Gold Price at a Crossroads: Will XAU/USD Soar Past $3,000 or Pull Back?

Gold has surged past $2,900, driven by economic uncertainty and US trade tensions. But can XAU/USD sustain this rally, or is a correction toward $2,800 inevitable? | That's TradingNEWS

Gold Price Analysis: Is XAU/USD Heading for $3,000 or a Major Pullback?

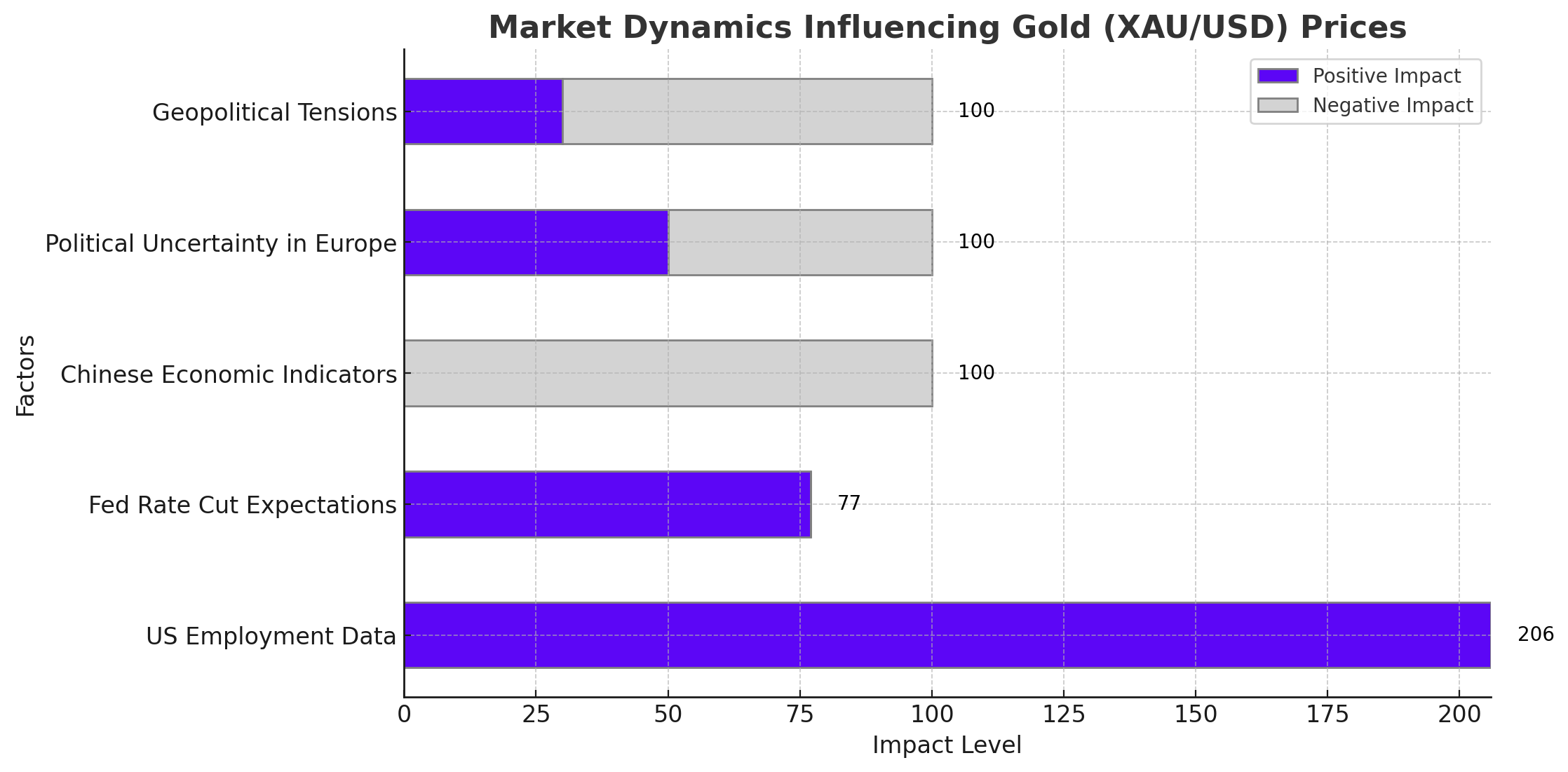

Gold prices have surged to record highs, breaking above $2,900 per ounce, as global market uncertainty, rising inflation, and renewed trade tensions drive demand for safe-haven assets. The question now is whether XAU/USD can push past the $3,000 level or if a correction is looming, bringing gold back toward $2,800 or even lower. The Federal Reserve’s next move, inflation data, and geopolitical risks will play a critical role in determining the direction of the precious metal.

