Gold Prices Fall Amid Hawkish Fed and Rising Yields

Gold Slips to $2,340 as U.S. Treasury Yields Climb, Market Awaits Key Inflation Data | That's TradingNEWS

Gold Price Analysis Amid Fed Policies and Geopolitical Tensions

Gold Prices Decline Amid Hawkish Fed Stance

Gold prices (XAU/USD) fell sharply to near $2,340 during Wednesday’s New York session, reversing the brief recovery to $2,360. The precious metal weakened as Federal Reserve (Fed) policymakers emphasized maintaining higher interest rates for a prolonged period.

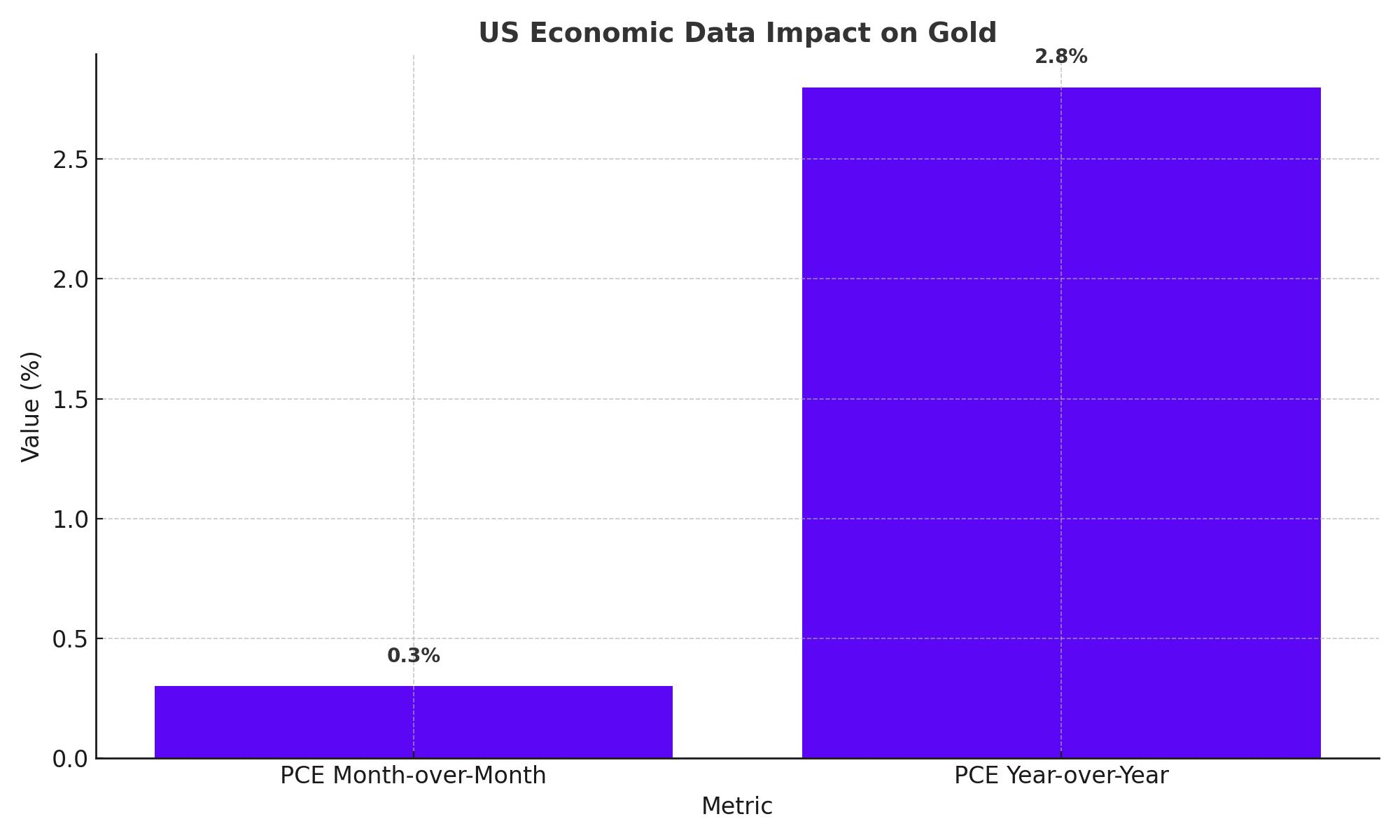

Impact of U.S. Economic Data on Gold

Investors are now focused on the U.S. core Personal Consumption Expenditure (PCE) Price Index for April, which is set to be released on Friday. This is the Fed’s preferred inflation gauge and is expected to grow steadily at 0.3% month-over-month and 2.8% year-over-year. An increase in the PCE data could reinforce the likelihood of sustained high-interest rates, which would negatively impact gold prices due to the higher opportunity cost of holding non-yielding assets like gold.

Market Sentiment and U.S. Dollar Dynamics

The U.S. Dollar (USD) rose to near 105.00, and the 10-year U.S. Treasury yields posted fresh three-week highs around 4.60%, driven by cautious market sentiment. This rise in yields and the USD added further pressure on gold prices, resuming their downward trend after a short-lived pullback.

Traders' Expectations and Fed's Rate Decisions

The CME FedWatch tool indicates a 46% chance that the Fed will reduce interest rates in September, down from 57.5% a week ago. Despite some easing of inflationary pressures in April, Fed officials remain committed to maintaining high rates to ensure inflation returns to the 2% target. Minneapolis Fed Bank President Neel Kashkari stated that substantial progress on inflation is needed before considering rate cuts, highlighting the Fed's cautious approach.

