Gold Market Analysis: Detailed Insights and Forecasts

Fed Rate Cut Expectations and Market Movements

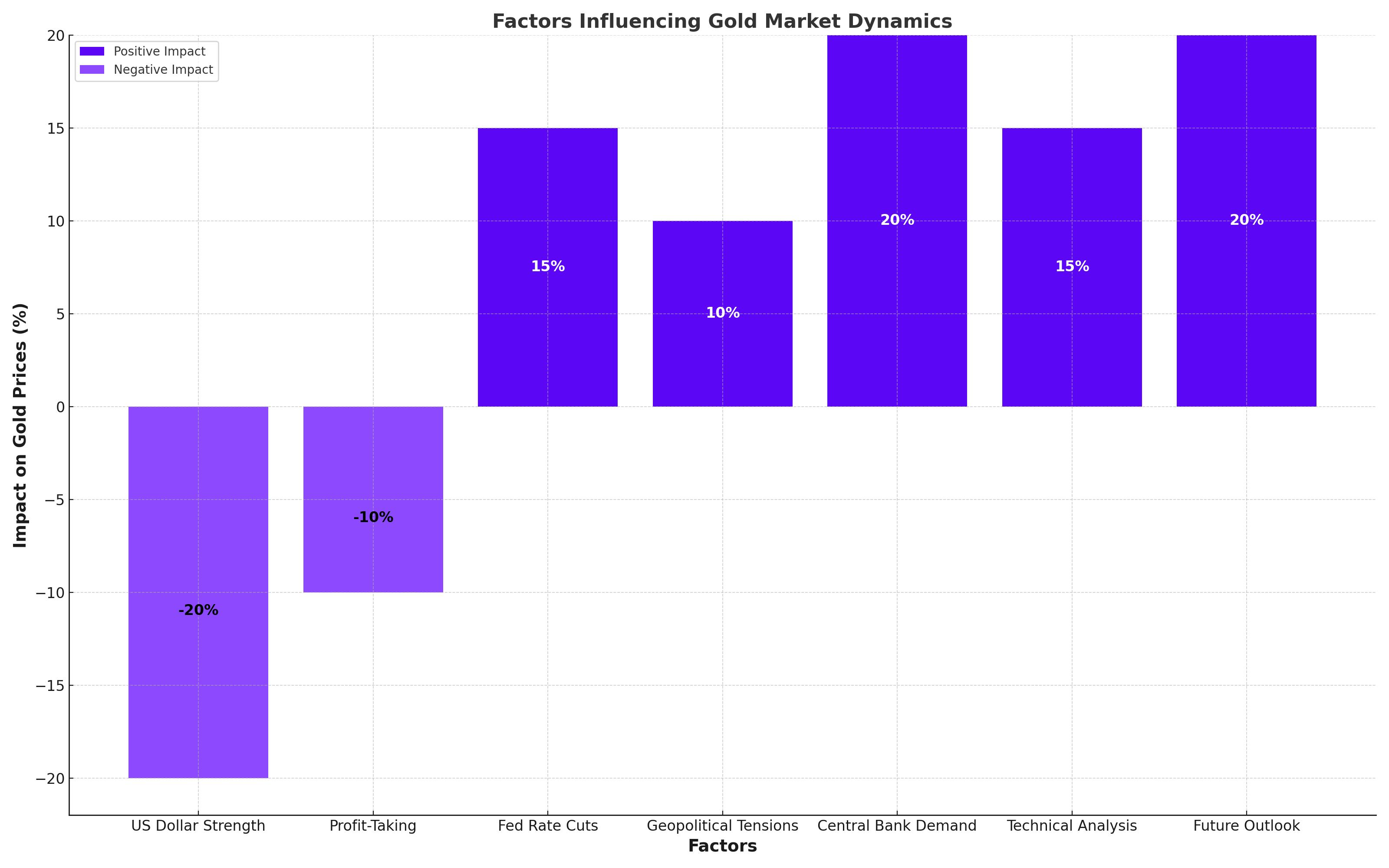

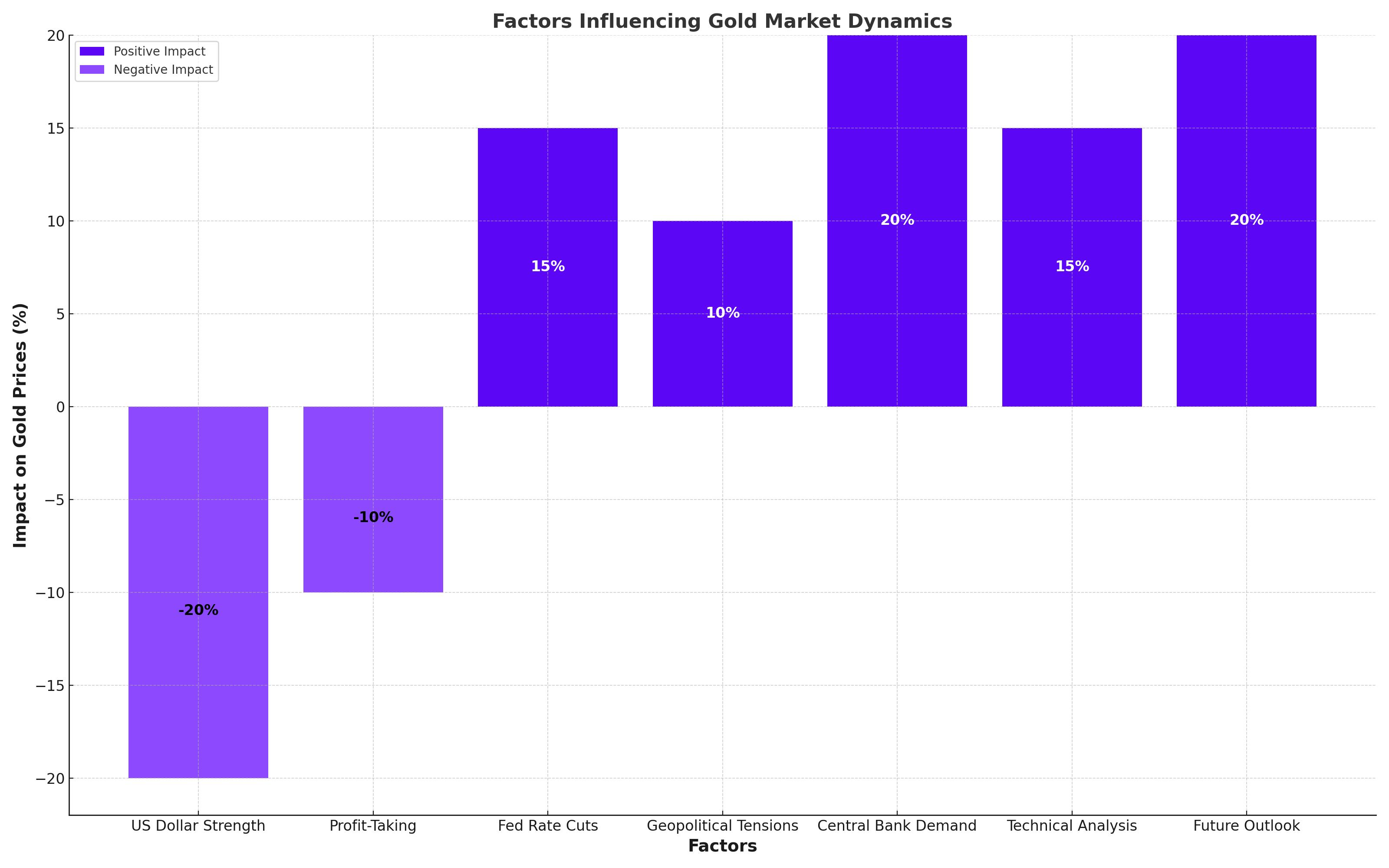

The gold price (XAU/USD) has been experiencing significant movements, particularly during the early European sessions. Currently, gold remains close to its highest level since May 22, supported by expectations of a dovish stance from the Federal Reserve (Fed). Market participants are increasingly convinced that the Fed will start cutting interest rates in September, providing a bullish outlook for the non-yielding precious metal. Additionally, there is speculation that the Fed might lower borrowing costs again in December, adding further support to gold prices.

Impact of US Dollar and Political Uncertainty

Despite a modest recovery in the US Dollar (USD) from a three-month low, gold prices have held firm. The USD's inability to capitalize on its gains is attributed to ongoing expectations of Fed rate cuts. Furthermore, political tensions in the US, including an alleged assassination attempt on former President Donald Trump, and economic uncertainties in China have contributed to a positive outlook for gold.

Chinese Economic Data and Its Implications

Recent economic data from China has raised concerns about global demand. China’s GDP growth slowed to 4.7% year-on-year (YoY) in Q2 2024, down from 5.3% in Q1, primarily due to weaker domestic demand and consumer confidence. Retail sales grew by only 2.0% YoY in June, below the expected 3.1%, and fixed asset investment increased by 3.9% YoY, slightly missing expectations. These figures highlight the uneven nature of China's economic recovery and have implications for global commodity markets, including gold.

Technical Analysis: Key Levels and Trends

From a technical perspective, gold's recent dip-buying indicates strong support near the $2,390-2,388 range. Oscillators on the daily chart remain positive, suggesting further upside potential. A break below $2,400 might be seen as a buying opportunity, with immediate support at $2,358 and further support near the 50-day Simple Moving Average (SMA) at $2,350.

