Gold Breaks $2,700: Unstoppable Rally Amid Geopolitical Tensions

Geopolitical uncertainty, inflation fears, and Fed speculation ignite a gold price surge. Is the all-time high of $2,790 within reach? | That's TradingNEWS

Gold Price Surges to Two-Week High: Momentum Fueled by Geopolitical Tensions and Inflation Concerns

Gold prices (XAU/USD) have rallied for five consecutive days, reaching a two-week high of $2,688.53 during Friday’s Asian trading session. This resurgence comes amid heightened geopolitical uncertainty stemming from the Russia-Ukraine conflict, robust US economic data, and shifting Federal Reserve policy expectations. Let's explore the driving forces behind this rally, the technical levels at play, and what lies ahead for the precious metal.

Geopolitical Unrest Sparks Safe-Haven Demand

The intensifying Russia-Ukraine conflict remains a key catalyst for gold's recent rally. Reports of Russia deploying advanced missiles, coupled with Ukraine's retaliatory strikes using US and UK-made weaponry, have escalated global tensions. Investors are increasingly turning to gold as a haven asset, particularly in the face of uncertain economic and geopolitical landscapes.

This demand for risk-averse assets has pushed gold prices higher, even as the US dollar strengthens. The USD Index (DXY), which tracks the greenback against a basket of currencies, rose to its highest level since October 2023. Traditionally, a stronger dollar puts downward pressure on gold, but the metal's allure as a hedge against geopolitical instability has overshadowed this dynamic.

Inflation and Fed Policy Speculation Boost Gold

Inflationary concerns and expectations surrounding the Federal Reserve's monetary policy are bolstering gold's appeal. Traders are closely watching for signs of a slowdown in the Fed's rate-cut trajectory. According to the CME FedWatch Tool, there is a 55% probability of a 25-basis-point rate cut in December, down from earlier estimates.

Chicago Fed President Austan Goolsbee emphasized progress toward the Fed’s 2% inflation target, while New York Fed President John Williams noted a balanced labor market with easing inflationary pressures. Both officials suggested a cautious approach to further rate cuts. Elevated US Treasury yields, which typically weigh on non-yielding assets like gold, have not deterred its upward momentum due to persistent inflation fears.

Economic Data Highlights Mixed Signals

US economic indicators present a mixed picture, contributing to gold's sustained rally. Weekly jobless claims fell by 6,000 to 213,000, marking a seven-month low and signaling a resilient labor market. Existing home sales also rebounded sharply, registering their first annual gain since mid-2021.

However, the Philly Fed Manufacturing Index unexpectedly contracted in November, falling to -5.5 from +10.3 in October. This divergence in economic performance adds to the uncertainty, reinforcing gold's position as a portfolio hedge. Investors now await the release of global flash PMIs, which could provide additional insights into economic health and influence gold's trajectory.

