Gold Price Analysis: Market Dynamics & Technical Indicators

Understanding Recent Movements, Economic Influences, and Geopolitical Impacts on Gold Prices | That's TradingNEWS

Gold Price Analysis: Market Dynamics, Technical Indicators, and Future Outlook

Recent Gold Price Movements

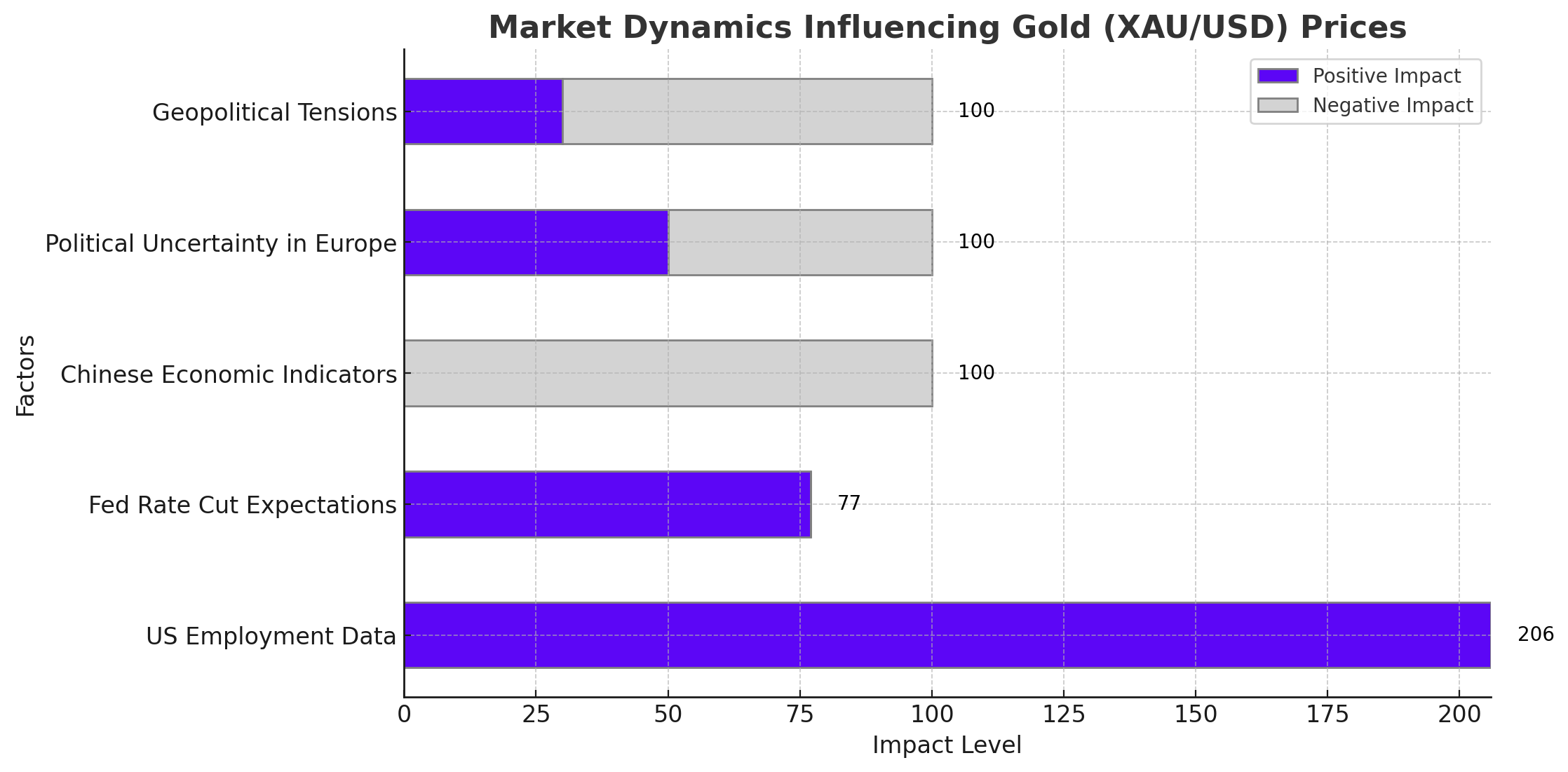

Gold prices (XAU/USD) edged lower to $2,320 after retreating from two-week highs of $2,368 during the early Asian session on Monday. The stronger-than-expected US Purchasing Managers Index (PMI) released on Friday has put downward pressure on the yellow metal. This week, the focus will be on the final readings of the US Gross Domestic Product (GDP) and Core Personal Consumption Expenditures (PCE) Price Index.

