Gold Price Analysis - Economic and Geopolitical Influences

Understanding Gold Market Fluctuations Amid Federal Reserve Policies and Global Developments | That's TradingNEWS

Gold Price Analysis: Navigating Economic and Geopolitical Currents

Current Gold Market Dynamics

Gold prices have recently experienced significant fluctuations, hitting two-week lows around $2,327. This downward trend has been driven by several economic factors, most notably the Federal Reserve's hawkish stance and stronger-than-expected US PMI data. The US Composite PMI jumped to 54.4, the highest since April 2022, exceeding the previous 51.3 in April. This robust data, combined with hawkish Fed communications, has dampened expectations for aggressive rate cuts, applying additional pressure on gold prices.

Impact of US Federal Reserve Policies

The release of the Federal Reserve’s May meeting minutes has been a critical factor influencing gold prices. The minutes revealed that several participants were open to further tightening if inflation risks warranted it. This hawkish outlook has diminished market expectations for rate cuts, negatively impacting non-interest-bearing assets like gold. According to CME Group’s FedWatch Tool, there has been a notable reduction in the bets for multiple rate cuts in 2024, further contributing to the downward pressure on gold.

Technical Analysis and Market Sentiment

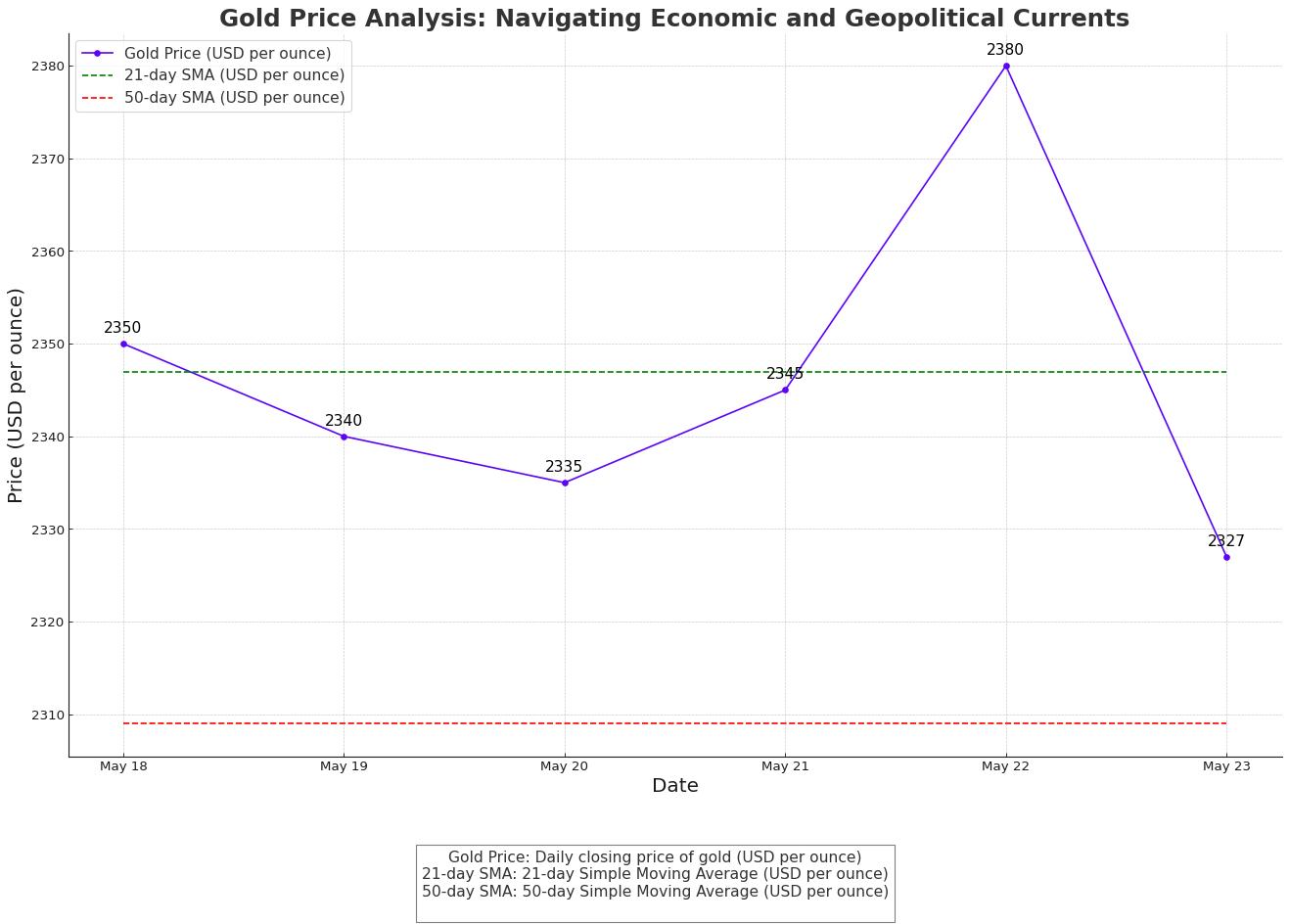

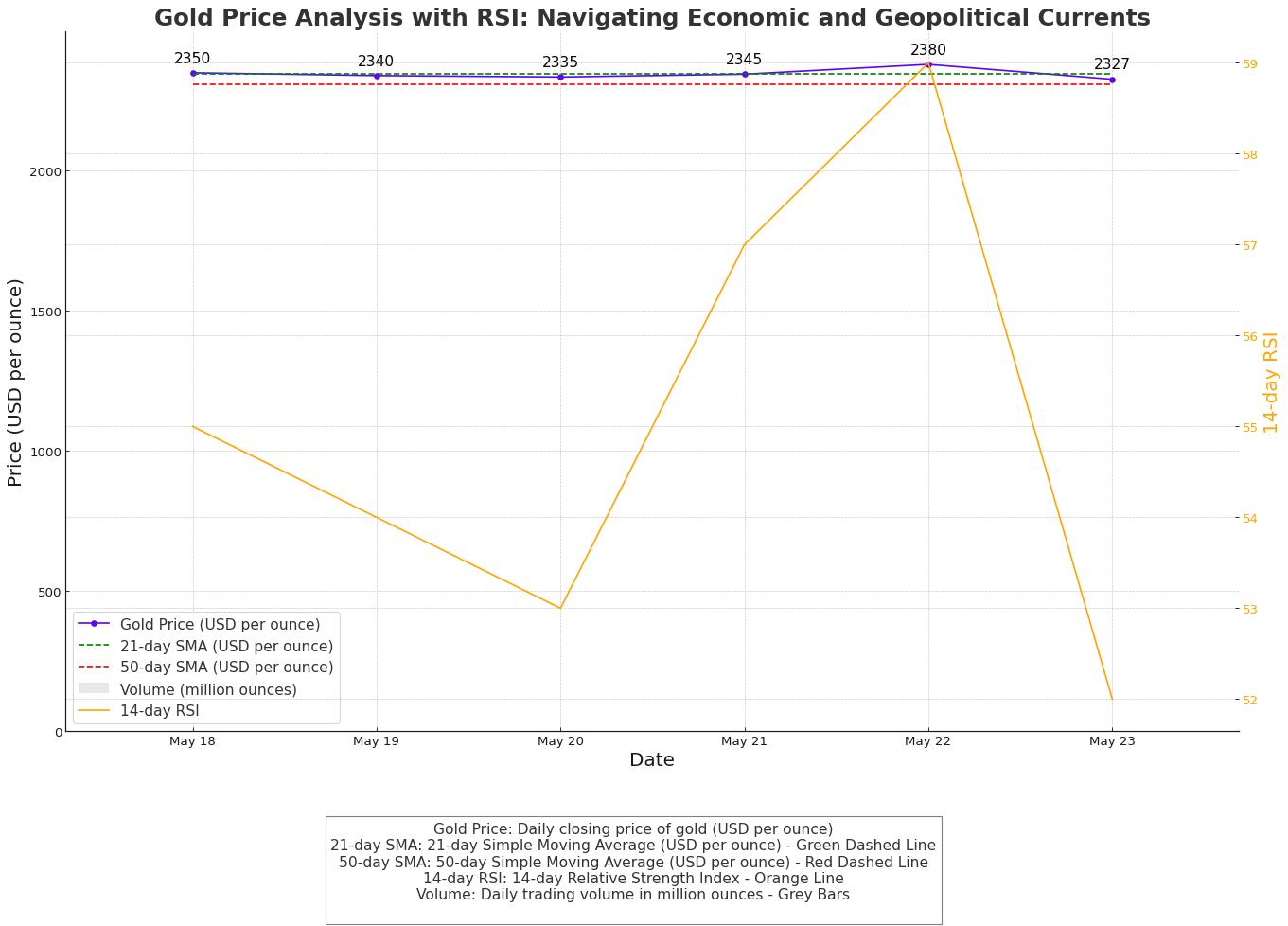