Technical Analysis: Key Levels and Momentum

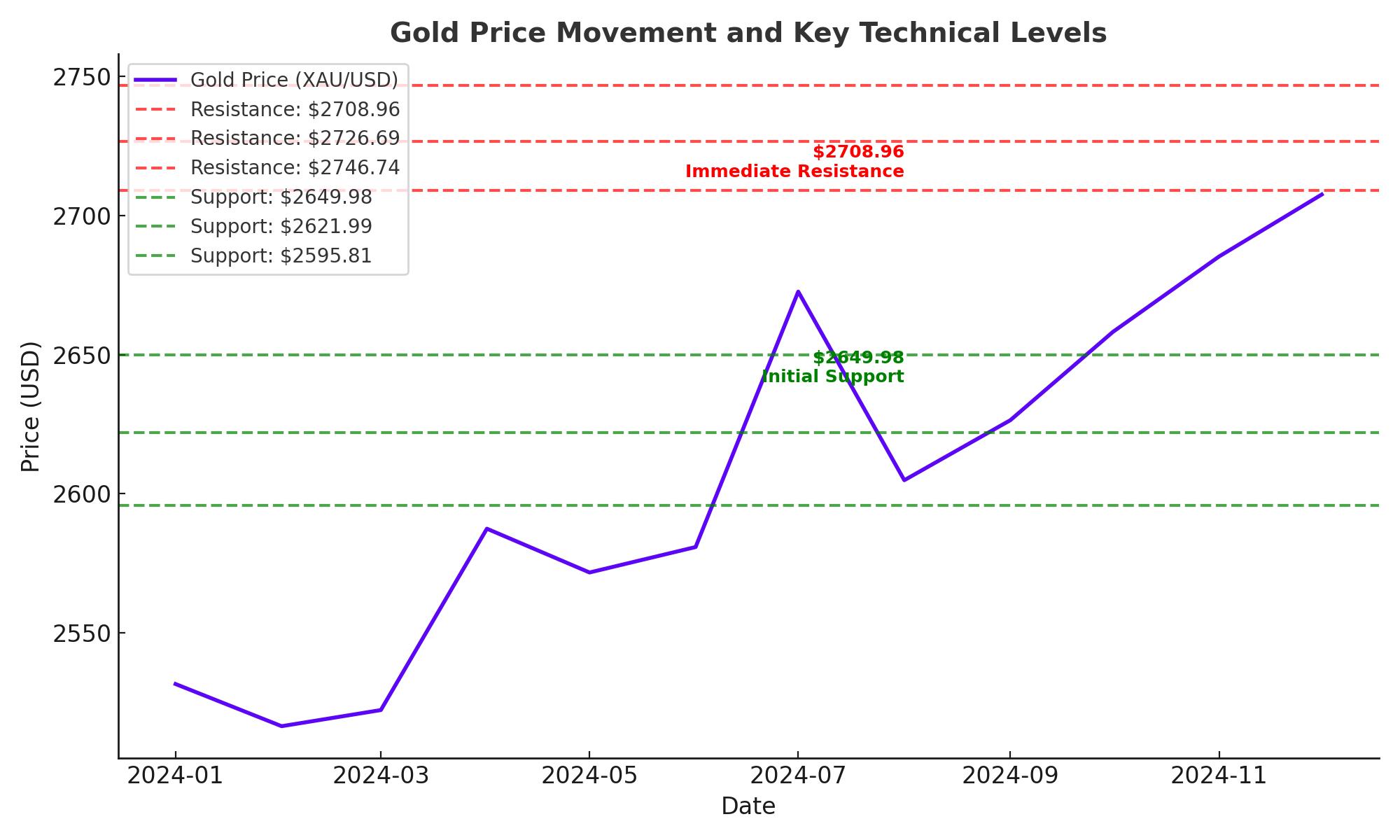

Gold’s technical indicators suggest a strong bullish bias, with prices breaking through critical resistance levels. The precious metal is currently trading above its 50-day Simple Moving Average (SMA) at $2,660, a level that previously acted as a significant barrier. This breakout aligns with the broader upward trend established over the past week.

- Resistance Levels: Immediate resistance is at $2,708.96, followed by $2,726.69 and $2,746.74. A decisive break above these levels could propel gold toward the all-time high of $2,790.

- Support Levels: On the downside, initial support lies at $2,649.98, followed by $2,621.99 and $2,595.81. A breach of these levels could signal a reversal in the current bullish trend.

The Relative Strength Index (RSI) is nearing overbought territory, suggesting that the rally may encounter resistance at higher levels. However, as long as prices remain above the 50-day and 200-day SMAs, the bullish trend is expected to persist.

Market Sentiment and Near-Term Forecast

The market sentiment around gold remains positive, driven by a combination of geopolitical uncertainty, inflation concerns, and mixed economic data. Gold is likely to test the psychological $2,700 barrier in the near term, with a potential breakout toward $2,750 if momentum continues.

However, traders should exercise caution as overbought conditions could trigger a pullback. A failure to hold above the $2,649 support level may lead to a deeper correction, targeting the $2,600 mark.

Conclusion: Bullish Outlook with Cautious Optimism

Gold’s recent rally underscores its resilience amid a volatile global environment. With geopolitical tensions showing no signs of abating and inflation remaining a key concern, the metal's safe-haven appeal is likely to persist. While technical indicators point to further upside potential, market participants should remain vigilant for signs of overbought conditions and resistance at higher levels.

For investors, the current environment offers a compelling case for maintaining exposure to gold, either as a hedge against uncertainty or as a long-term store of value. The next few trading sessions will be crucial in determining whether gold can sustain its upward momentum and challenge its all-time highs.