVGO Stock Crashes 11% and S&P 500 Slides to 6,827

13.12.2025 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast: Pound Tests 1.34 as BoE Cut, US Data Threaten the Rally

13.12.2025 · TradingNEWS ArchiveForex