Gold Price Analysis: XAU/USD Near $2,720 and Eyeing Record Highs

Gold Maintains Strength Amid Fed Rate Cut Expectations

Gold prices (XAU/USD) are holding near $2,715, a significant level that highlights the metal's resilience in a volatile market environment. Following softer inflation data from the United States and dovish comments from Federal Reserve officials, market participants are anticipating further rate cuts in 2025. These expectations have weighed on US Treasury yields and the US Dollar, providing a strong tailwind for gold.

Fed Governor Christopher Waller's recent remarks underscored the possibility of multiple rate cuts this year, potentially starting as early as March. With inflation edging closer to the Fed’s 2% target, the opportunity cost of holding gold has diminished, making the non-yielding metal an attractive investment in a low-rate environment.

Treasury Yields and Dollar Weakness Fuel Gold’s Rise

US 10-year Treasury yields have fallen to 4.60%, a five-basis-point drop that continues to strengthen gold’s appeal as a hedge against uncertainty. Simultaneously, the US Dollar Index (DXY) slipped below 109.00, further reducing its attractiveness against gold. Lower yields decrease the opportunity cost of holding gold, while a weaker dollar makes the metal more affordable for international buyers.

Adding to gold's support, US Retail Sales data missed expectations with a 0.4% increase in December compared to forecasts of 0.6%. However, November’s upward revision to 0.8% showed underlying consumer strength, keeping recession fears at bay but still supportive of gold’s bullish outlook.

Geopolitical and Economic Influences on Gold

Geopolitical developments have added complexity to gold’s trajectory. While the Israel-Hamas ceasefire deal has reduced immediate safe-haven demand, uncertainties surrounding US President-elect Donald Trump’s economic and trade policies remain a wildcard. Trump’s expected focus on deregulation and a pro-business agenda could stoke inflationary pressures, indirectly supporting gold prices.

The Bank of Japan's potential rate hike next week may also play a role in influencing gold. If Japanese yields rise, it could temporarily strengthen the yen and create short-term headwinds for gold. However, the metal’s overall trajectory remains upward, driven by global economic uncertainty.

