Gold Nears New Record Highs as Fed Rate Cuts and Global Turmoil Drive Prices

With Fed Decisions and Global Tensions Heating Up, Gold Shines as a Strategic Investment Opportunity | That's TradingNEWS

Gold Prices React to US Dollar Strength and Inflation Data

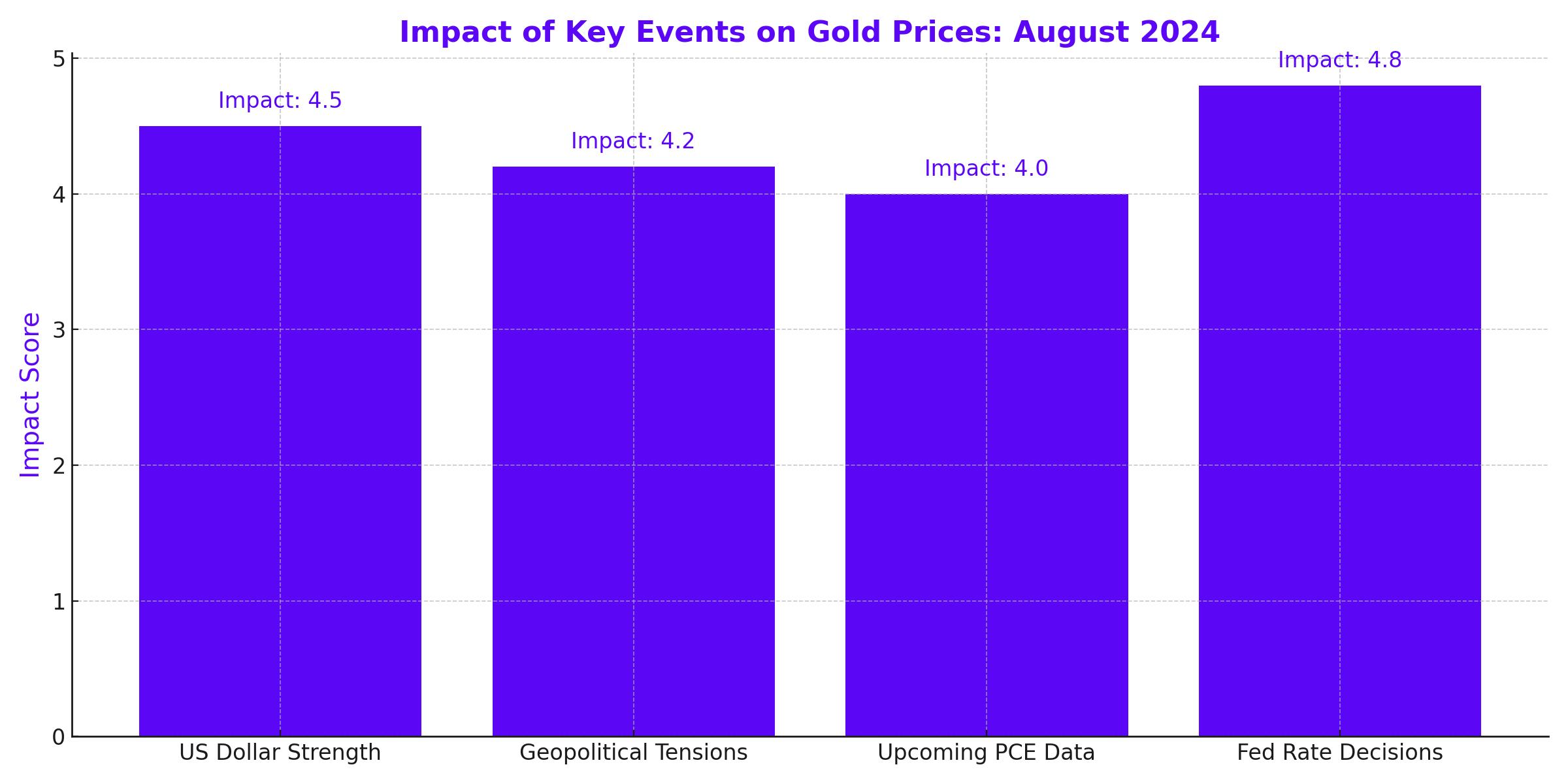

The price of gold (XAU/USD) has faced downward pressure recently, primarily due to the strengthening of the US dollar. The dollar’s rise was supported by a positive US growth report and a decline in Initial Jobless Claims, which together have decreased the likelihood of a significant rate cut by the Federal Reserve in September. This scenario has weighed heavily on the non-yielding precious metal, pushing gold prices lower.

