Gold Prices Near $2,700: Will XAU/USD Continue Its Rally Amid Geopolitical Unrest?

With gold trading at $2,660 per ounce, investors weigh safe-haven demand, Federal Reserve policies, and central bank purchases to gauge whether prices will breach the $2,700 resistance | That's TradingNEWS

Gold Price Hovering Amid Volatility: The Journey Towards $2,700

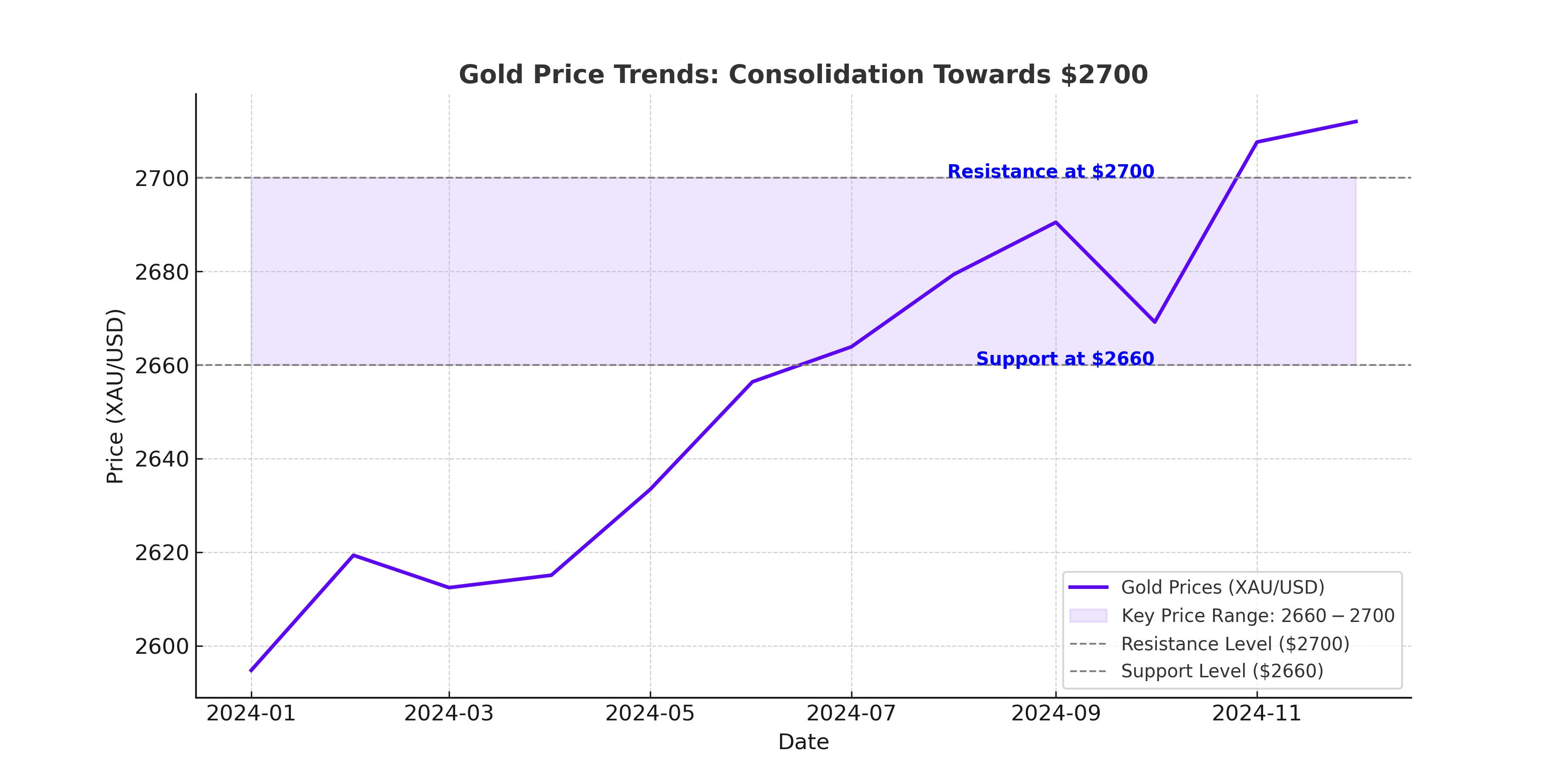

Gold prices, represented by XAU/USD, currently trade at $2,660 per ounce, exhibiting a cautious upward momentum while facing challenges from a robust US dollar and evolving geopolitical tensions. After an exceptional rally in 2024, which saw gold peak at $2,720 per ounce, the market now consolidates, teetering between strong support at $2,600 and resistance near $2,700. Investors are keenly observing macroeconomic conditions, especially the Federal Reserve’s monetary policy and the incoming Trump administration’s economic strategies, which may heavily influence gold’s trajectory.

Support and Resistance: Gold’s Critical Levels

The $2,600 support level has consistently cushioned gold prices, preventing significant declines, while the psychological resistance of $2,700 remains a crucial barrier. In recent sessions, gold has struggled to decisively break above this level. The 50-day Exponential Moving Average (EMA), hovering around $2,650, highlights the metal's neutral short-term bias, with a breakout or breakdown likely to set the tone for the coming weeks.

Impact of U.S. Dollar Strength and Interest Rates

A stronger US Dollar Index (DXY), which reached multi-year highs at 109.56, has weighed on dollar-denominated gold by making it more expensive for foreign buyers. At the same time, Treasury yields have stayed subdued, with 10-year yields around 4.56%, offering some relief for non-yielding assets like gold. However, the Federal Reserve’s signals for limited rate cuts in 2025, coupled with inflation hovering near target, could cap gold’s upside potential in the medium term.

Geopolitical Uncertainty Fuels Safe-Haven Demand

Gold has received consistent support as a safe-haven asset amid geopolitical unrest, including the prolonged Russia-Ukraine conflict and heightened tensions in the Middle East. Reports of U.S. contingency plans to address Iran’s nuclear ambitions and drone strikes on Ukraine’s capital have further intensified investor concerns, boosting gold's appeal as a hedge against uncertainty.

Central Bank Purchases: A Robust Demand Driver

