Gold Price Climbs Above $2,900 – Will XAU/USD Finally Break $3,000?

Is Gold's Rally Sustainable, or Are We Facing a Major Reversal? | That's TradingNEWS

Gold Price Approaching $3,000 – Is XAU/USD Ready for a Breakout or a Reversal?

Gold’s Historic Run – Can It Continue?

Gold (XAU/USD) has surged past $2,900 per ounce, marking another all-time high in 2025. This rally has been fueled by central bank purchases, inflation fears, and rising geopolitical tensions, all of which have reinforced gold’s role as a safe-haven asset. The question now is whether gold has enough momentum to break above $3,000 or if the market is setting up for a short-term pullback before resuming its upward trajectory.

At the start of 2025, gold prices already showed impressive strength, outpacing returns in silver, platinum, and most major commodities. Investors, both institutional and retail, have been piling into gold as persistent inflation and monetary policy uncertainty keep risk appetite in check. Even though the Federal Reserve has kept interest rates elevated, gold has remained resilient—defying conventional wisdom that higher yields should suppress non-yielding assets like gold.

Now, with gold sitting near record highs, traders and analysts are debating whether it is overbought or if the bullish cycle still has more room to run. The stakes are high as institutional investors, hedge funds, and central banks continue to accumulate gold at an aggressive pace, signaling confidence in long-term upside.

Central Banks Driving Demand – Why XAU/USD Keeps Rising

The most significant driver behind gold’s relentless rally has been central banks' massive accumulation of the metal. According to data from the World Gold Council, central banks added a record-breaking 1,136 tons of gold to their reserves in 2024, marking the second-largest annual purchase in history.

China’s central bank has been at the forefront of this trend, accumulating over 225 tons of gold in the past year, followed closely by Russia, India, and Turkey. The strategic shift away from U.S. Treasury bonds and the dollar has led to a flight toward hard assets, with gold emerging as the preferred alternative. The de-dollarization trend is strengthening, and with global reserves shifting away from the dollar, gold is being positioned as a more reliable store of value.

Historically, central bank demand for gold tends to cap downside risks, meaning that any short-term corrections could be quickly absorbed by continued accumulation from sovereign wealth funds and national reserves. If this trend continues, gold could find strong support around the $2,850–$2,900 range, paving the way for a further move toward the $3,000 psychological level.

Inflation & Fed Policy – The Biggest Risk to Gold’s Rally?

One of the paradoxes of the current gold rally is that interest rates remain elevated, which traditionally puts pressure on gold. However, inflationary pressures have remained stubbornly high.

The latest U.S. Producer Price Index (PPI) report showed an unexpected increase of 0.4%, indicating that inflation is still not fully under control. The Federal Reserve, led by Jerome Powell, has maintained a higher-for-longer stance, signaling that rate cuts might not happen until late 2025.

This poses a dilemma for gold traders—while inflation supports gold as a hedge, higher interest rates increase the opportunity cost of holding non-yielding assets like gold. Yet, investors are betting that inflation concerns will outweigh rate hike fears, keeping demand strong.

The gold market is now pricing in potential Fed pivots, watching for any signal that rate cuts may come sooner than expected. If inflation remains elevated and the Fed hints at monetary easing by Q3 or Q4 2025, gold could explode past $3,000 per ounce and enter a new long-term bull cycle.

Geopolitical Uncertainty – Will It Push Gold Even Higher?

Geopolitical tensions have always been a major catalyst for gold prices, and 2025 has been no exception. The Russia-Ukraine war, Middle East conflicts, and U.S.-China trade tensions continue to create uncertainty in global markets, reinforcing gold’s appeal as a safe-haven asset.

Recent diplomatic efforts, including a surprise phone call between Donald Trump and Vladimir Putin, have temporarily reduced some geopolitical risks, leading to short-term profit-taking in gold. However, if tensions escalate again, gold could see another parabolic move higher.

Additionally, with U.S. elections approaching, uncertainty surrounding potential policy shifts could inject more volatility into the markets, potentially driving even more investors toward gold.

As economic and political risks remain elevated, gold’s resilience is being tested. Investors looking for protection against market instability and currency devaluation are likely to remain long on gold, further fueling demand.

Can XAU/USD Break Above $3,000?

