Gold Prices Test Crucial Levels Amid Market Turbulence and Fed Uncertainty

Geopolitical Tensions and Gold's Safe-Haven Appeal

Gold prices (XAU/USD) continue to exhibit strength, with futures settling at $2,689.38, marking a 1.88% weekly gain. This performance defied traditional headwinds such as rising Treasury yields and a strengthening dollar, signaling robust demand for the precious metal. Geopolitical uncertainties, including the Federal Reserve’s cautious monetary stance and the looming economic policies of the incoming Trump administration, are driving increased interest in gold as a safe-haven asset.

The U.S. economy added an impressive 256,000 jobs in December, surpassing expectations of 160,000. The unemployment rate fell to 4.1%, reinforcing concerns that inflation may remain persistent. Treasury yields climbed to 4.79%, while the dollar index surged to multi-year highs, yet gold prices found support amid these pressures, reflecting broader market unease about fiscal health and geopolitical risks.

Central Bank Demand and China's Influence on Gold Prices

Central banks worldwide have been active gold buyers, but recent developments in China have added volatility to the market. Reports suggest that China’s central bank paused its gold reserve purchases in May 2024 after 18 consecutive months of accumulation. This pause coincided with spot gold prices hitting record highs, leading to weaker demand from one of the world’s largest buyers. Despite this, global central bank purchases remain a key factor, with countries like India’s RBI adding to reserves, maintaining gold's upward trajectory.

China's slower economic recovery and reduced consumer spending have also impacted gold's physical demand. Domestic gold consumption in China, a critical market, declined 6% year-over-year in Q4 2024, reflecting broader economic challenges.

