Gold Prices Poised for Action: XAU/USD Battles $2,650 Barrier

US Labor Data, Geopolitical Tensions, and Fed Moves Shape Gold’s Next Big Break | That's TradingNEWS

Gold Price Analysis: XAU/USD Navigates Uncertain Terrain Amid Rate Speculation and Geopolitical Tensions

Gold prices have been teetering around $2,650, a key level that reflects a delicate balance between bullish and bearish forces in the market. Over the past week, the precious metal has remained range-bound, with investors keenly awaiting the release of the US Nonfarm Payrolls (NFP) data, which is expected to provide crucial guidance on the Federal Reserve’s next monetary policy moves. This data, coupled with geopolitical turbulence and central bank actions, has created a highly dynamic environment for XAU/USD.

Market Reactions to Economic Data and Federal Reserve Policies

The upcoming NFP report is forecasted to show an increase of 200,000 jobs in November, a significant rebound from October's hurricane-affected results of just 12,000. However, an uptick in the unemployment rate to 4.2% from 4.1% could soften market expectations. These labor market dynamics will influence the Federal Reserve's anticipated December rate cut of 25 basis points, bringing the federal funds rate to a range of 4.25%-4.50%.

In recent weeks, Federal Reserve Chair Jerome Powell and other officials have maintained a cautious tone, emphasizing the resilience of the US economy while acknowledging that inflation remains a concern. The CME FedWatch Tool indicates a 79% probability of a December rate cut, yet hawkish remarks from policymakers have tempered expectations, putting additional pressure on gold prices.

