Gold Prices in Focus: Market Dynamics and XAU/USD Analysis

Spot Gold and Recent Volatility

Spot gold (XAU/USD) saw heightened volatility in early 2025, dipping to $2,614.44 before rebounding to stabilize around $2,630–$2,640. This movement was driven by fluctuations in the US Dollar (USD) and political headlines, particularly speculation regarding tariff policies under President-elect Donald Trump. The Washington Post initially reported potential universal tariffs on critical imports, such as defense and energy goods. However, Trump refuted these claims, briefly strengthening the USD and pressuring gold prices lower.

Despite this correction, gold remains a focal point for investors amid geopolitical uncertainties and upcoming US employment data, including the highly anticipated Nonfarm Payrolls (NFP) report.

Gold Technical Analysis and Key Levels

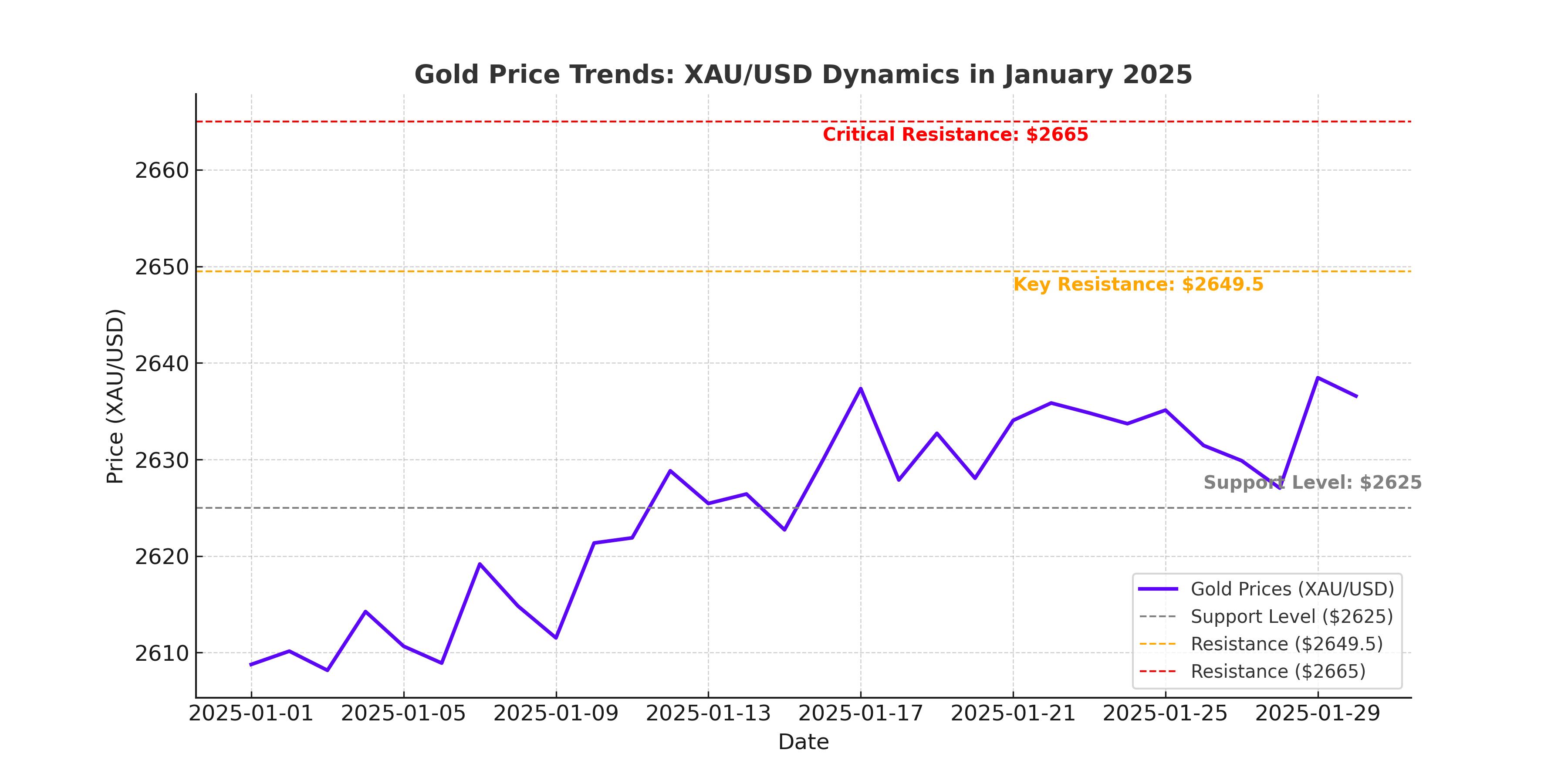

Technically, XAU/USD has traded in a narrow range for six consecutive weeks, reflecting investor hesitance to take directional bets. The daily chart shows gold hovering around the flat 20-day Simple Moving Average (SMA) while the 100-day SMA at $2,625 provides dynamic support. Resistance levels are prominent near $2,649.50 and $2,665, with a potential breakout targeting $2,700 if the metal sustains gains above $2,665. Conversely, a breakdown below $2,611 could signal a bearish shift, exposing gold to a decline toward $2,596.

Geopolitical and Economic Drivers Impacting Gold

Geopolitical tensions continue to play a critical role in shaping gold's outlook. The war in Ukraine, instability in the Middle East, and recent political movements, such as Canadian Prime Minister Justin Trudeau’s anticipated resignation, add to the uncertainty. Additionally, Italy's Prime Minister Giorgia Meloni’s independent visit to Trump underscores shifting alliances that could influence global trade dynamics.

On the economic front, the US 10-year Treasury yield hit a seven-month high of 4.639% last week before retreating to 4.57%. Rising yields typically weigh on gold, a non-yielding asset, by increasing the opportunity cost of holding it. However, a weaker US Services PMI at 56.8 (below the consensus of 58.5) and market anticipation of slower Fed rate hikes provide a supportive backdrop for the yellow metal.

Gold as a Hedge in a Challenging Environment

