Gold Prices Reach Eight-Day High Amid Economic Concerns and Fed Rate Cut Bets

Weak US Dollar, Lower Treasury Yields, and Global Economic Uncertainties Boost Gold Prices; Key Technical Levels and Market Insights Revealed | That's TradingNEWS

Gold Market Analysis: Understanding the Current Dynamics and Future Outlook

Gold Price Movement: Analyzing Recent Trends

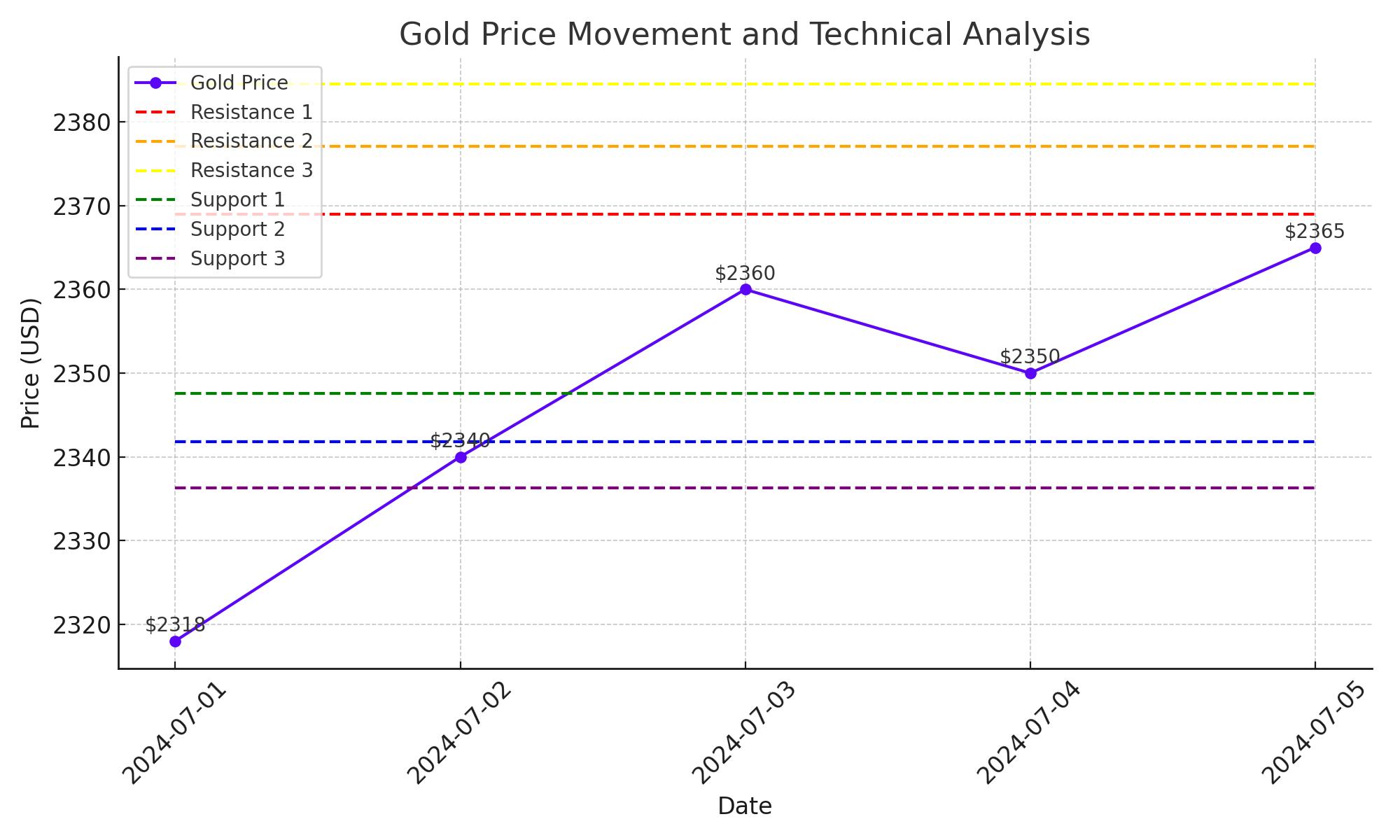

Gold prices have recently surged, reaching an eight-day high of $2,365 amid subdued trading conditions due to the US Independence Day holiday. The daily RSI holds firm above the 50 level, indicating a bullish momentum that backs the current price rise. The precious metal has charted a breakout from its previous range, settling above the 50-day Simple Moving Average (SMA), which is a crucial technical resistance level.

