Gold Prices Slide Below $2,330 as US Dollar Strengthens

Rising US Treasury Yields and Geopolitical Tensions Weigh on Gold Market | That's TradingNEWS

Market Overview

Gold prices (XAU/USD) are experiencing a downturn, falling to near $2,330 in early Thursday trading. This decline extends the previous day's losses, driven by a stronger US Dollar and rising US Treasury bond yields. The market sentiment remains cautious as investors await key US economic data and Federal Reserve (Fed) policymakers' speeches for fresh policy cues.

Impact of Fed Expectations on Gold

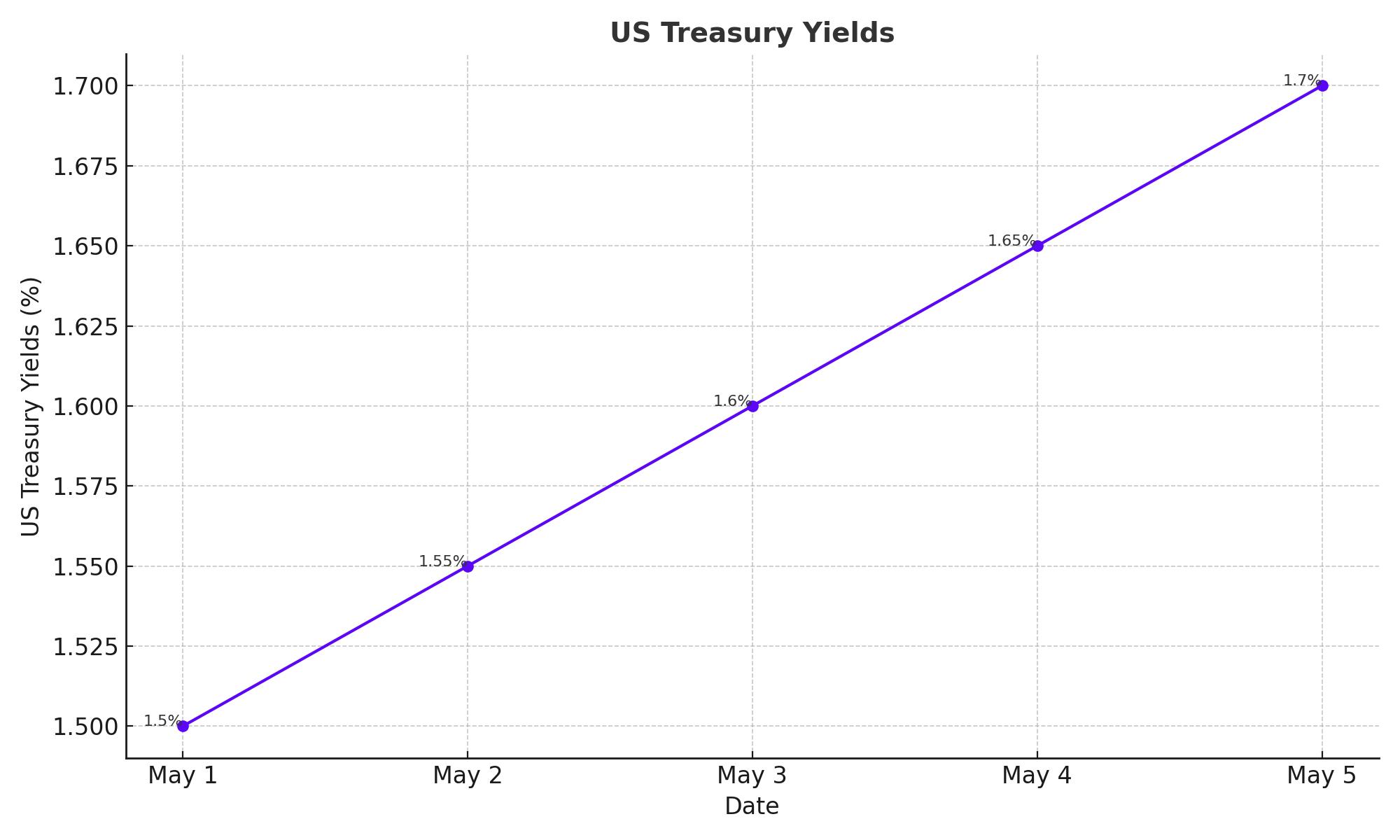

The primary factor weighing on gold prices is the growing skepticism about the Fed's potential rate cuts. According to the CME FedWatch Tool, there's a 53% chance the Fed will hold rates steady in September, while the probability of a rate cut in November stands at around 60%. Recent hawkish comments from Fed officials and persistent inflation concerns have reduced the likelihood of aggressive rate cuts, pushing US Treasury yields higher and strengthening the US Dollar.

Geopolitical Tensions and Gold Demand

Geopolitical risks, particularly the ongoing Israel-Hamas conflict, add to the market's risk-off sentiment. Reports of escalating tensions and potential regional conflicts have bolstered the US Dollar's haven demand, further pressuring gold prices. The Israeli military's actions along the Gaza-Egypt border underscore these geopolitical risks.

