Gold Price Analysis: Will XAU/USD Break $3,000 or Face a Correction?

Gold (XAU/USD) Extends Its Rally Toward $3,000 Amid Market Uncertainty

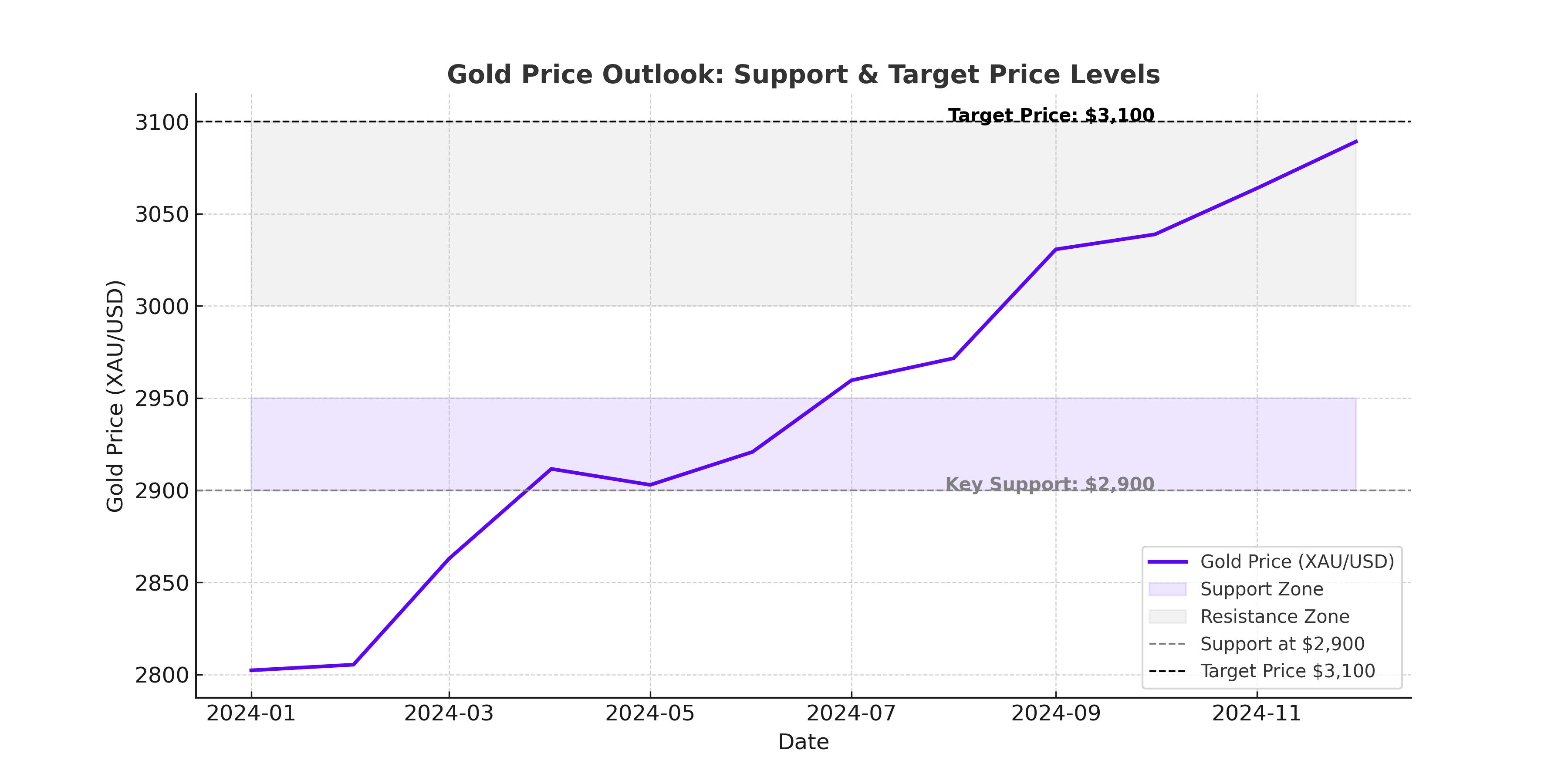

Gold prices are on a relentless surge, hitting a new all-time high of $2,956, just shy of the critical $3,000 psychological level. The XAU/USD rally is fueled by a combination of safe-haven demand, central bank purchases, and expectations of Federal Reserve rate cuts. However, overbought conditions suggest that profit-taking could emerge at these record levels.