From a technical perspective, gold prices have confirmed a breakdown from a five-week-long rising wedge pattern, closing below the lower boundary at $2,384. Additionally, the price fell beneath the 21-day Simple Moving Average (SMA) at $2,347, with the 14-day Relative Strength Index (RSI) indicating a bearish shift. These technical indicators suggest a shift in favor of sellers, with the 50-day SMA at $2,309 being a critical support level. Failure to maintain this level could expose gold prices to further declines, potentially testing the May low of $2,277 and the psychological barrier of $2,250.

Geopolitical Factors and Supply-Side Dynamics

Gold prices are also being influenced by supply-side developments. For instance, Russian metals giant Nornickel's plans for a joint project to construct a platinum group metals refinery in Bahrain could impact the supply dynamics. Such moves are crucial as they may affect the broader market sentiment and pricing of precious metals.

Long-Term Gold Price Forecast

Renowned analyst Ronald Stoeferle has reiterated his long-term bullish forecast for gold, predicting a price target of $4,821 per ounce by 2030. This projection is based on historical performance, where gold prices saw annualized returns of over 14% in the 2000s and 27% in the 1970s. Achieving this target would require an annualized return of just under 12%, which is deemed realistic considering past trends and current economic conditions.

Near-Term Market Outlook

Looking ahead, gold prices remain vulnerable due to the bullish consolidation of the US Dollar and rising US Treasury yields. Upcoming economic data releases, including US Durable Goods and Consumer Sentiment, along with speeches from Fed officials like Governor Christopher Waller, will be critical in shaping market expectations and influencing gold prices.

