Gold at $2,759 – Is XAU/USD Ready to Break $2,800 or Head for a Drop?

With Fed uncertainty and rising yields, will gold rally to $2,800 or slide back to $2,700? | That's TradingNEWS

Gold Price Forecast: Can XAU/USD Break Above $2,800 or Face a Correction?

Federal Reserve's Policy Shift and Its Impact on XAU/USD

Gold prices have been caught in a volatile range as the Federal Reserve delivered a hawkish hold, removing specific inflation language from its statement, which hints at a pause in future rate hikes. XAU/USD fluctuated between $2,750 and $2,740, with traders closely monitoring Fed Chair Jerome Powell’s upcoming comments. The Fed acknowledged that the labor market remains strong and that economic activity is expanding solidly, but the balance sheet reduction will continue at its previous pace.

After the announcement, U.S. Treasury yields surged, with the 10-year note hitting 4.581%, while the U.S. Dollar Index (DXY) strengthened to 108.29, gaining 0.22%. This rise in yields and dollar strength weighed on gold, limiting its upward momentum. Investors are now eyeing Powell’s tone—if he leans too hawkish, gold could slide further; however, any signs of dovishness could trigger another rally.

Gold’s Reaction to Fed’s Decision: Key Technical Levels

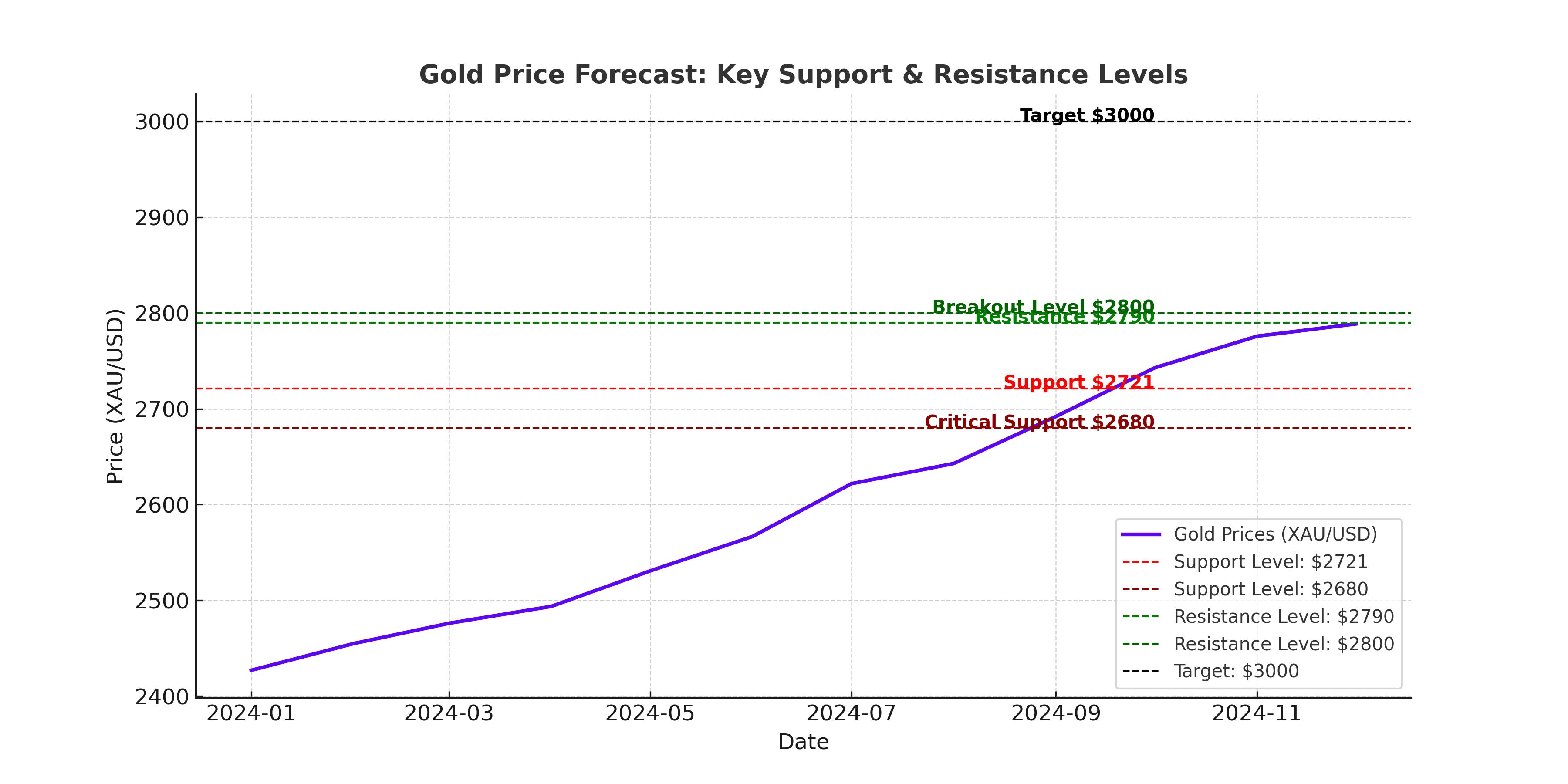

Following the Fed’s statement, XAU/USD dipped toward the 200-hour Simple Moving Average (SMA) at $2,743, a critical support level. If gold breaks below this level, it could retest the January 27 low of $2,730, with further downside potential toward $2,700. On the flip side, if bulls regain control and push above $2,766, it could open the door to a new record high.

The broader uptrend remains intact, but short-term weakness is evident. A break above $2,790 could pave the way for $2,800, with some analysts even targeting $3,000 if market conditions favor gold’s momentum. However, failure to hold above $2,740 could lead to further profit-taking, pushing prices lower in the near term.

Global Interest Rates and Gold’s Performance

Gold’s price remains sensitive to central bank policies, and not just in the U.S. The Bank of Canada (BoC) recently cut rates by 25 basis points, bringing its overnight rate down to 3%, while also announcing the end of its quantitative tightening measures. Despite this, the gold market in Canadian dollars remained strong, trading at C$3,986.10 per ounce, near its record highs.

This move signals that central banks are starting to ease policies, a scenario that historically benefits gold. However, uncertainty remains, especially with potential U.S. tariffs looming. If the U.S. imposes new tariffs, it could lead to higher inflation, forcing the Fed to keep rates elevated for longer—an outcome that could pressure gold prices in the short term.

