Gold at $2,600: Trump Era and Geopolitical Tensions Ignite Market Optimism

Inflation fears, Trump’s potential policy shifts, and central bank gold hoarding fuel bullish momentum for XAU/USD | That's TradingNEWS

Gold Price Analysis: Resilience Amid Market Volatility and Geopolitical Tensions

Gold Price Near $2,600 as Dollar Strength Caps Gains

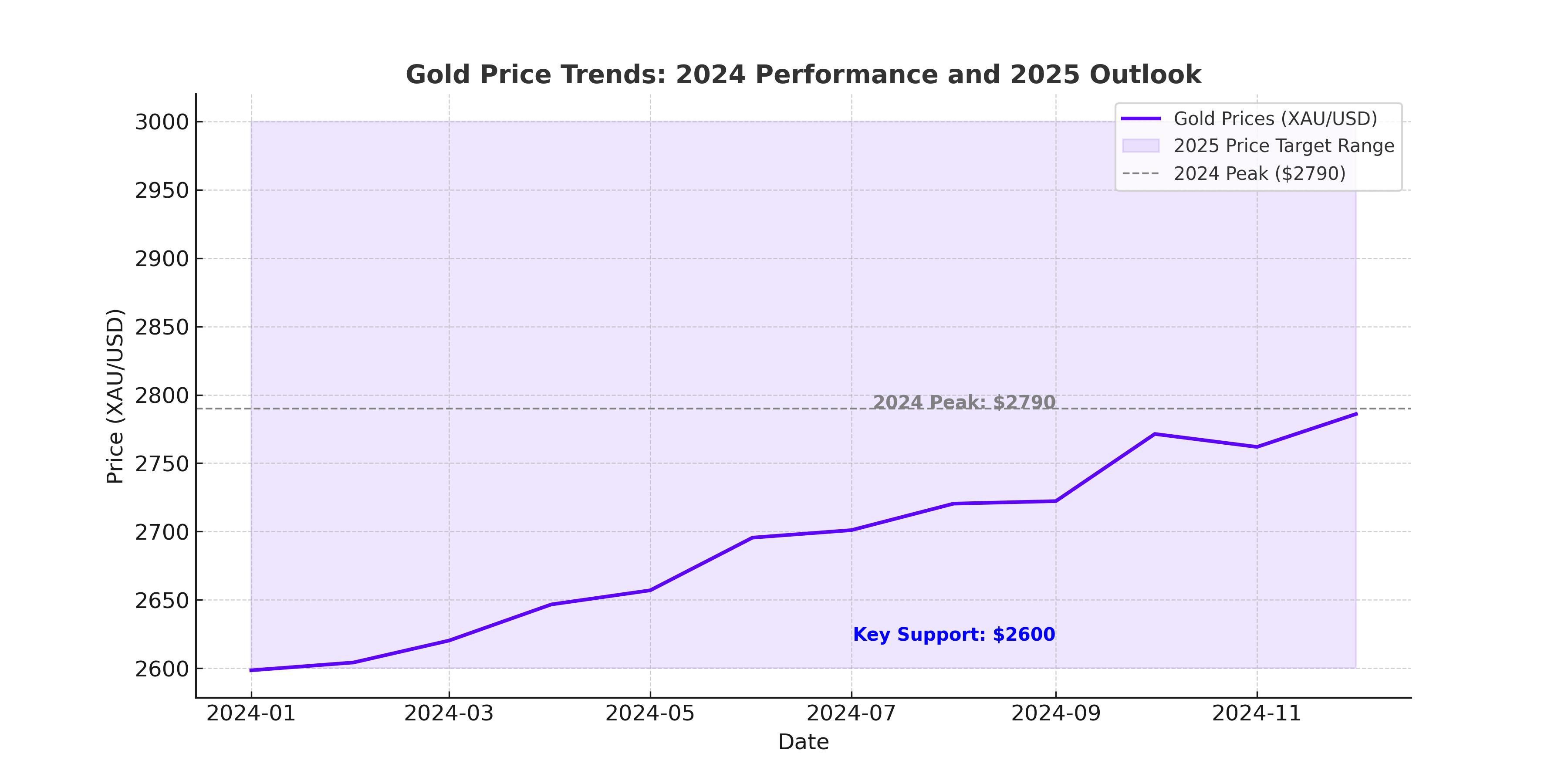

Gold (XAU/USD) currently trades around $2,600 per ounce, reflecting a pullback from its recent highs of $2,790 recorded in October. The dip comes as the U.S. Dollar Index (DXY) climbed above 108.00, supported by the Federal Reserve's indication of fewer interest rate cuts in 2025. The Fed's cautious approach, combined with rising bond yields, has dampened gold’s near-term momentum, making it less attractive for investors compared to interest-bearing assets like Treasuries. Despite these challenges, gold remains a preferred safe-haven asset amid geopolitical and economic uncertainties.

Fed’s Monetary Policy and Its Impact on Gold

The Federal Reserve's decision to reduce interest rates by 100 basis points in 2024 to a range of 4.25%-4.50% has been pivotal in shaping gold's price trajectory. However, expectations for only two additional rate cuts in 2025, as projected by analysts at Goldman Sachs, suggest that the easing cycle will be gradual. This has provided a tailwind for the dollar, pressuring gold prices lower.