However, geopolitical tensions, particularly in the Middle East and the ongoing conflict between Russia and Ukraine, have kept safe-haven demand alive. This has provided some support for gold, though the immediate outlook remains cautious as investors await further US inflation data.

The upcoming core Personal Consumption Expenditures (PCE) Price Index, a key inflation measure closely watched by the Fed, is expected to show a 2.7% year-over-year increase in July, up from 2.6% in June. A softer-than-expected PCE reading could reignite hopes for a Fed rate cut, potentially reversing the downward trend in gold prices.

Gold's Global Impact: A Closer Look at Regional Prices

The global dynamics of gold are reflected in regional markets, such as in the Philippines, where gold prices have also seen a decline. As of the latest data, gold in the Philippines is priced at PHP 4,540.55 per gram, down from PHP 4,553.82 the previous day. This reflects broader global trends, where the strength of the US dollar and investor sentiment have caused fluctuations in gold prices across different markets.

Despite these short-term declines, gold remains near its record highs. The precious metal has gained around 7% from its August lows and shows resilience against major pullbacks, underscoring the strong uptrend that has persisted over the past ten months.

Geopolitical Tensions: The Driving Force Behind Gold’s Safe-Haven Appeal

Gold’s status as a safe-haven asset continues to be reinforced by escalating geopolitical tensions. The situation in the Middle East, coupled with the prolonged conflict between Russia and Ukraine, has heightened global uncertainty. This has led to increased demand for gold as investors seek to protect their portfolios from potential market disruptions.

The impact of these geopolitical risks is significant, as they contribute to the ongoing support for gold prices despite the strengthening US dollar. As long as these tensions persist, gold is likely to remain an attractive option for risk-averse investors.

