Gold Prices Surge Amid Fed Rate Cut Speculations and Global Uncertainties

Emerging Market Demand, Central Bank Purchases, and Geopolitical Tensions Drive Gold's Upward Momentum | That's TradingNEWS

Gold's Price Movement and Market Dynamics

Gold's Resilient Performance Amid Global Uncertainties

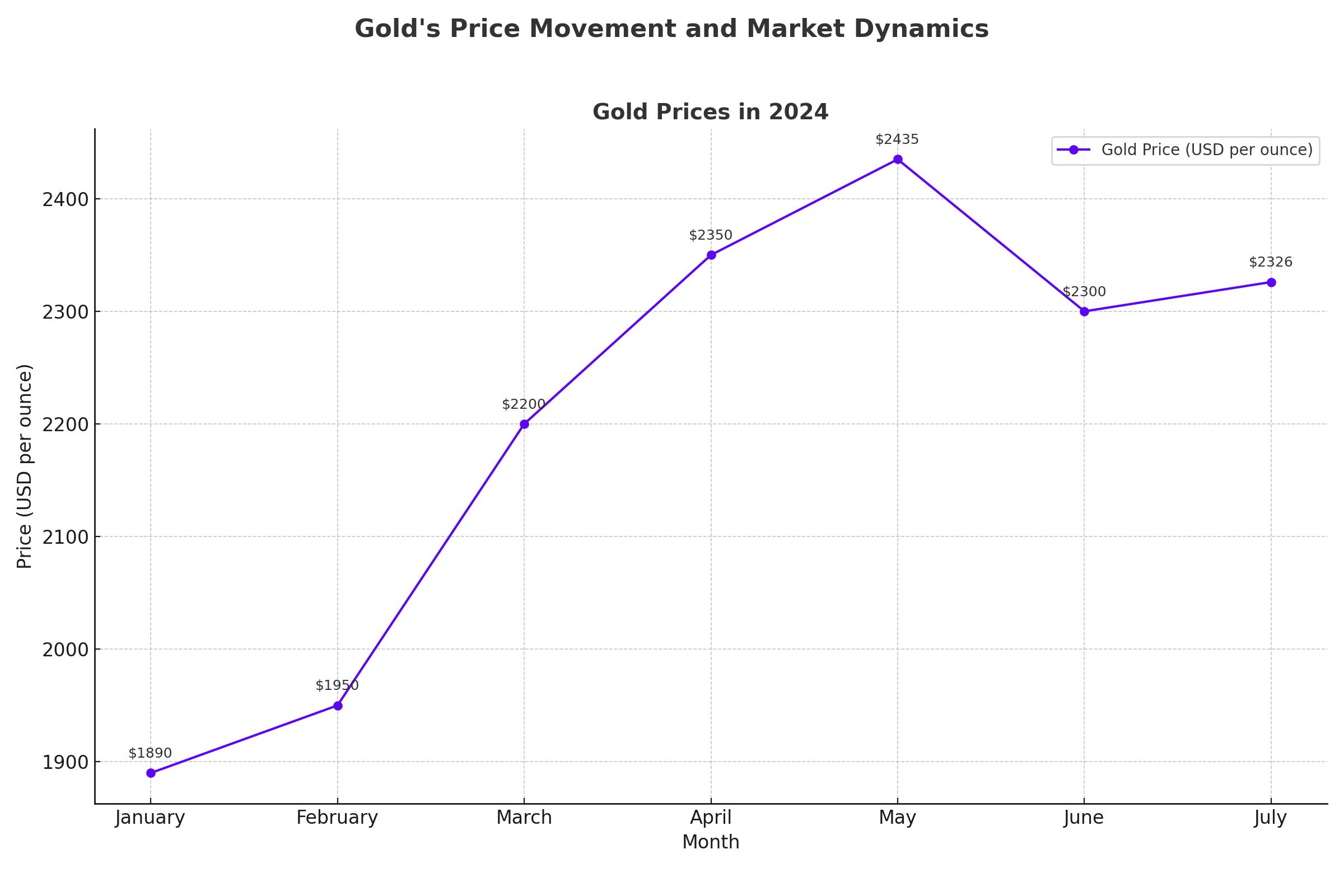

Gold (XAU/USD) has shown remarkable resilience, catching fresh bids during the Asian session and building on a rebound from the $2,319-$2,318 support zone. The precious metal is currently near the upper end of its short-term trading range, with bulls eyeing a sustained move beyond the 50-day Simple Moving Average (SMA) pivotal resistance. Recent dovish remarks by Federal Reserve Chair Jerome Powell have bolstered expectations of a rate-cutting cycle commencing in September, providing a tailwind for gold.

