Gold Prices Near Record Highs on Fed Rate Cut Speculations and Economic Uncertainties

US Inflation Data Spurs Gold Surge; Market Awaits Producer Price Index and Consumer Sentiment Reports | That's TradingNEWS

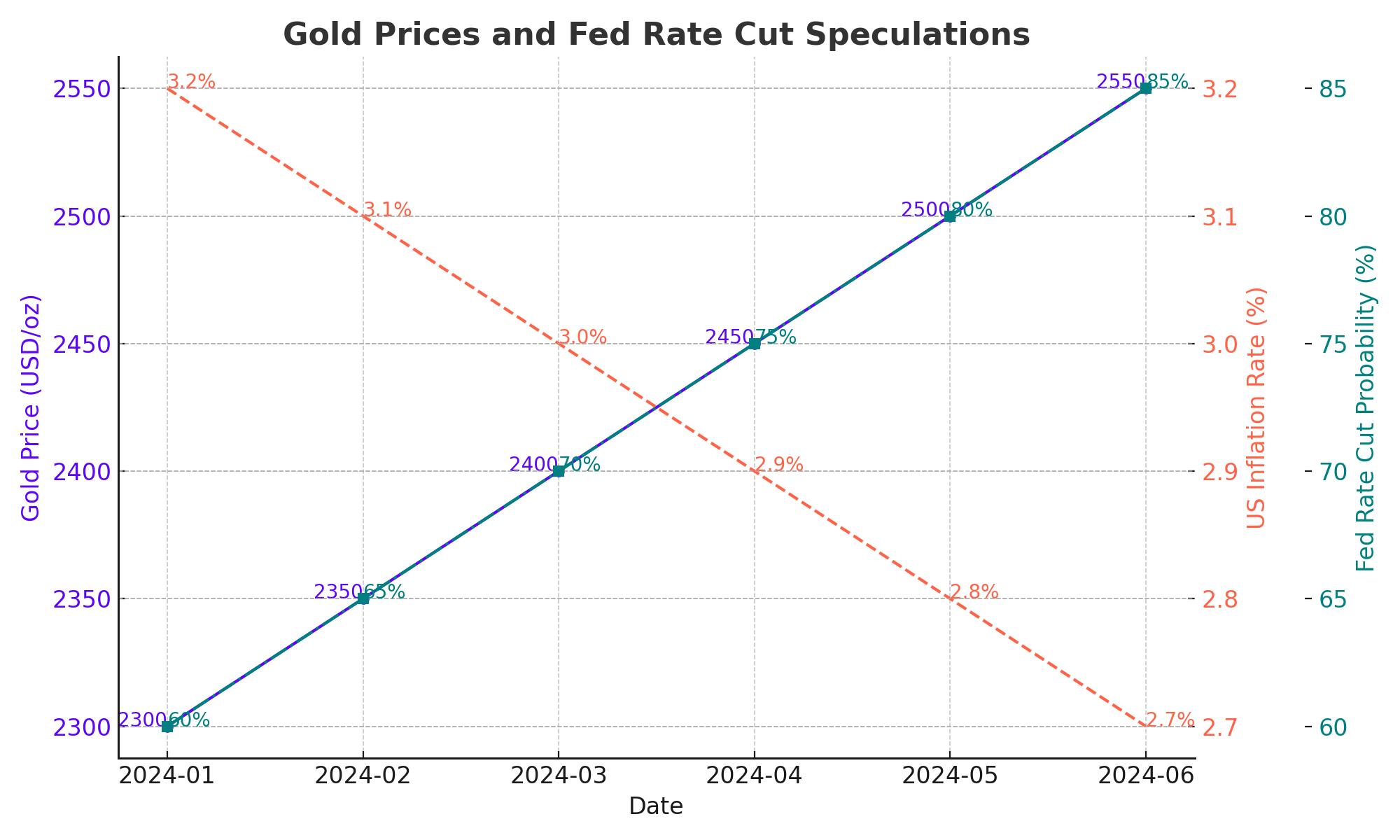

Gold Prices Skyrocket Amid Fed Rate Cut Speculations

Gold prices (XAU/USD) surged past the $2,400 mark, reaching the $2,424-2,425 region, their highest since May 22. This rally was triggered by a softer-than-expected US inflation report, reinforcing market expectations that the Federal Reserve might cut rates in September. However, the momentum faced a slight hiccup due to a modest rebound in the US Dollar (USD) and a pickup in US Treasury bond yields.

US Inflation Data and Federal Reserve Outlook

The latest data from the US Bureau of Labor Statistics (BLS) showed a significant dip in the headline Consumer Price Index (CPI), which fell for the first time in over four years. The yearly rate decelerated to 3% from 3.3% in May. Meanwhile, the core CPI, excluding volatile food and energy prices, rose by only 0.1% in June, slightly below the consensus estimate of 3.3% YoY.

Investors responded swiftly, with over a 90% probability now being priced in for a Fed rate cut in September. The December 2024 fed funds rate futures contract also indicated an expected policy rate cut of 49 basis points towards the end of the year. These expectations were bolstered by comments from Federal Reserve officials like San Francisco Fed President Mary Daly, who acknowledged the improving inflation figures.

Market Reactions and Gold's Performance

Following the inflation report, the yield on the 10-year US government bond fell to its lowest level since March, dragging the USD down and boosting gold. Spot gold jumped 2.0% to $2,418.78 an ounce, while US gold futures rose 1.6% to $2,419 an ounce in New York. This surge comes despite a modest uptick in USD during the Asian session on Friday.

Technical Analysis and Market Sentiment

Technically, the sustained breakout above the $2,400 mark is seen as a bullish signal. Oscillators on the daily chart show positive traction, further supporting the near-term positive outlook for gold. The next key resistance is at the $2,425 region, with the all-time high of $2,450 in sight. On the downside, support levels are seen at $2,388-2,387 and $2,358.

Economic Uncertainties and Geopolitical Risks

Political uncertainty in the US and Europe, alongside geopolitical risks and concerns about a global economic slowdown, continue to support gold's safe-haven appeal. The market is now focused on the upcoming US Producer Price Index (PPI) and the University of Michigan Consumer Sentiment survey for further direction.

Gold Price Forecasts and Long-Term Outlook

Analysts have raised their average price forecasts for gold due to its near-term strength but expect a potential decline towards the end of 2024 or into 2025. HSBC has lifted its average gold price forecast for 2024 from $2,160/oz to $2,305/oz, but the 2025 estimates are now lowered to $1,980/oz, suggesting a 12% drop from current levels.

Conclusion

Gold's rally towards record highs is driven by favorable economic data and expectations of rate cuts by the Federal Reserve. However, the market remains cautious, with potential corrections on the horizon. Investors should closely monitor upcoming economic reports and geopolitical developments to navigate the volatile gold market.