Gold Prices Push Toward $2,740 Amid Policy Uncertainty

The price of gold (XAU/USD) surged on Tuesday, reaching $2,727.39 per ounce in spot trading and $2,743.57 for February futures, bolstered by a declining U.S. dollar and safe-haven demand driven by uncertainty around U.S. President Donald Trump’s potential trade policies. These levels mark a notable recovery from recent consolidations, as the market adjusts to the evolving geopolitical and economic landscape.

The Safe-Haven Appeal: Why Gold Continues to Shine

Gold's strength can be attributed to its safe-haven appeal during periods of economic and geopolitical uncertainty. Trump's second-term inauguration and his rhetoric surrounding energy, immigration, and trade policies have intensified market volatility. While Trump's softer tone on tariffs initially buoyed risk assets, his hint at potential duties on Canadian and Mexican goods reignited fears of trade conflicts. This has driven investors toward gold, traditionally seen as a hedge against political instability and inflation.

Spot gold rose 0.3% to $2,727.39 during Asian trading, while gold futures added 0.4%. With the U.S. dollar index slipping over 1% overnight to a two-week low of 107.95 before rebounding slightly, gold remains an attractive choice for non-dollar holders.

Gold's Technical Landscape: Key Levels in Focus

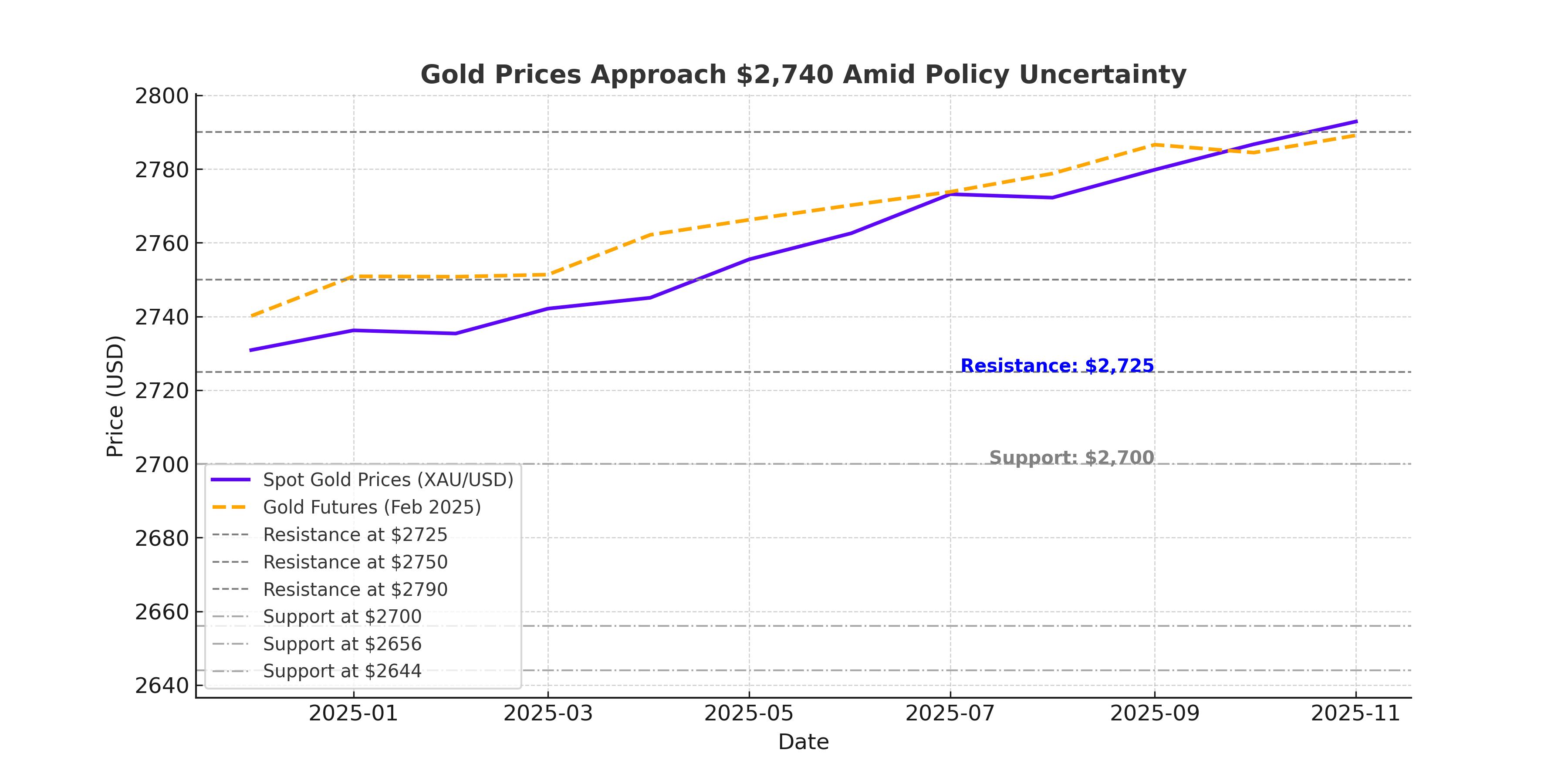

Gold prices are consolidating above the critical $2,700 support level, aiming for the psychological barrier at $2,750. The December 12 high of $2,725 has become a pivotal resistance point. A breakout above this level could set the stage for a test of $2,790, the all-time high recorded in October. Conversely, a dip below $2,700 would bring support levels at $2,656 and $2,644 into focus, where the 50-day and 100-day SMAs converge.

Indicators such as the RSI and MACD suggest mixed sentiment. While the RSI remains stable above 50, signaling continued bullish momentum, the MACD histogram shows early signs of waning upward pressure, indicating potential near-term consolidation.

Trump’s Policies and the Inflationary Narrative

The market's focus remains on Trump's economic strategy. His decision to revoke Biden-era energy mandates and his declaration of a national emergency to bolster U.S. oil reserves have sparked inflationary concerns. Inflation pressures could compel the Federal Reserve to maintain elevated interest rates, a traditionally bearish factor for non-yielding assets like gold. However, the potential inflationary impact of Trump's proposed tariffs may counteract rate concerns, supporting gold's long-term outlook.

Broader Market Context and Precious Metal Correlations

Gold's rally has been mirrored by mixed performances in other precious metals. Silver climbed 0.6% to $31.30 per ounce, while platinum and palladium faced minor losses, trading at $958.80 and $935.55, respectively. Industrial metals such as copper remained under pressure, with February futures falling 0.6% to $4.2910 per pound, reflecting fears of reduced global demand amidst tariff uncertainties.

The recent ceasefire in the Middle East and easing geopolitical tensions have tempered risk-off sentiment, yet gold continues to attract bids as a hedge against broader market volatility.

Outlook for XAU/USD: Buy, Sell, or Hold?

Given the ongoing uncertainty and the supportive backdrop of a weaker dollar, gold remains a strong buy for investors seeking a hedge against inflation and geopolitical risks. The bullish trajectory depends on holding above $2,700 and breaching the $2,750 mark. Failure to sustain momentum could prompt a pullback, presenting potential buying opportunities near the $2,650 zone.

With potential targets extending to $3,000 by mid-year, as suggested by market analysts, XAU/USD offers an appealing risk-reward profile. However, close monitoring of U.S. monetary policy and trade developments will be crucial for navigating gold's next move.