Current Gold Market Performance and Trends

Gold Price Movements

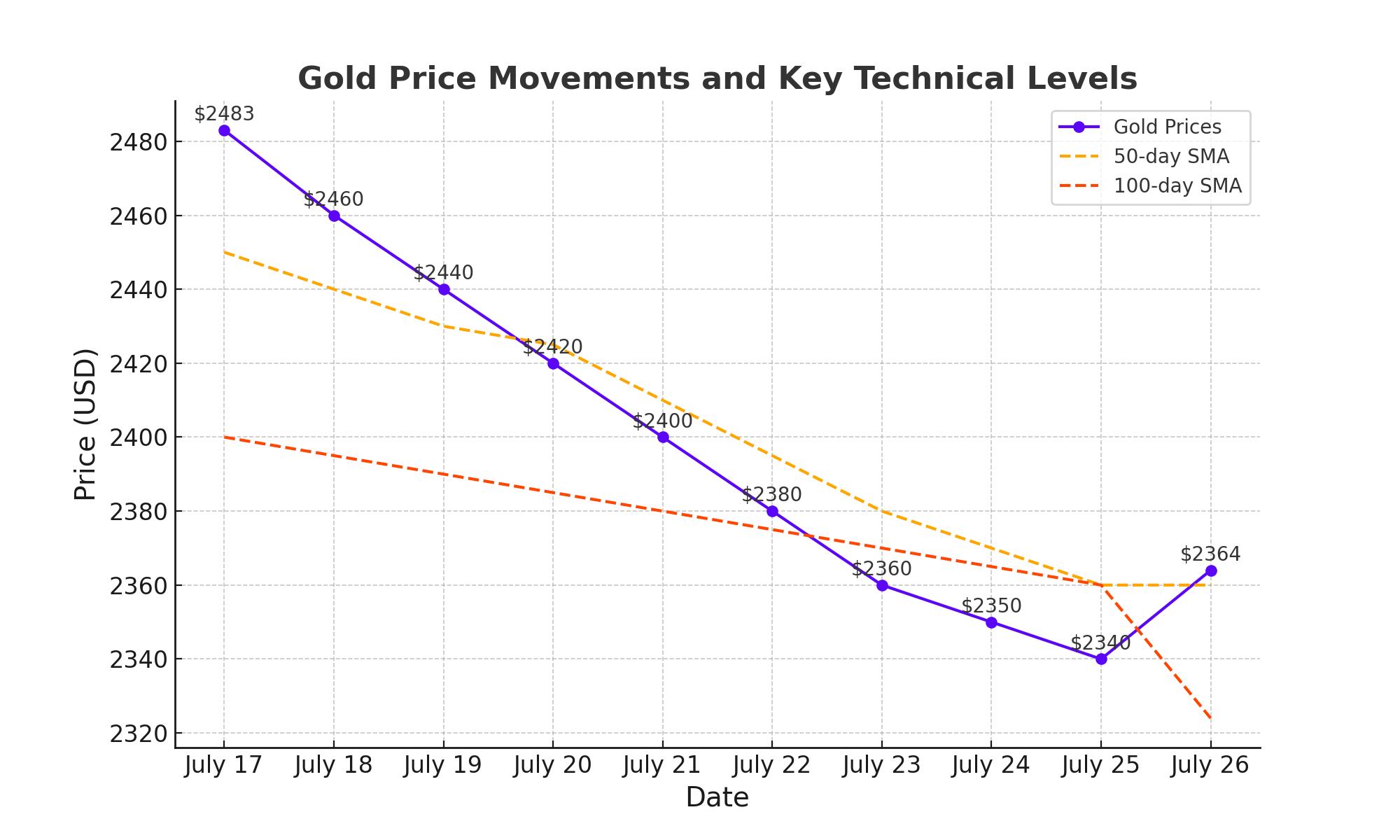

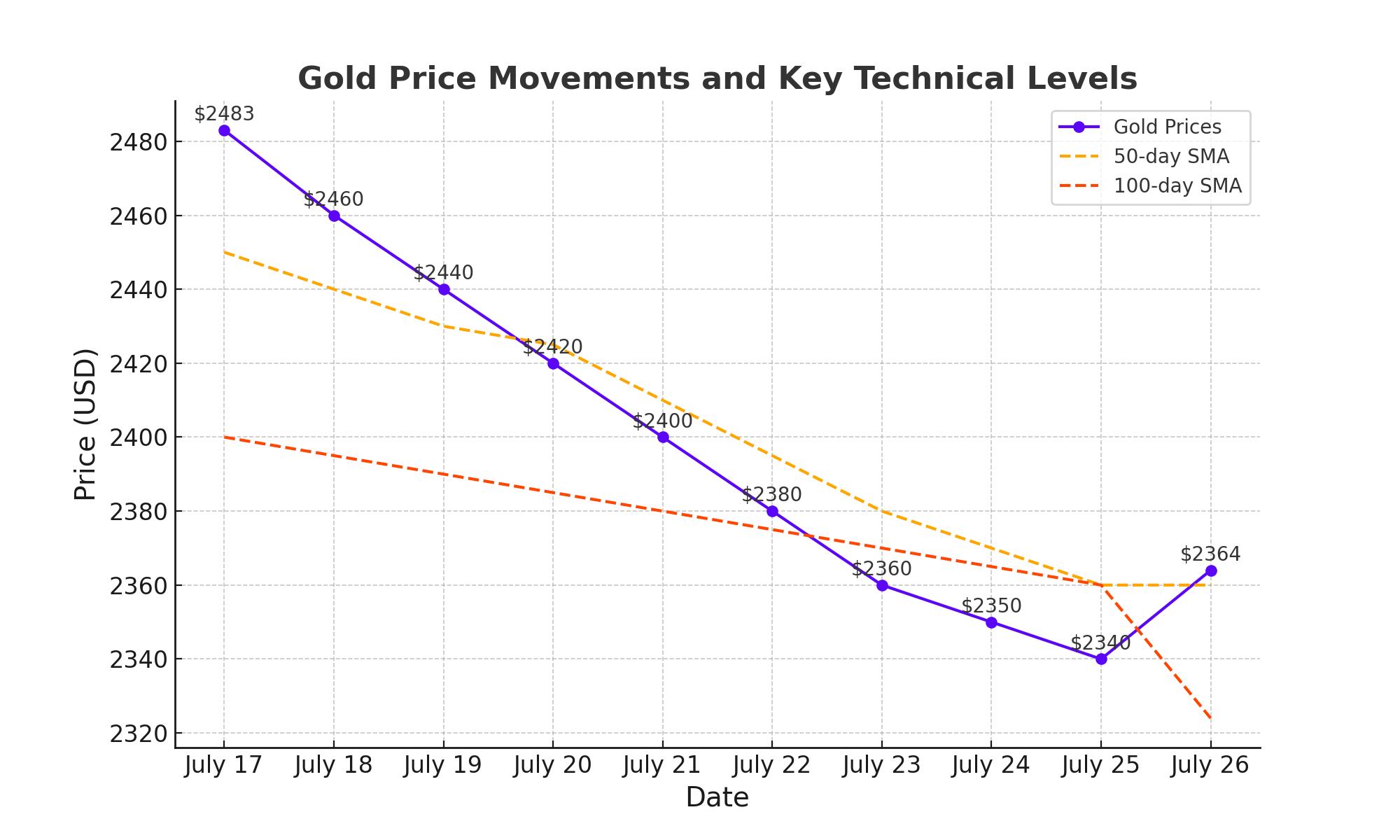

Gold prices have been volatile, with the precious metal recently holding a bounce off the $2,350 level as Friday’s trading kicked off. The price of gold reached an all-time high of $2,483 on July 17 but has since dropped approximately 5% to trade around $2,364. This fluctuation is attributed to various market dynamics, including profit-taking and shifts in investor sentiment.

