Gold Price Surges to $2,755: Can XAU/USD Break the $2,800 Barrier?

Analyzing Gold’s Bullish Momentum Amid Inflation Fears, Trump’s Policies, and Key Technical Levels | That's TradingNEWS

Gold Price Surge: Breaking Down Current Momentum and Key Levels

Gold at $2,755: Riding High on Geopolitical Tensions and Inflation Fears

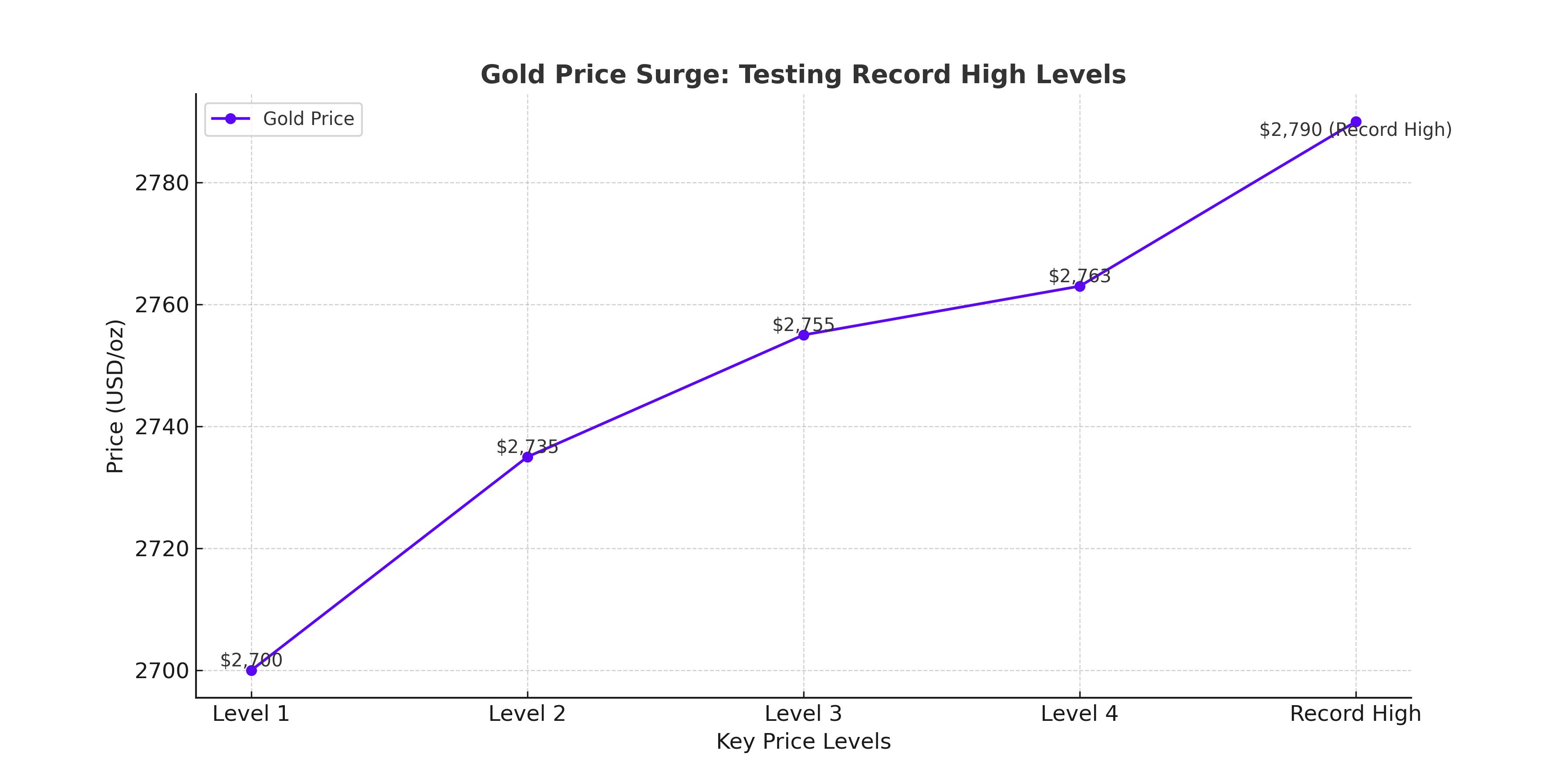

Gold prices surged to $2,755 per ounce, showing significant momentum as investors flock to the safe-haven asset amidst escalating geopolitical tensions and mounting concerns over inflation. The metal touched a daily low of $2,741 before climbing back near a key resistance of $2,763, a level not seen since October 2024. Gold’s performance comes amid President Donald Trump’s aggressive trade rhetoric, which now targets not only China but also the Eurozone, Canada, and Mexico, fueling uncertainty in global markets.

