Gold Prices - Decoding Market Reactions to Economic Signals and Fed Policies

Insight into how U.S. bond yields and Federal Reserve decisions are reshaping investor expectations for gold, amidst technical levels and market sentiment shifts | That's TradingNEWS

Deciphering Gold's Market Dynamics Amid Economic Signals and Federal Reserve Actions

Impact of U.S. Economic Data on Gold Prices

Recent economic reports from the United States have had a significant impact on gold prices, leading to unexpected market movements. Despite a decline in U.S. bond yields following a dovish outlook from Federal Reserve Chair Jerome Powell—who hinted at the unlikelihood of imminent rate hikes—gold prices did not rally as might have been expected. Instead, the precious metal saw a decrease, settling just above the critical $2,300 mark.

Understanding the Federal Reserve's Influence

The Federal Reserve's recent communications suggest a cautious approach towards rate increases, with indications that the next policy move could be a cut. This stance typically would bolster gold, a non-yielding asset, as lower interest rates decrease the opportunity cost of holding gold compared to yield-bearing assets. However, the market's muted response may reflect underlying complexities in investor sentiment and a breakdown in the traditional inverse relationship between gold prices and interest rates.

Technical Analysis and Market Sentiments

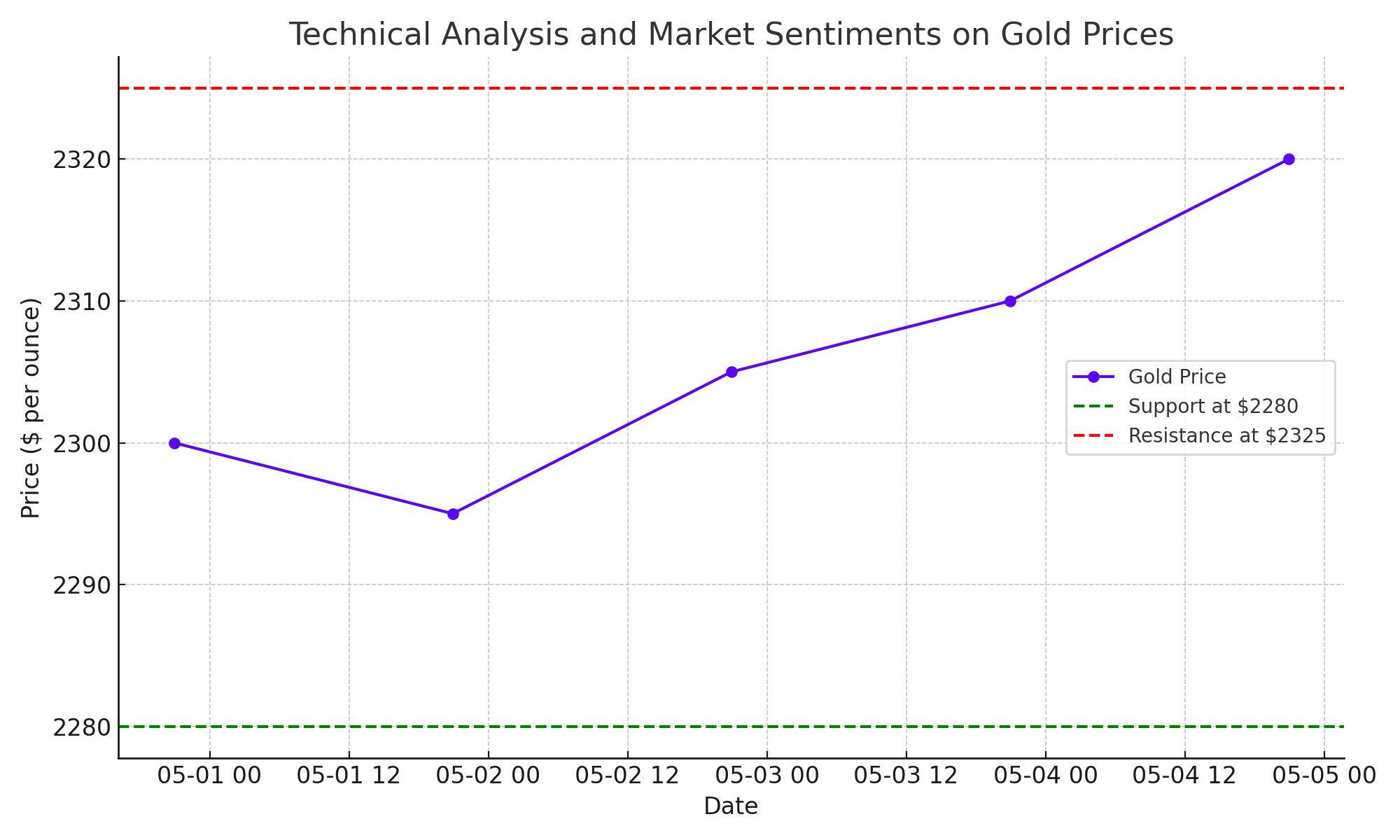

Gold's recent price behavior underscores a shift in market dynamics. Technical analysis indicates that gold managed to stay above the support level of $2,280 despite reaching monthly lows. For gold to maintain its bullish stance, it must defend this support vigorously to prevent a slide towards the $2,260 Fibonacci level. On the upside, resistance levels are spotted at $2,325 and $2,355, which could lead to a rally towards $2,375 if decisively breached.

Potential Federal Reserve Easing and Its Influence on Gold

The global economic landscape is peppered with uncertainties that typically enhance the allure of gold as a safe haven. Despite this, gold has recently shown an unusual detachment from traditional market drivers. In the past year, even as the Federal Reserve hinted at an easing cycle potentially starting, gold has not responded as predictably. Traditionally, Fed rate cuts lead to lower yields, making non-yielding assets like gold more attractive. However, despite these conditions, gold's price has oscillated, suggesting a decoupling from its standard economic correlations.

This year, gold surged to over $2,300 per ounce, only to face resistance and pull back, indicating that its rally may be more speculative than fundamentally driven. The anticipated Consumer Price Index (CPI) release on May 15 is a critical upcoming event that could sway gold markets. If the CPI indicates higher-than-expected inflation, it could rekindle volatility in gold prices as investors recalibrate their expectations for U.S. monetary policy.

Short-Term Gold Market Forecast and Investment Strategies

Investors currently face a complex scenario when considering gold. While the metal retains its appeal as a protective asset against long-term economic instability, the short-term outlook suggests potential for erratic price movements. Market participants should closely monitor upcoming economic indicators and Federal Reserve communications, as these will play crucial roles in shaping gold's price dynamics in the near term.

The ability to successfully navigate the gold market hinges on a nuanced understanding of both macroeconomic variables and technical trading levels. With gold's price recently testing support at $2,280 per ounce and resistance around $2,325 to $2,355, traders should be prepared for possible breaks in either direction, depending on economic news flows. This means watching for reactions to economic data releases and Fed statements, which could trigger swift price changes.