Investor Demand and ETF Inflows Drive Gold’s Strength

Gold’s rise has been heavily supported by increased exchange-traded fund (ETF) inflows, with SPDR Gold Trust holdings climbing to 904.38 metric tons, the highest since August 2023. This signals strong institutional interest, as investors view gold as a hedge against inflation, geopolitical risk, and US fiscal uncertainty.

Goldman Sachs has raised its year-end price target for gold to $3,100, citing central bank demand as a primary driver. Many central banks, particularly in China, India, and Russia, have been aggressively adding to their reserves, reducing reliance on the US dollar amid rising global tensions.

US Dollar Weakness and Treasury Yields Boost Gold’s Appeal

A weaker US dollar has also played a key role in gold’s surge. The US Dollar Index (DXY) dropped below 106.700, as disappointing US economic data heightened concerns over slowing growth. The latest US Flash Services PMI fell to 49.7, signaling contraction, while Consumer Sentiment dropped to 64.7, missing expectations of 67.8.

Meanwhile, the 10-year US Treasury yield dipped slightly to 4.443%, making non-yielding gold more attractive to investors. Lower real yields have historically supported higher gold prices, and if the Federal Reserve signals a dovish shift in its upcoming meetings, gold could continue its upward trajectory.

Trump’s Trade Policies Add to Uncertainty

Investor uncertainty surrounding former President Donald Trump’s tariff policies has further fueled demand for gold. Recent trade war fears between the US, China, and the European Union have heightened market volatility. Trump’s delay in imposing new tariffs has created speculation about economic retaliation, pushing investors toward safe-haven assets like gold.

Additionally, discussions between Germany, the US, and Mexico on trade restrictions and economic policy shifts have added uncertainty to global markets. Historically, heightened geopolitical tensions and trade disruptions have driven gold prices higher, reinforcing its role as a crisis hedge.

Gold’s Technical Outlook: Is a Breakout or Pullback Next?

Gold remains in a strong bullish uptrend, but technical indicators suggest that the rally may soon face resistance near the $3,000 level. The Relative Strength Index (RSI) is hovering above 70, indicating that gold is in overbought territory. Historically, such conditions have preceded short-term pullbacks before further upside continuation.

If XAU/USD breaks decisively above $2,956, the next key resistance will be the $3,000 mark. A sustained move above this level could open the door for $3,050 and even $3,100, aligning with Goldman Sachs' latest forecast.

On the downside, immediate support lies at $2,900, followed by the $2,850 level. A break below $2,850 could trigger deeper profit-taking, pushing prices toward the $2,800 region, where strong buying interest is likely to re-emerge.

Will Gold Continue Its Bull Run or Face a Correction?

Gold’s trajectory will largely depend on upcoming US economic data, particularly the Personal Consumption Expenditures (PCE) inflation report. If inflation remains elevated, the Federal Reserve may delay rate cuts, potentially strengthening the US dollar and capping gold’s gains. However, if inflation cools as expected, rate cut expectations could further weaken the dollar, pushing gold higher.

Additionally, central bank demand, geopolitical risks, and fiscal concerns will continue to shape gold’s outlook. As long as uncertainty persists, investors are likely to favor gold as a safe-haven asset.

For now, XAU/USD remains bullish, with $3,000 firmly in sight. Whether gold breaks out further or faces a pullback will depend on how markets react to economic data and Federal Reserve policy shifts in the coming weeks.