Gold Climbs to $2,700! Is $3,000 the Next Stop?

Explosive gold price movements fueled by global tensions, Fed expectations, and central bank buying—XAU/USD could be gearing up for unprecedented highs. Don’t miss what’s next! | That's TradingNEWS

Gold Prices Face Volatility Amid Geopolitical Tensions and Fed Expectations

Gold Price Trends Show Mixed Signals

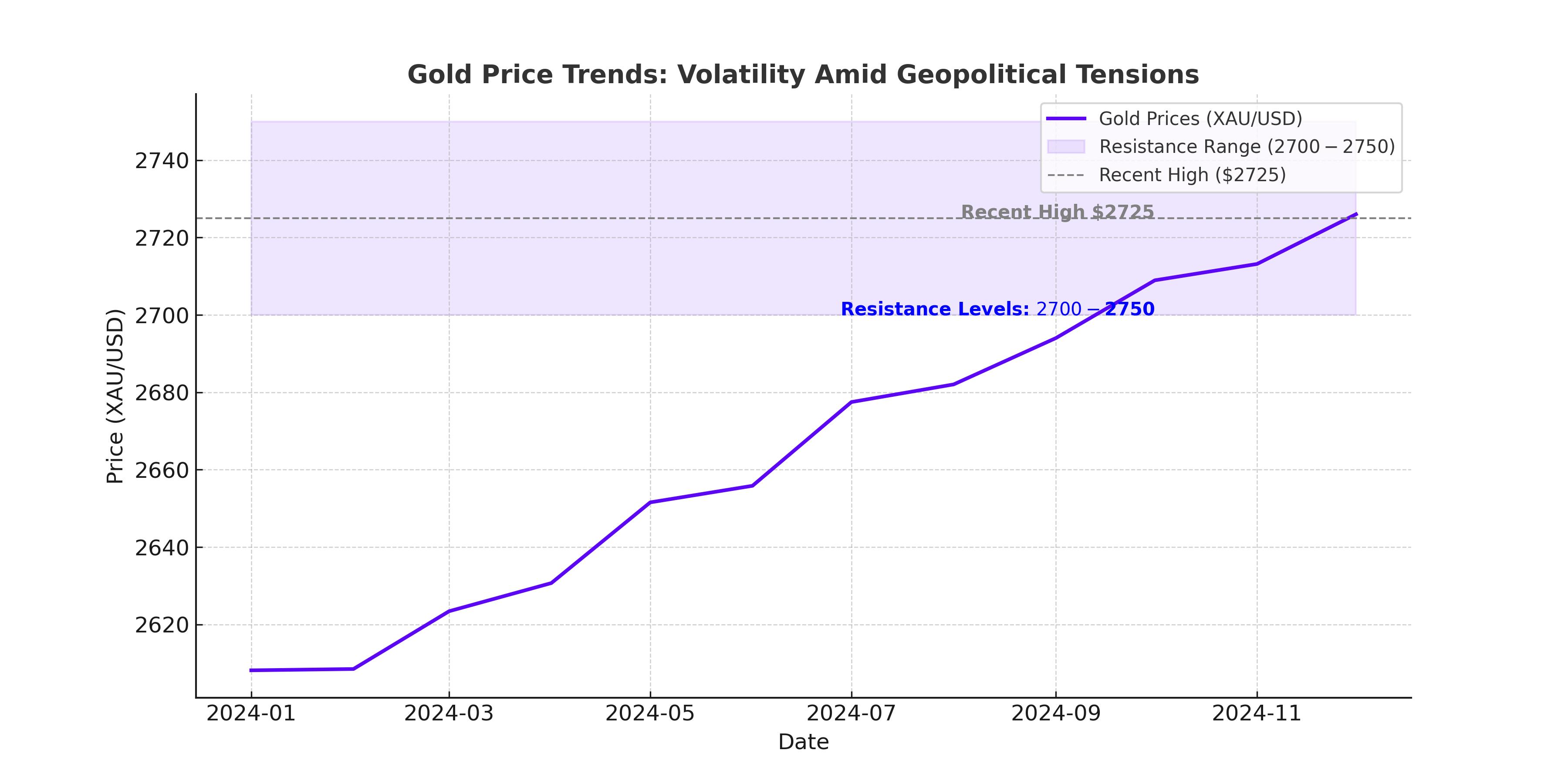

The price of gold (XAU/USD) has experienced significant fluctuations recently, with spot prices briefly surging to $2,725 per ounce before retreating below the $2,700 mark. This marked a reversal after gold hit a five-week high, showcasing the underlying volatility influenced by global economic and political events. As of Friday afternoon, gold prices hovered around $2,658.89 per ounce, reflecting a 1% weekly gain despite pressures from a strengthening U.S. dollar and rising Treasury yields.