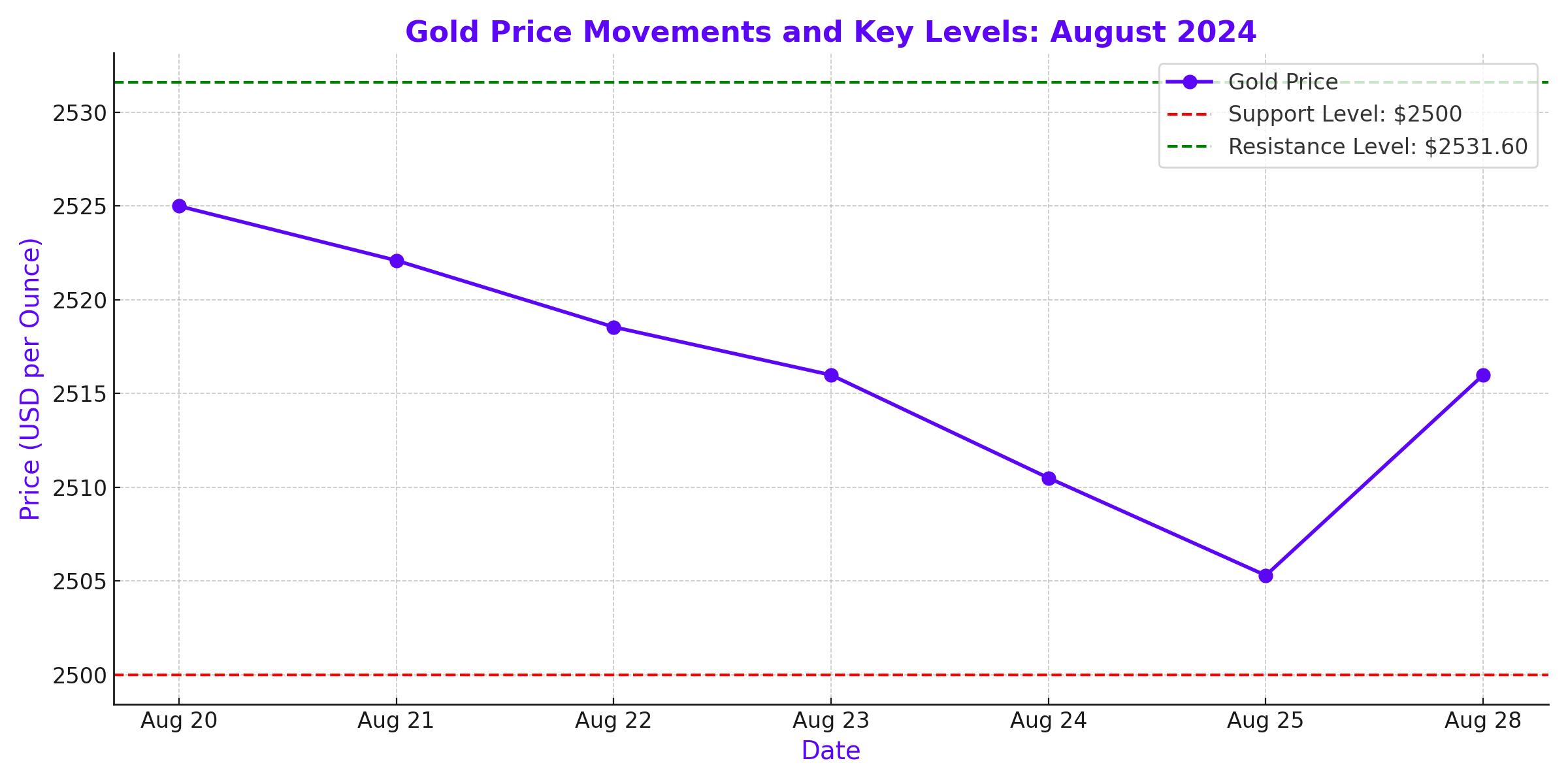

Gold’s Technical Outlook: Examining Key Support and Resistance Levels

From a technical perspective, gold remains in a bullish trend, although recent movements have been tempered by external factors. Spot gold is currently hovering around $2,515.99 per ounce, slightly down from its all-time high of $2,531.60 reached on August 20. Despite this dip, the metal is on track for a 3% gain this month, highlighting its strong performance amid market volatility.

Key support levels to watch include the $2,500 mark, which has served as a critical threshold in recent trading. A break below this level could lead to further declines, while resistance at $2,531.60 remains a crucial barrier for any potential upside. If gold manages to breach this resistance, it could set the stage for a rally toward the $3,000 mark, a level that some analysts believe is within reach in the near future.

US Economic Data and Fed Policy: The Tug-of-War Continues

The direction of gold prices will largely depend on upcoming US economic data, particularly the PCE Price Index and employment figures. With the Fed's focus shifting from inflation to unemployment, the market is keenly watching for any signs that could influence the central bank’s next move.

Current market sentiment suggests a 69% chance of a 25-basis-point rate cut in September, with a 31% possibility of a more substantial 50-basis-point reduction. These expectations have played a pivotal role in gold’s recent performance, as lower interest rates tend to boost the appeal of non-yielding assets like gold.

However, the market remains on edge, as any unexpected shifts in economic indicators could alter these expectations and, in turn, gold’s trajectory.

Conclusion: Is Gold Still a Strong Investment?

Given the current landscape, gold continues to present a mixed but potentially lucrative opportunity for investors. The metal’s safe-haven status is reinforced by geopolitical tensions and economic uncertainties, while its technical outlook suggests further gains are possible if key resistance levels are breached.

For investors, the focus should be on monitoring US economic data and the Fed’s policy decisions, as these will be the primary drivers of gold’s price in the coming weeks. As always, maintaining a diversified portfolio with a modest allocation to gold—around 10%—can help balance potential gains with overall portfolio stability.

In summary, while the short-term outlook for gold is influenced by a strengthening dollar and the possibility of a Fed rate cut, the longer-term view remains bullish, especially as global risks continue to support its role as a safe-haven asset.