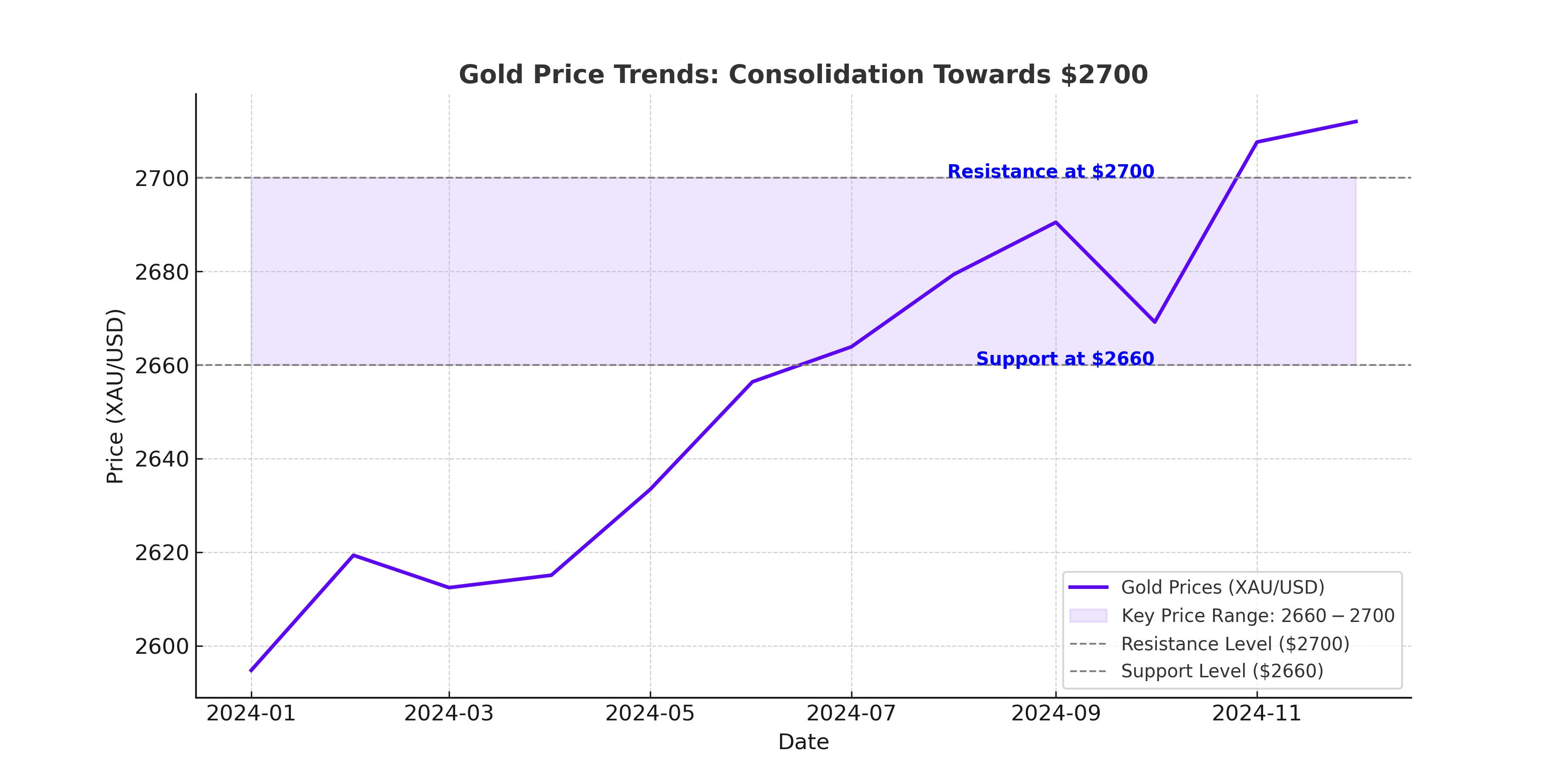

Technical Analysis: Resistance at $2,720 and Beyond

Gold’s technical outlook remains firmly bullish, supported by positive momentum indicators. The Relative Strength Index (RSI) is firmly in bullish territory, signaling room for further upside. Immediate resistance is seen at $2,726, followed by $2,750, and ultimately the all-time high of $2,790, which was last tested in October 2024.

On the downside, support lies at $2,700, a key psychological level, and further at $2,662, near the 50-day Simple Moving Average (SMA). Any pullback to these levels may present a buying opportunity for traders looking to capitalize on the long-term bullish trend.

Institutional and Market Sentiment

Institutional sentiment remains bullish, with significant inflows into gold-backed ETFs observed over the past quarter. This aligns with projections from analysts who forecast gold could test $2,800 or higher in 2025, provided dovish monetary policies and geopolitical uncertainties persist.

Key Drivers to Watch

- US Fed Policy: If the Fed signals a more aggressive rate-cutting cycle, gold could see a rapid ascent past $2,790.

- Treasury Yields: Continued declines in yields will bolster gold’s appeal as a non-yielding asset.

- Geopolitical Developments: Any flare-ups in global tensions could drive safe-haven demand further.

- Dollar Index: Sustained weakness in the DXY could add significant upward pressure to gold prices.

Outlook and Final Thoughts

Gold remains well-positioned for further gains, with strong support from both technical and fundamental factors. While resistance at $2,726 and $2,790 could challenge bullish momentum, a break above these levels would set the stage for gold to test $2,800 and potentially establish new record highs. Conversely, any pullbacks to $2,662 or lower should be viewed as opportunities for strategic accumulation.

With a dovish Fed, easing inflation, and global uncertainties, gold is poised to remain a cornerstone asset in diversified portfolios throughout 2025.