Gold Prices Remain Resilient: XAU/USD Steady Above $2,640

Macroeconomic factors, geopolitical tensions, and inflation drive gold's momentum as central banks remain pivotal | That's TradingNEWS

Gold (XAU/USD) Price Analysis: Key Drivers and Market Dynamics

Macroeconomic Pressure and Inflationary Impact

Gold prices, represented by XAU/USD, have remained resilient in the face of global macroeconomic turbulence, holding firmly above $2,640. Recent U.S. inflation data reflects a CPI increase from 2.6% to 2.7% in November, underscoring the persistence of inflationary pressures. This inflationary environment continues to bolster the appeal of gold as a hedge against eroding purchasing power. Investors now anticipate a dovish pivot by the Federal Reserve with an expected 25 basis point rate cut, adding to gold’s upward momentum.

Central Bank Demand and Geopolitical Uncertainty

Central bank net purchases of gold have provided significant support to prices. With geopolitical risks escalating, particularly in the Middle East and Eastern Europe, demand for safe-haven assets like gold has surged. Analysts project that ongoing geopolitical tensions will sustain robust gold buying by central banks, providing a strong floor for prices around $2,600 and creating potential for a move towards $2,800 by 2025.

Technical Patterns in XAU/USD

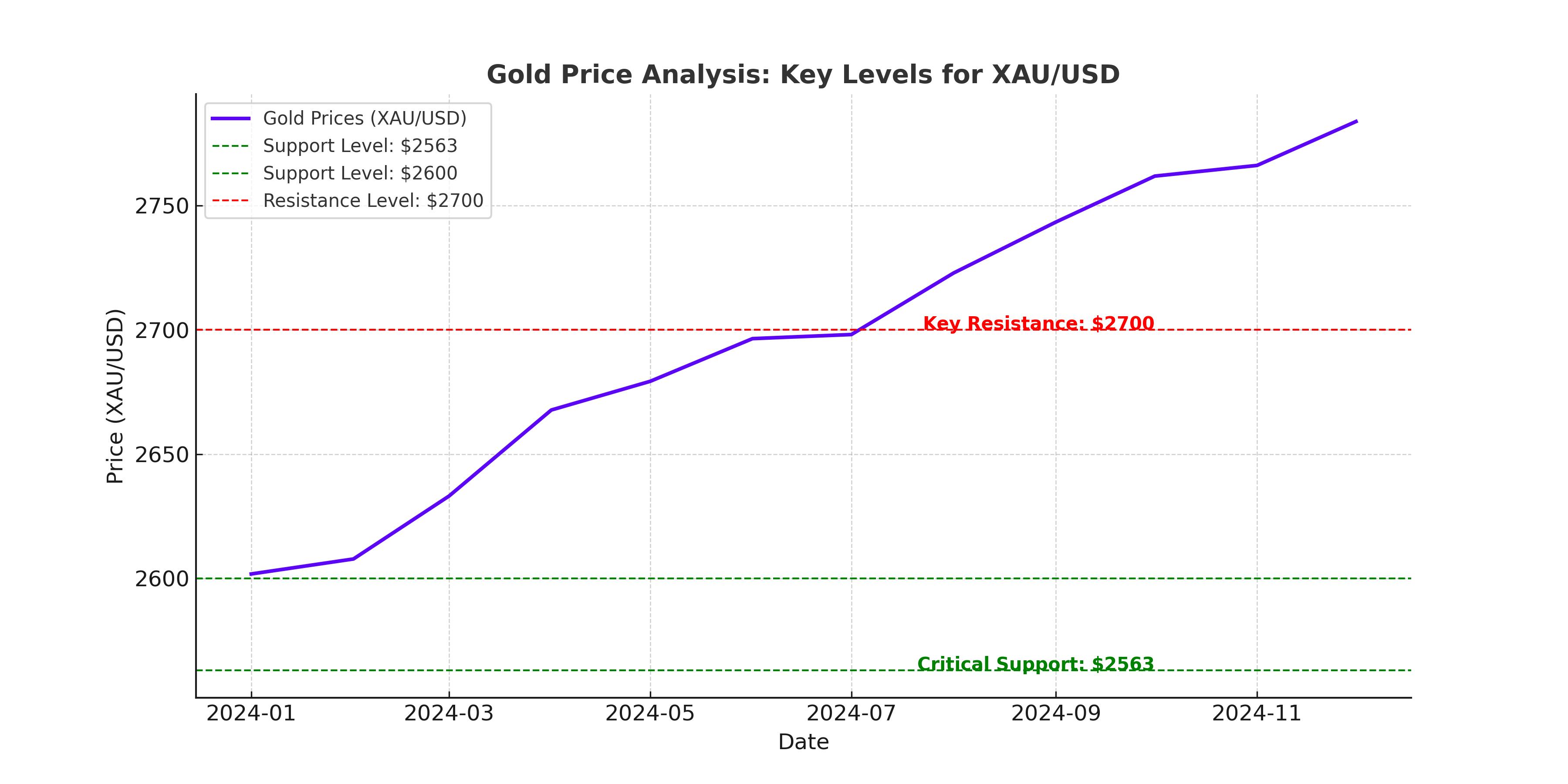

Gold's price action reveals a consistent trading range, with support levels at $2,563 and resistance nearing the psychological $2,700 mark. November's dip to $2,563.25 marked a critical inflection point, but the subsequent recovery suggests firm bullish sentiment. Technical indicators signal potential for further gains, especially if prices close above $2,700 in the near term. Fibonacci retracement levels show additional support at $2,520, aligning with broader market stability.

Gold Miners Lag Behind Spot Prices