Central banks continue to play a significant role in gold’s demand dynamics. The World Gold Council reported record purchases in 2024, with expectations of further acquisitions in 2025. This trend underscores the sustained preference for gold as a strategic reserve asset, particularly in times of economic and geopolitical instability.

China’s Role in Gold Demand

China’s economic recovery efforts, led by President Xi Jinping’s proactive policies to boost domestic growth, are expected to provide tailwinds for gold demand. As the world’s largest consumer of gold, China's recovery will be pivotal in shaping the metal’s price movement. The recent uptick in import quotas for independent refiners further signals a potential rise in demand from the region.

Short-Term Market Dynamics and Technical Indicators

Gold’s near-term technical indicators suggest continued consolidation. The Relative Strength Index (RSI) sits at 50.37, signaling neutral momentum, while the 200-day Simple Moving Average (SMA) remains well below current prices at $2,583, confirming a long-term bullish trend. A breakout above $2,700 could pave the way for further gains toward $2,720 and beyond, with the next major resistance projected around $2,750. Conversely, a failure to hold $2,600 may prompt a retest of the $2,580 level.

Seasonal Trends and Market Outlook

Seasonal factors have historically supported gold prices in January, driven by fresh portfolio allocations and heightened demand for jewelry during festive seasons. Analysts remain optimistic, citing gold's strong 27% annual gain in 2024 as a foundation for continued strength in 2025. However, the market’s direction will largely depend on how macroeconomic variables, such as US interest rate movements and China’s recovery pace, unfold.

Conclusion: Navigating Gold’s Price Potential

Gold remains an attractive asset for both short-term traders and long-term investors, balancing between safe-haven demand and macroeconomic headwinds. While current consolidation around $2,660 suggests market indecision, breaking above $2,700 could reignite bullish momentum, targeting levels near $2,750. Investors should stay vigilant, tracking key geopolitical events, Federal Reserve policies, and dollar strength, which will play critical roles in shaping the price trajectory of XAU/USD in the coming months. Gold’s enduring appeal as a hedge against volatility and inflation positions it as a compelling asset for 2025.