Gold Prices React Positively to Subdued Job Market Data

A detailed analysis of how recent economic indicators and Federal Reserve policies are influencing gold's value, driving investor interest in this classic safe-haven asset | That's TradingNEWS

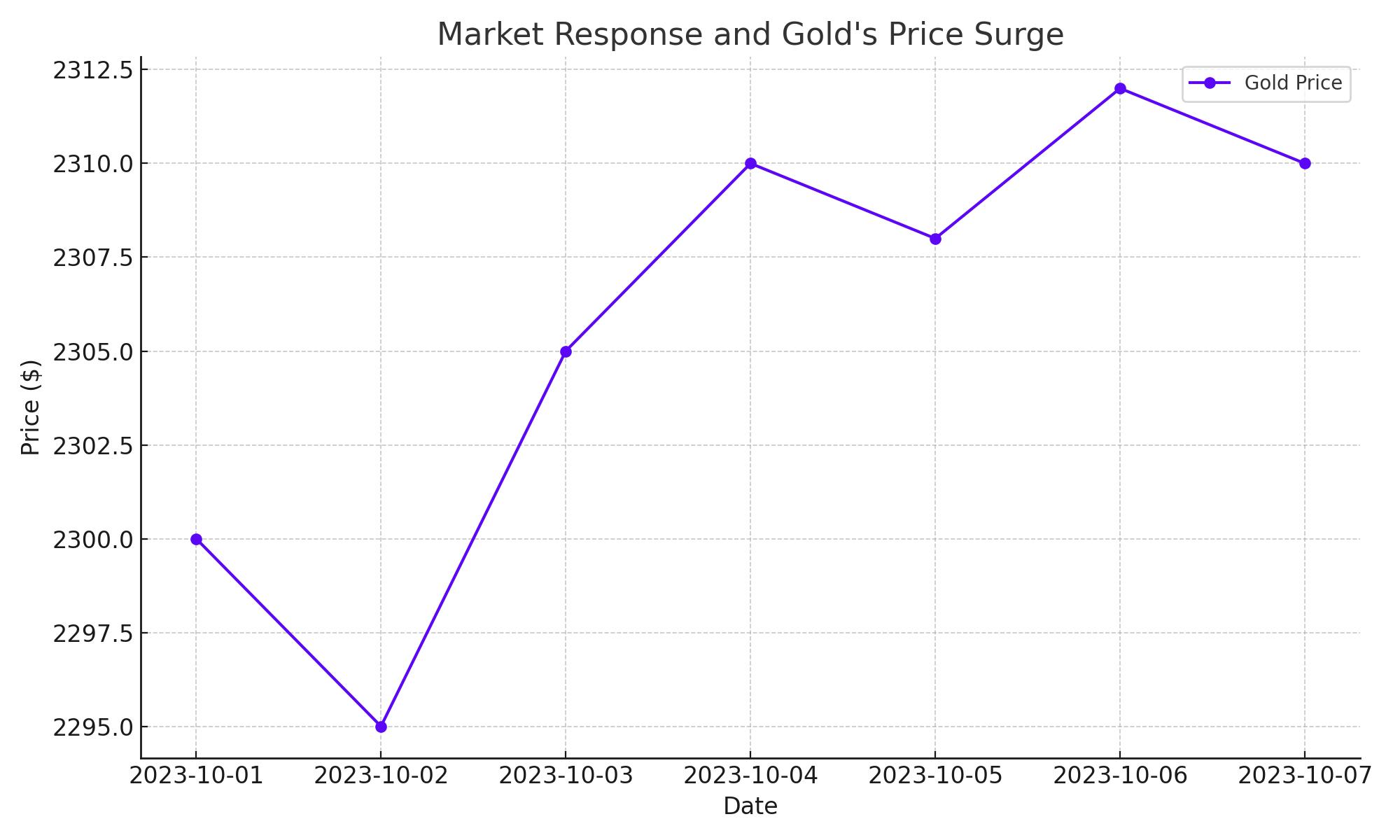

Market Response and Gold's Price Surge

Following the release of the weaker-than-expected job data, gold prices experienced a notable recovery, surging to approximately $2,310—an increase of over half a percent. This price movement underscores gold's role as a hedge against economic uncertainty, a characteristic that comes into play amid signs of potential slowdowns or adjustments in monetary policy. The immediate market reaction highlighted the sensitivity of gold prices to macroeconomic indicators, which influence investor sentiment and strategic positioning in safe-haven assets.

Economic Indicators and Their Impact

The details of the Nonfarm Payrolls report painted a picture of an economy that might be cooling off. Average Hourly Earnings increased by only 3.9% year-over-year, and other metrics such as the Unemployment Rate and Average Weekly Hours worked all undershot expectations. These indicators suggest lessening inflationary pressures, which traditionally lead to a more dovish stance from the Fed. Speculations that the Fed might cut interest rates sooner than later due to these pressures could decrease the yield on dollar assets, making non-yielding gold more attractive.

USD Dynamics and Gold Prices

The expectation of a dovish shift by the Federal Reserve has a direct impact on the U.S. Dollar, with the Dollar Index (DXY) falling over half a percent post-report. Gold typically moves inversely to the dollar; hence, a weaker dollar makes gold less expensive for holders of other currencies, potentially increasing demand for the yellow metal.

Technical and Sentiment Analysis

From a technical perspective, gold prices showing resilience above the $2,300 mark suggest a strong support level that could catalyze further gains if sustained. Market sentiment, as gauged by movements in gold ETFs and other investment vehicles, also indicates a cautious but growing optimism about gold’s role in portfolios, particularly if economic uncertainties persist.

Bullish Outlook for Gold

The combination of softer economic indicators, potential shifts in U.S. monetary policy, and the resulting weakness in the U.S. Dollar collectively bolster a bullish outlook for gold. Should these trends continue, gold may not only test previous highs but could potentially set new benchmarks. Investors and market watchers will do well to monitor upcoming economic data releases and Fed communications closely, as these will provide critical insights into the likely trajectories of interest rates, inflation, and by extension, gold prices.