Federal Reserve's Influence on Gold Prices

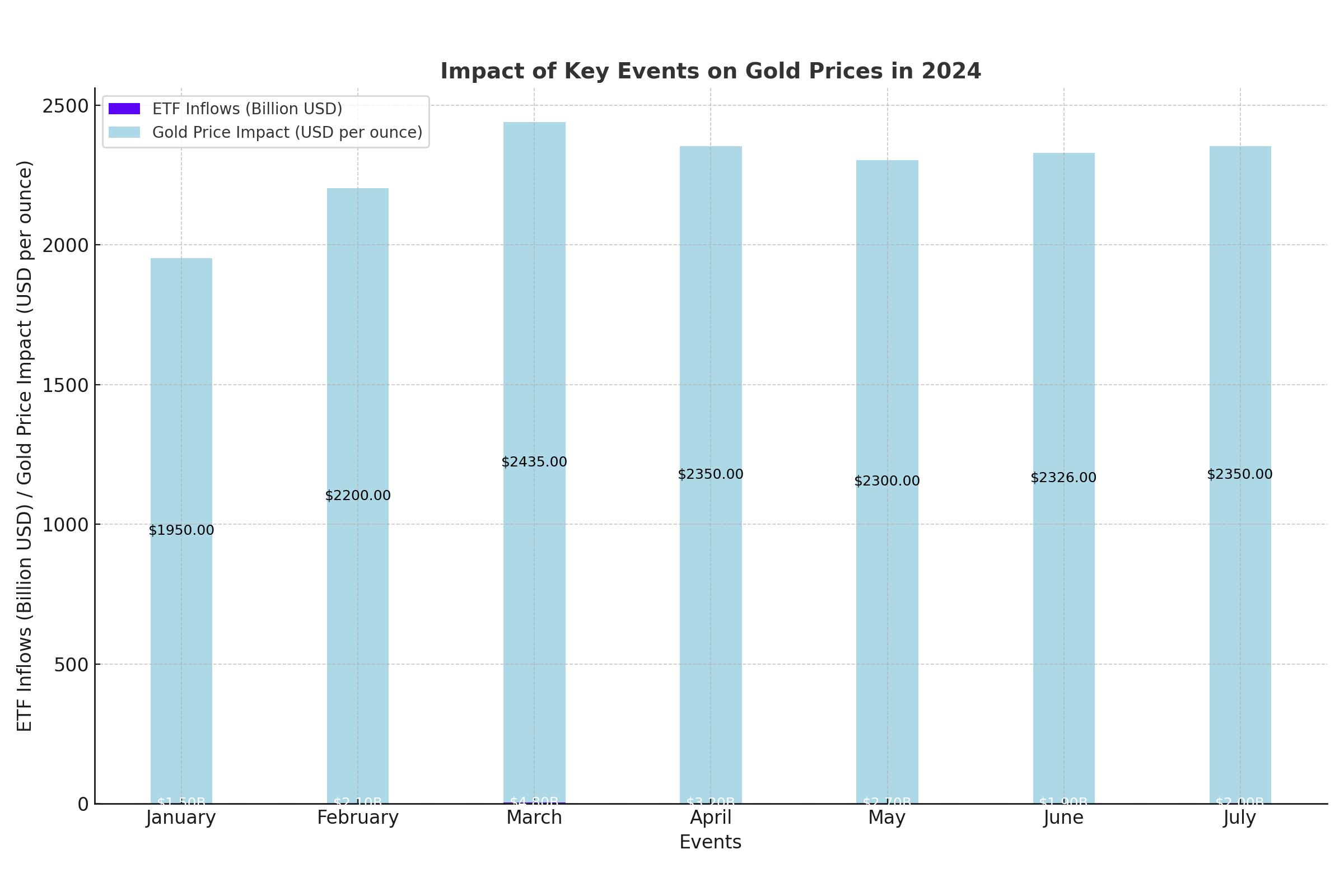

The potential for rate cuts by the Federal Reserve remains a critical driver for gold. Powell expressed satisfaction with inflation progress but emphasized the need for more data before reducing rates. Market anticipation of rate cuts in September and possibly December has pressured US Treasury bond yields and supported gold prices. Despite the Job Openings and Labor Turnover Survey (JOLTS) showing an increase to 8.140 million job openings in May, the dovish Fed stance has kept USD bulls on the defensive, aiding gold's upward momentum.

Technical Analysis: Key Levels and Trends

From a technical perspective, gold's recent range-bound action indicates trader indecision. The 50-day SMA around the $2,340 area presents immediate resistance, followed by the late June swing high near $2,365-$2,370. A decisive break above these levels could propel gold towards the $2,400 mark and potentially challenge the all-time peak of around $2,450. On the downside, support remains strong at $2,319-$2,318, with further cushions at $2,300 and $2,285. A breach below these levels could trigger a bearish trend towards the 100-day SMA at $2,258 and possibly down to $2,200.

Market Sentiment and Economic Indicators

Gold's path is influenced by various economic indicators, including the ADP report on private-sector employment and the ISM Services PMI. These reports, along with the upcoming FOMC meeting minutes, will provide fresh impetus for gold's direction. Investors remain cautious, preferring to wait for more clarity on the Fed's policy moves. The global economic slowdown, geopolitical tensions, and political uncertainties in the US and Europe also continue to drive safe-haven demand for gold.

Emerging Market Demand and Central Bank Purchases

John Reade, Chief Market Strategist at the World Gold Council, highlights the significant demand for gold from emerging markets like China, India, and Turkey. Nearly three-quarters of consumer demand for gold in the past decade has come from these regions. Central banks have also been major buyers, with their purchases doubling historical averages to over 1,000 tons in recent years. This strong demand from emerging markets and central banks has been a pivotal factor in supporting gold prices.

Global Economic Factors and Gold's Future

