Gold Price Gains Amid Geopolitical Tensions and Economic Indicators

Gold's Performance Boosted by Weaker USD and Middle East Turmoil | That's TradingNEWS

Gold Price Gains Amid Geopolitical Tensions and Economic Indicators

Gold's Performance in Early European Session

Gold prices gained ground in Monday’s early European session, rising by 0.30% as the weaker USD and escalating geopolitical tensions in the Middle East supported the yellow metal. The softer US Dollar and renewed geopolitical risks provide a boost to gold, although the hawkish stance from the Federal Reserve (Fed) and lower bets on a rate cut this year could exert selling pressure.

Market Movers: Geopolitical Risks and Economic Data

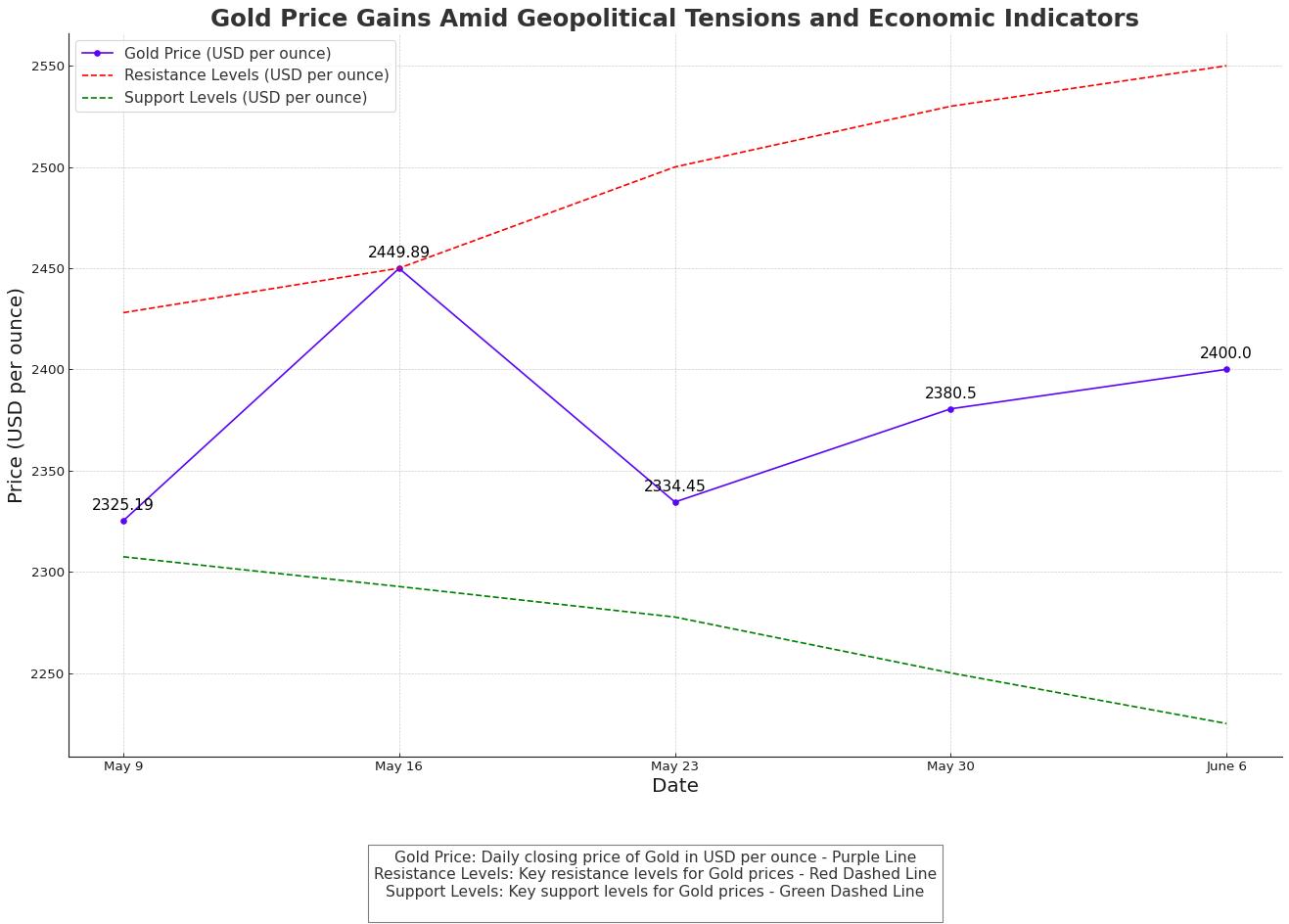

The Ministry of Health in Gaza reported at least 35 Palestinian casualties and dozens injured due to Israeli air attacks on a camp in Rafah, highlighting the ongoing geopolitical turmoil. Year-to-date, gold has surged over 16%, reaching a record high of $2,400 per ounce in May, according to World Gold Council data. Additionally, US Durable Goods Orders rose by 0.7% in April, exceeding expectations and potentially supporting the USD.

Technical Analysis: Bullish Picture Unchanged

Gold's technical outlook remains constructive as it holds above the key 100-day Exponential Moving Average (EMA) on the daily chart. Despite the 14-day Relative Strength Index (RSI) being in a bearish zone at 48.5, indicating possible consolidation or further downside, the overall bullish trend remains intact. Immediate resistance levels are at the upper boundary of the Bollinger Band at $2,428, with extended gains potentially rallying to the all-time high of $2,450 and the psychological mark of $2,500.