Technical Analysis of Gold Price

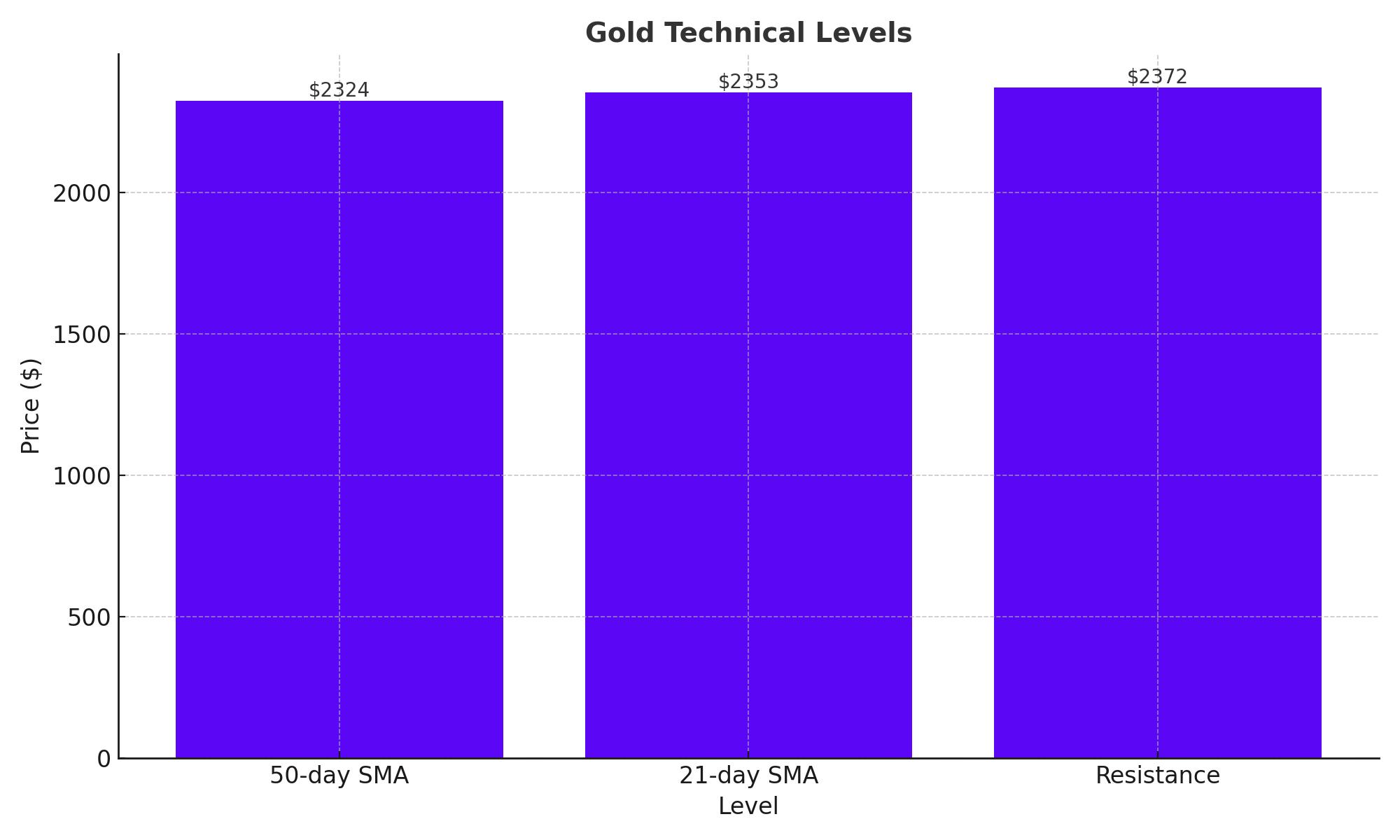

Gold prices have been unable to sustain a recovery above the rising wedge support-turned-resistance at $2,372, turning lower on Wednesday. The 14-day Relative Strength Index (RSI) has flipped bearish, indicating more downside potential. Key technical levels to watch include the 50-day Simple Moving Average (SMA) at $2,324, which, if breached, could lead to a fresh downtrend towards $2,300 and possibly the May 3 low of $2,277. On the upside, immediate resistance is seen at the 21-day SMA at $2,353 and the $2,372 resistance level.

Upcoming US Economic Data

Investors are keenly awaiting the second estimate of Q1 US Gross Domestic Product (GDP), weekly Jobless Claims, and Pending Home Sales data. Additionally, speeches from New York Fed President John Williams and Dallas Fed President Lorie Logan will be closely monitored. These data points and Fedspeak will provide insights into the timing of potential Fed rate cuts, influencing the US Dollar and gold prices.

Analyst Insights and Market Sentiment

UBS analyst Giovanni Stanovo noted that the gold market has suffered from hawkish Fed comments and strong US economic data, shifting expectations for the Fed's first rate cut. Federal Reserve officials have indicated that achieving the 2% inflation target may take longer than anticipated, with further rate hikes not ruled out. Rising interest rates increase the opportunity cost of holding non-yielding assets like gold, putting downward pressure on prices.

Gold Price Forecast

Despite the recent pullback, some analysts remain optimistic about gold's long-term prospects. UBS forecasts that gold prices will test new highs later this year, targeting levels above $2,500 per ounce. Central bank demand, particularly from BRICS nations, and ongoing geopolitical uncertainties continue to support gold as a safe-haven asset.

Conclusion

Gold prices are currently under pressure due to rising US Treasury yields and a stronger US Dollar, influenced by hawkish Fed expectations and geopolitical tensions. Key technical levels and upcoming US economic data will play a crucial role in determining gold's near-term direction. While short-term sentiment is bearish, long-term fundamentals and geopolitical risks could provide support for gold prices in the future.

That's TradingNEWS

WTI & Brent Crude Prices Face Major Setback: How Will Trump's Tariffs and OPEC+'s Output Boost Impact Oil Markets?

Gold Price Surges to Record Highs Before Retreating: How Will Tariff Uncertainty Affect XAU/USD?