Gold Prices Rally to $2,693: Will XAU/USD Break $2,700 and Beyond?

As Inflation Eases and Treasury Yields Drop, Can Gold Hit $3,000 in 2025? | That's TradingNEWS

Gold Prices Surge Amid Inflation Data and Federal Reserve Speculations

Gold prices have rallied strongly in recent sessions, with the XAU/USD pair climbing to $2,693.63 per ounce, just shy of its recent peak of $2,700. This bullish momentum reflects a combination of factors, including softer-than-expected U.S. core inflation data, declining Treasury yields, and shifting market expectations regarding Federal Reserve policy. Spot gold advanced 1.3% on the day, settling at $2,717.80, supported by a weakened U.S. dollar and the anticipation of rate cuts later in the year.

Market Drivers Behind Gold's Recent Surge

Gold's impressive rise has been fueled by the release of December's Consumer Price Index (CPI) data, which showed a 0.4% monthly increase and a year-over-year rate of 2.9%. Core CPI, which excludes food and energy prices, came in slightly below expectations at 3.2%, easing concerns about persistent inflationary pressures. These figures have bolstered market sentiment, as investors increasingly believe the Federal Reserve may have room to begin cutting interest rates in 2025, with the CME FedWatch Tool suggesting a 40 basis-point reduction by year-end.

The decline in real yields has been a significant tailwind for gold. The 10-year Treasury Inflation-Protected Securities (TIPS) yield dropped from 2.33% to 2.23%, reflecting heightened demand for safe-haven assets like gold. As real yields decrease, the opportunity cost of holding non-yielding assets such as gold diminishes, further supporting prices.

The Impact of U.S. Dollar and Treasury Yields on Gold Prices

The U.S. dollar index (DXY) fell to 109.29, marking a slight recovery from its intraday low but remaining weak overall. A softer dollar enhances gold's appeal for foreign investors, as it reduces the relative cost of purchasing the precious metal in other currencies. Meanwhile, the benchmark 10-year Treasury yield also slipped, easing financial conditions and providing additional support for gold prices.

