Gold Price Surges Past $2,900 – How Soon Before We See $3,000?

XAU/USD maintains bullish momentum as central bank demand and inflation risks fuel buying pressure. But is gold overheating, or does it still have room to run? | That's TradingNEWS

Gold (XAU/USD) Price Analysis: Momentum Builds Above $2,900 – Can Bulls Push to $3,000?

Gold Holds Strong Above $2,900 as Investors Seek Safety

Gold (XAU/USD) has maintained its bullish momentum, trading firmly above $2,900 per ounce, reflecting strong demand for the precious metal amid global uncertainty. This year alone, gold has gained over 12%, significantly outperforming major stock indices such as the S&P 500, which has risen 4%, and Australia’s ASX 200, which is up just 2%. The key driver behind this surge is investors' growing demand for safe-haven assets amid rising inflation fears, geopolitical risks, and persistent concerns about global economic stability.

Why is Gold Rising? The Key Factors Behind the Rally

Multiple forces are driving gold’s historic rally. The first and most immediate catalyst has been central bank purchases. Data shows that central banks have been aggressively buying gold, with 1,041 metric tons added to reserves in 2024 alone. This trend, largely led by China and other BRICS nations, reflects a strategic move to reduce reliance on the U.S. dollar and mitigate economic risks.

Additionally, inflation concerns remain a dominant theme. The latest U.S. inflation data shows core PCE rising 3.5% year-over-year, above the Federal Reserve’s 2% target. This has led markets to believe that the Fed will keep rates higher for longer, a factor that could typically weigh on gold. However, given that inflation is persistent and real yields remain low, investors are still piling into gold as a hedge against potential currency depreciation.