Economic Concerns and Their Impact on Gold Prices

The US economic landscape significantly influences gold prices. The dollar has weakened recently due to expectations that the Federal Reserve may begin a rate-cutting cycle later this year. This sentiment is driven by recent economic data showing signs of a slowdown. For instance, the private sector added 150,000 jobs in June, slightly below the expected 160,000, while the number of first-time unemployment claims rose to 238,000, the highest in two and a half years. Additionally, the ISM Services PMI fell to 48.8, indicating a contraction in the services sector.

These developments have pushed US Treasury bond yields to their lowest point in three weeks, weakening the dollar and supporting gold prices. The minutes from the latest Federal Open Market Committee (FOMC) meeting further revealed concerns about the cooling US economy, reinforcing the belief that the Fed might reduce interest rates soon.

Gold Price Technical Analysis

Gold (XAU/USD) is currently trading around $2,355.755, showing a mild positive bias. The 4-hour chart highlights several critical technical levels. The pivot point at $2,360.44 is significant, serving as a potential reversal or continuation point. Immediate resistance levels are at $2,368.99, $2,377.06, and $2,384.50. Breaching these levels could trigger further buying pressure. Immediate support is found at $2,347.61, with additional support at $2,341.81 and $2,336.27, offering potential buying opportunities if the price dips.

The Relative Strength Index (RSI) is at 68, nearing the overbought zone, indicating a possible bearish correction. The 50-day Exponential Moving Average (EMA) at $2,327.71 suggests a bullish trend as long as the price remains above this average.

Influence of Federal Reserve Policies on Gold

Federal Reserve Chairman Jerome Powell's recent remarks at the European Central Bank (ECB) Forum On Central Banking in Sintra highlighted the progress in disinflation but emphasized the need for more data before starting rate cuts. This dovish stance from the Fed has fueled expectations of a rate cut, contributing to the decline in the dollar and supporting gold prices. Markets now price a 73% chance of a rate cut in September, up from 67% before the data release.

Global Economic Factors and Geopolitical Concerns

Geopolitical tensions and political uncertainties also play a crucial role in influencing gold prices. The ongoing UK general elections and uncertainties in global politics increase market anxiety, driving investors towards safe-haven assets like gold. Additionally, global economic concerns, including signs of economic slowdown in major economies like Germany and China, contribute to the bullish sentiment in the gold market.

Gold Price Technical Outlook

From a technical perspective, gold's breakout through the 50-day SMA and the positive traction in daily chart oscillators favor bullish traders. Sustained strength beyond the $2,365 area could set the stage for a move towards the $2,400 mark and potentially challenge the all-time peak around $2,450. Conversely, meaningful pullbacks could attract buyers near the 50-day SMA resistance breakpoint around $2,339-2,338. Further support is pegged near the $2,319-2,318 area, with a break below this level exposing gold to a decline towards the $2,300 mark and lower support zones.

Investment Strategy and Market Sentiment

Investors should closely monitor the upcoming US Nonfarm Payrolls (NFP) report for further clues on the Fed's policy direction. The current market setup suggests a cautious approach, with potential for both bullish and bearish movements based on upcoming economic data. Given the strong support levels and bullish technical indicators, gold remains a favored asset for hedging against market volatility and potential interest rate cuts by the Federal Reserve.

Conclusion

Gold prices have been buoyed by dovish Fed expectations, economic concerns, and geopolitical uncertainties. The current technical setup favors bulls, with the potential for further gains if key resistance levels are breached. Investors should stay vigilant, closely monitoring economic data and geopolitical developments to navigate the gold market effectively. With the ongoing economic uncertainties, gold continues to be a valuable asset for portfolio diversification and risk management.

That's TradingNEWS

WTI & Brent Crude Prices Face Major Setback: How Will Trump's Tariffs and OPEC+'s Output Boost Impact Oil Markets?

Gold Price Surges to Record Highs Before Retreating: How Will Tariff Uncertainty Affect XAU/USD?