Gold's Technical Outlook: Resistance and Support Levels

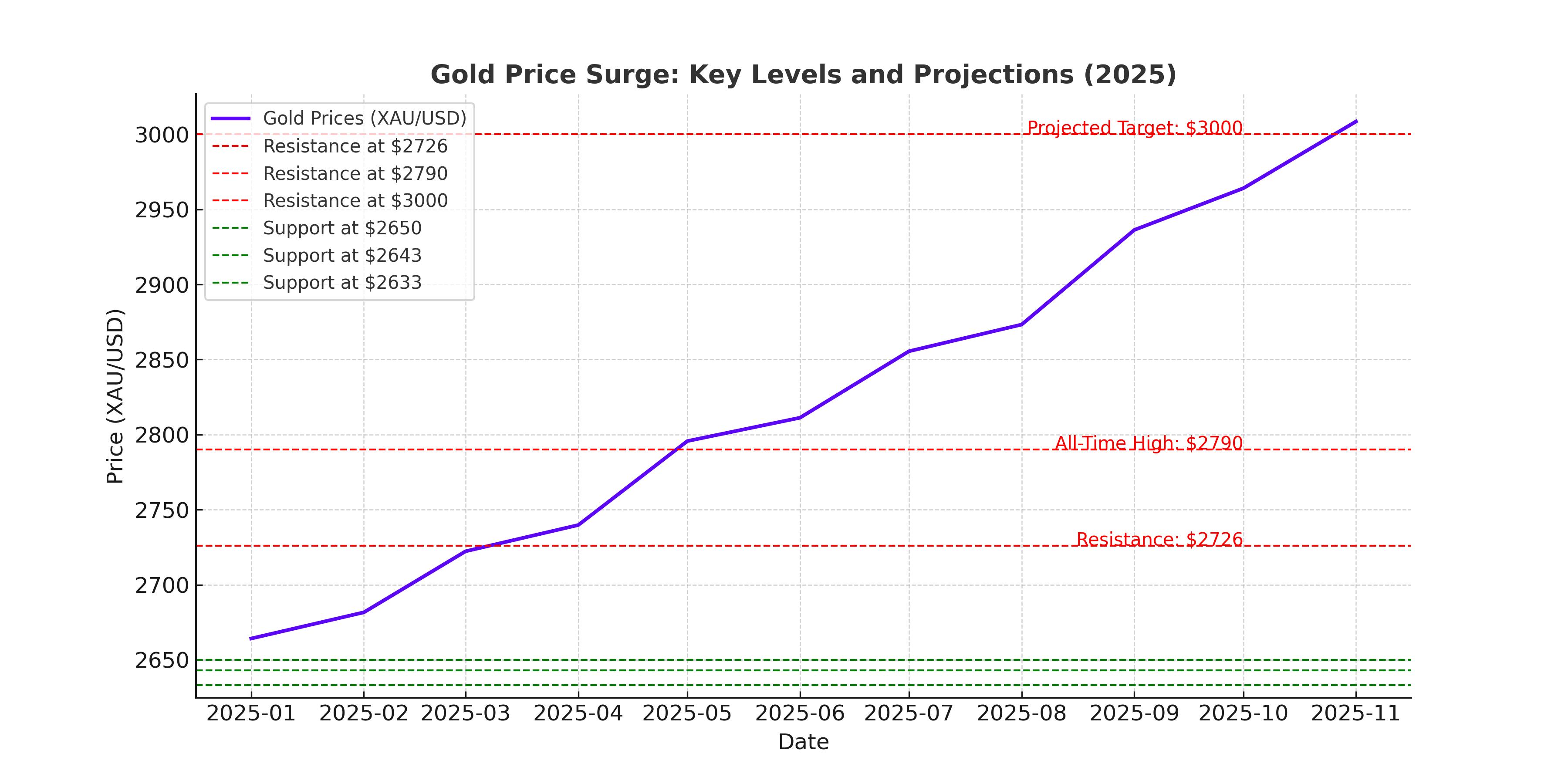

Gold's uptrend remains firmly in place, with the Relative Strength Index (RSI) signaling strong bullish momentum. The next key resistance lies at $2,726, the December 12 peak, followed by the all-time high of $2,790. A breakout above these levels could pave the way for a test of the psychologically significant $3,000 mark by the third quarter of 2025.

On the downside, immediate support is seen at $2,650, with further levels at the 50-day Simple Moving Average (SMA) of $2,643 and the 100-day SMA at $2,633. A sustained move below these levels could signal a shift in market sentiment and invite additional selling pressure.

Macroeconomic and Geopolitical Influences on Gold

The incoming Trump administration's proposed economic policies, including potential tariffs and additional tax cuts, have emerged as a wildcard for gold prices. Tariffs could stoke inflation, complicating the Federal Reserve's rate-cutting agenda and potentially boosting demand for gold as an inflation hedge. However, a stronger U.S. dollar stemming from these policies might counterbalance some of gold's upside potential.

Further uncertainty stems from global geopolitical tensions and central bank gold purchases. The People's Bank of China has consistently added to its reserves, reflecting a strategic shift toward diversifying away from the U.S. dollar. This trend supports a structurally bullish outlook for gold, as central banks worldwide continue to increase their allocations to the metal.

Comparing Gold with Other Precious Metals

While gold remains the star performer, other precious metals have also seen notable gains. Silver advanced 2.6% to $30.66 per ounce, reflecting its dual role as both an industrial and monetary asset. Platinum and palladium also posted gains, rising 0.2% and 2.6%, respectively, driven by robust demand in the automotive and electronics sectors.

Potential Risks and Market Considerations

Despite the bullish outlook, gold is not without risks. A stronger-than-expected U.S. economic recovery or a hawkish shift in Federal Reserve policy could cap further price appreciation. Additionally, profit-taking by institutional investors may lead to short-term corrections, particularly if prices approach record highs.

Market participants should also monitor key economic indicators, including upcoming retail sales data and unemployment claims, for clues on the Federal Reserve's policy trajectory. These factors will play a crucial role in shaping gold's medium-term outlook and determining whether the metal can sustain its recent gains.

Is Gold a Buy, Hold, or Sell at Current Levels?

Given the current macroeconomic environment and technical setup, gold appears poised for further gains. The combination of declining yields, a weaker dollar, and persistent inflation concerns creates a favorable backdrop for the metal. Long-term investors may consider accumulating positions, particularly if prices break above $2,726 and establish new support levels.

However, traders should remain vigilant for potential headwinds, including shifts in Federal Reserve policy and geopolitical developments. For those already holding gold, maintaining positions while setting stop-loss levels near key support zones could be a prudent strategy. As gold approaches the $3,000 threshold, profit-taking opportunities may arise, offering an attractive exit point for short-term investors.

Gold continues to demonstrate its resilience as a safe-haven asset, offering a compelling mix of stability and growth potential in an uncertain economic landscape. Whether as a hedge against inflation or a store of value during turbulent times, gold's appeal remains as strong as ever.