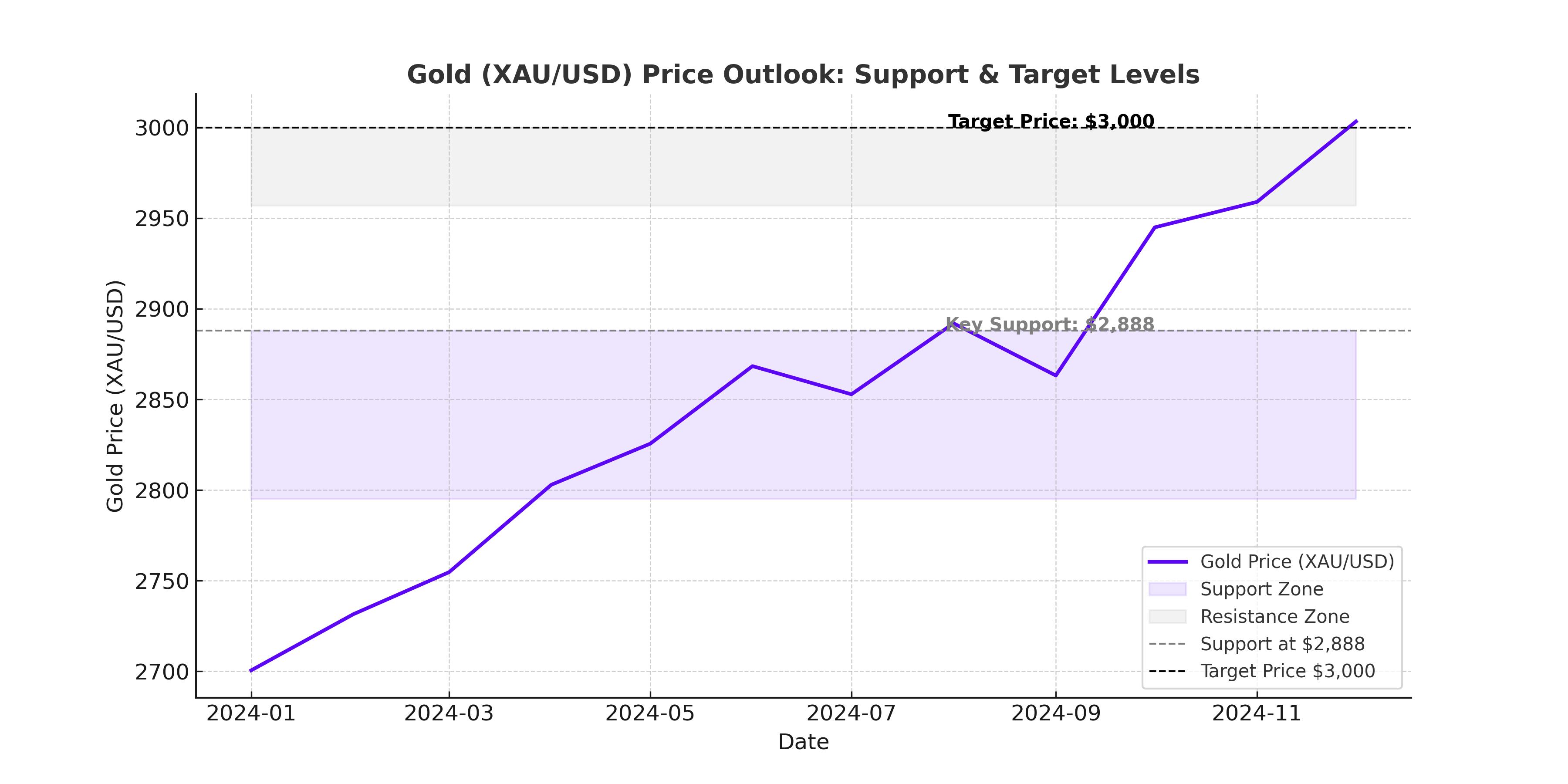

Technical Analysis: XAU/USD Targets $3,000 After Breaking Resistance

From a technical standpoint, gold’s bullish outlook remains intact. XAU/USD has held above the key 100-day Exponential Moving Average (EMA) at $2,718, confirming strong upside momentum. The 14-day Relative Strength Index (RSI) sits at 64, indicating strong but not yet overbought conditions, leaving room for further gains.

Key resistance levels to watch include the all-time high of $2,957. A breakout above this level would open the door to $2,980, the upper boundary of the Bollinger Band, followed by the psychologically crucial $3,000 mark.

On the downside, immediate support is seen at $2,888, followed by $2,795, where the lower Bollinger Band sits. The 100-day EMA at $2,718 serves as the key contention level—any breach below this could indicate a shift in sentiment.

Geopolitical Risks and Tariffs: The Gold Market's Next Big Catalyst?

Beyond technical factors, geopolitical risks are playing a pivotal role in gold’s surge. Recent market movements suggest investors are closely monitoring President Trump’s tariff threats on Canadian and Mexican imports, which could further disrupt global trade and push inflation even higher. Markets are also digesting Trump’s recent Executive Order probing the copper market, which has sparked fears of trade wars extending into the metals sector.

Gold has historically thrived during periods of economic and political instability. The ongoing uncertainty around China-U.S. relations, sanctions on Russia, and conflicts in Ukraine and the Middle East are fueling gold’s safe-haven appeal. Additionally, the potential for an economic slowdown—with U.S. consumer confidence plummeting to 98.3 in February, the lowest since August 2021—is driving further investor interest in gold.

Will Central Banks Keep Buying? The Gold Reserve Strategy

One of the most overlooked but critical drivers of gold’s bull run is central bank accumulation. China, in particular, has been reducing its U.S. Treasury holdings and increasing gold reserves, signaling a broader shift away from dollar-based assets. The People’s Bank of China alone has purchased more than 200 metric tons of gold in the past 12 months.

Russia and India have also been adding to their gold reserves, while European central banks have subtly increased their holdings as well. The total global central bank gold purchases reached 1,082 metric tons in 2022, followed by 1,051 metric tons in 2023, and another 1,041 metric tons in 2024 so far. This trend underscores a long-term shift towards gold as a financial hedge, a move that could keep demand elevated for years to come.

The $3,000 Question: How High Can Gold Go?

With XAU/USD trading near record highs, investors are asking: Will gold break through $3,000, or is a correction overdue?

Several factors will determine the next move. First, Federal Reserve policy will be crucial—if inflation remains sticky and the Fed signals a prolonged period of high interest rates, gold could face resistance. However, any signs of monetary easing later in the year could provide a major boost.

Second, market sentiment around geopolitical risks will be key. If trade tensions escalate, global instability worsens, or economic uncertainty deepens, gold could see a fast push beyond $3,000.

Finally, technical factors will play a role—watch for sustained closes above $2,957 to confirm further bullish momentum. Conversely, failure to hold above $2,900 could trigger a retracement toward the $2,800-$2,850 range.

Final Outlook: Is Gold a Buy, Hold, or Sell?

With gold’s technical and fundamental backdrop remaining bullish, the bias remains to the upside. However, traders should be cautious of short-term volatility, particularly if profit-taking occurs near record highs.

For long-term investors, gold remains a strong buy, especially as central bank demand, inflation fears, and geopolitical risks continue to dominate the macro landscape.

Short-term traders should monitor resistance levels closely, as a clean breakout above $2,957 could lead to a rapid test of $3,000. On the downside, support at $2,888 and $2,795 will be critical levels to watch.

For now, gold’s bull run remains intact—but the battle for $3,000 per ounce is just beginning.