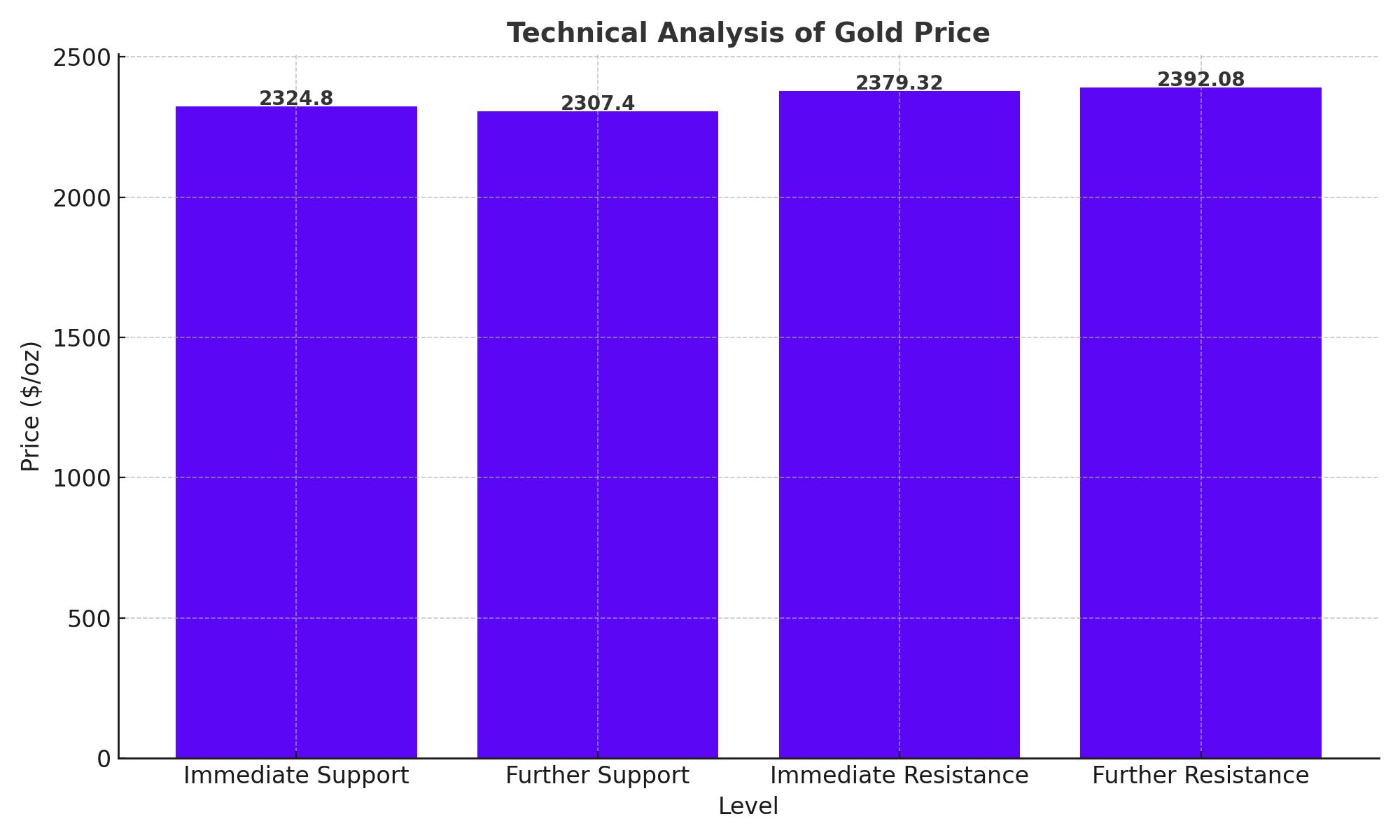

Technical Analysis: Gold Price Trends

Gold prices weakened after breaking down from an inverted flag chart formation on an hourly timeframe, indicating the resumption of a downward trend. The 14-period Relative Strength Index (RSI) shifted into the bearish range of 20.00-40.00, suggesting established bearish momentum. Immediate support is seen at the May 24 low of around $2,320, while a recovery above the May 28 high of around $2,365 would put bulls back in control.

Influence of Global Geopolitical Developments

Geopolitical risks remain high, with Israeli Prime Minister Benjamin Netanyahu reaffirming his stance against Hamas after a deadly airstrike in Rafah. Additionally, the World Gold Council reported a net outflow of 11.3 metric tonnes from physically-backed gold ETFs last week, reflecting a shift in investor sentiment.

Analysts’ Forecasts and Consumer Confidence

Despite current challenges, UBS analysts have revised their forecasts upwards, expecting gold to reach $2,500 per ounce by September and $2,600 by the end of the year. This optimism is supported by improvements in U.S. consumer confidence, which rose unexpectedly in May, suggesting a robust economic backdrop that could influence future Fed policy decisions.

Gold Technical Outlook

In today’s session, gold (XAU/USD) registered a slight decline, trading at $2,357.58, down by 0.18%. Immediate resistance is at $2,379.32, with further resistance at $2,392.08. On the downside, immediate support is at $2,324.80, with further support levels at $2,307.40 and $2,291.54. The RSI is neutral at 49.00, while the 50-Day Exponential Moving Average (EMA) at $2,363.49 suggests a potential resistance level.

Influence of Middle East Tensions and Fed Speeches

Middle East tensions, including Israeli forces shelling a tent camp in Rafah and ongoing conflicts, continue to support gold prices. Traders are also awaiting Friday’s PCE inflation data and speeches from Fed officials for further guidance on rate cuts.

Conclusion

The near-term outlook for gold remains influenced by U.S. economic indicators and geopolitical developments. The gold price is expected to remain volatile, with significant support and resistance levels defining market movements. Investors should watch key data releases and Fed communications closely to navigate the evolving market landscape.

Read More

-

Nike Stock Price Forecast - NKE at $60: Insider Buying, China Slump and a $75 Upside Target

28.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD at $1.87: ETF Hunger and Vanishing Supply Put a $2.10 Breakout Back on the Table

28.12.2025 · TradingNEWS ArchiveCrypto

-

Oil Prices Surge Then Slip: WTI Around $56 And Brent Near $61 As Venezuela And China Set The Tone

28.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today: S&P 500 Stalls Near 6,940 As NVDA Stock And Gold Lead Into 2026

28.12.2025 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Tests 1.3500 as Dollar Weakens and Rate Path Divergence Lifts Sterling

28.12.2025 · TradingNEWS ArchiveForex