As the US Dollar Index (DXY) inched up 0.08% to 108.16, gold defied its typical inverse correlation to the dollar, underscoring robust demand. While rising Treasury yields, particularly the 10-year TIPS yield at 2.18%, typically weigh on non-yielding gold, the metal’s strong ascent reflects a heightened appetite for safe havens in a volatile economic environment.

Geopolitical Instability and Trump's Trade Policies Boost Safe-Haven Demand

The Middle East remains a hotspot of tension, with a ceasefire between Israel and Hamas abandoned, following Israel’s drone strikes in southern Lebanon. Concurrently, Trump’s policy threats of a 10% tariff on Chinese imports, coupled with a universal tariff on other nations, have compounded fears of rising inflation. Historically, gold has been a favored hedge against inflation, and these developments further solidify its appeal.

Trump’s latest remarks about potentially taxing Russian goods add another layer of complexity to the market. While these measures are yet to be implemented, their mere announcement has heightened the uncertainty surrounding global trade. Investors are keenly watching Trump’s next steps, as any escalation could push gold closer to its record high of $2,790.

Technical Analysis: Bullish Momentum Building Toward $2,800

From a technical perspective, gold remains firmly bullish. The price has cleared the $2,750 level, with buyers now eyeing the $2,800 mark as the next psychological resistance. Should this level be breached, further targets include $2,850 and $2,900 per ounce. Key support levels lie at the 50-day and 100-day SMAs, both near $2,647. A break below these could expose gold to the 200-day SMA at $2,515, though such a pullback seems unlikely given current market conditions.

Indicators like the RSI and MACD suggest the market is nearing overbought territory, signaling potential consolidation. However, the broader trend remains upward, supported by ongoing global economic and political uncertainties.

Fed and ECB Policies Add Another Layer to Gold’s Outlook

Central bank actions are another critical driver for gold. The Federal Reserve is expected to maintain interest rates in the 4.25%-4.50% range during its next policy meeting. However, markets have priced in a 50% probability of two rate cuts by the Fed in 2025, with the first expected in June. This dovish outlook supports gold prices as lower rates reduce the opportunity cost of holding non-yielding assets like gold.

On the European side, the ECB is set to continue its rate-cutting cycle, with markets expecting at least four reductions in 2025. This aligns with gold's upward trajectory, as central bank easing typically weakens fiat currencies, bolstering demand for precious metals.

Impact of the US Dollar and Treasury Yields

The US dollar has shown mixed performance, weakening earlier in the week before stabilizing around 108.16 on the DXY. A strong dollar generally pressures gold, but the current environment is an exception. As Trump delays the immediate imposition of tariffs, the dollar remains under pressure, indirectly supporting gold prices.

US Treasury yields, particularly the 10-year bond yield, have also played a role. While yields rose to 4.57%, limiting gold's upside, they remain below recent highs, keeping the metal’s bullish momentum intact.

Global Central Bank Buying Supports Gold

In addition to geopolitical factors, central bank purchases of gold have significantly bolstered the market. Data shows that central banks added substantial amounts of gold bullion to their reserves in 2024, a trend expected to continue into 2025. This consistent demand adds a strong foundational layer to gold prices, making a significant downside correction less likely.

Future Outlook and Strategy for Gold Investors

Gold's current trajectory suggests it remains a strong buy, especially on pullbacks to support levels like $2,700 or $2,647. Given the looming threats of inflation, geopolitical instability, and dovish central bank policies, the yellow metal offers a compelling case as a safe-haven asset. Traders should keep an eye on key resistance levels, particularly $2,800 and $2,850, while monitoring global developments for any shifts in sentiment.