Gold Breaks $2,630 Amid Fed Cuts and Middle East Tensions

Federal Reserve’s rate cuts and rising geopolitical risks push gold to new heights, with analysts eyeing the $2,700 mark next | That's TradingNEWS

Gold Surges Amid Fed Rate Cuts and Geopolitical Tensions: A Closer Look at XAU/USD

Record High Driven by Federal Reserve’s Rate Cut

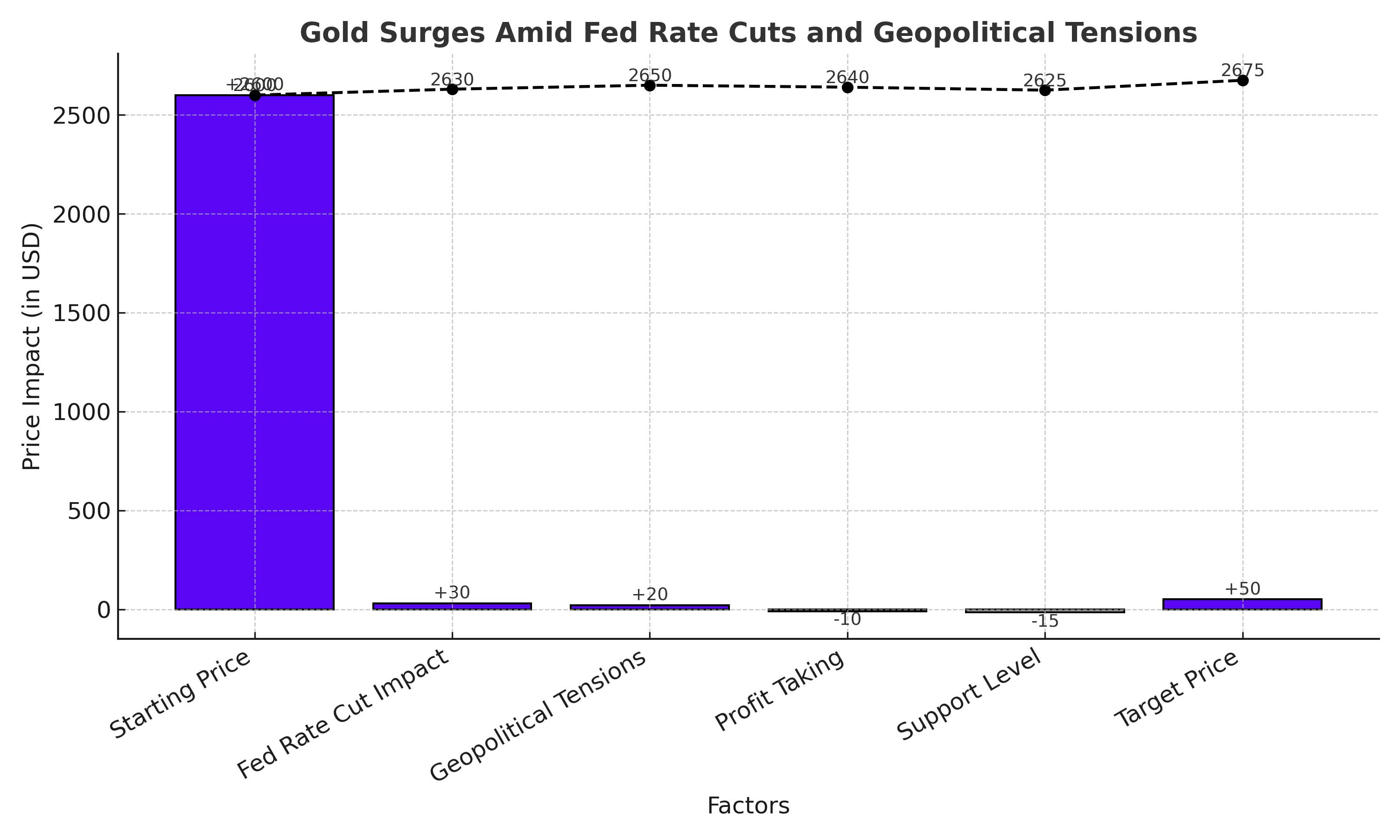

Gold (XAU/USD) reached an all-time high, surpassing $2,630 per ounce, buoyed by the Federal Reserve's 50 basis point interest rate cut. Investors are increasingly turning to safe-haven assets like gold as expectations of more aggressive monetary easing take hold. The Fed’s move, coupled with rising geopolitical tensions in the Middle East, has added momentum to the precious metal's rally, pushing it towards new highs.

Geopolitical Tensions Underpin Safe-Haven Demand

The escalation of conflicts, notably between Hezbollah and Israel, has provided additional tailwinds for gold. Safe-haven demand surged as investors sought refuge from the instability in the region. Despite short-term profit-taking, which slightly tempered the rally, market sentiment remains firmly in favor of continued gold accumulation as geopolitical risks persist.

Technical Analysis: Key Resistance and Support Levels

Gold prices continue to hover above $2,600, with bullish momentum well-supported by the 100-day Exponential Moving Average (EMA). However, with the 14-day Relative Strength Index (RSI) indicating overbought conditions, the market could see some consolidation before attempting to breach the next resistance level at $2,625. A breakout above this critical resistance would position gold to test the psychological barrier at $2,700.

Should the price dip, the first support zone lies at $2,600, with further downside potentially testing the $2,546.86 level. Any sustained move below this point could lead to a retest of $2,481, a key support level identified in technical analysis.

The Role of the U.S. Dollar and Treasury Yields

A weakening U.S. dollar has further fueled gold’s ascent, as a softer greenback typically enhances gold's appeal for foreign investors. As the dollar loses value, gold becomes a more attractive asset, particularly in times of economic uncertainty or inflationary pressures. Rising U.S. bond yields have traditionally worked against gold, but current conditions suggest that gold’s safe-haven appeal remains resilient, despite these headwinds.

Gold’s Long-Term Outlook: Bullish with Caution

Despite some short-term volatility and profit-taking, gold’s long-term outlook remains firmly bullish. Analysts project that gold could reach the $2,700 mark by early 2025, driven by continued geopolitical risks, anticipated rate cuts by the Fed, and persistent demand for inflation hedges. However, investors should be cautious of potential reversals if gold fails to hold key support levels, particularly as technical indicators suggest a possible correction.

Support from Federal Reserve Policy

Fed Chair Jerome Powell's signals of further easing have strengthened gold’s position as a safe-haven asset. The Fed’s dovish stance, coupled with global central banks leaning towards easing, is likely to support gold prices in the long term. A sustained easing cycle, which could lower rates by as much as 125 basis points this year, offers further upside potential for gold investors.

Global Central Bank Actions and Impact on Gold

In addition to the Fed’s moves, central banks in Switzerland and Sweden are also expected to lower interest rates, adding more support to gold’s bullish trajectory. These synchronized global actions to loosen monetary policy are expected to sustain gold’s momentum through the remainder of the year.

Conclusion: Gold Set for Continued Upside, but Watch for Key Levels

With gold sitting at historical highs and strong support from both macroeconomic factors and technical indicators, the precious metal is well-positioned for further gains. Investors should watch for consolidation phases and potential pullbacks, but the overall trend remains bullish. A decisive move above $2,625 could see gold pushing toward $2,700, while key support at $2,546.86 will be critical in maintaining upward momentum. The convergence of Fed policy, geopolitical tensions, and a weakening dollar continues to create a favorable environment for gold in the months ahead.