Gold Prices Hold Firm Above $2,900 – Is a Breakout to $3,000 Inevitable?

With central banks buying aggressively and inflation fears rising, can gold (XAU/USD) sustain its momentum and reach new highs? | That's TradingNEWS

Gold Price Holds Above $2,900 – Is a New Breakout Toward $3,000 Coming?

Gold Surges as Trade War Fears and Fed Uncertainty Drive Safe-Haven Demand

Gold prices rebounded sharply from their steepest intraday decline in two months, climbing back above the $2,900 per ounce level, as investors rushed to hedge against escalating geopolitical tensions and ongoing trade war risks. Spot gold was last seen trading at $2,899.81, up 0.6%, while US gold futures advanced 0.4% to $2,913 per ounce.

The rally in XAU/USD comes despite technical indicators signaling overbought conditions, with the 14-day relative strength index (RSI) reaching elevated levels in recent sessions. However, the underlying bullish trend remains intact, largely fueled by central bank demand, expectations of Federal Reserve rate cuts, and a weaker US dollar, which is hovering near a two-month low.

Investor concerns deepened after US President Donald Trump reaffirmed his commitment to imposing automobile tariffs by April 2, signaling an escalation in trade tensions. This has prompted a renewed flight into gold, as traders anticipate further market disruptions. Meanwhile, negotiations surrounding the Russia-Ukraine war remain in focus, with US Secretary of State Marco Rubio stating that Europe and Kyiv would be central to any peace agreement. A potential resolution could impact gold demand, particularly from central banks, as noted by Morgan Stanley in a recent market note.

Federal Reserve Policy and US Economic Data: What’s Next for Gold?

The latest US economic data revealed a sharp decline in retail sales, which fell 0.9% in January—the largest drop in nearly two years. This has fueled speculation that the Federal Reserve may begin cutting interest rates as soon as September 2025. Fed policymakers, however, have maintained a cautious stance, with Philadelphia Fed President Patrick Harker emphasizing that monetary policy remains "steady" as inflation remains above target.

Despite lingering concerns over inflation, traders have increased bets on rate cuts in 2025, with Fed funds futures pricing in 43 basis points of easing over the next year. Lower interest rates typically support gold prices by reducing the opportunity cost of holding non-yielding assets. However, uncertainty surrounding the FOMC meeting minutes—set to be released this week—could drive short-term volatility in gold markets.