Gold's price has broken away from traditional correlations, such as with US Treasury yields and the US dollar. Despite high real yields and a strong dollar, gold has maintained its upward trajectory. Factors like geopolitical tensions, particularly in Ukraine and the Middle East, and macroeconomic policies, including the Fed's rate decisions, continue to influence gold's outlook. Emerging market central banks' pivot towards gold, driven by sanctions, inflation concerns, and dedollarization, further underscores gold's appeal.

Investment Sentiment and Technical Drivers

Investment sentiment towards gold remains cautiously optimistic. The American Automobile Association forecasts a 5.2% increase in travel during the Independence Day holiday period, potentially boosting demand. Analysts from J.P. Morgan project Brent oil to average $84 per barrel in Q3 and reach $90 by August/September, driven by a global oil liquids deficit and strong demand indicators, which could indirectly support gold prices.

Supply Constraints and Recycling Trends

Gold supply may face constraints due to production bottlenecks. Mining operations are becoming harder to finance and operate, particularly with stringent environmental permits. This has led to a resurgence in gold recycling from old jewelry. The combination of strong demand and potential supply limitations could further bolster gold prices.

Conclusion: Navigating Gold's Market

The global gold market remains dynamic, shaped by a blend of technical factors, geopolitical risks, and macroeconomic policies. As central banks continue to purchase gold and emerging markets drive demand, the precious metal's outlook remains bullish. Investors should monitor economic indicators, Fed policy developments, and global geopolitical events to make informed decisions. With its current support levels and potential for breaking key resistance, gold offers a compelling opportunity for investors in a volatile economic landscape.

That's TradingNEWS

Read More

-

SMH ETF: NASDAQ:SMH Hovering at $350 With AI, NVDA and CHIPS Act Fueling the Next Move

16.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: Can $1B Inflows Lift XRP-USD From $1.93 Back Toward $3.66?

16.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Falls to $3.80–$3.94 as Warm Winter Kills $5.50 Spike

16.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides, BoJ 0.50% Hike, Fed Cut and NFP Set the Next Big Move

16.12.2025 · TradingNEWS ArchiveForex