Gold Hits Record $2,570 Amid Fed Rate Cut Speculation and Global Unrest

As the US Federal Reserve hints at aggressive rate cuts and geopolitical tensions mount, gold reaches new highs, with investors flocking to the safe-haven asset | That's TradingnEWS

Gold's Meteoric Rise: Analyzing the Surge in XAU/USD Prices

Record-Breaking Gold Prices: A New Era for XAU/USD

Gold (XAU/USD) has broken through its previous all-time high, reaching $2,570 per troy ounce on Friday. The rally is fueled by expectations of aggressive interest rate cuts by the US Federal Reserve. The market is pricing in a potential 100 basis points cut by the end of the year, with a further 100 basis points expected by mid-2025. This has positioned gold as the ultimate safe-haven asset, supported by both global macroeconomic instability and monetary policy shifts.

Fed Rate Cuts Fuel Gold’s Rally

The surge in gold prices is closely tied to the Fed's anticipated rate cuts. Investors expect the Fed to cut interest rates aggressively, which increases the appeal of non-yielding assets like gold. As the probability of a 50-basis-point cut at the next FOMC meeting hovers around 45%, the momentum behind gold's rally remains strong. A similar scenario is unfolding in Europe, where the ECB’s rate cuts have pushed gold prices to record levels in EUR terms, exceeding 2,300 EUR per troy ounce.

Supply Dynamics: A Stable Base for Gold Prices

Gold’s supply structure provides a reliable foundation for its price. In 2023, 75% of the global gold supply came from mining, with the remainder coming from recycling. While gold recycling has increased by 9% this year due to rising prices, mining production remains relatively stable, with an average production cost of $1,300 per ounce acting as a floor for prices. This stability in supply is crucial, particularly as demand for gold increases from both traditional sectors like jewelry and newer financial instruments like gold-backed ETFs.

Global Demand for Gold: Drivers of Growth

Demand for gold is led by the jewelry sector, which accounts for 49% of total demand, followed by central banks at 23%, financial investors at 21%, and the electronics sector at 7%. China and India remain the largest consumers of gold jewelry, with a combined share of 57% of global demand. Central bank purchases, particularly from emerging economies, have significantly bolstered gold prices. Central banks are increasingly using gold as a diversification tool, away from dollar-denominated assets, driven by geopolitical concerns and macroeconomic factors.

The Role of US Interest Rates and Inflation

Gold’s price is largely influenced by interest rates and inflation. As a non-yielding asset, gold becomes more attractive when real interest rates are low or negative, which has been the case since 2019. Despite recent Fed tightening cycles, gold has continued to rise, as the geopolitical risk associated with the war in Ukraine and tensions in the Middle East have amplified risk aversion in financial markets. Inflationary fears further bolster gold’s appeal, particularly in periods of uncertainty like the one we are currently experiencing.

Central Banks and Dedollarization: A Key Factor

One of the most significant factors behind the rise in gold prices is the large-scale purchase of gold by emerging market central banks. Countries like Russia and China have been leading this movement as they seek to diversify their reserves away from the US dollar. The IMF recently reported that the dollar’s share of global central bank reserves has fallen to 59%, a 25-year low. This dedollarization trend has pushed central banks to double their gold purchases over the past two years, significantly impacting the price of the yellow metal.

Gold-Backed ETFs and Financial Investors

Another factor driving gold prices is the rise in financial instruments like gold-backed ETFs, which have made it easier for institutional and retail investors to gain exposure to physical gold. These products, which are directly backed by gold reserves, have increased demand for the metal and driven up its price. Although ETF outflows have been trending downward since 2023, geopolitical tensions and inflation concerns continue to attract financial investors to gold as a safe-haven asset.

Geopolitical Risks Fuel Gold’s Appeal

Gold's role as a hedge against geopolitical risks has never been more apparent. The ongoing war in Ukraine, coupled with rising tensions in the Middle East, has created an environment of heightened risk aversion. Investors are flocking to gold as a safeguard against these uncertainties. As risk aversion increases, so does the demand for gold, driving prices higher. This trend is amplified by the diversification strategies of emerging economies, further elevating gold’s status as a premier financial asset.