Key Support and Resistance Levels

In the immediate term, gold prices need to defend the 50-day SMA at $2,309 to avoid further declines. A successful defense could lead to a rebound towards the 21-day SMA support-turned-resistance at $2,347. Breaking above this level could pave the way for a recovery towards the previous high of $2,384 and potentially challenge the $2,400 threshold.

Investor Sentiment and Strategic Outlook

Despite recent volatility, the long-term fundamentals for gold remain strong, driven by ongoing geopolitical uncertainties and central bank policies. Investors should watch key support levels closely and consider potential entry points for long-term positions, especially if gold prices stabilize above critical technical levels.

Conclusion

The gold market is navigating a complex landscape of economic indicators and geopolitical developments. While short-term pressures have led to recent declines, the long-term outlook remains bullish, supported by historical performance and fundamental drivers.

Read More

-

FDVV ETF: $57.09 Dividend Grower Riding AI And Big-Cap Cash Flows

24.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF: XRPI at $10.70 and XRPR at $15.19 Ride $1.13B Inflows as XRP-USD Holds $1.85

24.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Holds Around $4 as Record LNG Feedgas Anchors Winter Range

24.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Retreats to 155.80 After 157.77 High as BoJ–Fed Divergence Tests Bulls

24.12.2025 · TradingNEWS ArchiveForex