The Federal Reserve's upcoming monetary policy decision looms large over the gold market, with traders pricing in a near-certain 25 basis point rate cut. While easing monetary policies typically benefit non-yielding assets like gold, mixed economic data in the U.S.—including unexpectedly strong Producer Price Index (PPI) figures—has complicated the narrative. The PPI increased by 3% year-over-year in November, up from 2.6% in October, signaling persistent inflationary pressures.

Central Bank Buying Remains a Key Support

Central banks have continued to demonstrate robust interest in gold, with recent data showing year-to-date purchases of 694 tons by Q3, according to the World Gold Council. The People's Bank of China resumed gold purchases in November, adding to its reserves after a six-month pause. This move aligns with broader strategies by Asian central banks to diversify away from U.S. dollar assets. For instance, Poland's central bank has been another major buyer, adding 42 tons to its reserves this quarter. Such consistent demand underscores gold's enduring appeal as a hedge against currency devaluation and geopolitical instability.

Geopolitical Risks Drive Safe-Haven Demand

Ongoing geopolitical tensions have played a pivotal role in supporting gold prices. Escalations in the Middle East, including intensified conflicts in Gaza and Syria, coupled with heightened U.S.-Russia tensions over Ukraine, have created an environment of uncertainty. Additionally, China's assertive stance in East Asia, particularly around Taiwan, has further fueled safe-haven demand for gold. These geopolitical flashpoints have amplified investor concerns, prompting a shift toward assets that can offer stability amid global turmoil.

Technical Indicators Highlight Crucial Resistance Levels

From a technical perspective, gold faces critical resistance at $2,700, with further barriers near $2,725 and $2,750. A sustained break above these levels could pave the way for a test of the all-time high of $2,800 reached earlier this year. On the downside, immediate support lies at $2,675, followed by stronger levels at $2,650 and $2,600. Analysts forecast a potential dip below $2,600 if bearish momentum persists, although the broader outlook remains bullish, with expectations of gold reaching $3,000 or higher by Q1 2025.

Impact of the Fed's Policies and Economic Data

The Federal Reserve’s cautious stance on rate cuts has been a double-edged sword for gold. While lower interest rates reduce the opportunity cost of holding non-yielding bullion, stronger-than-expected economic indicators, such as resilient job data and consumer spending, have tempered bullish sentiment. U.S. Treasury yields, which have edged higher in recent weeks, also continue to exert downward pressure on gold prices.

Meanwhile, speculation around President-elect Donald Trump’s expansionary fiscal policies, including potential tariffs that could stoke inflation, adds another layer of complexity. Markets anticipate that these policies may push the Fed to adopt a more measured approach to rate cuts in 2025, potentially limiting gold's upside in the short term.

Global Markets and Investor Sentiment

Gold demand has shown regional variations, with India and China witnessing contrasting trends. In India, elevated gold prices have deterred retail demand, leading to discounts in the local market. Conversely, China’s central bank purchases reflect strategic intent, aligning with broader economic policies aimed at stabilizing the yuan. In Europe, the gold price in euros has mirrored broader market dynamics, impacted by the European Central Bank’s (ECB) recent rate cuts and political uncertainties in Germany and France.

Despite these challenges, global investor sentiment remains broadly optimistic. Analysts at MKS Pamp project an average gold price of $2,750 for 2025, while UBS forecasts a continued upward trajectory for silver, with prices potentially reaching $36-$38 per ounce.

Market Outlook: Bullish or Bearish?

Gold's trajectory remains intricately tied to macroeconomic developments and geopolitical risks. While technical indicators suggest potential for further downside in the near term, the broader fundamentals—central bank buying, geopolitical instability, and inflationary concerns—point to a bullish outlook. Investors are advised to monitor key resistance and support levels closely, as well as upcoming Fed announcements and global economic data, to navigate the evolving gold market landscape.