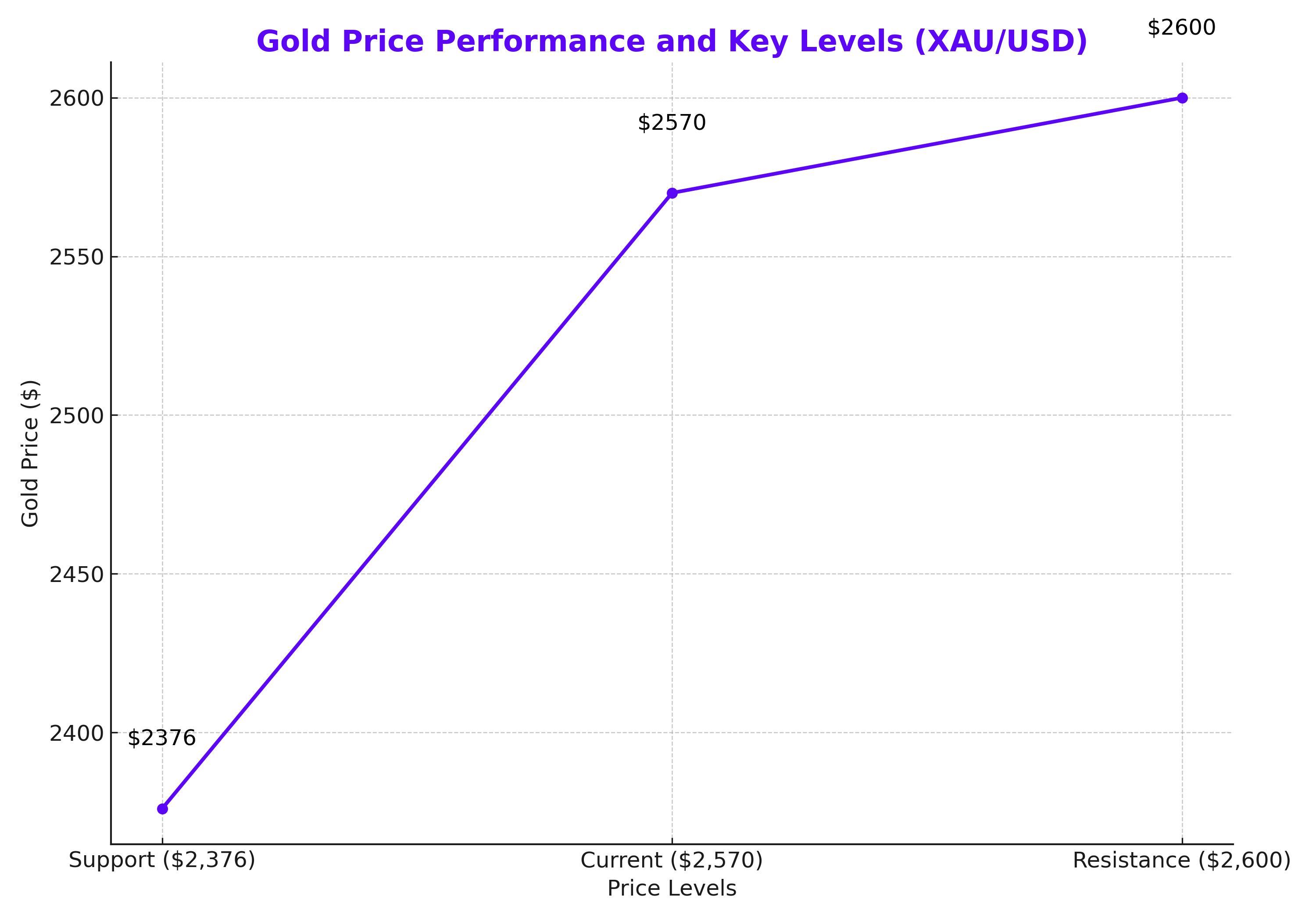

Key Support and Resistance Levels for Gold

Technically, gold has broken past the key resistance level of $2,472, signaling the potential for further gains. The next major resistance stands at $2,600, while immediate support can be found around $2,376. If gold fails to maintain its upward trajectory, a dip below this support could push prices down to $2,285, a level that has held firm since May. However, with strong bullish momentum and growing geopolitical risks, the likelihood of gold continuing its upward march remains high.

The Fed’s Impact on Gold Prices

Gold's short-term price movements are highly sensitive to US Federal Reserve policy. The Fed is expected to cut interest rates by 25 to 50 basis points at its next meeting, depending on inflation data and employment figures. As inflationary pressures persist and the labor market falters, the Fed is increasingly likely to take aggressive action. Lower interest rates will make gold even more attractive to investors seeking a hedge against inflation and geopolitical risks.

The Role of Emerging Markets and Central Banks

Emerging market central banks, particularly those in Russia and China, have been the largest buyers of gold in recent years. These purchases are driven by geopolitical and economic factors, including the desire to reduce reliance on the US dollar and diversify reserves. According to World Gold Council data, demand for gold from central banks has doubled over the past two years, making them a key force behind the surge in gold prices.

Market Outlook and Sentiment

The gold market is currently driven by a confluence of factors, including inflation concerns, interest rate expectations, and geopolitical risks. As traders anticipate further rate cuts by the Fed and the ECB, gold is likely to remain a preferred asset for those seeking protection against economic uncertainty. Investors are closely watching whether the price of gold will break through the key resistance level of $2,600. If it does, further gains are expected, with potential for gold to reach new highs.

Conclusion: Gold’s Outlook Remains Bullish

With gold prices surging past $2,570 per ounce, the outlook for the yellow metal remains bullish. Supported by aggressive Fed rate cut expectations, central bank purchases, and heightened geopolitical risks, gold is set to continue its upward momentum. As global economic uncertainty persists, gold will remain a key asset for investors seeking a safe haven. Whether gold will reach the $2,600 mark soon depends on upcoming central bank decisions and macroeconomic developments, but the fundamentals strongly support further gains for XAU/USD.