Gold Price Near $2,700: Will Bullish Momentum Continue or Face Resistance?

As gold prices flirt with $2,700, key levels and market sentiment shape its next move | That's TradingNEWS

Gold Price Nearing Key Levels Amid Fed Speculation

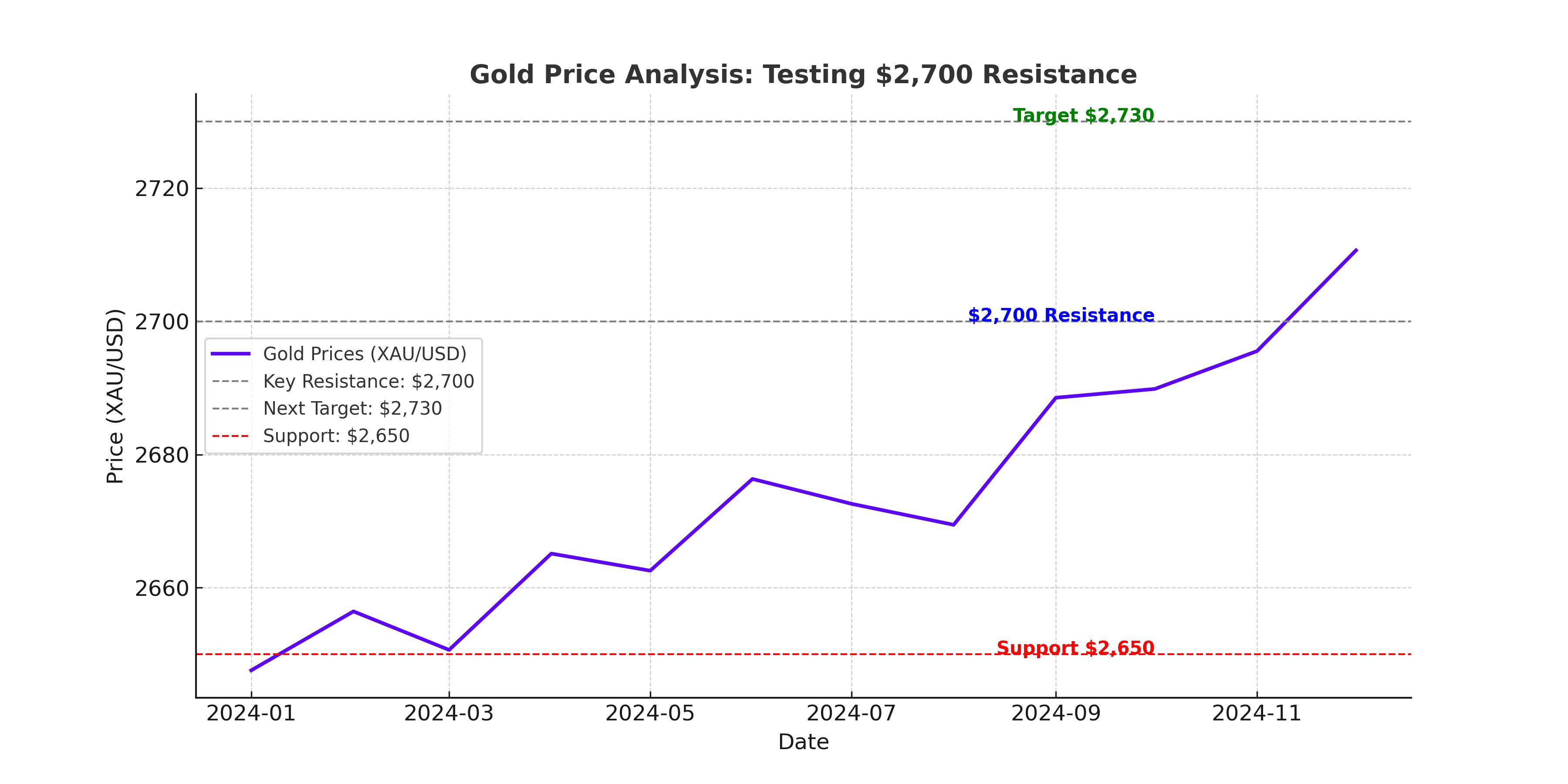

The XAU/USD price is showcasing mixed momentum as it tests resistance near the $2,700 mark. After reaching a swing high at $2,698, gold prices retreated slightly but maintained strength above $2,657. The ongoing consolidation reflects a market hesitating ahead of key US economic data releases, including the Consumer Price Index (CPI), Producer Price Index (PPI), and broader Federal Reserve signals, all of which will heavily influence gold's next directional move.

Technical Analysis Signals Bullish Patterns

Gold's price trajectory has seen repeated bullish tests. Last week’s breakout above $2,675 triggered a rally, setting a seven-week high at $2,694. On the daily chart, gold maintains support from both the 50-day moving average at $2,645 and the 20-day moving average at $2,637. These levels are critical as they provide technical anchors for potential rebounds.

If gold breaks above $2,698, the next immediate resistance is $2,720. A sustained move above this level could set the stage for an attempt at the December high of $2,726 and potentially the November high of $2,762. Conversely, a decline below $2,630 would raise concerns about a retest of $2,610, a level supported by both Fibonacci retracement indicators and a multi-week trendline.

Demand Dynamics and Global Influences

The demand for gold as a safe haven remains robust despite recent dollar strength. Global inflation fears, driven by lingering high US Treasury yields, have pressured gold in the short term but simultaneously underscored its status as a hedge against economic uncertainty. Yields on US 10-year Treasury bonds recently peaked at 4.8%, while the dollar index climbed near two-year highs, creating headwinds for bullion prices.

Economic data remains the primary driver of market sentiment. The US economy added 256,000 jobs in December 2024, dampening immediate expectations of aggressive Fed rate cuts. However, the upcoming inflation data could shift this narrative. Persistent inflation near 2.9% year-on-year could reinforce a hawkish Fed stance, potentially capping gold's upside momentum.

Weekly and Monthly Trends Indicate Bullish Bias

Gold's weekly chart reflects a strong bullish inclination, with the price holding well above the 20-week moving average at $2,635. The sustained trend upward since October 2023 highlights solid market confidence in gold's medium-term prospects. Key technical patterns—such as bullish engulfing candles—point toward further upside if external shocks, like geopolitical tensions or surprising inflation data, align with market trends.

Institutional Positions and Market Sentiment

Institutional interest in gold has remained steady. Analysis of order books shows robust buying near the $2,675 level, with significant accumulation between $2,650 and $2,680. These areas provide strong support for gold’s medium-term trajectory. Trading volumes across major exchanges also signal healthy participation, suggesting that the consolidation phase may soon give way to a breakout.

Despite the Federal Reserve's hawkish outlook, safe-haven demand for gold could see a resurgence if market sentiment turns risk-averse. Institutional accumulation remains a bullish indicator, with reports indicating systematic buying during recent pullbacks.

XAU/USD Outlook and Predictions

If XAU/USD successfully breaches $2,700, analysts anticipate a rally toward $2,730. Breaking this level could push gold to test the psychological $2,800 resistance. Conversely, sustained failure to clear $2,698 would risk a retracement toward $2,610.

Short-term consolidation and external drivers, including Federal Reserve decisions and geopolitical developments, will dictate whether gold sustains its upward momentum or consolidates further.