Gold Price Analysis: XAU/USD Approaches Key Levels as U.S. Election Adds Volatility

Gold Maintains Upward Momentum at $2,740, Driven by Election Uncertainty, Fed Rate Cuts, and Surging Central Bank Demand | That's TradingNEWS

Record Highs and Price Drivers: Gold Holds Steady Near $2,740

The gold market has captured attention with prices hovering near $2,740 per ounce after a recent high of $2,790, underscoring the precious metal's resilience in an uncertain environment. Several factors are at play here, including the upcoming U.S. presidential election and the Federal Reserve’s interest rate stance. Gold's current price reflects a cautious investor sentiment as market participants seek safe-haven assets amidst political and economic volatility.

A primary driver of recent gold price fluctuations has been the tight U.S. presidential race between Kamala Harris and Donald Trump, with opinion polls indicating an unpredictable outcome. Historically, periods of political uncertainty push gold prices higher as investors brace for potential market shocks. Gold, known for its status as a hedge against volatility, has seen increased demand, bolstered by concerns over inflation, potential monetary policy shifts, and geopolitical tensions.

Federal Reserve Rate Cut Expectations and Implications for Gold

The U.S. Federal Reserve’s upcoming decision on interest rates further contributes to the upward momentum in gold prices. With a quarter-point rate cut widely anticipated, the Fed’s dovish stance supports gold by weakening the dollar and lowering Treasury yields. As yields fall, the opportunity cost of holding gold—a non-yielding asset—diminishes, making it more attractive to investors seeking safety amidst low returns on fixed-income securities.

Additionally, the weak U.S. labor market data, as evidenced by lower-than-expected non-farm payrolls, reinforces expectations for a more accommodative monetary policy. This scenario strengthens gold’s appeal as a defensive asset, particularly when coupled with the possibility of continued rate cuts in the coming months.

Impact of U.S. Election on Gold Prices: Policy Differences and Market Sensitivity

The uncertain political landscape in the U.S. has significant implications for gold. If Trump secures a second term, analysts predict a rise in inflation due to potential fiscal policies aimed at boosting growth, such as tax cuts and increased infrastructure spending. Such inflationary pressures would likely drive gold prices higher, as gold is traditionally seen as a hedge against inflation.

On the other hand, a Harris administration could bring about lower inflation expectations due to potentially less aggressive spending policies. Market participants also worry about the Fed’s independence under Trump, whose previous rhetoric suggested interference with the central bank's policies. A perceived lack of Fed autonomy under a Trump presidency would likely add fuel to the gold rally as investors seek stability in tangible assets.

For investors, an uncertain or contested election outcome could sustain gold prices at elevated levels in the weeks following the election. Should results remain unclear, gold may benefit from safe-haven demand as the market reacts to heightened volatility.

Record Q3 Gold Demand and Central Bank Influence

Gold demand in the third quarter of 2024 reached record highs, with total supply climbing 5% year-over-year to 1,313 metric tons, according to the World Gold Council (WGC). Central banks, notably in emerging economies, continued their aggressive gold purchases, adding a net 186 tons in Q3. Although this marked a slower pace than earlier in the year, it highlights the shift among global central banks towards assets viewed as stable and inflation-resistant.

Demand from high-net-worth individuals and institutional investors has also surged, largely due to a perceived increase in financial risk associated with the massive U.S. national debt, which currently stands at $35 trillion. The potential instability surrounding the sustainability of U.S. debt has prompted many investors to diversify away from Treasuries and into gold, particularly given its historical role as a safeguard against fiscal uncertainty.

Investment Trends in Gold ETFs and Jewelry: A Complex Market Landscape

Global gold ETFs recorded an inflow of 95 tons in Q3, marking the first positive quarter for ETF demand since early 2022. This influx underscores the renewed interest among institutional investors, likely fueled by growing concerns about inflation and the longevity of current monetary policies. In contrast, physical demand saw mixed results: gold bar and coin investments declined by 9% year-over-year to 269 tons, while jewelry consumption dropped by 12% despite robust demand in India due to seasonal trends.

China, a key consumer of gold, saw a 19% quarter-on-quarter increase in jewelry demand, even as high prices led to a 23% year-on-year decline in overall jewelry purchases. The WGC attributed this trend to seasonal factors and a slight recovery in consumer sentiment, spurred by recent economic stimulus measures. However, challenges remain as consumers weigh the impact of persistently high prices against the appeal of gold as an investment.