Impact of US Economic Data

The U.S. economy's robust performance in Q2 2024, with GDP expanding at an annualized rate of 2.8%, has influenced gold prices. This growth surpassed the 1.4% increase from the previous quarter. Despite this positive economic indicator, the core Personal Consumption Expenditures (PCE) price index showed a moderation in inflation, rising only 2.9% compared to the previous quarter’s 3.7%. This has fueled speculation that the Federal Reserve might cut interest rates in September, maintaining disinflation progress and supporting gold prices.

Influence of US Dollar and Treasury Yields

The US Dollar's strength and fluctuations in US Treasury bond yields have also impacted gold prices. After initially reacting negatively to the GDP report, the US Dollar returned to familiar ranges. Concurrently, US Treasury yields dropped, with the 10-year note falling over four basis points to 4.245%, creating a favorable environment for gold by reducing the opportunity cost of holding non-yielding assets.

Technical Analysis of Gold Prices

From a technical perspective, gold sellers maintain control, with the 14-day Relative Strength Index (RSI) holding below the 50 level. The price is currently testing the 50-day Simple Moving Average (SMA) at $2,360. A daily close below this level could initiate a fresh downtrend towards the 100-day SMA support at $2,324. However, buyers may find support again at the psychological level of $2,350, with immediate resistance seen at the 21-day SMA at $2,387, and further targets at $2,412 and $2,425.

Geopolitical and Economic Factors

China’s Economic Slowdown

China’s economic challenges have added pressure on gold prices. The People’s Bank of China’s decision to cut interest rates from 2.5% to 2.3% reflects attempts to stimulate weak economic growth, raising concerns about reduced demand from one of the world's largest consumers of gold. This economic slowdown has played a significant role in recent market movements, contributing to gold’s sell-off.

US Inflation and Employment Data

The US core PCE inflation rate, a key indicator for the Federal Reserve, showed a slight decrease from 2.6% to 2.5% in June. This stability in core inflation supports the view that the Fed might cut rates, which is generally positive for gold. Additionally, initial jobless claims dropped by 10,000 to a seasonally adjusted 235,000, indicating a resilient labor market that further complicates the inflation outlook and impacts gold prices.

Institutional Confidence and Market Reactions

Institutional investors have significantly increased their interest in gold as a safe haven, reflecting global economic uncertainties. Central banks, notably from China and Russia, have been steadily augmenting their gold reserves. China’s central bank, which previously paused gold purchases in May after 18 consecutive months of accumulation, holds a substantial 2,260 tons of gold, up from 395 tons in 2000. Russia and Turkey have also built up their gold reserves amid geopolitical tensions with the United States. This persistent demand highlights gold’s crucial role as a hedge against economic instability and currency devaluation. Despite recent fluctuations, with gold trading around $2,364 after hitting a high of $2,483 in mid-July, the sustained buying by central banks underscores the metal's enduring appeal as a strategic asset

Analyst Projections and Market Outlook

Analysts are bullish on gold's future, citing the metal’s resilience even amidst high-interest rates and a robust U.S. dollar. The price of gold has shown remarkable stability, trading near session highs at $2,374.40, up 0.88% on the day, driven by expectations of a Federal Reserve rate cut in September. This potential cut could decrease the competition from yield-bearing assets, thereby enhancing gold's attractiveness. The structural demand from central banks, combined with gold's safe-haven status during geopolitical and economic turmoil, supports a positive outlook. Projections indicate that gold prices could continue their upward trend, particularly if inflation pressures ease and economic conditions warrant further monetary easing by the Fed. The forecast of core PCE inflation remaining steady at 2.6%, alongside strong GDP growth, bolsters the scenario for continued strength in gold prices.

Conclusion

Gold (XAU/USD) is poised for continued growth, driven by favorable market conditions, strategic institutional participation, and positive expert predictions. Despite inherent volatility, gold's robust performance and future potential make it an attractive investment option. Investors should leverage these insights, monitor market trends, and capitalize on gold's upward trajectory for long-term gains. The ongoing economic data releases, geopolitical developments, and central bank policies will continue to shape the gold market, offering opportunities for informed and strategic investments.

That's TradingNEWS