Gold's Technical Landscape: Key Support and Resistance Levels

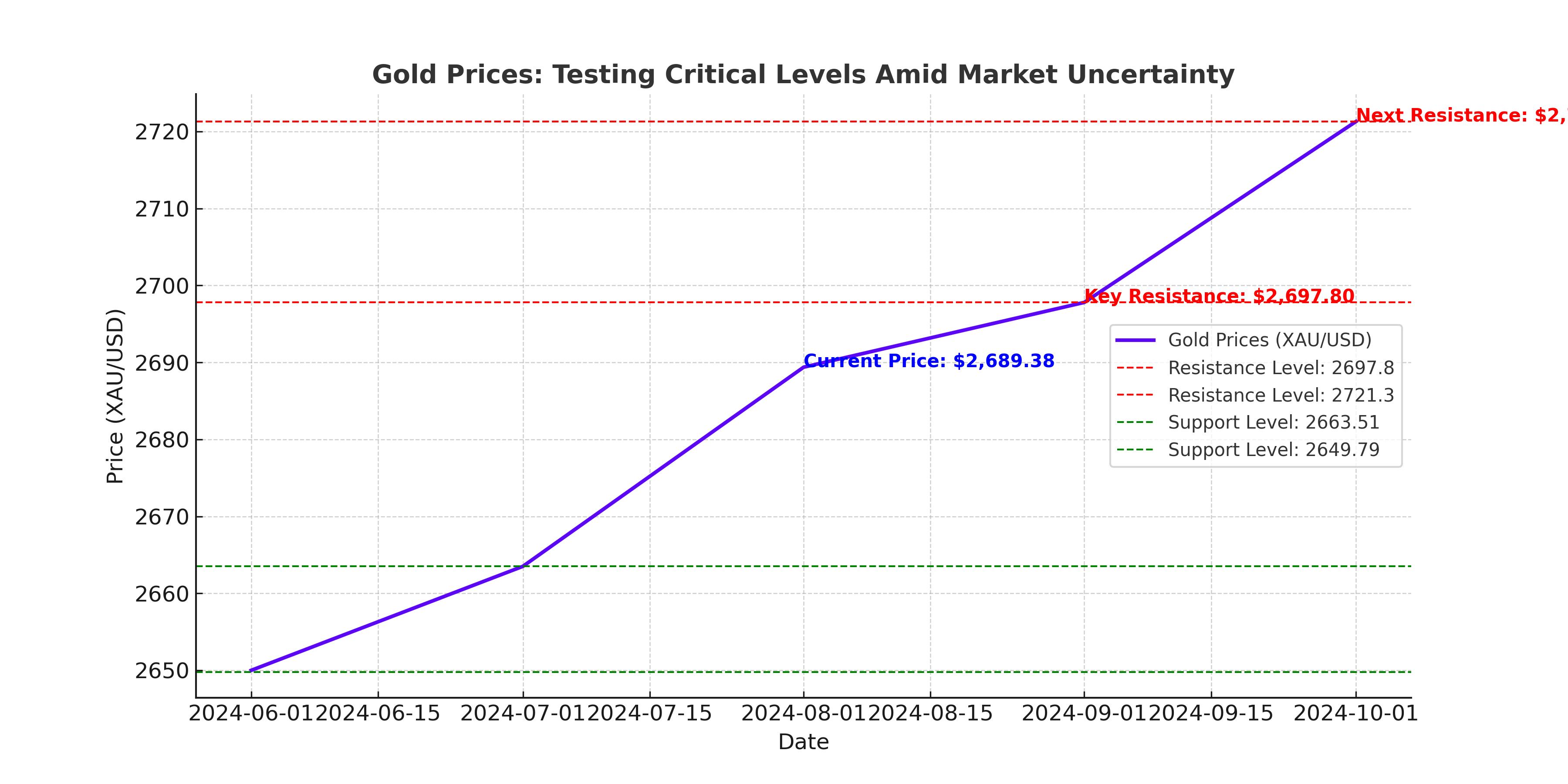

From a technical perspective, gold’s rally to $2,689.38 remains supported by strong levels at $2,663.51, a pivotal point for near-term price direction. Resistance looms at $2,697.80 and $2,721.30, with $2,790.17 representing the all-time high. Should prices breach the $2,721 threshold, it could ignite further bullish momentum, driven by inflation fears and geopolitical tensions. On the downside, critical support lies at $2,666.33 and $2,649.79. Failure to hold above these levels could signal a bearish reversal, potentially targeting $2,533.76.

Short-term charts highlight the resilience of gold, trading within a well-defined upward channel. The RSI indicates balanced momentum, providing room for price advances if inflation data or geopolitical developments spark fresh buying interest.

Fiscal Concerns and Inflationary Risks

U.S. fiscal conditions remain a dominant theme, with ballooning deficits amplifying concerns about long-term economic stability. The Federal Reserve's cautious approach to rate cuts in 2025 has kept markets on edge. December’s robust labor data reduced expectations of aggressive monetary easing, as futures markets now anticipate a mere 30-basis-point rate reduction this year, compared to earlier forecasts of 45 basis points.

Inflation remains a critical factor. The upcoming Consumer Price Index (CPI) data release on January 15 could prove pivotal. A higher-than-expected print may bolster gold’s appeal as an inflation hedge, pushing prices closer to the $2,721.30 resistance level. Conversely, a softer CPI reading could dampen sentiment, pressuring gold toward $2,631 and lower support zones.

Geopolitical Dynamics Supporting Gold Prices

Geopolitical tensions also contribute to gold's rally. The Federal Reserve’s signals of restricted monetary easing, paired with global concerns about U.S. fiscal health, have driven demand for gold. Additionally, uncertainties surrounding the Trump administration’s fiscal and trade policies, including tariffs and proposed tax cuts, add layers of complexity, boosting gold's safe-haven allure.

Global tensions, including U.S. sanctions on Russia and heightened risks in the Middle East, further reinforce gold's position as a hedge against instability. Iranian regional influence has waned, while renewed sanctions on its energy sector have stoked fears of broader market disruptions, adding to gold's resilience.

Gold’s Role in Diversified Portfolios

Institutional and retail investors alike continue to see gold as a critical asset in portfolio diversification. The World Gold Council estimates a 15% year-to-date increase in gold prices, underscoring its importance in managing risk during economic turbulence. While traditional equity markets face pressures from rising rates and fiscal uncertainty, gold provides a counterbalance, mitigating portfolio volatility.

Outlook for Gold Prices in 2025

The interplay of inflation data, Federal Reserve policy, and geopolitical developments will define gold's trajectory in the coming months. If CPI data exceeds expectations, signaling persistent inflation, gold could break through resistance levels, targeting new highs above $2,790.17. Conversely, easing inflation fears and stronger economic indicators could cap gains, leading to a period of consolidation.

In the long term, gold's fundamental drivers—scarcity, central bank demand, and its role as an inflation hedge—remain intact. Investors should monitor critical levels and economic indicators closely as the market navigates a complex web of fiscal, monetary, and geopolitical factors. Gold's ability to defy conventional headwinds underscores its enduring appeal in uncertain times.