While XAU/USD has gained 28% year-to-date, the NYSE Arca Gold Miners Index (GDMNTR) trails with a 21% increase. This disparity highlights poor sentiment in the gold mining sector despite record-high profit margins for many producers. Companies like Agnico Eagle Mines (NYSE:AEM) remain undervalued relative to their fundamentals. Agnico's Q3 2024 revenue surged 31.3% year-over-year, while adjusted net income margins rose to 26.6%, reflecting operational strength. Analysts expect gold equities to catch up with spot gold prices as market sentiment improves.

Emerging Trends in Mining and Production

Mining companies are leveraging record-high margins to expand production. Agnico Eagle's full-year gold production is forecast to reach 3.52 million ounces, supported by stable all-in sustaining costs (AISC). Meanwhile, the sector faces challenges such as subdued investor interest and increased operational costs. Acquisitions, like Agnico's $143 million deal for O3 Mining, indicate strategic expansion but also highlight potential near-term earnings dilution.

Global Demand and Regional Influences

India’s gold market reflects mixed signals with domestic futures trading near ₹78,970 per 10 grams, slightly lower due to weak spot demand. However, global futures rose 0.64% to $2,718.84 per ounce, supported by inflation and geopolitical tailwinds. Chinese demand is also rebounding, driven by strategic stockpiling and improved economic sentiment.

Outlook for Gold Prices and Equities

Looking ahead, gold prices are poised to test the $2,800 threshold in 2025, driven by a convergence of inflationary pressures, central bank demand, and geopolitical instability. Gold equities remain a compelling opportunity, with valuations lagging spot prices despite robust financial metrics. Companies like Agnico Eagle and Franco-Nevada (NYSE:FNV) are well-positioned to benefit from rising prices and increased investor confidence.

Decision: Bullish Bias with Strategic Entry Opportunities

Gold (XAU/USD) presents a strong bullish case for investors seeking inflation protection and portfolio diversification. While gold mining equities are undervalued, they offer a leveraged play on rising spot prices. Investors should consider accumulating positions on pullbacks, focusing on miners with strong balance sheets and low production costs. Gold's role as a safe-haven asset remains integral, making it a strategic buy for 2024 and beyond.