Conversely, resistance is seen at the recent high of $2,425, with the all-time peak around $2,450 as a significant target for bullish traders. A sustained break above this level could set the stage for further gains.

Market Movers and Economic Indicators

The gold market is closely watching several key economic indicators and events. The US Producer Price Index (PPI) for June rose by 2.6% YoY, higher than the expected 2.3%, adding some pressure on gold prices. However, the dovish Fed outlook continues to support gold. The upcoming release of the Empire State Manufacturing Index and Fed Chair Jerome Powell's speech will be critical in shaping short-term market movements.

Gold Price Rebound and Outlook

Gold prices have rebounded above $2,400 in Monday's European session after a modest correction. The assassination attempt on former President Trump has boosted the USD, making gold more expensive for investors. However, expectations of Fed rate cuts in September provide a counterbalance, supporting gold's near-term outlook.

US Treasury yields, a key factor influencing gold prices, remain mixed. The 10-year US Treasury yield is close to a four-month low, reducing the opportunity cost of holding gold. Last week’s US Consumer Price Index (CPI) report showed decelerating inflation, reinforcing expectations of a dovish Fed stance.

Conclusion: Buy, Sell, or Hold?

Based on the current analysis, gold appears to be in a bullish phase, supported by dovish Fed expectations and global economic uncertainties. Investors should watch key support and resistance levels, with $2,450 as a critical target. Considering the dovish outlook and technical indicators, gold is likely to remain a favorable asset in the near term. Traders are advised to stay vigilant and adjust their positions based on upcoming economic data and Fed communications.

For real-time updates and detailed charts, visit Trading News.

That's TradingNEWS