Gold Prices Respond to US Dollar Strength and Geopolitical Shifts

Analyzing the Impact of Upcoming US Economic Data and Federal Reserve Policies on Gold Market Trends | That's TradingNEWS

Market Overview and Immediate Influences

Gold's resilience in the face of a consolidating US dollar this Tuesday reflects ongoing complexities in global finance where geopolitical tensions and forthcoming US economic data play pivotal roles. Despite the broader trend of a strong dollar imposing pressure on gold prices, recent geopolitical escalations in the Middle East have reinstated gold's appeal as a safe-haven asset. The immediate future of gold prices seems capped, with traders likely to adopt a cautious stance as they anticipate key inflationary data from the United States.

Inflation Data and Federal Reserve's Policy Direction

The spotlight intensifies on significant economic indicators such as the US Producer Price Index (PPI) and Consumer Price Index (CPI). Expected to be released this week, these metrics are crucial for understanding the trajectory of the Federal Reserve's monetary policy. Statements from Fed Chair Jerome Powell and other Fed officials suggest a conservative approach towards rate adjustments, emphasizing the need for sustained evidence of easing inflation before any policy softening.

Technical and Market Analysis

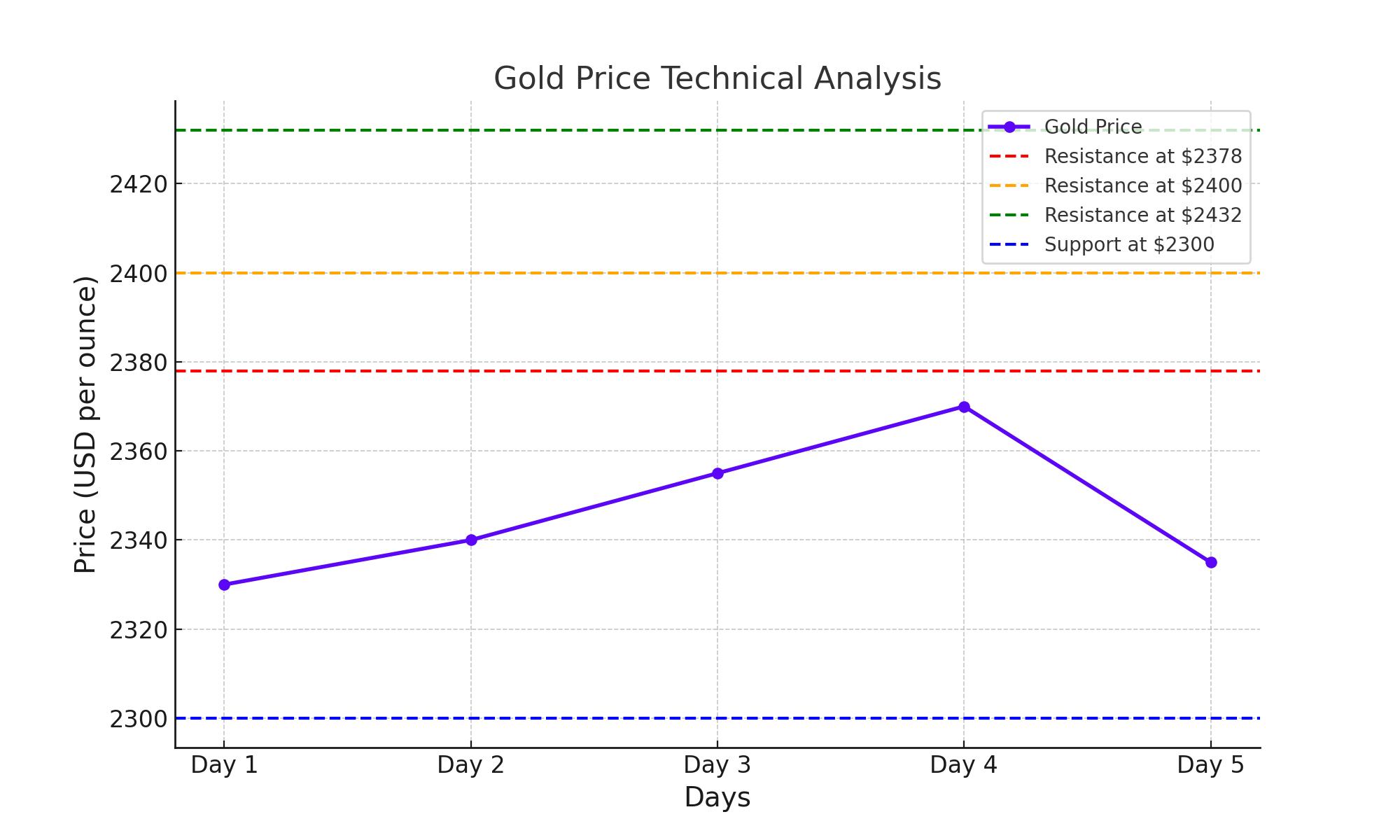

From a technical standpoint, gold maintains a bullish posture above critical thresholds like the 100-day Exponential Moving Average (EMA). Key resistance and support levels have been tested, with gold currently trading at $2,335.53 per ounce, reflecting a slight pullback after consecutive days of gains. The anticipated resistance lies around $2,378, stretching up to psychological levels at $2,400, with potential peaks near $2,432.

Long-term Perspectives and Strategic Considerations

Investor attitudes are significantly shaped by inflation expectations and interest rate forecasts. Recent surveys indicate a sustained belief in gold as a prime hedge against inflation, with substantial competition from tech stocks. Despite a challenging high-interest rate environment which traditionally dampens non-yielding asset appeals, gold's fundamental attributes as a diversifier and safe haven continue to support its investment case.

Global Economic Interactions and Projections

Internationally, the economic landscape presents mixed signals, with Asian and European markets showing varied responses to US economic policies and data releases. The interconnectedness of global markets means that developments in one region can have cascading effects across others, particularly influencing commodity prices such as gold.

Final Analysis

As investors navigate through these turbulent times, the overarching advice would be to maintain vigilance and adaptability. The upcoming US CPI and PPI data will provide further clarity and could either confirm or adjust the prevailing market sentiments towards gold. The strategic stance for gold investors should consider both short-term tactical positions and long-term portfolio allocations, given gold's proven stability in times of economic uncertainty.