Economic Events and Fed's Influence

The US banks will be closed on Monday for Memorial Day, but gold traders will closely watch speeches from Fed officials, including Michelle Bowman, Loretta Mester, and Neel Kashkari on Tuesday. The preliminary reading of US GDP for Q1, expected to expand by 1.5%, will be in the spotlight on Thursday. Stronger-than-expected GDP data could boost the USD, impacting USD-denominated gold prices.

Gold Forecast: Analyst Predictions and Market Trends

UBS analysts have raised their gold price forecast to $2,600 by the end of 2024, while Citi analysts predict gold could reach $3,000 per ounce within the next six to eighteen months. However, high gold prices may reduce imports to India, the world’s second-largest gold consumer, by nearly 20% this year as consumers exchange old jewelry for new items.

Technical Levels and Market Sentiment

Gold (XAU/USD) continues to show strength, currently trading at $2,334.45. Immediate resistance levels are at $2,325.18, $2,351.01, and $2,366.51. On the downside, support levels are at $2,307.40, $2,292.70, and $2,277.62. The RSI stands at 37, indicating potential for a rebound from oversold conditions. The 50-day EMA is at $2,369.86, suggesting strong resistance around this level.

Recent Price Movements and Market Sentiment

Gold's Modest Recovery

Gold prices saw a modest recovery on Monday, rebounding from a two-week low. Spot gold has inched up after hitting its lowest point since May 9 at $2,325.19 on Friday. This comes after bullion surged to a record high of $2,449.89 earlier last week but then fell back by over $100.

Inflation Report in Focus

The upcoming release of the core personal consumption expenditures price index (PCE) on Friday has the market’s attention. This index is the U.S. Federal Reserve’s preferred inflation measure and its results could significantly influence gold prices. Historically, gold serves as a hedge against inflation, but the appeal of non-yielding gold diminishes when interest rates are higher.

Fed's Outlook and Market Reactions

Minutes from the Federal Reserve’s Latest Meeting

Minutes from the Federal Reserve’s latest meeting indicated that achieving the central bank’s 2% inflation target could take longer than anticipated. This has tempered market expectations for rate cuts, with traders now predicting only a 62% chance of a rate reduction by November 2024.

Market Forecast: Bearish Outlook

Given the current market conditions and the Federal Reserve’s stance, the outlook for gold remains bearish in the short term. The potential for further interest rate hikes and strong U.S. economic data could continue to pressure gold prices downward. Traders should remain cautious, as the upcoming inflation data could trigger further volatility in the market.

Geopolitical Tensions and Central Bank Demand

Geopolitical Tensions in the Middle East

Geopolitical tensions in the Middle East have intensified, with recent Israeli air attacks in Gaza resulting in significant casualties. This situation typically drives demand for safe-haven assets like gold.

Central Bank Demand

Furthermore, the consistent demand for gold from central banks globally is likely to support gold prices in the long term.

Upcoming Economic Events and Fed’s Influence

Memorial Day and Fed Speeches

The US banks will be closed on Monday for Memorial Day, but gold traders will be closely watching Fed speeches on Tuesday, including those by Michelle Bowman, Loretta Mester, and Neel Kashkari.

US GDP Data

The preliminary reading of US Gross Domestic Product (GDP) for Q1, due on Thursday, is expected to show a 1.5% growth. Stronger-than-expected GDP data could boost the USD, negatively impacting USD-denominated gold prices.

Market Sentiment and Price Movements

Recent Price Performance

Gold has increased by over 16% year-to-date, hitting a record high of over $2,400 per ounce in May. US Durable Goods Orders for April rose by 0.7% MoM, exceeding expectations and potentially supporting the USD.

Consumer Sentiment

The University of Michigan Consumer Sentiment Index increased to 69.1 in May from 67.4 in April, with inflation expectations for one year rising slightly.

Analyst Predictions and Market Trends

UBS Forecast

UBS analysts have raised their gold price forecast to $2,600 by the end of 2024.

Citi Prediction

Citi analysts predict gold could reach $3,000 per ounce within the next six to eighteen months.

Gold Imports to India

High gold prices are likely to reduce gold imports to India by nearly 20% this year, as consumers exchange old jewelry for new items.

Gold Price Forecast: Technical Outlook

Current Trading Levels

Gold (XAU/USD) continues to show strength, currently trading at $2,334.45, up 0.36% so far. The green line marks the pivot point at $2,334.45, a critical level to watch for potential market direction.

Support and Resistance Levels

Immediate resistance levels are at $2,325.18, $2,351.01, and $2,366.51. On the downside, support levels are at $2,307.40, $2,292.70, and $2,277.62. The Relative Strength Index (RSI) stands at 37, indicating potential for a rebound from oversold conditions. The 50-day Exponential Moving Average (EMA) is at $2,369.86, suggesting strong resistance around this level.

That's TradingNEWS

WTI & Brent Crude Prices Face Major Setback: How Will Trump's Tariffs and OPEC+'s Output Boost Impact Oil Markets?

Gold Price Surges to Record Highs Before Retreating: How Will Tariff Uncertainty Affect XAU/USD?