Gold Climbs Above $2,700 as Fed Easing Signals Ignite Bullish Momentum

Can Gold Maintain Its Rally and Break the $2,750 Barrier? | That's TradingNEWS

Gold Surges Amid Dovish Fed Sentiment and Weak US Economic Indicators

The gold market continues its bullish ascent, with XAU/USD trading above the critical $2,700 level, fueled by a combination of weaker-than-expected US economic data and dovish comments from Federal Reserve officials. At the time of writing, gold is trading at $2,715 per ounce, up 0.72% for the day, as traders anticipate rate cuts and brace for the potential impacts of geopolitical tensions and fiscal policies under the new US administration.

Retail Sales Miss Expectations, but Consumer Resilience Supports Gold

US retail sales for December rose by 0.4% month-over-month, falling short of the 0.6% forecast. However, November’s data saw an upward revision to 0.8%, showcasing underlying consumer strength. Despite this, rising initial jobless claims, which climbed to 217,000 from the prior 201,000, hinted at a softening labor market. These mixed signals have pressured the US dollar, as reflected in the DXY Index, which dropped below the 109.00 mark, boosting the attractiveness of non-yielding assets like gold.

Federal Reserve Dovish Tone Amplifies Gold's Appeal

Fed Governor Christopher Waller struck a dovish tone, stating that inflation is nearing the central bank's 2% target, leaving room for interest rate cuts as early as March. Markets are now pricing in a near 50% probability of two rate cuts by the end of 2025, with the first potentially occurring in June. Lower rates reduce the opportunity cost of holding gold, further fueling its appeal as a safe-haven asset.

Geopolitical Uncertainty and Gold’s Role as a Hedge

The announcement of a ceasefire between Israel and Hamas, set to begin this Sunday, temporarily eased geopolitical tensions but failed to significantly dampen gold's upward momentum. The ongoing war in Gaza, combined with tensions surrounding US-China trade and Trump's potential fiscal policies, has kept market participants on edge, supporting gold’s role as a hedge against uncertainty.

Technical Outlook: Bulls Eye $2,750 and Beyond

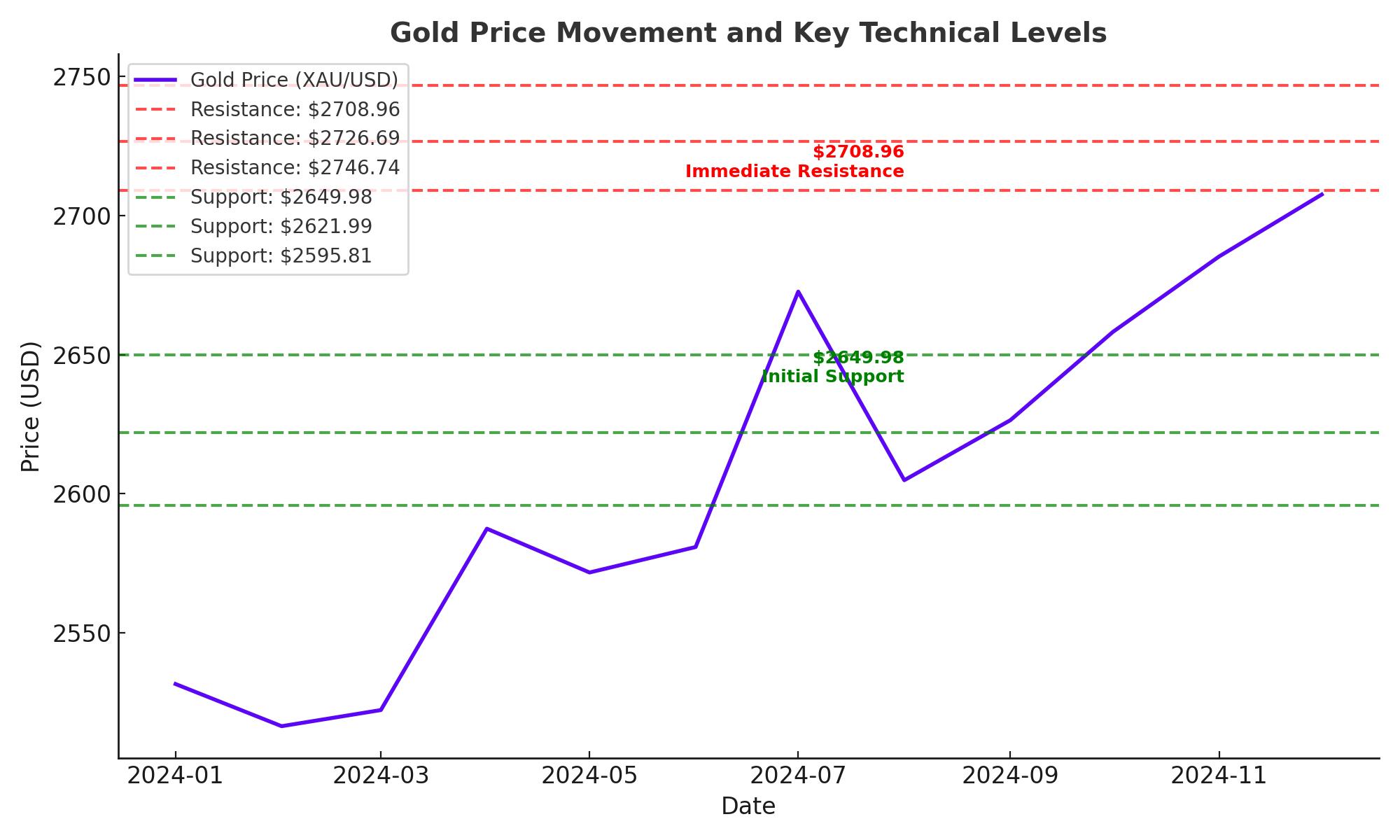

Gold's bullish momentum is supported by technical indicators. The Relative Strength Index (RSI) remains above the neutral 50 level, signaling further upside potential. Immediate resistance lies at $2,726, with a breach opening the path to $2,750 and potentially the all-time high of $2,790. On the downside, support is seen at $2,700, with further levels at $2,656 and the 50-day SMA around $2,640.

Impact of Treasury Yields on Gold Prices

US 10-year Treasury yields have dipped to 4.60%, reflecting market expectations of a slowing economy and dovish monetary policy. The drop in real yields, as measured by the 10-year Treasury Inflation-Protected Securities (TIPS), enhances the appeal of gold, which thrives in low-yield environments. A continued decline in yields could accelerate gold's march toward higher levels.

Global Gold Demand and Market Dynamics

Gold prices also draw strength from robust physical demand, particularly in India and China, where seasonal and cultural factors boost consumption. Lunar New Year celebrations and wedding seasons have historically driven higher gold purchases, adding to price momentum. Meanwhile, central banks around the world continue to diversify reserves into gold, further bolstering demand.

Will Gold Break Its All-Time High in 2025?

Given the current economic and geopolitical backdrop, gold's path to reclaiming its all-time high of $2,790 seems increasingly likely. The combination of dovish Federal Reserve policy, declining Treasury yields, and sustained geopolitical uncertainty provides a supportive environment for the precious metal. Traders and investors alike are closely watching whether XAU/USD can sustain its bullish momentum and break through critical resistance levels in the coming weeks.