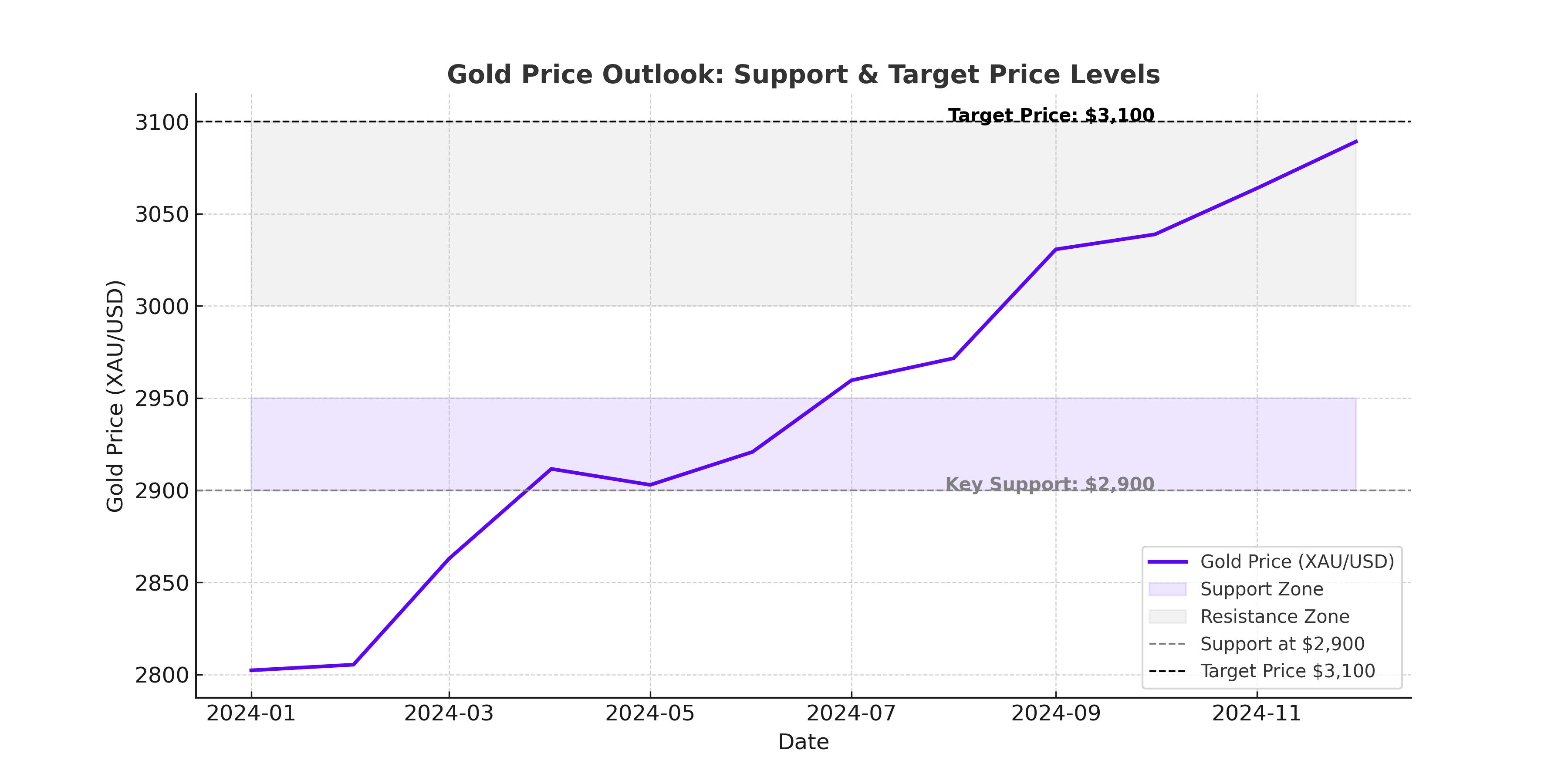

Technical Outlook: Can Gold Hold Above $2,900 and Challenge All-Time Highs?

Gold’s recent surge has reinforced key technical levels, with immediate resistance at $2,915, followed by the year-to-date high of $2,942. A break above these levels could set the stage for a test of the psychological $3,000 mark, which many analysts, including UBS, have identified as a likely near-term target.

On the downside, gold remains well-supported at $2,877, which marked last Friday’s swing low. Further weakness could see the price retesting $2,864, followed by a critical support zone at $2,790. The 20-day simple moving average (SMA) at $2,826 remains a key dynamic support level, indicating that buyers are likely to step in on any pullback.

Momentum indicators remain bullish, but signs of consolidation are emerging. The MACD histogram remains flat, suggesting that gold may trade sideways in the near term before making its next move. The RSI at 59 signals that gold is not yet in overbought territory, leaving room for further upside.

Central Bank Demand Remains a Key Driver for Gold

One of the biggest long-term drivers for gold prices has been sustained central bank buying. According to the World Gold Council (WGC), central banks purchased over 1,000 tonnes of gold for the third consecutive year in 2024, marking an increase of over 54% year-over-year following Trump’s re-election. This aggressive accumulation highlights the global shift away from the US dollar, particularly among emerging markets and economies seeking to diversify their reserves.

Notably, central banks from China, Russia, and India have ramped up gold acquisitions, with China’s central bank alone adding 225 tonnes of gold in 2024, making it one of the largest buyers. This trend is expected to continue into 2025, providing a strong structural tailwind for XAU/USD.

Gold vs. US Dollar: The Battle for Safe-Haven Demand

Gold’s latest rally coincides with weakness in the US dollar, which has struggled to maintain strength amid Trump’s tariff threats and expectations of softer Fed policy. A weaker dollar makes gold more attractive for foreign investors, boosting demand. The US dollar index (DXY) recently hit a two-month low, and if downward momentum persists, gold could see further upside.

However, the potential for US economic resilience remains a key risk factor. If upcoming inflation data and employment reports come in stronger than expected, it could delay the Fed’s rate-cut timeline, leading to a temporary pullback in gold.

Gold Mining Stocks Struggle to Match Bullion's Performance

While XAU/USD has surged, many gold mining stocks have underperformed, reflecting rising operational costs and geopolitical risks. Newmont Corporation (NYSE: NEM) has gained only 8.35% over the past five years, while Barrick Gold (NYSE: GOLD) has fallen 6.5%. In contrast, gold royalty and streaming companies such as Franco-Nevada (NYSE: FNV) and Wheaton Precious Metals (NYSE: WPM) have delivered stronger returns, rising 24.5% and 130.9%, respectively.

Miners that have successfully controlled costs and optimized production—such as Agnico Eagle Mines (NYSE: AEM) and Kinross Gold (NYSE: KGC)—have outperformed, with gains of 102.15% and 125.94%, respectively. These companies have benefited from efficient operations, strategic acquisitions, and disciplined capital management, allowing them to take advantage of rising gold prices.

Is Gold a Buy, Sell, or Hold?

With gold holding above $2,900 and macroeconomic factors supporting further upside, XAU/USD remains a strong BUY in the medium to long term. The combination of geopolitical risks, central bank demand, inflation hedging, and Fed rate-cut expectations continues to provide a favorable environment for gold.

Short-term volatility is likely, particularly ahead of key US economic data releases and Fed commentary. However, any pullbacks toward $2,850–$2,870 could present buying opportunities for investors looking to capitalize on further upside.

The next major test will be the $2,942 resistance, and if gold breaks above this level, $3,000 becomes the next logical target. On the downside, $2,877 remains the key support level, with further declines limited unless there is a shift in Fed policy expectations.

Final Outlook: Can Gold Sustain Its Rally and Reach $3,000?

Gold’s bullish trajectory remains firmly intact, supported by a weaker dollar, central bank buying, and economic uncertainty. While short-term corrections are likely, the broader trend suggests that gold could test all-time highs above $3,000 in 2025.

For now, traders and investors should watch key resistance at $2,915 and $2,942, while keeping an eye on upcoming Fed minutes, inflation data, and geopolitical developments. With gold’s role as a hedge against uncertainty continuing to strengthen, the path toward $3,000 remains a strong possibility in the months ahead.