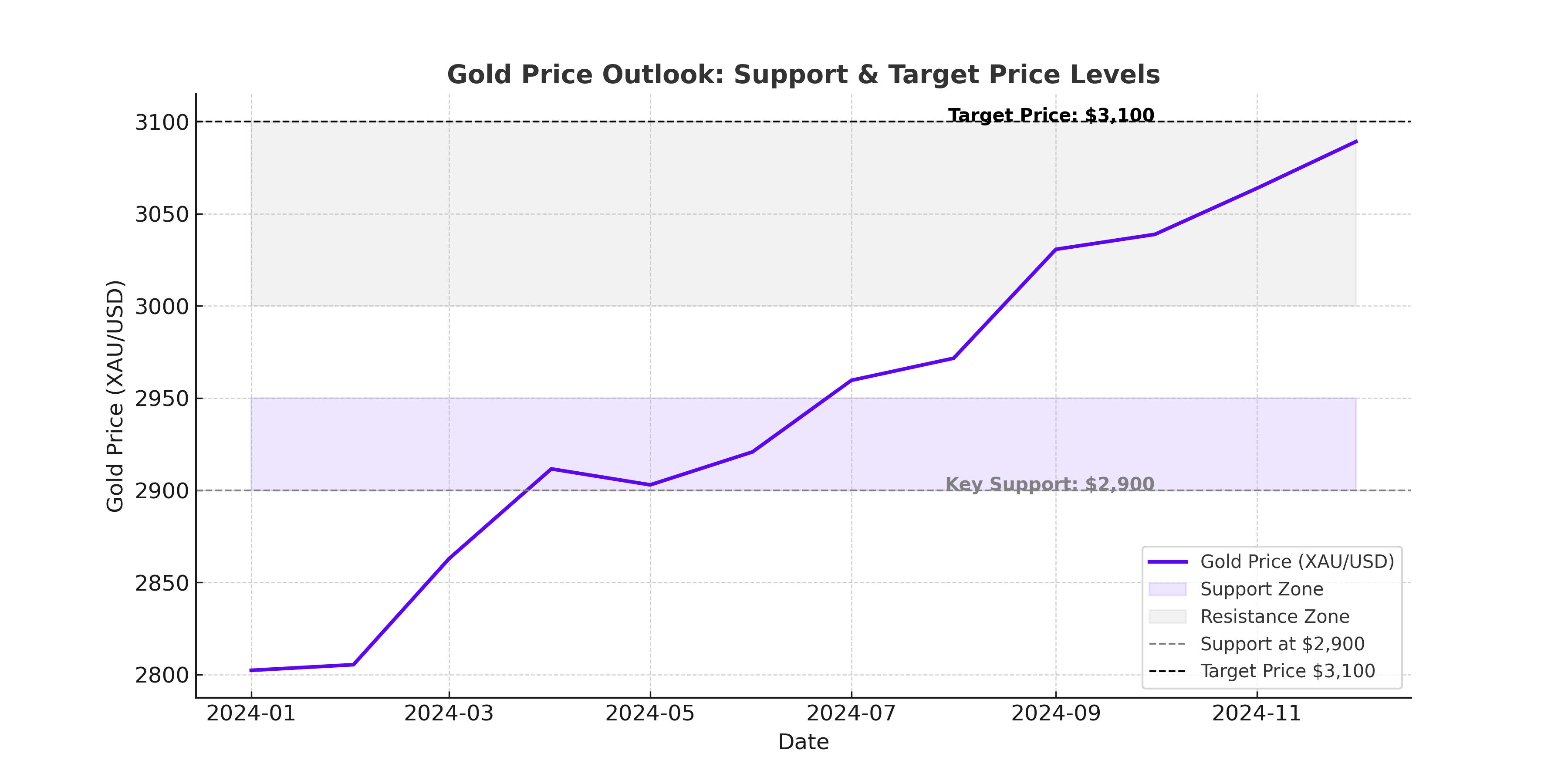

With gold now trading around $2,915 per ounce, the $3,000 milestone is within reach. However, short-term technical indicators suggest that gold is approaching overbought territory, which means that a pullback before the next leg higher is possible.

Key support levels to watch:

- $2,850 – Strong institutional buying zone

- $2,800 – Major psychological level

- $2,750 – Long-term trendline support

Key resistance levels:

- $2,942 – Previous all-time high

- $2,970 – Short-term breakout level

- $3,000 – Psychological barrier

If gold decisively breaks and holds above $2,942, it could quickly rally toward $3,000–$3,100. However, if the Fed continues to delay rate cuts and the dollar strengthens, gold could struggle to maintain momentum in the short term.

Final Verdict – Is Gold a Buy, Sell, or Hold?

Given the strong macroeconomic tailwinds, central bank demand, and inflationary environment, gold remains a long-term buy. However, with short-term volatility expected, traders should be cautious about chasing highs.

For long-term investors, any dips toward $2,850 or lower could be strong buying opportunities. The fundamental backdrop remains supportive, and as long as inflation concerns persist, gold will likely remain in an uptrend.

Short-term traders should watch key technical levels, as profit-taking could create temporary pullbacks before the next breakout. If gold struggles to hold $2,900, a retracement toward $2,850–$2,800 would not be surprising.

If the Fed signals a policy shift or geopolitical tensions escalate, expect gold to explode past $3,000, setting the stage for an even more aggressive bull run toward $3,200 and beyond.

Gold remains one of the strongest-performing assets in 2025, and with global economic uncertainty far from over, the long-term bullish case remains intact. Whether XAU/USD breaks above $3,000 in the coming months will depend on central bank flows, inflation data, and Federal Reserve policy, making this a critical time to watch the gold market closely.