Gold's role as a hedge against risk remains vital, particularly as investors grapple with inflation concerns, government debt, and disruptive trade policies. Despite bullish momentum easing from the highs of early January, analysts remain optimistic about gold's medium-term trajectory. JPMorgan predicts that gold could reach $3,000 per ounce by mid-2026, fueled by persistent geopolitical risks and central bank purchases.

Year-to-Date Gold Performance and Investor Sentiment

Gold prices gained 27% in 2024, marking the metal's best annual performance in over a decade. Central bank demand and retail investor purchases drove this rally, reflecting confidence in gold’s safe-haven appeal. As of early 2025, February gold futures traded at $2,657.30, up $2.60 for the day, while March silver surged to $30.87, gaining $0.805. Analysts attribute these moves to a sharp sell-off in the US Dollar Index, which began the week at multi-year highs but subsequently retreated.

Broader Commodity Trends and Implications for Gold

Commodity markets are expected to face headwinds in 2025 due to a sluggish global economy and a resurgent dollar. While base metals like copper may struggle, gold and silver are likely to shine, supported by their industrial and investment demand. Silver’s role in solar panel production and green energy projects provides additional upside potential. Meanwhile, platinum, another precious metal, benefits from strong supply deficits and increasing demand in industrial applications.

Market Outlook and Key Risks

Gold’s near-term trajectory depends on several variables, including the Fed’s interest rate policy, US employment data, and global geopolitical developments. A failure to break above $2,665 resistance could limit bullish momentum, while a breach below $2,625 support risks triggering further declines.

However, the broader macroeconomic landscape remains favorable for gold. The Fed's projected fewer rate cuts, coupled with rising geopolitical uncertainties, underscore its safe-haven status. Investors should monitor developments in the US Dollar, bond yields, and central bank policies closely to assess gold’s next move.

Conclusion: Navigating the XAU/USD Landscape

Gold (XAU/USD) remains at a critical juncture, trading within a well-defined technical range. With support near $2,625 and resistance at $2,665, the metal's next move could determine its medium-term trend. While risks such as higher US yields persist, gold’s status as a hedge against inflation and geopolitical turmoil reinforces its investment appeal. Analysts and investors alike should remain vigilant as the market digests upcoming economic data and political developments.