Gold’s Technical Landscape and Key Levels

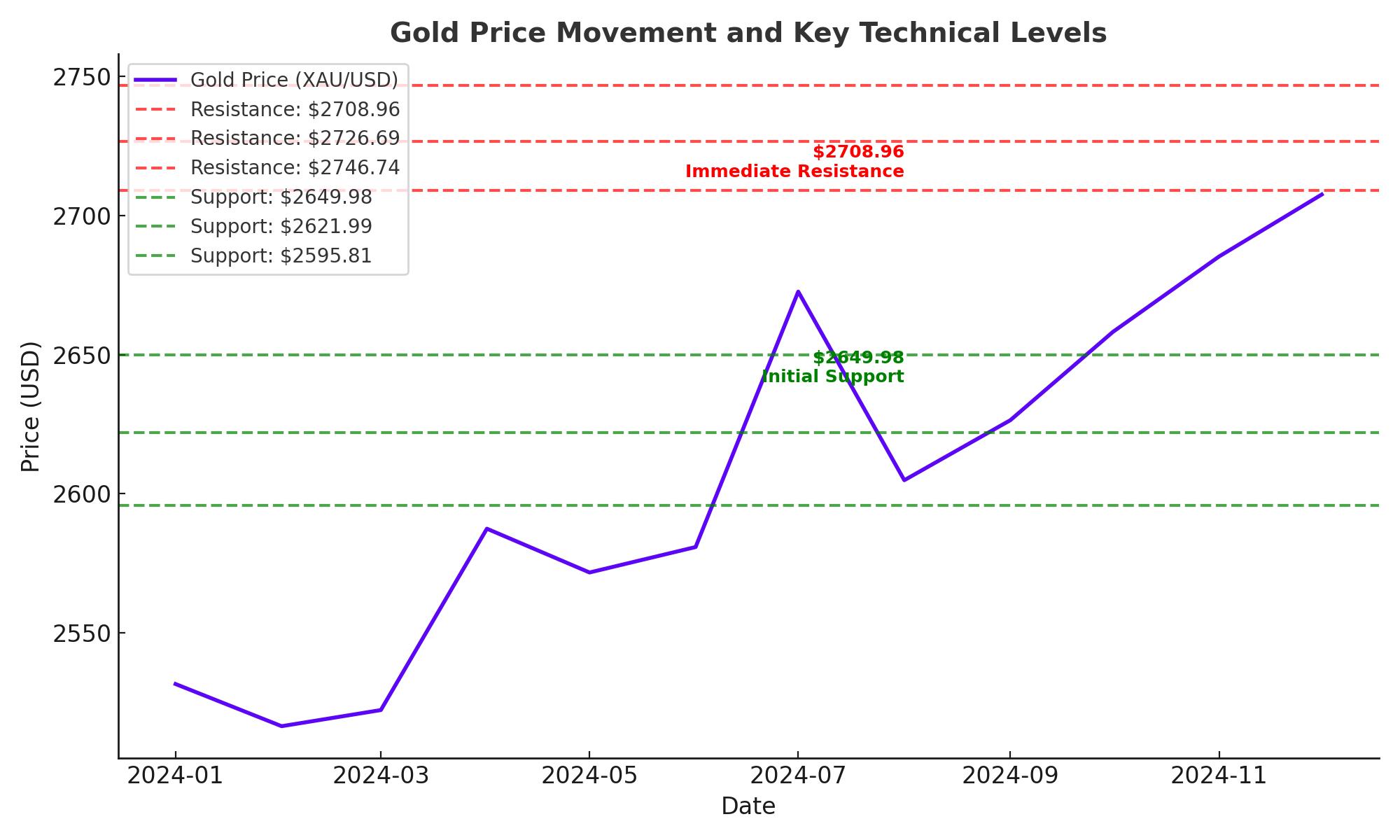

On the technical front, XAU/USD has been consolidating between $2,600 and $2,668, the latter marked by the 50-day Simple Moving Average (SMA). A sustained move above this SMA could open the path to test $2,700, with further upside resistance at October’s high of $2,790. Conversely, a break below $2,600 may expose gold to deeper corrections toward the 100-day SMA at $2,578 and November’s low of $2,537.

Relative Strength Index (RSI) readings suggest a neutral stance, oscillating between 40 and 60, while the upward-sloping trendline from February’s low of $1,984 continues to provide long-term support. Traders should monitor these technical indicators closely as they navigate a market rife with mixed signals.

Geopolitical Risks and Central Bank Activity Boost Gold’s Appeal

Beyond economic data, geopolitical risks remain a potent driver of gold prices. Escalating tensions in Ukraine and persistent instability in the Middle East have kept demand for the safe-haven asset elevated. Additionally, central banks worldwide continue to bolster their gold reserves, a trend that has underpinned the precious metal’s resilience even amid corrections.

China and Russia have been particularly active in increasing their gold holdings, a move interpreted as part of broader efforts to diversify away from the US dollar. The cumulative effect of these purchases is a strong foundational demand for gold, providing a buffer against downside risks.

Impact of the US Dollar and Treasury Yields

The US Dollar Index (DXY) has shown signs of weakening, trading near 106.20. A softer dollar typically benefits gold prices, as it makes the metal cheaper for holders of other currencies. However, 10-year US Treasury yields have edged higher to around 4.21%, exerting downward pressure on gold by increasing the opportunity cost of holding non-yielding assets.

Investors should remain alert to any shifts in these macroeconomic variables, as they are likely to dictate short-term price movements in the gold market.

The Broader Economic and Commodity Outlook

Gold’s trajectory also intersects with trends in other commodities and currencies. Weakness in the euro, South Korean won, and several BRICS currencies has driven a flight to the US dollar, which in turn weighs on gold. However, this dynamic could reverse if global economic conditions stabilize or if central banks accelerate monetary easing measures.

Investment Sentiment and Future Price Projections

Gold’s year-to-date performance has been robust, with prices up approximately 28%, driven by monetary easing and central bank activity. Major financial institutions remain optimistic about gold’s prospects. JPMorgan Chase forecasts an average price of $2,950 for Q4 2025, while Goldman Sachs anticipates a bullish scenario where gold reaches $3,150 per ounce by December 2025.

Despite recent consolidation, the long-term fundamentals for gold remain strong. Persistent inflationary pressures, geopolitical uncertainty, and central bank purchases are likely to sustain demand. For investors, the current price levels around $2,650 offer a compelling entry point, particularly for those seeking to hedge against economic volatility.

Final Thoughts

While gold prices face immediate resistance and a potential for short-term pullbacks, the broader outlook remains decidedly bullish. As XAU/USD navigates a complex interplay of economic data, geopolitical risks, and central bank actions, it presents both challenges and opportunities for traders and investors. Careful monitoring of key levels and market drivers will be essential to capitalize on the next big move in the gold market.