Gold has historically thrived in low-interest-rate environments, as reduced yields lower the opportunity cost of holding non-yielding assets. Still, the Fed's cautious approach and signals of a strong U.S. economy, supported by better-than-expected labor market data, suggest gold may face headwinds in the short term. If the Fed’s March 2025 meeting confirms a rate cut, gold prices could regain bullish momentum, potentially testing the psychological $2,700 mark.

Technical Analysis: Consolidation Signals Ahead

Gold trades in a symmetrical triangle pattern on the daily chart, reflecting a period of consolidation after sharp volatility in recent months. The 20-day Exponential Moving Average (EMA) near $2,630 serves as a key resistance level, while support is observed at the November low of $2,537. The Relative Strength Index (RSI) remains neutral, oscillating between 40 and 60, signaling indecisiveness among market participants.

A breakout above $2,726, the December high, could pave the way for gold to challenge $2,800, while a decline below $2,537 may open the door for a deeper correction toward $2,500.

Geopolitical Tensions and Safe-Haven Demand

Geopolitical tensions, including the Russia-Ukraine conflict and the ongoing Middle East unrest, continue to drive safe-haven demand for gold. Reports of Israeli strikes on Gaza hospitals and escalations in Eastern Europe have heightened risk aversion, supporting gold's appeal as a hedge against uncertainty. Historically, geopolitical crises have provided strong upward momentum for gold, and 2025 is expected to see continued reliance on the metal as a refuge for investors.

Central bank purchases of gold remain a significant driver of demand. In 2024, central banks globally added record reserves to mitigate currency risks and bolster financial stability. This trend is expected to continue into 2025, providing a robust foundation for gold prices.

Outlook for 2025: Can Gold Break Above $3,000?

Projections for 2025 highlight bullish prospects for gold, with estimates ranging from $3,000 to $3,200 per ounce. BullionVault’s user survey predicts a 17.8% increase in gold prices, driven by continued geopolitical instability and rising government debt levels. Analysts at Standard Chartered and VanEck align with these forecasts, projecting gold to reach $3,000 as central banks maintain dovish stances and fiscal deficits widen.

Further upside could come from increased demand for gold-backed financial instruments. ETFs, for instance, witnessed significant inflows in 2024, reflecting heightened interest from institutional investors. If this trend continues, it could serve as a catalyst for gold to achieve new all-time highs.

Economic and Political Influences: Trump Administration's Role

The incoming Trump administration is poised to implement a series of policies that could significantly influence market dynamics and, by extension, gold prices. Potential measures, including aggressive tariffs, extensive deregulation, and major tax reforms, are expected to create heightened economic uncertainty. Historically, such unpredictability drives investors toward gold as a hedge against inflation and geopolitical instability. For instance, should new tariffs strain global trade, the resulting economic disruptions could amplify safe-haven demand for gold, pushing prices well above the $2,600 mark.

Economic turbulence stemming from these policies could increase inflationary pressures, further boosting the appeal of non-yielding assets like gold. Analysts suggest that if the administration intensifies trade conflicts, gold prices could test key resistance levels at $2,700 and potentially climb toward $3,000 in 2025. Moreover, a volatile policy environment could also drive central banks to ramp up gold purchases, a trend that has already supported prices in 2024.

The Dollar's Role in Gold’s Trajectory

The strength of the U.S. dollar has been a significant headwind for gold, with the U.S. Dollar Index (DXY) hovering around 108. A stronger dollar typically makes gold more expensive for international buyers, curbing demand. This dynamic was evident in late 2024, as gold prices fell from their peak of $2,790 in October to the current levels near $2,600. Robust U.S. economic data and rising bond yields have further bolstered the dollar, intensifying pressure on gold.

However, a shift in dollar momentum could reverse this trend. If the Federal Reserve resumes its easing cycle with rate cuts in March 2025, as projected by Goldman Sachs, the dollar may weaken, paving the way for gold to regain lost ground. A softer dollar, coupled with a dovish Fed stance, could lift gold prices back toward the $2,700 range and potentially beyond, as global investors seek refuge from currency volatility.

Long-Term Risks and Opportunities

The long-term outlook for gold is shaped by a complex interplay of inflationary pressures, monetary policy, and geopolitical risks. While a stronger-than-expected dollar and delays in Federal Reserve rate cuts remain key risks, the broader environment appears favorable for gold.

Central bank demand continues to serve as a powerful tailwind. In 2024, global central banks added record amounts of gold to their reserves, driven by concerns over currency stability and escalating geopolitical tensions. This trend is expected to persist in 2025, with further purchases likely to underpin prices. Current projections suggest gold could breach the $3,000 threshold by the end of 2025 if geopolitical tensions, such as the ongoing conflicts in the Middle East and Ukraine, intensify.

Conversely, delays in the Fed’s easing cycle or stronger-than-anticipated U.S. economic data could prolong gold's consolidation near $2,600. For investors, the current price levels represent an attractive entry point, given the metal’s long-term potential to outperform in uncertain economic conditions.

Investment Outlook: Buy, Hold, or Sell?

Given gold's robust performance in 2024, with a 27% annual gain, and its strong fundamentals, the metal remains an attractive asset for long-term investors. Current price levels around $2,600 offer a favorable entry point for those looking to hedge against economic uncertainty and capitalize on gold’s potential to reach $3,000 in 2025. While short-term volatility may persist, the long-term outlook remains decidedly bullish. Investors are advised to monitor Fed policy developments and geopolitical events closely, as these will play pivotal roles in shaping gold’s trajectory moving forward.