US Economic Data and Its Impact on Gold

The US economic data for June continues to show mixed signals. On Friday, the advanced US Composite PMI for June came in better than expected, rising to 54.6 from a final reading of 54.5 in May, marking the highest level since April 2022. The Manufacturing PMI climbed to 51.7 from 51.3 in May, beating the expectation of 51.0. The Services PMI increased to 55.1 from 54.8 in May, above the consensus of 53.7.

Federal Reserve's Position on Interest Rates

Federal Reserve officials have delayed the timing of the first interest rate cut this year. Fed Bank of Richmond President Tom Barkin stated that the central bank is well-equipped with the necessary tools but will need more data over the next several months. Fed Bank of Minneapolis President Neel Kashkari noted that it might take a year or two to bring inflation back to 2%. The stronger US economic data and the hawkish tone of Fed policymakers continue to support the US Dollar, putting pressure on gold prices as higher interest rates increase the opportunity cost of holding non-yielding assets like gold.

Geopolitical and Economic Uncertainty

On the other hand, safe-haven flows due to geopolitical and economic uncertainties could support gold prices. The UN Secretary-General warned that a full-scale war between Israel and Hezbollah would be catastrophic. Recent Israeli air strikes in Gaza, resulting in casualties, further heighten geopolitical tensions, potentially supporting gold as a safe-haven asset.

Local and Global Gold Price Trends

In local markets, gold prices recorded a 0.2% increase during the week ending last Saturday evening, while global gold prices experienced a slight decline of 0.6% during the same period. This global decrease was influenced by factors such as a strengthening dollar and rising Treasury yields amidst mixed economic data and the Federal Reserve’s interest rate expectations.

Local Market Insights

Embaby, CEO of iSagha, an online platform for trading gold and jewelry, highlighted that local gold prices rose by EGP 5 over the past week. The price of 21k gold opened at EGP 3,140 per gram and closed at EGP 3,145. Meanwhile, global gold prices fluctuated, opening at $2,333 per ounce, dropping to $2,307, then rising to $2,368, and finally closing at $2,320.

Other gold categories also saw price variations:

- 24-karat gold was priced at EGP 3,594 per gram.

- 18-karat gold was priced at EGP 2,696 per gram.

- 14-karat gold was approximately EGP 2,097 per gram.

- The gold sovereign commanded a price of around EGP 25,160.

Export and Exchange Rate Impact

The export of raw gold continues to dominate local markets, despite sluggish sales. This sustained demand contributes to the gradual rise in prices, even as the global market faces fluctuations. Additionally, the rising exchange rate of the dollar in the parallel market is expected to impact local prices at the start of the trading week on Monday. The dollar exchange rate reached approximately EGP 48.80 after the Eid al-Adha holiday.

Technical Analysis and Market Projections

Gold prices fell on Friday following their highest weekly level on Thursday. This decline coincided with the release of the US Purchasing Managers’ Index (PMI) data, which indicated an increase. Uncertainty surrounding the Federal Reserve’s future interest rate decisions has been fueled by mixed statements from officials. While some suggest a potential rate cut by year-end, others emphasize the need for further measures.

Spot gold traded at $2,331.24 per ounce, marking a 1.2% drop, while three-month gold futures in New York lost 0.8% at $2,350.40 per ounce. Gold has benefited from a run of soft economic data, with traders considering bad news as 'good news,' anticipating earlier and more rate cuts.

Other Precious Metals

Palladium rose 7.5% to $995.50 per ounce, nearing a one-month high, although it remains down 10% so far this year after a 39% slump in 2023. Platinum was up 1.3% to $996.59 per ounce, while silver fell 2.9% to $29.85 an ounce. Both metals are heading for a weekly gain.

Gold Markets Technical Analysis

The gold market showed a slight bounce during the early hours on Monday, with the 50-day EMA acting as an important support level. The $2,300 level serves as a significant psychological and technical support, while the $2,400 level above remains a major resistance barrier. Despite short-term fluctuations, there are numerous reasons to believe that gold could continue its upward trend, including ongoing central bank purchases and geopolitical concerns.

Market Sentiment and Future Outlook

Gold price (XAU/USD) attracts bids near $2,315 in Monday’s American session as the US Dollar corrects amid firm speculation that the Federal Reserve will deliver two rate cuts this year. The US Dollar Index (DXY) drops to 105.60, with expectations for the Fed to reduce interest rates twice in 2024 strengthening amid easing inflationary pressures in the United States.

The US Consumer Price Index (CPI) report showed that price pressures decelerated more than expected in May. The preliminary S&P Global PMI report for June indicated moderate cooling in cost growth.