Gold’s Rally Fueled by Inflation and Market Uncertainty

Gold has historically been a hedge against inflation, and with US inflation concerns resurfacing, investors are turning to XAU/USD as a store of value. Data shows that US CPI increased by 0.3% in January, reinforcing expectations that the Federal Reserve will keep rates elevated for longer. Gold’s rally comes as a response to inflation eroding the real value of cash and bonds, making the non-yielding asset more attractive.

Federal Reserve Chair Jerome Powell recently reaffirmed the Fed’s commitment to maintaining rates at 4.25%-4.5%, citing persistent inflation risks. If rate cuts are delayed, gold could see temporary pressure, but if the Fed pivots to a dovish stance, gold prices could extend gains well past $3,000.

Technical Analysis: Key Levels to Watch for XAU/USD

Gold’s breakout past $2,900 has put $3,000 in focus, but technical indicators suggest that XAU/USD is overbought, raising the possibility of a pullback. The Relative Strength Index (RSI) is above 70, a signal that the asset may be due for consolidation or a temporary decline.

Immediate resistance is seen at $2,942, the recent peak, followed by the psychological barrier of $3,000. A breakout above this level could push gold toward $3,100, where profit-taking may emerge.

On the downside, key support sits at $2,850, followed by the 50-day EMA at $2,735. If gold falls below these levels, the next target would be $2,800, a crucial area where buyers may step in to defend the bullish trend. A deeper correction below $2,700 could trigger further selling, bringing $2,600 into view.

Trump’s Tariffs and Trade Wars: A Catalyst for Gold?

Former US President Donald Trump’s recent tariff policies have reignited concerns about global trade disruptions. With a 25% tariff imposed on steel and aluminum imports, markets are bracing for retaliatory measures from trading partners, which could fuel economic uncertainty. Historically, trade wars and geopolitical tensions have been bullish for gold, as investors seek safety from currency volatility and stock market declines.

European Commission President Ursula von der Leyen has vowed retaliation against US tariffs, while China is reportedly preparing countermeasures. If a full-scale trade war erupts, XAU/USD could see further inflows as investors hedge against economic instability.

Gold’s Historical Performance During Economic Crises

Gold’s rise in 2025 mirrors previous market crises where the metal acted as a hedge against uncertainty. During the 2008 financial meltdown, gold surged past $1,900 per ounce, marking a new all-time high. Similarly, in 2022, when Russia invaded Ukraine, gold spiked to $2,070 as investors sought safety.

With rising geopolitical risks, persistent inflation, and volatile equity markets, the current gold rally could have more room to run. However, unlike past crises, central banks now have fewer tools to stimulate the economy due to high government debt levels, making gold’s long-term outlook even more compelling.

Gold Market Sentiment and Investor Positioning

Institutional investors continue to accumulate gold, with ETF holdings increasing by 3.2% in the last quarter. Central banks, led by China and India, have been net buyers of gold, reinforcing its role as a key asset in global reserves. The gold-to-dollar correlation remains strong, meaning any weakness in the US Dollar Index (DXY) could further support higher gold prices.

At the same time, hedge funds and speculators have increased their long positions in COMEX gold futures, suggesting confidence in gold’s ability to hold above $2,900. However, if economic data surprises to the upside, particularly stronger-than-expected US jobs and GDP figures, gold could face profit-taking.

Gold Price Forecast: Buy, Sell, or Hold?

With gold nearing $3,000, the decision to buy, sell, or hold depends on time horizon and risk tolerance. Short-term traders should watch $2,942 resistance and $2,850 support for potential breakout or reversal signals. A confirmed breakout above $3,000 could trigger momentum buying, while a rejection could lead to a pullback toward $2,800.

For long-term investors, dips below $2,850 could present a strategic buying opportunity, especially if inflation remains persistent and central banks continue to accumulate gold. The Federal Reserve’s rate path and geopolitical developments will be crucial in determining whether gold sustains its bullish momentum or faces a temporary correction.

Final Outlook on XAU/USD: Bullish or Bearish?

The overall outlook for gold remains bullish, but traders should expect volatility. As long as gold holds above $2,800, the path toward $3,000 remains intact. The next major catalyst will be the US CPI report and Federal Reserve statements, which could either confirm gold’s strength or trigger a short-term correction.

A break below $2,735 would weaken the bullish structure, potentially opening the door for a larger selloff. However, with inflation concerns, trade tensions, and central bank buying, any pullback in gold could be seen as a buying opportunity for long-term investors.

If the US economy slows down and the Fed signals rate cuts in the second half of 2025, XAU/USD could rally well beyond $3,000, marking a new era for gold prices.