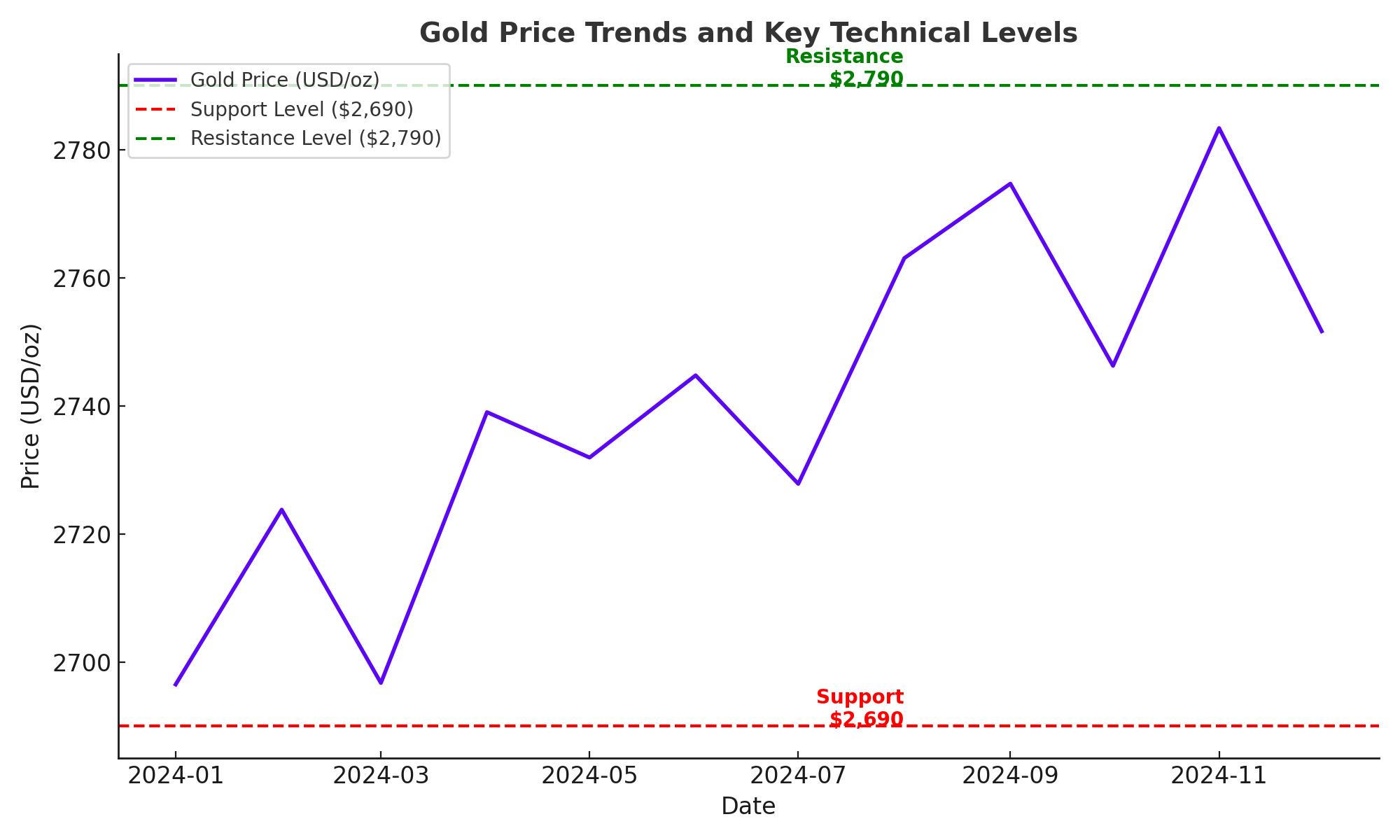

Technical Analysis: Key Support and Resistance Levels

Gold’s technical patterns indicate a robust uptrend with support at approximately $2,690 per ounce, according to current chart data. The ascending trend line, established since August 2024, provides a foundational level that has yet to be breached. A break below this support could signal further declines, while resistance remains at the recent high of $2,790. Should prices exceed this resistance, gold may advance toward new highs.

Gold’s price action over the past year has been characterized by consistent upward movement, driven by factors such as geopolitical tensions, monetary policy uncertainty, and investor flight to safe-haven assets. With demand fundamentals remaining strong, technical indicators suggest continued price stability at current levels, barring any drastic shifts in global economic policies or financial stability.

Geopolitical Tensions and Their Influence on Gold Demand

Global geopolitical events, particularly in the Middle East, add a layer of complexity to gold’s pricing. Ongoing hostilities between Iran and Israel elevate the risk of conflict, increasing demand for safe-haven assets. The market remains cautious as further escalation could disrupt oil supplies, adding inflationary pressure and subsequently boosting gold prices.

Additionally, tensions between the U.S. and other global powers over economic and trade policies could drive a continued reallocation of reserves toward gold. Many investors and central banks, wary of potential disruptions in the global economy, are diversifying away from fiat currencies and into gold as a strategic hedge.

Future Outlook: Projections and Price Targets

Analysts have set ambitious price targets for gold, with UBS forecasting levels as high as $3,000 per ounce by mid-2025. Factors supporting this bullish outlook include continued rate cuts, ongoing inflationary pressures, and demand stability from central banks and institutional investors. If the political and economic landscape remains volatile, gold is expected to maintain its upward momentum.

However, certain factors could dampen gold’s ascent. Should global economies show signs of recovery, or if political stability returns following the U.S. election, gold may face headwinds from a strengthening dollar and rising Treasury yields. Additionally, if the Fed signals a potential halt to its rate-cutting cycle, investor sentiment could shift, leading to a temporary softening in gold demand.

Investment Recommendation: Buy, Hold, or Sell?

Based on current market dynamics, gold appears to be a Buy for investors seeking to hedge against volatility and inflation. Its role as a safe haven is reinforced by global uncertainties, particularly with the upcoming U.S. election and the anticipated rate cuts by the Fed. Central bank purchasing trends and ETF inflows further bolster gold’s long-term prospects, with high-net-worth investors and institutions turning to gold as an inflation-resistant asset.

For investors focused on short-term gains, gold’s current price levels suggest stability, though a breakout above $2,790 would confirm a bullish continuation. Conversely, a dip below the $2,690 support could present a buying opportunity for those looking to enter at a lower level.