Gold's Position Against a Strengthening U.S. Dollar

The U.S. dollar’s recent rally has created headwinds for gold, making it more expensive for non-dollar holders. XAU/USD has struggled to maintain gains above $2,750 as the DXY index continues to push higher. Historically, gold and the dollar share an inverse relationship—when the dollar strengthens, gold tends to decline, and vice versa.

A major factor influencing the dollar’s strength is the ongoing speculation about the Fed’s next move. If Powell signals a higher-for-longer rate strategy, the dollar could extend its gains, putting additional pressure on gold. However, if the Fed acknowledges slowing growth and signals future rate cuts, gold could see renewed buying interest, potentially pushing it back toward its all-time highs.

Institutional Demand and Hedge Fund Interest in Gold

Hedge funds and institutional investors have been increasing their gold exposure amid growing concerns over U.S. debt levels. Australian hedge funds, in particular, have been aggressively accumulating gold, betting that Trump’s second term could trigger more economic instability, leading to a weaker bond market and higher gold prices.

Additionally, central banks continue to add gold to their reserves, with countries like China and India increasing their purchases in recent months. This long-term demand provides strong fundamental support for XAU/USD, even as short-term volatility persists.

Gold Price Outlook: Breakout or Correction?

Gold is currently at a critical inflection point. The support at $2,721, which was a key level in November and December, remains intact. If gold fails to hold above this level, a deeper correction toward $2,680 is possible. However, if the Fed takes a more dovish stance, gold could quickly rebound, with $2,790-$2,800 being the next major resistance zone.

A break above $2,800 could set the stage for a rally toward $3,000, especially if economic uncertainties persist. Some analysts have already projected that gold could reach $3,200 by the end of the year, given the global shift toward de-dollarization and rising geopolitical tensions.

Final Verdict: Is Gold a Buy, Sell, or Hold?

Given the current market dynamics, gold remains a BUY for long-term investors seeking a hedge against inflation and central bank policy shifts. However, in the short term, traders should remain cautious as volatility remains high. The key levels to watch are $2,740 on the downside and $2,800 on the upside—a breakout above or below these levels will determine gold’s next move.

For now, the trend remains bullish, but traders should be prepared for short-term pullbacks as the market digests Fed policy signals and broader macroeconomic developments.